In the past 24 hours, approximately $200 million worth of leveraged positions in the cryptocurrency market have been liquidated.

According to the current aggregated data, the liquidated positions were mainly long positions, especially those related to Bitcoin and Ethereum, which saw large-scale liquidations.

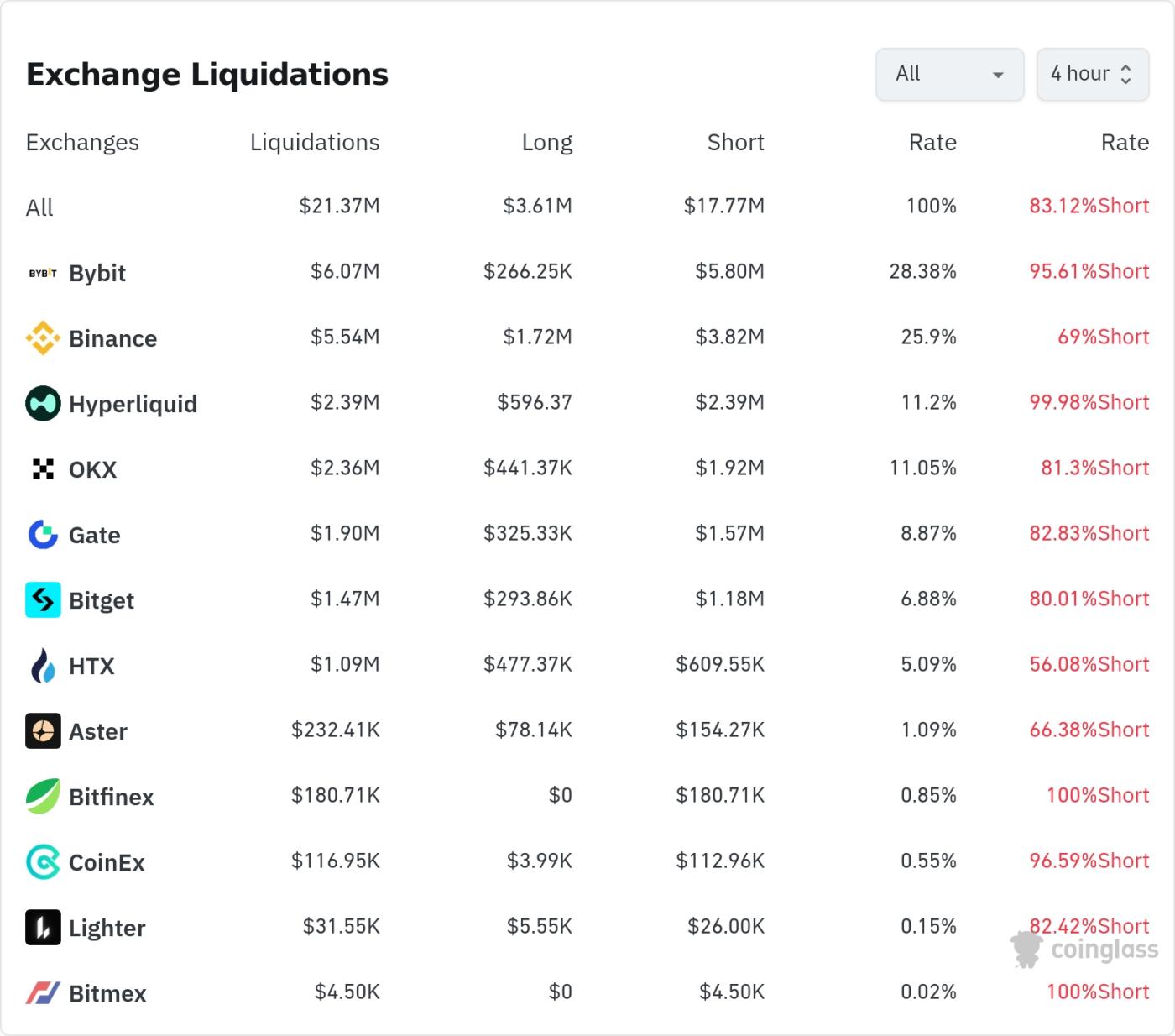

In the past four hours, Bybit experienced the most position liquidations, totaling $6.07 million (28.38% of the total). Long positions accounted for 95.61% of these liquidations, representing an overwhelming majority.

Binance had the second-highest number of liquidations, with $5.54 million (25.9%) of positions liquidated, of which 69% were long positions.

OKX experienced approximately $2.36 million (11.05%) in liquidations, representing 81.3% of long positions.

It is worth noting that on Bitfinex, 100% of long positions were liquidated, and there were no short positions liquidated at all.

