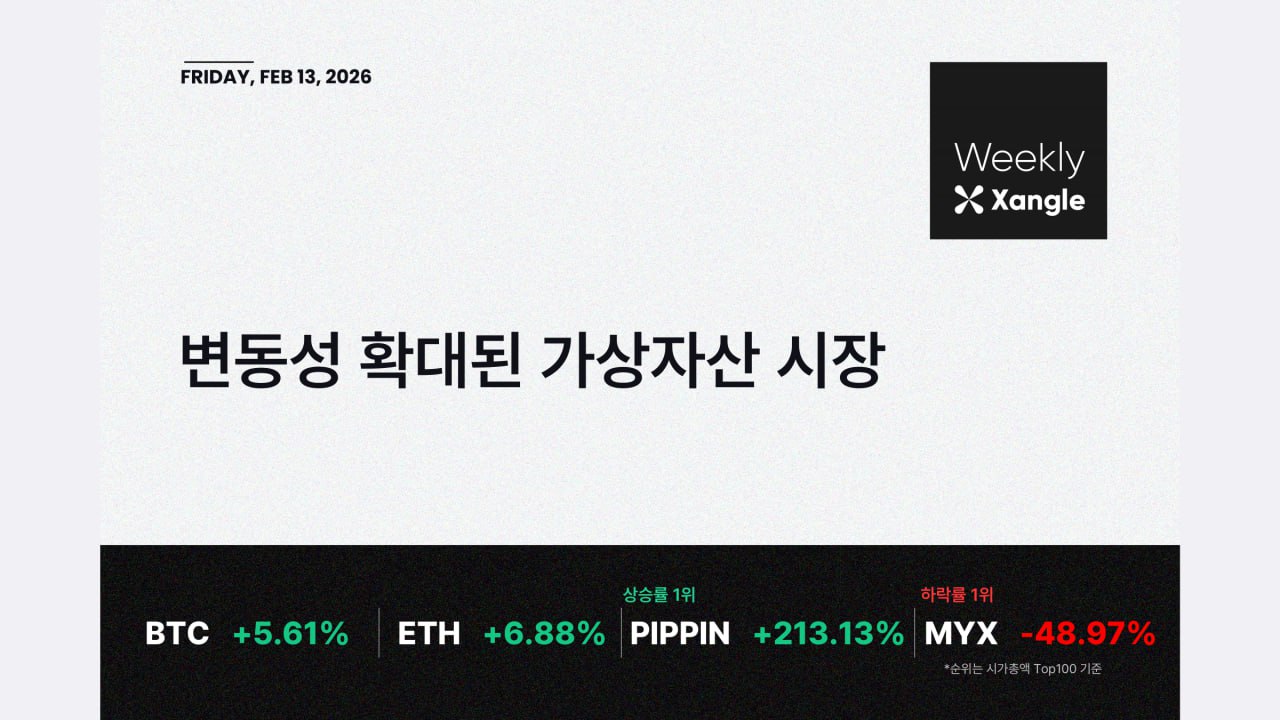

[Weekly Xangle] Increased Volatility in the Virtual Asset Market The virtual asset market achieved a technical rebound following last week's plunge, but remained highly volatile amid macroeconomic uncertainty. Bitcoin closed at $66,222, up 5.61% from the previous week, and Ethereum rose 6.88% to $1,947. Large-cap assets rebounded, but remain in a period of significant corrections from their highs. Meanwhile, the altcoin market saw significant speculative inflows, driven by individual themes, with some stocks, such as PIPPIN (+213.13%), RIVER (+74.45%), and Humanity Protocol (H, +53.75%), soaring. The key variable in the market this week was uncertainty regarding the Federal Reserve's monetary policy path. As discussions surrounding the nomination of Federal Reserve Chairman Kevin Warsh continued, concerns persisted that a hawkish policy stance could intensify, leading to a strengthening dollar and rising long-term interest rates. Furthermore, the stronger-than-expected January employment figures (nonfarm payrolls increased by 130,000, exceeding the expected 70,000) further dampened expectations of a rate cut. The likelihood of a March rate cut declined in the interest rate futures market, weakening expectations of liquidity easing, which limited the upside in the virtual asset market. On the supply-demand front, signs of a full recovery were also lacking. Bitcoin spot ETFs showed no significant net inflows, and sentiment indicators, which had entered a period of extreme fear, showed only limited improvement. In the derivatives market, leverage decreased following the previous week's large-scale liquidations, but selling pressure continued to intensify during periods of increased volatility. In particular, the strengthening dollar and rising US long-term interest rates pressured global liquidity, creating an environment that weighed on risk assets across the board. 👉 Go to 'Weekly Jangle for the Second Week of February' on Jangle

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content