Written by: David, TechFlow

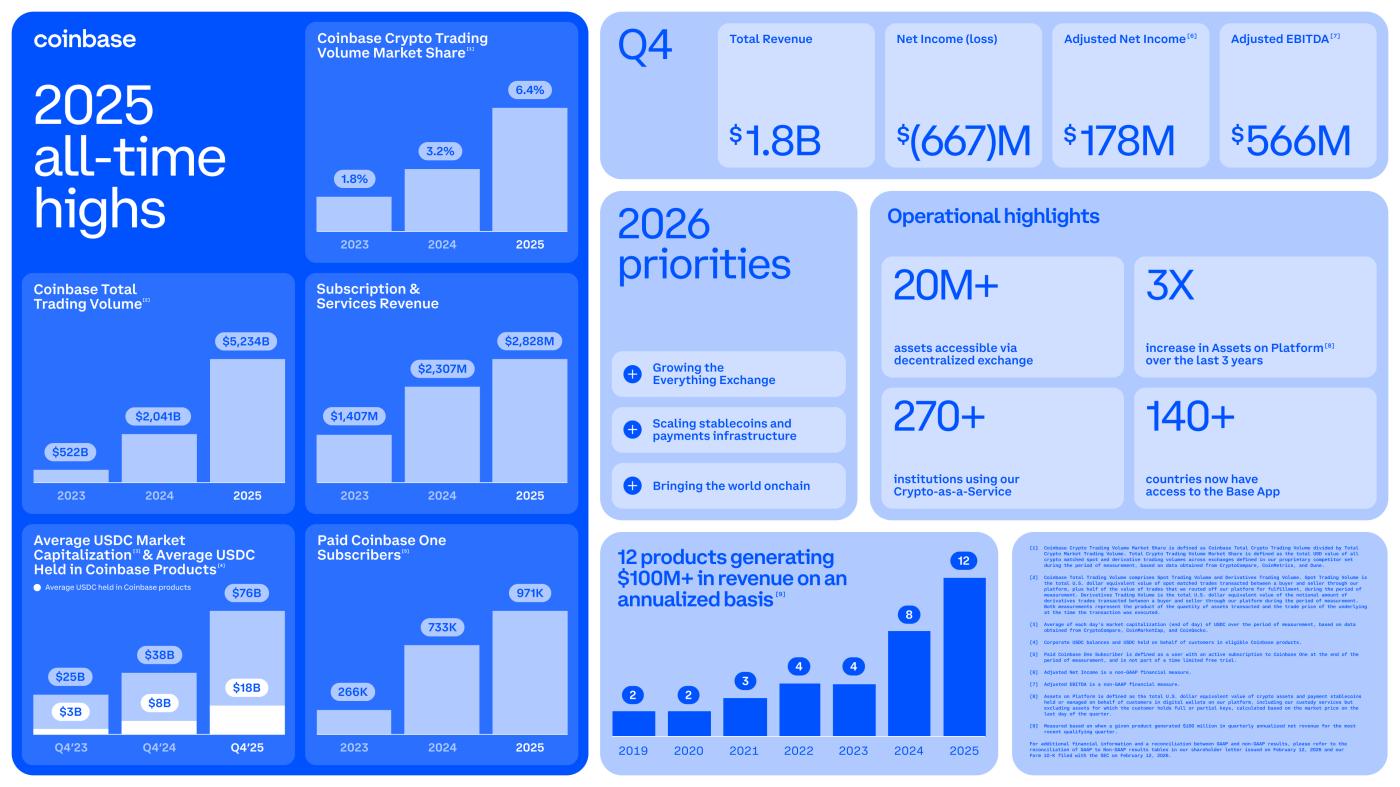

After the US stock market closed on February 12, Coinbase released its financial report for the fourth quarter and full year of 2025.

Full-year revenue was $7.2 billion, a 9% year-over-year increase. That sounds decent, but last year's growth rate was 115%. Q4 revenue was $1.78 billion, a 21.6% year-over-year decline, below Wall Street's expectation of $1.85 billion. Earnings per share were $0.66, compared to market expectations of $1.05, a difference of 37%.

The market's expectations for this financial report have already been reflected in the stock price.

COIN closed at $141, down 68% from its high of $445 last July. It touched $134 in after-hours trading, a new low in nearly 52 weeks.

