Bitcoin (BTC) continues its downward trend. In the last 24 hours, the asset has fallen 1.39%, bringing its total monthly loss to over 30%.

Bitcoin (BTC) continues its downward trend. In the last 24 hours, the asset has fallen 1.39%, bringing its total monthly loss to over 30%.

While the broader bear market environment remains the primary cause of the weakness, emerging on-chain signals suggest that concentrated whale activity may be amplifying BTC's downward momentum.

Whale activity raises concerns about short-term volatility in Bitcoin.

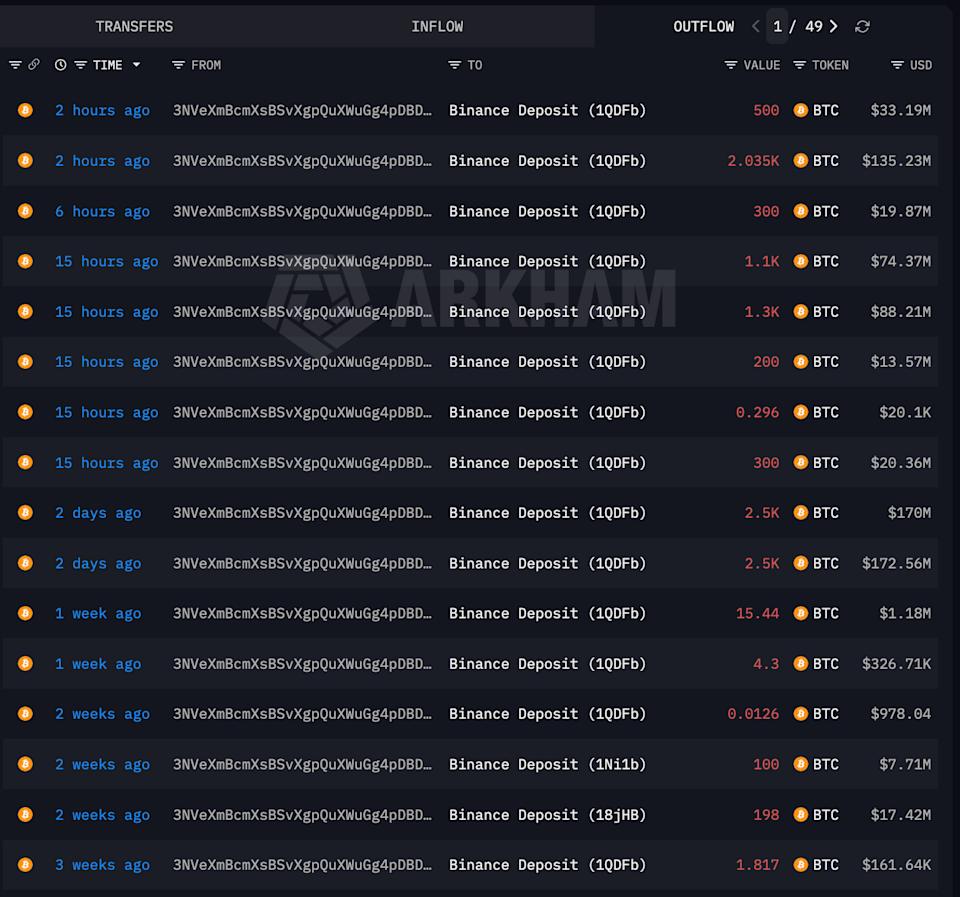

In a post on X (formerly Twitter), blockchain analytics firm Lookonchain stated that deposits from a whale (3NVeXm) coincided with Bitcoin price drops. Data from Arkham shows that this whale began depositing Bitcoin to Binance three weeks ago, initially in small volumes.However, activity has accelerated this week. On February 11th, the whale transferred 5,000 BTC to the exchange. The chain of transactions continued as the wallet sent an additional 2,800 BTC today alone.

Lookonchain suggests that the timing of these deposits may have influenced short-term price movements.

