Canto was one of the hottest emerging Layer1s at the beginning of the year, and its price rose about 7 times within 30 days. What is so special about Canto? Let's find out together.

What is Canto?

Canto is a Layer1 blockchain designed for DeFi. Canto is based on the Cosmos network, uses Cosmos' Tendermint consensus mechanism and is compatible with EVM. Canto is committed to providing users with free DeFi infrastructure services, aiming to serve users as a Free Public Infrastructure.

Canto infrastructure mainly consists of three components:

- Canto DEX

- Canto Lending Market (CLM)

- $NOTE

Canto DEX

Canto DEX is an AMM DEX developed by the Canto team, which uses a constant sum formula for stable currency pairs that require centralized liquidity, and a constant product formula for assets that require unlimited liquidity. In addition, Canto DEX is also designed to have no transaction fees and cannot be upgraded permanently. Liquidity providers can only get incentive rewards from Canto's native asset $CANTO, and cannot get fee income from it.

Canto Lending Market (CLM)

CLM is a lending market forked from Compound v2, and the governance right is in the hands of $CANTO pledgers. LP tokens obtained by providing liquidity to Canto DEX can be deposited in CLM as collateral and lent out other assets. But LP tokens themselves cannot be lent out.

$NOTE

$NOTE is an over-collateralized "stable currency" within the Canto ecosystem, which can only be obtained by borrowing from CLM. The currently supported mortgage assets are $USDC and $USDT. The price of $NOTE is controlled by a smart contract, and its interest rate is periodically adjusted according to an algorithm, so that its price is stable at around $1. So it can be said that the price of $NOTE is cointegrated with USD, but not pegged. $NOTE mainly serves the Canto ecosystem as a stablecoin that is "softly pegged" to the US dollar.

What is Canto's rating?

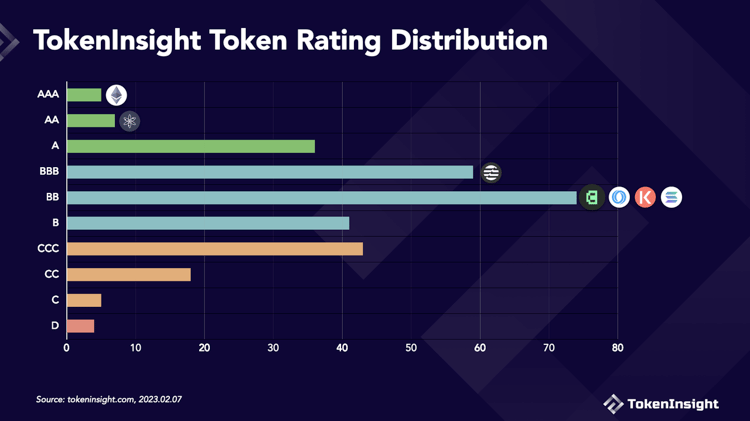

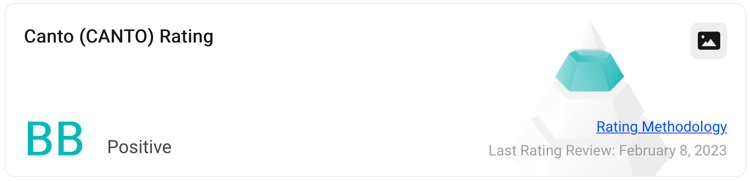

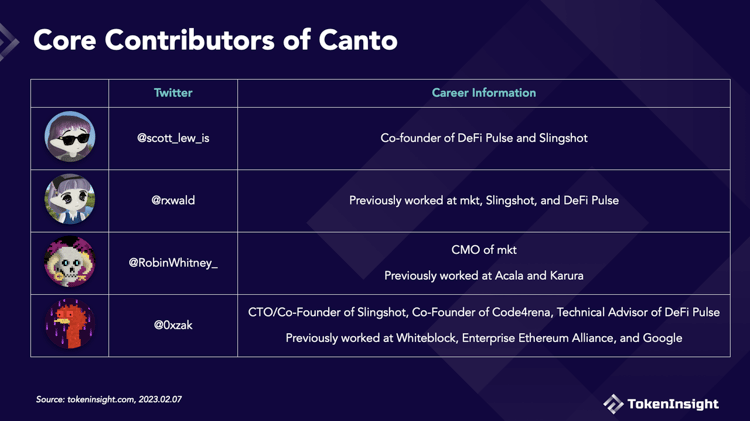

TokenInsight rated Canto's current performance, the result is BB, and the outlook is positive. Among all the public chains, the public chain projects that rank in the middle of the BB rating like Canto include: Kava, Oasis Network, etc.