However, in its shareholder letter released on the same day, Coinbase again filled the page with "all-time highs":

Trading volume doubled throughout the year, market share in the crypto trading market doubled, USDC holdings hit a record high, and paid subscribers approached 1 million.

CEO Brian Armstrong said in the subsequent earnings call that 2025 is a "strong year" and Coinbase has taken a significant position.

However, on the same day as the earnings release, Coinbase experienced a technical glitch, preventing some users from trading and transferring funds normally for several hours. The company stated that the issue was under investigation and that user assets were safe. But the timing, coinciding with the earnings release date, was somewhat awkward.

A financial report filled with record highs, coupled with a stock price hitting a 52-week low. Coinbase's 2025 presents two contrasting faces simultaneously.

We've analyzed Coinbase's shareholder letter, earnings call, and publicly available market data to dissect this contradictory performance report.

Trading volume doubled, but profits decreased.

The conflict started with transaction volume.

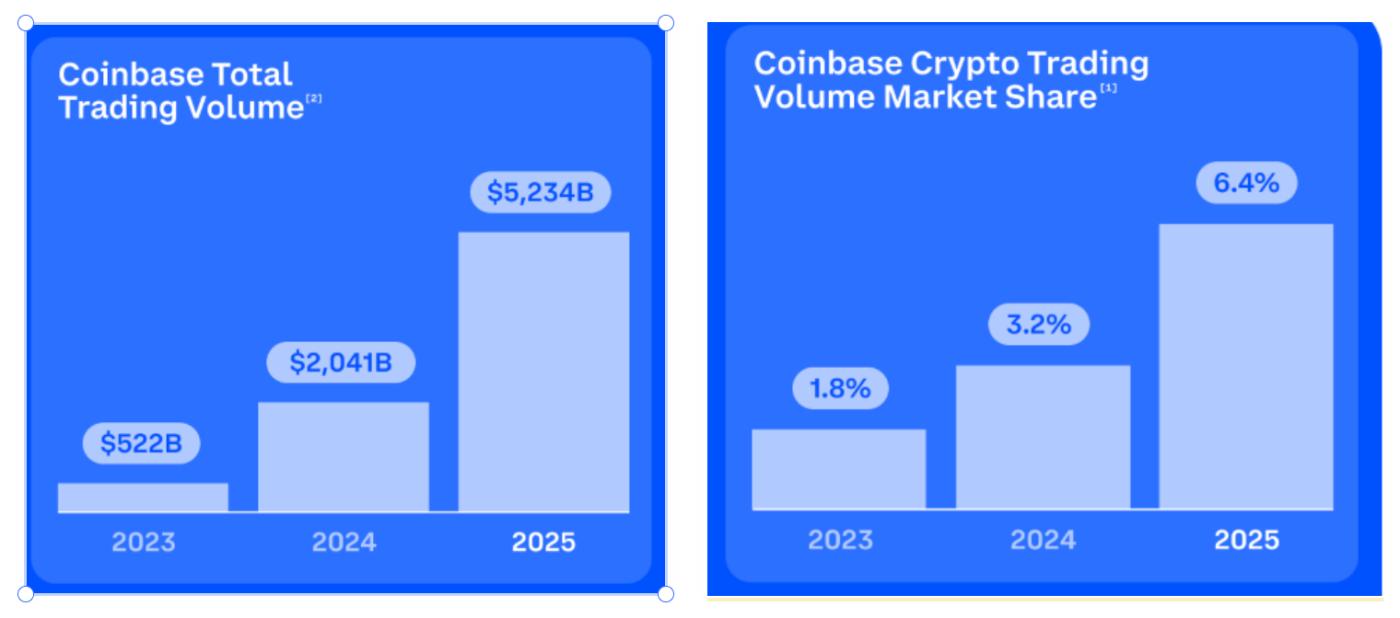

In 2025, Coinbase's total transaction volume reached $5.2 trillion, a year-on-year increase of 156%. Its market share in the crypto trading market jumped from 3.2% to 6.4%. Both figures are the highest since the company went public.

However, transaction revenue was only $4.1 billion, a mere 2% increase year-over-year.

The volume increased by one and a half times, but revenue barely changed. This is because the fee rate per transaction is decreasing.

Coinbase completed its acquisition of Deribit in August 2025, a $2.9 billion deal that became the largest merger and acquisition in the history of the crypto industry. Deribit is the world's largest crypto options exchange, bringing huge volumes of derivatives trading, but the fees per transaction for derivatives are much lower than those for spot trading.

