Bitcoin ETFs see $410.57 million in outflows, while Ethereum ETFs see $113.08 million in outflows, led by BlackRock and Fidelity.

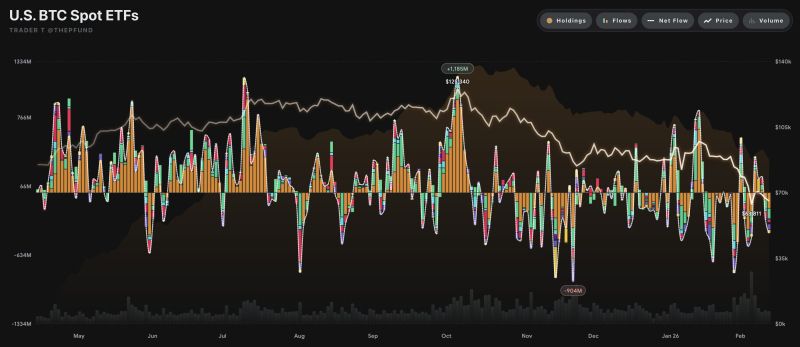

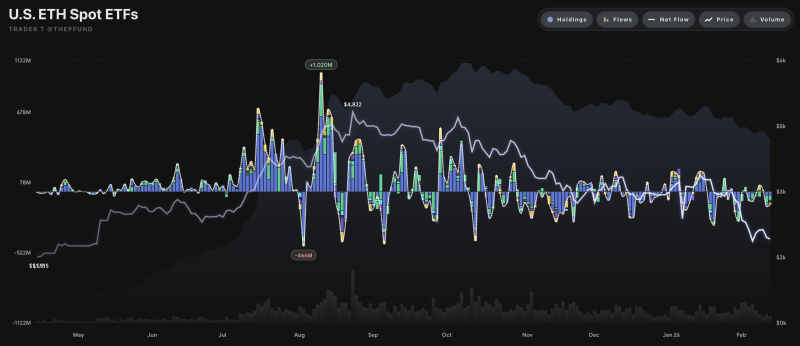

US spot Bitcoin exchange-traded funds (ETFs) saw a net outflow of $410.57 million (KRW 589.4 billion) the previous day. Ethereum ETFs also saw a net outflow of $113.08 million (KRW 162.3 billion) on the same day, continuing a two-day streak of massive capital outflows.

Bitcoin ETFs see net outflows exceeding $400 million, led by BlackRock and Fidelity.

On February 12th, US spot Bitcoin ETFs recorded a net outflow of $410.57 million. BlackRock's IBIT suffered the largest outflow, with $157.76 million (KRW 226.4 billion), followed by Fidelity's FBTC, with $104.13 million (KRW 149.5 billion).

Grayscale's GBTC saw a net outflow of $59.12 million (KRW 84.8 billion), and Grayscale Mini BTC saw a net outflow of $33.54 million (KRW 48.1 billion). Ark Invest's ARKB saw an outflow of $31.55 million (KRW 45.3 billion), Bitwise's BITB saw an outflow of $7.83 million (KRW 11.2 billion), and Invesco's BTCO saw an outflow of $6.84 million (KRW 9.8 billion).

Franklin Templeton's EZBC recorded a net outflow of $3.79 million (KRW 5.4 billion), Valkyrie's BRRR recorded $2.77 million (KRW 4 billion), and VanEck's HODL recorded $3.24 million (KRW 4.7 billion). WisdomTree's BTCW saw no movement of funds.

Ethereum ETF also sees over $100 million in outflows, with Fidelity seeing the largest outflows.

On the same day, the US spot Ethereum ETF recorded a net outflow of $113.08 million, continuing its outflow for the second consecutive day.

Fidelity's FETH saw the largest outflow, with $43.52 million (KRW 62.5 billion), followed by BlackRock's ETHA with $28.96 million (KRW 41.6 billion). Grayscale's mini ETH saw net outflows of $18.11 million (KRW 26 billion), and Grayscale's ETHE saw net outflows of $13.43 million (KRW 19.3 billion).

Bitwise's ETHW saw a $6.18 million (KRW 8.9 billion) outflow, and 21Shares' CETH saw a $2.88 million (KRW 4.1 billion) outflow. Invesco's QETH, Franklin Templeton's EZET, and VanEck's ETHV saw no movement.

Joohoon Choi joohoon@blockstreet.co.kr