The specific analytical scores of Canto's rating results are as follows:

- Underlying technology and security 59.55%

- Roadmap and progress 62%

- Token Economy 61%

- The performance of the secondary market of tokens is 57.73%

- Ecological development 57.25%

- Team, partners and investors 62.67%

Team, partners and investors (62.67%)

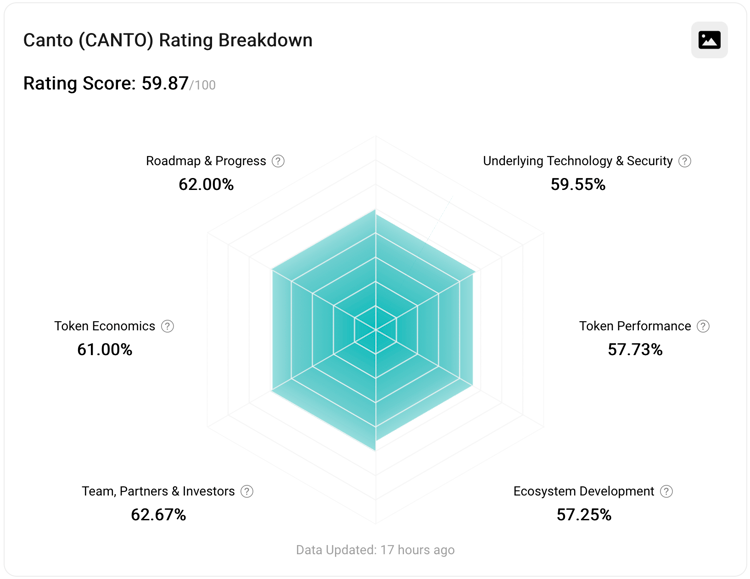

Decentralization is one of the main characteristics of Canto, which is evident in its team composition. The team behind Canto operates anonymously, calling themselves a “loosely organized collection of blockchain builders.” Members of the team are called "contributors" and are responsible for overseeing the day-to-day operations of the Canto network and running the Canto community.

Most of Canto's contributors are distributed in other Crypto-related projects, and they work together to help run Canto. According to statistics, most of Canto’s core contributors come from DeFi Pulse and Slingshot.

In addition, Canto has not conducted primary market financing, nor has it established a foundation.

Underlying technology and security (59.55%)

Canto publicly released its project-related code on GitHub, including technical documents such as the main network, genesis block, and smart contracts.

As of February 2023, Canto has publicly disclosed 4 code audit reports in its official documents. The 4 audits were all done by Code4rena, the latest being in July 2022. The audit content not only includes $NOTE, CLM and other major infrastructure-related codes, but also includes the code of Gravity Bridge, the Cosmos ecological cross-chain bridge. According to the report results, most of the security issues found in the audit have been fixed by the team of Canto contributors.

As of February 2023, Canto has not had any incidents of crisis affecting safety.

Token economy (61%)

$CANTO is the native asset of Canto, mainly used for network security, gas fee and governance. $CANTO will have an initial total supply of 1 billion. Among them, the initial circulating supply is 150 million.

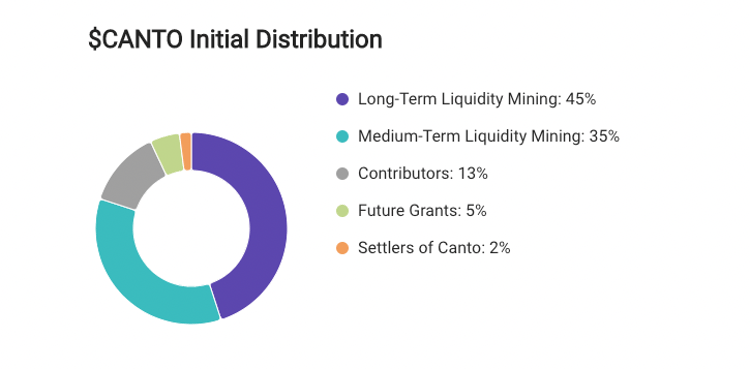

According to the distribution plan announced by Canto, 80% of the initial supply of $CANTO will be allocated to liquidity providers for Canto DEX through the mid-term/long-term liquidity mining plan, and 2% will be allocated to early users participating in the launch of the testnet. Of the remainder, the portion allocated to early contributors represents 13% of the initial supply. In addition, $CANTO has not conducted early token sales, and the token unlocking plan has not yet been announced.