In other words, the "historic high" in trading volume is inflated. With a larger market capitalization, the profit per unit is thinner.

Looking at Q4 alone, transaction revenue was $983 million, the first time it has fallen below $1 billion in six quarters. This represents a 36.8% year-over-year decline. This comes against the backdrop of BTC's decline from its all-time high of approximately $126,000 in October of last year, falling back to around $90,000 by the end of Q4.

The decline intensified after entering 2026, and it even fell below $60,000 in early February.

The overall market capitalization of the crypto market shrank by 11% in Q4 compared to the previous quarter, volatility decreased, and retail investors' willingness to trade contracted significantly.

According to Zacks data, Q4 spot trading volume for consumers was $59 billion, while for institutional investors it was $237 billion. Institutions supported the volume, but retail investors were leaving the market.

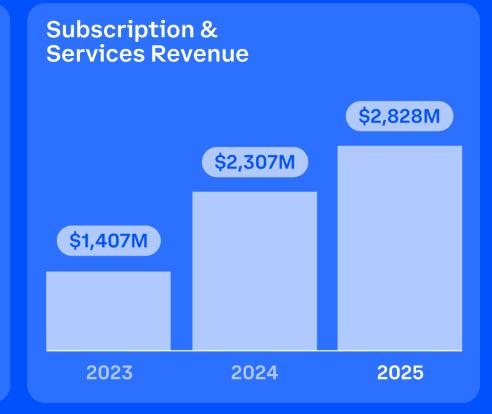

Subscription revenue is 5.5 times the peak of the last bull market, but growth is slowing.

The good news is in another column.

Subscription and service revenue reached $2.8 billion for the year, a 23% year-over-year increase and 5.5 times that of the peak of the 2021 bull market. This revenue now accounts for 41% of net revenue.

Looking at it separately, stablecoin revenue is the biggest contributor.

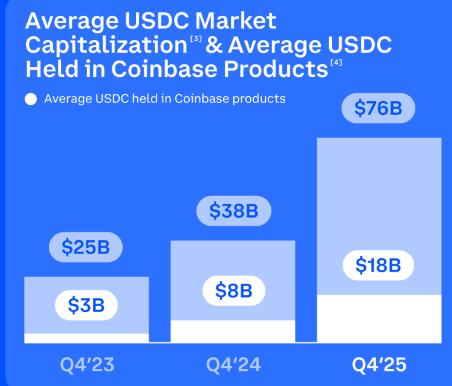

In Q4, stablecoin-related revenue reached $364 million, a year-over-year increase of 61.2%. The average holding of USDC on the platform reached $17.8 billion, and the total market capitalization of USDC averaged approximately $76 billion in Q4.

Coinbase takes a cut from the interest income and circulation revenue of USDC. This money does not depend on user transactions and is more like a "deposit-based interest" model.

Coinbase One's paid subscribers reached nearly 971,000 by the end of 2025, a three-fold increase in three years. Twelve products generated over $100 million in annualized revenue, with six exceeding $250 million and two exceeding $1 billion.

However, Q4 subscription and service revenue was $727 million, a 3% decrease quarter-over-quarter. Management is also not optimistic about future subscription revenue.

During the earnings call, CFO Alesia Haas gave a forecast range for subscription and service revenue in the first quarter of 2026: $550 million to $630 million, a further decrease from the previous Q4.

She cited two reasons: the Federal Reserve cut interest rates by 25 basis points each in October and December last year, which lowered the interest rate yield of USDC; and the recent continuous decline in the price of crypto assets, which dragged down staking-related income.

Armstrong also said in the conference call that Coinbase is building a "universal exchange" where anything can be traded.

Subscription revenue is the new pillar of this story. But under the test of the Crypto Winter, this pillar is also shaky.

The company suffered huge losses, but it wasn't because the business was poorly managed.

According to U.S. Generally Accepted Accounting Principles (GAAP), Coinbase reported a net loss of $667 million in Q4, compared to a profit of $1.3 billion in the same period last year.

The bulk of the losses weren't from the business itself. Two unrealized investment losses ate up the profit and loss statement.

The first loss was a paper loss of $718 million on the crypto portfolio.

Coinbase continued to increase its BTC holdings throughout 2025, doubling its total BTC holdings for the year and buying every week . This strategy incurred significant paper costs during the quarter when BTC's value halved from its peak.

The second loss was $395 million from strategic investments. A large portion of this came from Coinbase's stake in Circle, the issuer of USDC and one of Coinbase's most important partners.

