This article is from: Arkham

Compiled by Odaily Odaily( @OdailyChina ); Translated by Moni

Anatoly Yakovenko (@toly) is the creator of the Solana blockchain and has become a leading figure in the blockchain industry, as well as a well-known billionaire. This article will delve into his personal wealth.

As one of the most influential figures in the cryptocurrency field, Anatoly Yakovenko founded Solana, one of the most widely used blockchain platforms in the industry. Based on available information, the number of tokens he personally holds, and his equity stake in Solana Labs, his net worth in 2026 is estimated to be between $500 million and $1.2 billion. The reason for the large range is mainly due to the significant fluctuations in the price of Solana tokens recently.

Anatoly Yakovenk's early life

Anatoly Yakovenk was born in the Soviet Union and immigrated to the United States with his family in the early 1990s, settling in Illinois. He showed a talent for computer science and engineering at an early age and eventually earned a degree in computer science from the University of Illinois at Urbana-Champaign, one of the top universities in the United States in this field.

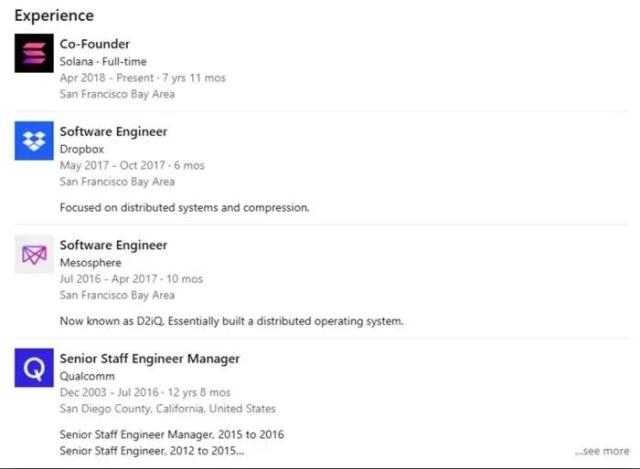

Anatoly Yakovenk's academic background focused on distributed systems and compression algorithms, technologies that later proved crucial to his innovation in the blockchain field. According to information disclosed on LinkedIn (as shown in the image below), after graduation he joined Qualcomm, where he worked on operating system-level software and distributed systems for over a decade, truly experiencing the field. However, this experience at a leading communications technology company also allowed Anatoly Yakovenk to accumulate deep expertise in building systems that handle large-scale, high-throughput systems.

During his time at Qualcomm, Anatoly Yakovenk also participated in the development of technology that required coordination across multiple devices and maintaining accurate timing. This challenge is conceptually similar to blockchain consensus mechanisms. He later worked briefly at Dropbox, which further deepened his understanding of the challenges of distributed computing in consumer-facing applications.

How did Anatoly Yakovenk get involved in the cryptocurrency field?

Like many others, Anatoly Yakovenk's initial foray into the cryptocurrency space began with Bitcoin mining. Reportedly, he and his friends used the profits from mining to subsidize the graphics processor costs of a side project they were developing together. This experience also allowed him to witness firsthand the scalability limitations of Bitcoin and Ethereum, networks that can only process a small number of transactions per second, creating bottlenecks and high transaction fees, seemingly incompatible with mainstream applications.

Instead of viewing these limitations as inherent flaws in blockchain technology, Anatoly Yakovenk began to explore whether technologies from other fields could solve the throughput problem. He drew inspiration from his telecommunications background, particularly the concept of time itself as a reliable reference point in distributed systems.

In November 2017, Anatoly Yakovenk published a white paper that described in detail the "Proof of History" technology, a cryptographic technique used to create verifiable time passage between events. This innovation allows network validators to process transactions in a predetermined order without extensive communication between nodes, thus significantly increasing potential throughput. The Solana blockchain is built on this concept.

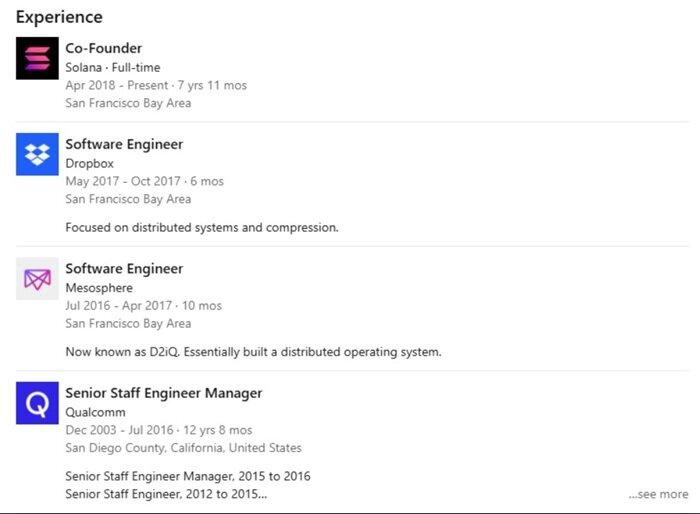

Soon, Anatoly Yakovenk recruited former Qualcomm colleagues Greg Fitzgerald and Stephen Akridge to assist in building the prototype. The team officially established Solana Labs in 2018 and received initial funding from a development agreement. Raj Gokal, one of Solana's co-founders, also joined the project shortly after the release of the "Proof-of-History" white paper, serving as the Chief Operating Officer of Solana Labs (the core founding team members of Solana are shown in the image above). Solana Labs launched its first testnet in 2018, followed by a mainnet beta launch in March 2020, and entered the market at the beginning of the COVID-19 pandemic.