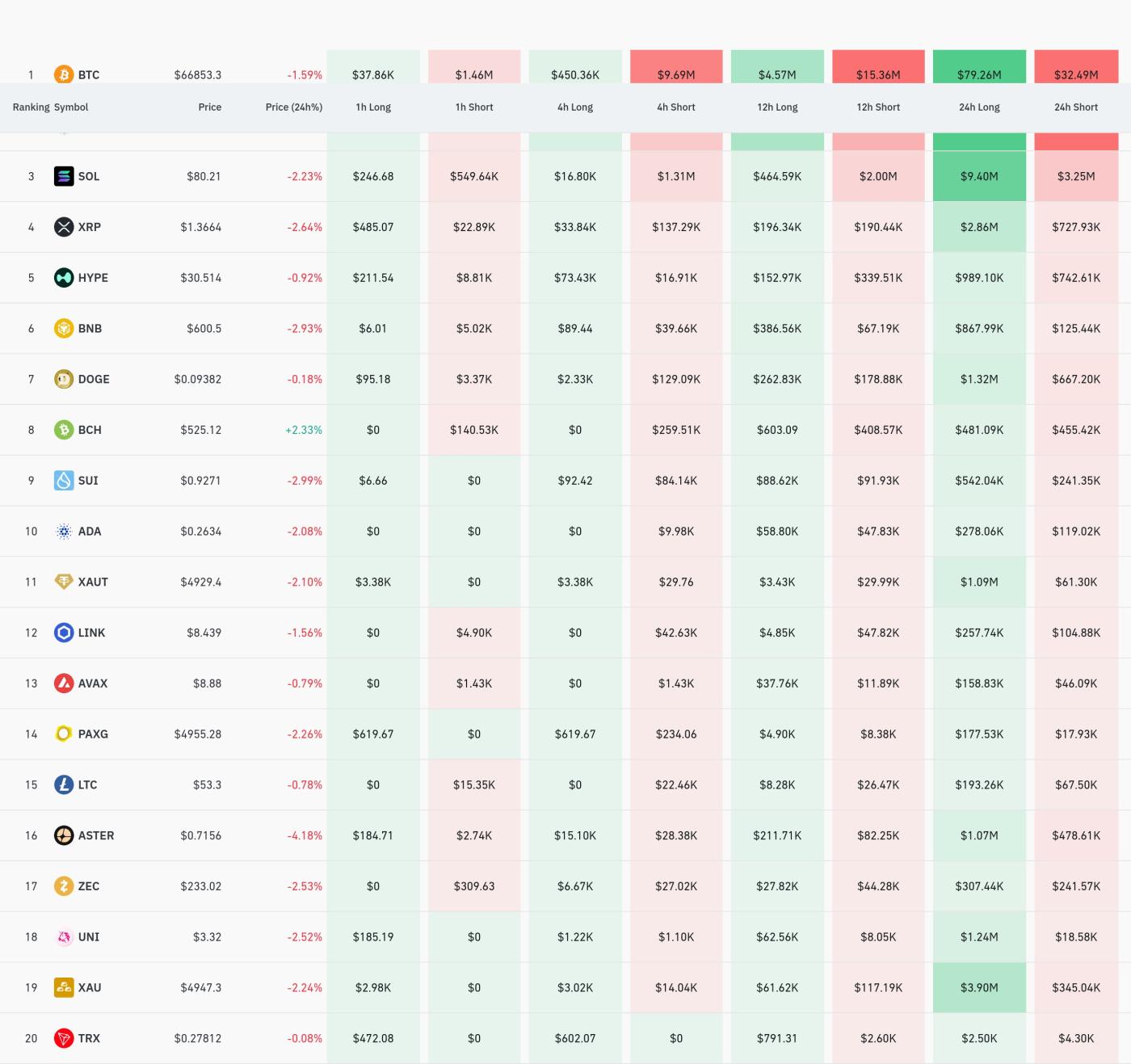

By currency type, Bitcoin (BTC) related positions saw the most liquidations. On a 4-hour timeframe, approximately $450,000 of Bitcoin long positions were liquidated, while a staggering $9.69 million of short positions were liquidated.

This appears to be due to the recent upward trend in Bitcoin prices, causing significant losses for traders holding short positions. Bitcoin is currently trading at around $66,853.

Ethereum (ETH) experienced its second-largest liquidation to date, amounting to $52.32 million. Similar to Bitcoin, the liquidation of short positions was particularly prominent due to price increases.

Solana (SOL) is showing significant price volatility following the liquidation of $1.31 million in short positions, and is currently trading at $80.21.

In particular, Dogecoin (DOGE) saw approximately $129,000 in short positions liquidated in the past four hours, and is currently trading at $0.09382.

Overall, the liquidation data shows that investors holding short positions are under significant pressure during the recent upward trend in the cryptocurrency market. In particular, the continued strength of mainstream cryptocurrencies, primarily Bitcoin and Ethereum, is leading to a large-scale liquidation of short positions.

Article summary by TokenPost.ai

🔎 Market Analysis

In the past 24 hours, approximately $200 million worth of leveraged positions have been liquidated, with a particularly large number of short positions being liquidated on Bitcoin and Ethereum. This reflects the upward trend in the market, with Bybit and Binance exchanges experiencing the largest liquidations.

💡 Key Strategies

The current market has formed a strong bullish bias, so caution is advised regarding short-term selling positions. The extremely high liquidation rate of Bitcoin short positions suggests that the upward trend may continue temporarily.

📘 Terminology Explanation

Liquidation: In leveraged trading, a position is forcibly liquidated when the value of the collateral falls below the maintenance margin.

Long position: An investment strategy that involves buying assets in anticipation of price increases.

Short position: An investment strategy that involves selling assets in anticipation of a decline in asset prices.

TokenPost AI Notes

This article uses a language model based on TokenPost.ai for article summarization. The main content may be omitted or may not be factual.