Circle's stock price fell by about 40% in Q4, directly dragging down Coinbase's investment balance.

The two losses combined exceed $1.1 billion. However, these are "unrealized" losses, meaning the assets haven't been sold yet; they've simply been revalued at market price. If BTC recovers, these losses will reverse.

Excluding these investment fluctuations, Coinbase's adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization, typically used to measure the earning power of a company's core business) was $566 million, and adjusted net income was $178 million.

According to this calculation, Coinbase has been profitable for 12 consecutive quarters.

There's a structural contradiction here. Coinbase is both an exchange and an asset holder. Its balance sheet is filled with a large amount of BTC and crypto-related investments.

During a bull market, this acts as a profit amplifier; a significant portion of the 1.3 billion net profit in 2024 came from investment income. However, in a bear market, the same logic reverses, taking a bite out of the market.

CFO Haas did not shy away from the question during the conference call. She stated that Coinbase had "slightly increased its weekly BTC purchases" in the current price environment.

Let me translate it for you: The price dropped, but we bought more.

This approach is similar to the logic of Strategy (formerly MicroStrategy), both of which are betting on the long-term value of BTC using the company's balance sheet.

The difference is that Strategy treats this as its main business, while Coinbase treats it as a side business. But when BTC drops by nearly 50%, even a side business can significantly impact the appearance of financial reports.

Finally, the financial report shows that Coinbase had $11.3 billion in cash and equivalents at the end of the year. While they have plenty of money, the fact that they've been consistently buying BTC and losing money is still worrying.

What exactly does Coinbase want to become?

Crypto exchage face an inescapable fate:

Making a fortune in a bull market, only to see profits halved in a bear market. Coinbase's financial reports over the past four years have repeated this pattern.

In 2025, management attempted to rewrite the script.

During the earnings call, Armstrong repeatedly mentioned the term "Everything Exchange." He wanted Coinbase to be more than just a place to buy and sell cryptocurrencies; he wanted it to be a platform where any asset could be traded.

In fact, some actions have already been taken.

In Q4 of last year, Coinbase opened its prediction market feature to all users, allowing them to bet on the outcomes of real-world events such as sports events and political elections; in February of this year, the platform plans to launch nearly 10,000 US stock tickers.

Armstrong mentioned in the conference call that the forecasting market and trading volumes for gold and silver both broke records in the first quarter of this year.

The significance of these new categories is that their trading volume does not fluctuate with the rise and fall of the crypto market.

Even if Bitcoin drops by 50%, users can still trade Tesla stock or bet on the Super Bowl on Coinbase . The more diversified your revenue streams, the less dependent you are on the crypto cycle.

Another big move is Deribit.

In the derivatives sector, Coinbase completed its acquisition of Deribit for $2.9 billion in August 2025, capturing approximately 80% of the global crypto options market. Combined with its existing futures and perpetual contract businesses, Coinbase now boasts a complete derivatives product line.

Stablecoins are what Armstrong calls the "second killer app." USDC holdings on the platform hit a record high in Q4, and stablecoin-related revenue grew by over 61% year-over-year.

He even proposed an even more ambitious plan:

In the future, AI agents will use stablecoins as the default payment method, and Coinbase's Base Chain will become the entry point for this.

Stocks, derivatives, prediction markets, stablecoins, AI infrastructure. Coinbase practically covered every possible sector in 2025, completing 10 acquisitions or talent acquisitions throughout the year.

The blueprint for the so-called "universal exchange" has been drawn up, but a bear market is the best time to test the transformation. One detail you might be overlooking is:

Before and after the earnings release, Monness Crespi Hardt downgraded Coinbase's rating from "buy" to "sell," arguing that the market underestimated the duration of the crypto bear market.

On the other hand, 23 out of 35 analysts still maintain a "buy" rating, with a consensus target price of $326, which means there is more than double the upside potential relative to the current stock price.

Both bulls and bears are betting on the same question: can Coinbase's transformation outpace the economic cycle?

The golden age of exchanges may not be over. But the days of doubling revenue and making money effortlessly are unlikely to return. Coinbase itself knows this, which is why it's desperately trying to become a universal exchange.

When crypto prices plummet, retail investors leave, and transaction fees fall, are these new sectors truly revenue engines, or merely embellishments to a bull market hype story?

The answer may not be clear until the financial reports are released in two or three quarters.