“Every time he deposits BTC, the price drops. Yesterday, I warned him when he made a deposit — and shortly after, BTC dropped more than 3%,” the post stated.

According to the latest data, this address still holds 166.5 BTC, worth over $11 million at current market prices. Large inflows into exchanges are often interpreted as a harbinger of selling, as investors frequently move assets to trading platforms for liquidation or hedging.

While correlation doesn't necessarily equate to causation, the scale and timing of these transactions may have immediately increased selling pressure in an Capital fragile market structure. During periods of high sensitivity, even awareness of whale selling could amplify the downward momentum as traders reacted to on-chain signals and adjusted their positions.

A surrender signal indicates the market is under pressure.

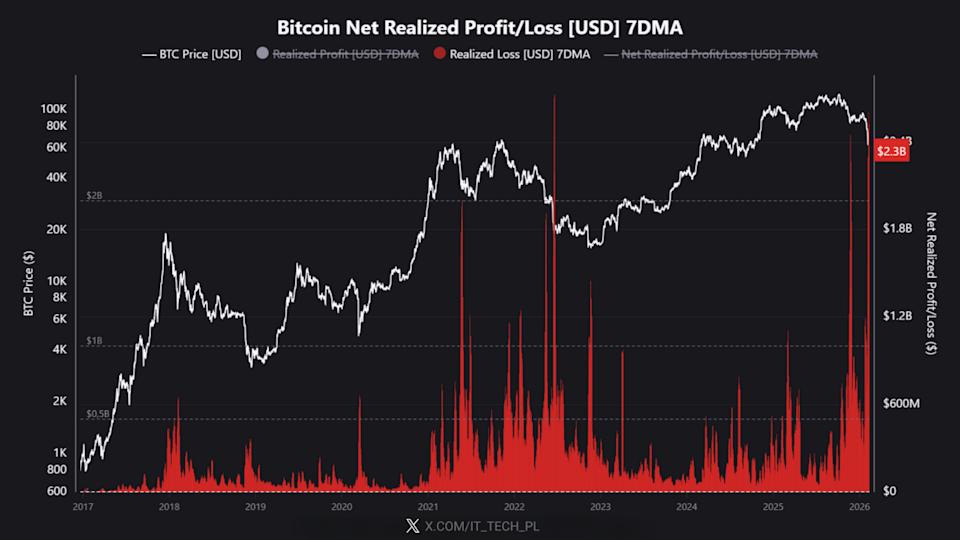

These transfers are taking place against the backdrop of a clearly weakening Bitcoin market. One analyst said Bitcoin's actual losses have skyrocketed to $2.3 billion."This puts us in the top 3-5 biggest loss-making events ever recorded. Only a few moments in Bitcoin's history have seen this level of capitulation," the analysis stated.

Analysts added that short-term investors, defined as those holding coins for less than 155 days, appear to be driving much of the current wave of capitulation. Investors who bought BTC in the $80,000–$110,000 range are now taking significant losses, suggesting that individual investors using high leverage and those with weaker hands are exiting their positions.

Conversely, long-term investors do not appear to be the primary source of this sell-off. Historically, this group has tended to hold on throughout sharp declines.

“In the past, extreme losing rallies like this have triggered rallies. We’re seeing that: BTC bounced from $60,000 to $71,000 after the sell-off. But this could still be just the beginning of a deep and prolonged downturn. Technical rallies still occur even in long-term bear markets,” the analyst said.

Meanwhile, BeInCrypto previously highlighted several signals suggesting that BTC may still be in the early stages of a broader bear market, meaning there is still room for further downside risk. CryptoQuant analysts point to $55,000 as Bitcoin's realized price, a level historically associated with the Dip of a bear market.

In previous cycles, BTC traded 24% to 30% below its intrinsic price before stabilizing. Currently, Bitcoin remains above that level.

As BTC approaches its target price, historically, it often enters a sideways consolidation phase before recovering. Some analysts suggest that a deeper correction below $40,000 could mark the formation of a clearer Dip .