$CANTO distribution plan, source: Canto’s currency details page on TokenInsight

Token issuance

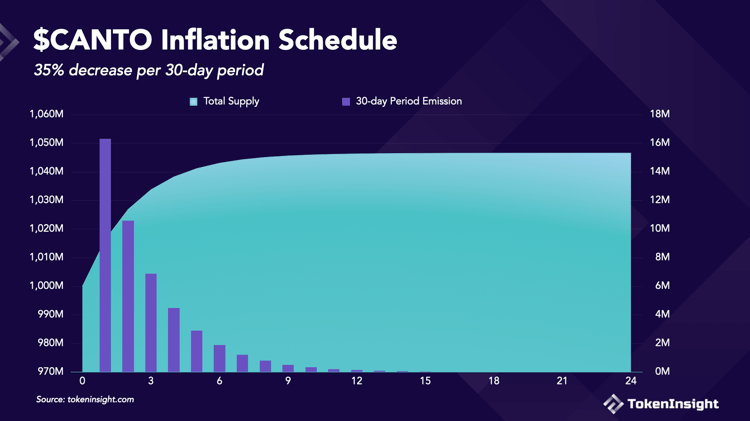

In order to maintain network security for a long time, $CANTO is designed for limited issuance. The annual issuance of $CANTO will continue to decrease over time, and the additional issuance $CANTO will be distributed to stakers through staking rewards.

The specific plan for additional issuance of $CANTO is as follows:

- The additional issuance of $CANTO will be in a 30-day cycle

- In cycle 1, approximately 16 million $CANTO will be minted at an annual interest rate of 19.84%

- In the next cycle, the additional issuance will be reduced by 35% in each cycle until it tends to 0

$CANTO additional issuance plan, source: Canto official document

Token secondary market performance (57.73%)

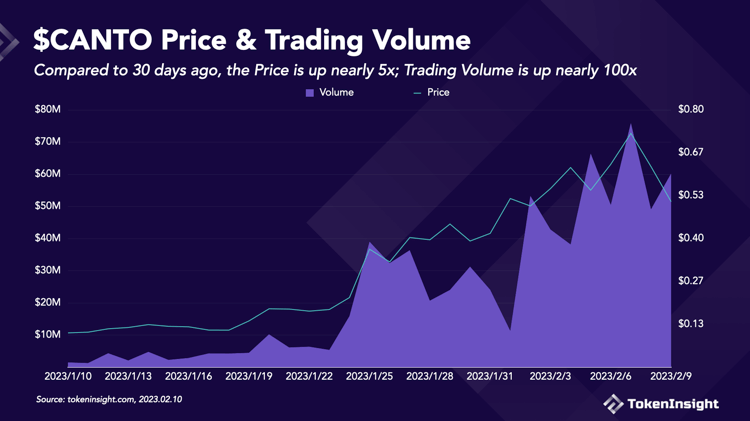

The price and trading volume of $CANTO are affected by the Contract Secured Revenue (CSR), a contract security income distribution model released by Canto last month, and have recently shown a violent upward trend.

What is Contract Secured Revenue (CSR)?

Contract Secured Revenue (CSR) is a cost-splitting model used to solve the revenue problem brought by Canto's infrastructure for free and help developers earn revenue. CSR allows developers to extract a certain percentage (initially 20%) from the network Gas fee as income, and at the same time generate NFT for income accumulation and extraction. NFT itself can be traded and combined in DApp, and the supported use cases include trading, investment, loan collateral, etc.

On February 8, 2023, the 24h spot transaction volume of $CANTO reached about 76 million US dollars, which was the peak of the recent transaction volume, an increase of nearly 100 times compared with 30 days ago, and even surpassed Aptos.

Source: Canto's currency details page on TokenInsight

In terms of price, the price of $CANTO increased about 7 times in 30 days, from $0.11 on January 10 to a maximum of $0.77 (2023-02-07). But according to the latest data, on February 10, the price of $CANTO fell back to around $0.55, a drop of more than 25% from the ATH.

