A bull market is full of nonsense, and a bear market is fruitful.

Original: 10 Highlights From Messari's Prodigious 'Crypto Theses 2023

By Lou Kerner

Compilation: ETH, Foresight News

Cover: Photo by Dennis Mita on Unsplash

At 157 pages, Messari's " Annual Paper on Cryptocurrencies in 2023 " is slightly down on 2022's masterpiece, but it's still one of the industry's most impressive overviews of the crypto ecosystem and a must for any crypto enthusiast. Must read.

While Messari has a research team of approximately 200 people, a 3x increase from 2020, the report was written in first person by co-founder and CEO Ryan Selkis. I've been a fan of Selkis since January 2020, he gave a talk at CryptoMondays NYC and we were fascinated by his talk about Crypto Theses 2020 and the story of cracking down on the Mt. Gox hackers .

The longest chapter in this year's article is "Ten Trends in Cryptocurrency Policy," but each chapter is packed with great insights. The report provides a comprehensive account of the current state of cryptocurrencies, as well as predictions for the development of the industry in 2023:

Although the report is very detailed, few people will read all 157 pages. Here are the most interesting points I found in each of the report's 10 great chapters.

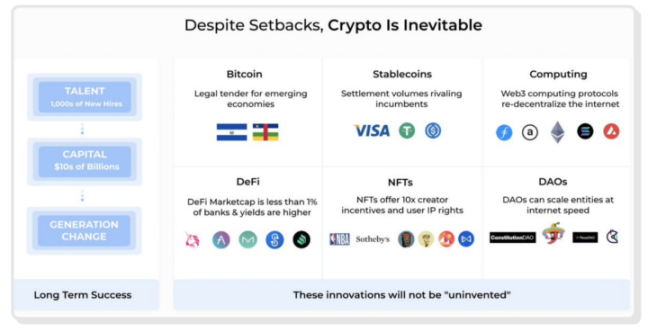

Chapter 1 Highlights of "Ten Narratives" - Cryptocurrency is an Inevitable Trend

While "long-term builders may be temporarily hurt by market volatility, they are not the ones who perpetuate fraud or deceive investors," Selkis noted. Although the industry currently has less liquidity, Web3 is still attracting the world's brightest minds, leveraging more and more critical infrastructure to change the world:

Selkis repeated the oft-quoted statement that, in many ways, it is easier to build in a bear market than in a bull market. Or as Brock Pierce puts it: "Bull markets are bullshit, bear markets are fruitful."

Highlights of Chapter 2 "Top Ten People to Watch"——CZ

Last year I chose "WAGMI" as a crypto person who needed extra attention, which in hindsight was a poor choice as many of us (e.g. FTX, Terra Luna, Three Arrows, BlockFi, Celsius, Voyager...) Neither worked. I chose CZ this year not only because I had an exchange with him at Paris Blockchain Week.

It's because after the demise of FTX, Binance now accounts for 75% of global spot trading volume. However, Binance is operating in “a gray area of epic jurisdictional mobility.” So I'm watching CZ, like many others, to see if he's a benevolent dictator or if he'll be the same as SBF and Do Kwon.

Chapter 3 "Top 10 CeFi Trends to Watch" Highlights - Institutions are Coming

“This is part of the report, the minute I pretend to care about agency encryption,” Ryan wrote. I know they will come eventually.

But institutions are a lagging indicator of where the crypto space is, not a leading one. When the inevitability of cryptocurrency is clearer and the timing is more certain, institutions will not lead, they will follow.

Chapter 4 "Ten Trends in Cryptocurrency Policy" Highlights - Tornado Cash and OFAC

In the report's preface, Ryan wrote: "While writing this report, there is a certain level of anger. Bad actors have gotten all the market attention this year and have hindered the development of good actors, whose progress over the years may also be overshadowed. Market ignores". But as with SBF and other scammers, Gary Gensler may have actually done the most damage. In an article titled "Everyone Hates Gary", Ryan stated that "the first thing you need to know about the SEC under Gary Gensler is that they never had a company they didn't want to sue (except, obviously, FTX) ".

While I applaud those who won the battle in Washington, I am confident that these issues will eventually be resolved through regulatory arbitrage. I'm glad builders are leaving the US for Singapore, Lisbon, or other places that are very welcoming to innovators, rather than staying in places that put people in jail because of it. So my personal view is that I want to spend more time thinking about regulatory policy, just like regulators spend time thinking about me.

But Ryan chose the opposite direction. In the preface, he admits that he "probably spends more time in this report than you think deciphering cryptocurrency policy." The policy section is 23 pages long, which is 20% longer than the next longest section.

But of all the egregious moves by regulators and lawmakers, the most egregious was the August arrest of Alexey Pertsev, a Dutch national who co-founded Tornado Cash, in connection with money laundering. Also Russian expats. Authorities have so far failed to outline formal charges against Alexey. No one knows exactly what actions are considered illegal, but the chilling effect has made the crypto winter all the more brutal. The whole incident also highlights why encryption technology is so important to making the world a better place.