On-chain holdings tracking by Anatoly Yakovenk

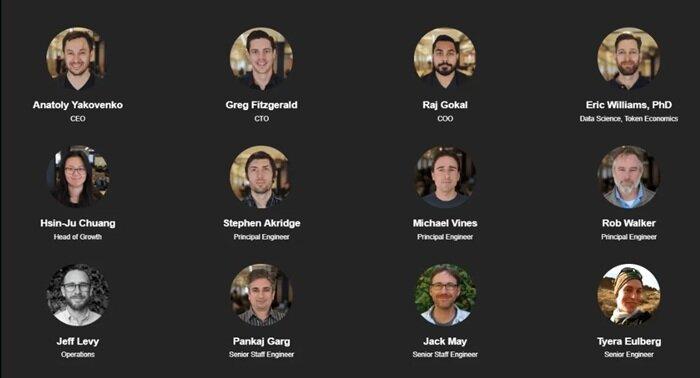

Solana launched with 500 million SOL tokens, of which 12.5% were allocated to the founding team, including Anatoly Yakovenk. A Solana address starting with "9QgXq" has been widely rumored to be associated with Anatoly Yakovenk (as shown in the image below), but this has not yet been confirmed. This wallet holds over 136,725 SOL tokens, most of which are staked, and early transactions transferred millions of SOL tokens to this address. This wallet address is over five years old, and if it does indeed belong to Solana co-founder Anatoly Yakovenk, then his SOL token holdings would be worth over $11 million.

Furthermore, by tracking the historical transaction records of Anatoly Yakovenko's staking accounts, it can be found that these accounts have conducted large-scale SOL transactions with multiple Solana addresses. For example, between August and November 2024, more than 3 million SOL tokens were unstaking and transferred, of which more than 1.5 million SOL tokens are still staked in multiple addresses, including 9E8zG, JQ5jC, A6mJn, and 7pgzZ. If these addresses also belong to Anatoly Yakovenko, then the value of the SOL tokens he holds will far exceed the current valuation, and at the current price, the value will be close to $122 million.

Another domain suspected to be related to Anatoly Yakovenko is the Solana domain toly.sol, because Anatoly Yakovenko's username on X is Toly. Tracing this domain reveals that its owner is an address starting with "86xCn", which currently holds various tokens worth over $1.3 million. However, the value of this address is mainly in tokens with low liquidity, so the actual liquid value of the tokens it holds is only about $16,500, equivalent to 203.8 SOL.

Anatoly Yakovenko's off-chain holdings tracking

In addition to holding tokens, Anatoly Yakovenko also holds a significant stake in Solana Labs, a company currently responsible for the development of the Solana protocol and its related infrastructure. Although the specific percentage of his shareholding has not been publicly disclosed, it is estimated that he holds approximately 5% to 10% of Solana Labs.

As a privately held company, Solana Labs' valuation has not been publicly disclosed. Solana Labs has completed multiple funding rounds in the past, with investors including prominent venture capital firms such as a16z (Andreessen Horowitz), Polychain Capital, and Multicoin Capital. These investments have valued the company in the billions of dollars, with many estimating its worth between $5 billion and $8 billion. Based on these valuations, Anatoly Yakovenko's stake is worth between $250 million and $800 million, not including his personal token holdings.

While Solana Labs' valuation remains partly tied to the market performance of the SOL token, the dual ownership structure—comprising both tokens and company equity—provides Anatoly Yakovenko with a degree of diversification in how she holds her wealth. While the SOL token price can be highly volatile, company equity represents a more stable asset, especially as Solana Labs expands its business beyond protocol development to other blockchain infrastructure projects.

In addition to his stake in Solana Labs, Anatoly Yakovenko is an active angel investor, having invested in over 40 companies. Some of these companies have grown into giants within the Solana ecosystem, including liquidity staking service providers Jito Labs and Solayer, perpetual DEXs Drift Protocol and Infinex, and staking infrastructure project Helius.

Who owns the most Solana?

As an emerging blockchain, Solana has made significant progress since its inception. Today, Solana tokens are distributed in a diverse manner, with holders including institutional investors, exchanges, founders, and retail participants. Major institutional holders include Solana Treasury, cryptocurrency exchanges that hold tokens on behalf of users, the Solana ETF, and staking service providers.

