BTC falls 3% from its previous high.

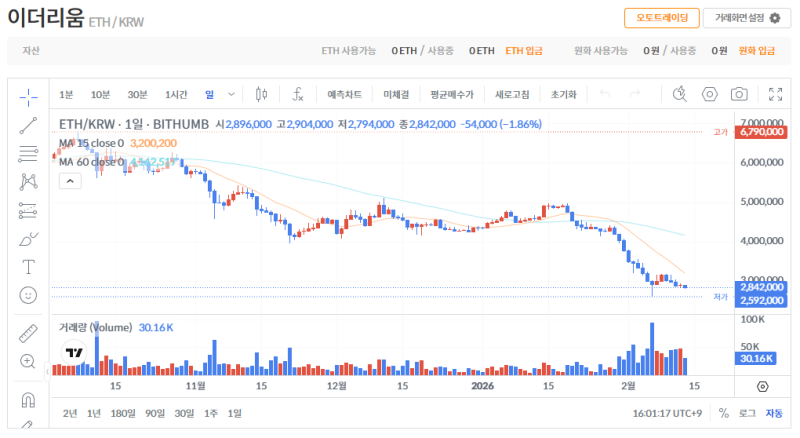

ETH retreats again to the low $1,900s.

XRP weakens after confirming resistance at $1.50

As of 4:00 PM on the 13th , Bitcoin (BTC) was trading at $66,104, down approximately 3.3% from its previous high. Short-term rebounds appear to be limited by news of ETF fund outflows and large-scale selling of holdings.

Ethereum (ETH) fell 3.7% from its previous high, hitting $1,930 at the same time. After attempting to recover above $2,000, the price fell back to the low $1,900 range, continuing a period of short-term selling.

XRP is currently trading at $1.35 after failing to settle in the $1.50 and $1.44 ranges, where it has turned into resistance. Technical analysis suggests further declines to the $1.20 range are possible.

The market believes that if Tether dominance stabilizes above 8%, further corrections across virtual assets cannot be ruled out. Conversely, a full-blown short-term rebound is only likely if dominance falls below 8% again.

Reporter Jeong Ha-yeon yomwork8824@blockstreet.co.kr