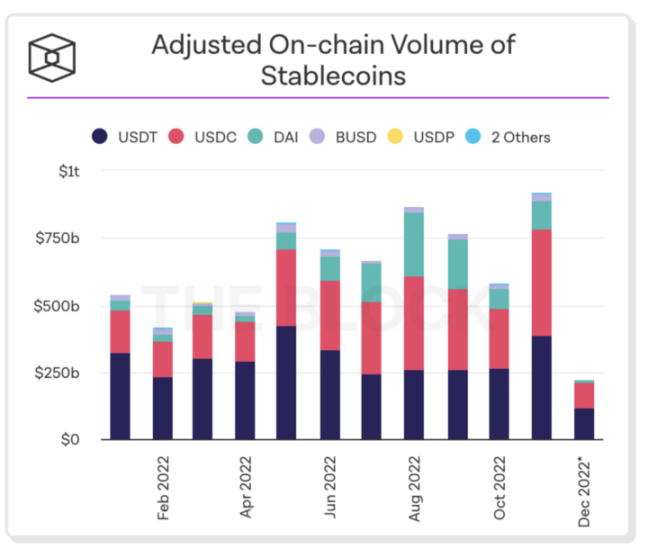

Highlights of Chapter 5 "Top 10 Cryptocurrency Trends" - Stablecoin should be our main output

I did 26 episodes of " Stablecoins Are Killing It " in 2020, because this is the fastest growing part of the crypto ecosystem, and it will continue to grow in 2023, and the volume of Stablecoin transactions on the chain will continue to hit new highs.

While most people focus on USDC and USDT fighting for Stablecoin dominance, I am more interested in Algorithmic Stablecoin like Frax, Rai, and Reserve. I'm also more bullish on the impact of CBDC than Ryan, who is more Orwellian in impact, as if US CBDC is more dystopian than our current banking system. Instead, I am more concerned that CBDC can allow billions of people to use digital currency.

Highlights of Chapter 6 "Ten Trends in Ethereum and L1" - New Ethereum Roadmap

The highlight I picked last year was "Solana Summer Never Ends," which turned out to be not a good choice. Relative to the picks a year ago, I think Cosmos is probably the biggest winner in non-Ethereum L1.

While we felt at the beginning of 2022 that we were going down the Multichain path, by the end of the year we were back to focusing on the EVM. While non-EVM chains are working to become EVM compatible and bridges between chains are being built and strengthened, Ethereum is becoming more dominant.

"Consolidation" is the L1 highlight in 2022. The continued progress on the Ethereum roadmap below is expected to be a bright spot for L1 again in 2023.

Highlights of Chapter 7 "Top Ten Trends in DeFi" - Real Asset Mortgage

Like Ryan, "I'm incredibly excited about the future of decentralized finance DeFi." I also believe that "we need more applications to serve users' daily work and find use cases that we can be proud of".

But the part I'm most excited about is the migration of real world assets RWA to the chain. This is a huge opportunity, and it's already happening, as RWA has grown to 57% of Maker's revenue in December:

A great example of RWA in DeFi is END-Labs , which is tokenizing compensation pools of gig workers (e.g. from Uber, Lyft, DoorDash, etc.), giving gig workers the opportunity to get paid earlier while giving them Sustained double-digit return on investment.

Like Ryan, I am very bullish on "regenerative finance," a term coined by John Fullerton to describe an economic design that "protects what is left and secures long-term financial Prosperity". I am proud to be part of the Celo community that is doing a lot of great work on regenerative finance.

Highlights of Chapter 8 "Ten Trends of NFT and DeSoc" - Decentralized Social DeSoc

DeSoc is re-architecting Web2 social media in the crypto space, potentially providing "people's on-chain reputation, ownership of organization DAOs and their content. DeSoc also introduces new ways for people to better capture the value of their online IP." DeSoc is going to change the way value flows on the internet." DeSoc is still early days, early leaders like Lens have small communities, but decentralized Facebook is on our radar, and when that happens the world will be a better place.

Chapter 9 "DAO and Web3 Top 10 Trend Takeaways" Highlights - DAOs That Actually Work

I completely agree with Ryan that "what is most lacking in the crypto space is not talent, but good governance and protocols that encode better layer 0 value at the community level". But we can look at some early examples of DAOs that are actually useful.

- New business model: Vibe Bio aims to change the incentive structure in biotech. The agreement makes drug-funded research more accessible to people with rare diseases.

- SPAC: ConstitutionDAO is a flash mob that demonstrates how easily a single-purpose community can rally around a cause and fund investment. The concept could be extended to buying sports clubs, financing crypto ventures or funding lawsuits against deep-pocketed enemies.

- Investment clubs: Syndicates makes it easier to form NFT and token investment clubs (such as Orange DAO).

- Impact DAOs: Gitcoin has been one of the most innovative early-stage DAO projects, pioneering the quadratic funding model and helping to seed core ecosystem infrastructure such as ethers.js, Optimism, and Uniswap.

- The Ultimate DAO, Cyber Nation: "A cyber nation is a highly coherent online community with the ability to act collectively to crowdfund territories or DAOs around the world and eventually gain diplomatic recognition from existing nations," writes Balaji. "

- In the past six months, my most passionate project has been the CryptoOracle Collective, so I am also very excited about the decentralized talent market.

Chapter 10 I Have Something to Say—Why You Must Write

I've written over 300 articles related to cryptocurrency and most of the time nobody cares.

"I don't know what I'm thinking until I read what I've written about it - William Faulkner"

Or as Ryan puts it, "Reading helps me identify my blind spots, but writing helps me focus and organize my thoughts".

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.