The U.S. Bureau of Labor Statistics (BLS) released its latest January Consumer Price Index (CPI) data at 8:30 a.m. (Eastern Time) on February 13, 2026. This highly anticipated inflation report shows that the overall U.S. inflation rate has slowed further, providing the Federal Reserve (Fed) with more flexibility in its future monetary policy.

Core inflation eased slightly to 2.5%.

Data shows that the US overall CPI rose 2.4% year-on-year in January, a significant drop from 2.7% in December and below market expectations of 2.5%. This is the lowest level since May 2025. The monthly increase (seasonally adjusted) rose only 0.2%, also below the expected 0.3%.

The core CPI, excluding food and energy, rose 2.5% year-on-year, slightly lower than the previous month's 2.6%, while the monthly increase was 0.3%. Although core inflation remains somewhat sticky, the overall trend is still moving closer to the Federal Reserve's long-term target of 2%.

Market Reaction and Fed Outlook

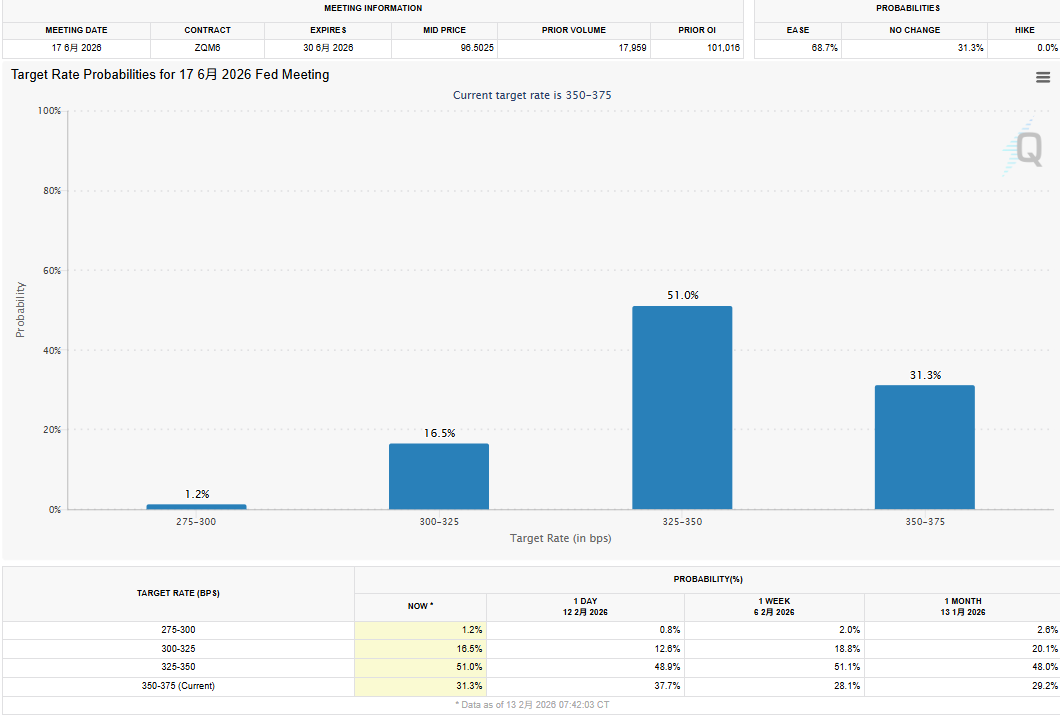

Following the data release, according to the CME FedWatch tool, although the market still believes that the Federal Reserve will maintain the current interest rate level in March and April, the probability of the Fed restarting its rate cuts and cutting rates by 25 basis points at the June FOMC meeting has risen to 51%, indicating that the market has reacted positively to this CPI data.