In addition, according to the statistics of TokenInsight, Canto's native exchange, Canto DEX, currently occupies the No. 1 exchange in $CANTO trading volume, accounting for about 97.22% of the total trading volume. The second-ranked MEXC Global only accounted for $CANTO 1.6% of the trading volume.

Ecological development (57.25%)

After the Contract Secured Revenue (CSR) proposal was passed, Canto's TVL ushered in explosive growth. According to DeFiLlama's data, its TVL rose from $100M in early January to a maximum of $203M (2023-02-08). It currently ranks 15th among all public chain projects.

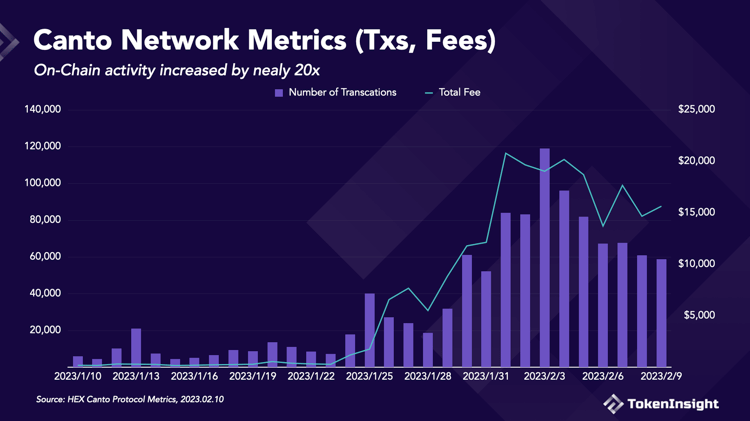

Judging from the activity data on the chain, the rise of Canto is also very obvious. After the implementation of the CSR proposal, the number of transactions and gas fees on the Canto network have increased significantly, with the number of transactions rising from 7,249 on January 23 to a maximum of 119,012.

Source: HEX Canto Protocol Metrics

popular items

- Gravity Bridge

Gravity Bridge is an asset cross-chain bridge in the Cosmos network, which is used to connect Ethereum and Cosmos network for cross-chain transfer of funds. Gravity Bridge uses Cosmos' IBC, so in addition to Canto, it also supports other blockchains in the Cosmos ecosystem.

- Synapse Protocol

Synapse Protocol is a multi-chain cross-chain protocol using liquidity swap, which will be deployed to Canto in September 2022. Currently supports 18 blockchains and 19 assets. According to Synapse, on February 2, the single-day transaction volume of Synapse on Canto reached 5 million US dollars, becoming the second largest cross-chain bridge protocol on Canto after Gravity Bridge.

- CantoSwap

CantoSwap is the native DEX on Canto. Currently supports 12 assets including $CANTO and $NOTE. CantoSwap's share in the Canto ecosystem is second only to Canto DEX and Canto Lending, accounting for 0.59% of the total TVL.

- Sling shot

Slingshot is a multi-chain aggregation DEX with a financing amount of more than $15M. Currently supports 6 blockchains including Canto and more than 10,000 tokens. In addition to the transaction function, Slingshot also supports NFT transactions.

- Y2R Finance

Y2R Finance is a DeFi income aggregator that can amplify LP income through automatic income strategies. Currently, Y2R Finance's revenue optimization service supports 4 liquidity pools including $CANTO and $NOTE.

- Alto Market

Alto Market is one of the main NFT trading markets within the Canto ecosystem and does not charge any handling fees. There are currently about 200 NFTs that can be traded on Alto. In addition to NFT transactions, Alto also supports NFT minting. As of February 9, 2023, the No. 1 NFT on the Alto Market is Canto Longnecks (CLNFT), with a floor price of 4,200 $CANTO and a transaction volume of nearly 4 million $CANTO.

write at the end

In general, the CSR revenue split model launched by Canto has solved the disadvantages of its free service and brought stable income to developers. At the same time, this also motivates more developers to enter the Canto ecosystem. They further increase $CANTO use cases while bringing more and richer applications to Canto. The rise in currency prices and transaction volume will attract more users to Canto, thus forming a positive cycle.

But on the other hand, while the projects in the ecology are developing rapidly, many details are often ignored. Therefore, Canto may need to further optimize user experience and improve composability between applications to achieve long-term stable development. In addition, although Canto's TVL is currently growing rapidly, they are all concentrated on two native DApps, and other DApps need further development.

Based on the above information, TokenInsight gave Canto a BB rating with a positive outlook.