However, based on existing data analysis, the largest holder of SOL tokens is likely the successful bidder in the FTX bankruptcy auction. After the centralized exchange FTX collapsed, its SOL token holdings were auctioned off as part of the liquidation process. During this process, a total of 41 million SOL tokens were sold, with Galaxy Digital and Pantera Capital acquiring the majority. Although these tokens were subject to a lock-up and vesting plan, approximately 60-70% of the sold SOL tokens have been unlocked and may have already been sold. Considering this, Galaxy Digital may still hold approximately 6-8 million SOL, while Pantera may still hold approximately 3-5 million SOL.

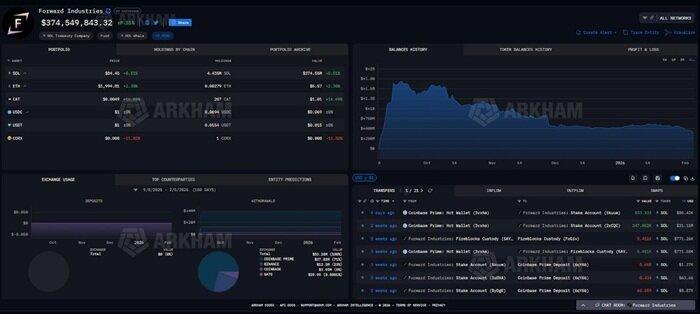

In 2025, Solana Treasury companies came into the spotlight. Due to the high transparency of their holdings, the largest SOL holder was Forward Industries (as shown in the image below), a Solana Treasury company, which currently holds 6.9 million SOL tokens (worth $583 million), representing 1.115% of the total SOL supply. Other Solana Treasury companies lagged far behind; the nine companies following Forward Industries collectively held only 1.5% of the total SOL supply.

On the custody service provider side, some centralized exchanges also provide SOL token custody services for users. For example, Binance's latest proof of reserves shows that the exchange holds more than 24.2 million SOL tokens. Similarly, ETF providers have also become one of the major holders of SOL tokens. Among them, Bitwise Solana Staking ETF (BSOL) holds more than 5.5 million SOL tokens and is currently the largest spot SOL ETF.

Among individual holders, while Anatoly Yakovenko may rank highly, she may not be the individual holding the most SOL tokens, as other co-founders and early team members of Solana Labs also received a considerable number of SOL tokens. Furthermore, some early private investors may even have held more SOL than the co-founders of Solana Labs.

Anatoly Yakovenko's net worth fluctuates significantly with the market.

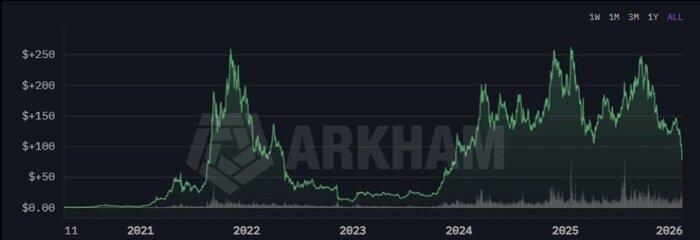

Over time, Anatoly Yakovenko's net worth is likely closely correlated with Solana's market performance, having weathered its dramatic stock price fluctuations (the chart below shows the Solana token price movement over recent years). When SOL reached a cyclical high of approximately $260 in November 2021, his combined holdings of tokens and company equity likely put his net worth at over $2 billion, and possibly even close to $3 billion, depending on the value of his Solana Labs stake.

On the other hand, the 2022 crypto bear market severely compressed Anatoly Yakovenko's asset value. With the price of Solana falling below $10 at one point, the value of the tokens held by Anatoly Yakovenko also dropped by more than 95% from its peak. Network outages during this period, as well as Solana's close ties with FTX and Alameda Research, had an additional negative impact on token prices and ecosystem sentiment. Assuming Anatoly Yakovenko's net worth moved in line with market fluctuations, his net worth may have fallen below $100 million at one point during the bear market.

However, as the market returns to a bull market between 2023 and 2025, Anatoly Yakovenko's net worth is likely to grow as well, and coupled with the growing equity value of Solana Labs (currently estimated at between $4 billion and $10 billion), it could once again push Anatoly Yakovenko's net worth to several billion dollars.

At the beginning of 2026, the cryptocurrency market experienced a crash, and the price of Solana also fell below $100. Anatoly Yakovenko's net worth valuation has remained between $500 million and $1.2 billion, depending on the liquidity of the tokens held and the valuation of the equity held by Solana Labs.

Summarize

As of early 2026, Anatoly Yakovenko remained one of the core architects of the digital economy. His net worth fluctuated as the Solana ecosystem matured. Although the crypto market crash in early 2026 shrank his wealth from a peak of several billion dollars, his financial situation remained robust, mainly due to his equity in Solana Labs and a series of early-stage investments.

From a hard-working engineer who toiled for ten years at an internet company to a crypto billionaire who has built a blockchain comparable to Bitcoin and Ethereum, Anatoly Yakovenko's influence on the crypto industry is evident. Solana has also evolved from a high-speed blockchain into a hub integrating institutional finance, stablecoin payments, and trading functions. Yet, it all seems to be just beginning.