Original title: "The complete guide to GLP wars"

By Henry Ang, Mustafa Yilham, Allen Zhao & Jermaine Wong, Bixin Ventures

Real Yield (Real Yield) is considered to be the purest form of income that people can find on the chain. It does not rely on excessive token release, but relies on the fees and income generated by the actual transaction of the agreement. This sustainable benefit is extremely attractive to DeFi farmers if the protocol chooses to share the profits with users.

GMX is a representative project that generates real income. As a popular perpetual trading platform, GMX uses GLP as trading liquidity, and 70% of user trading losses and platform fees will be distributed to LPs and GMX Token holders in the form of ETH or AVAX . In other words, as one of the largest fee generators in the DeFi protocol, GMX distributes most of the fee income to stakeholders.

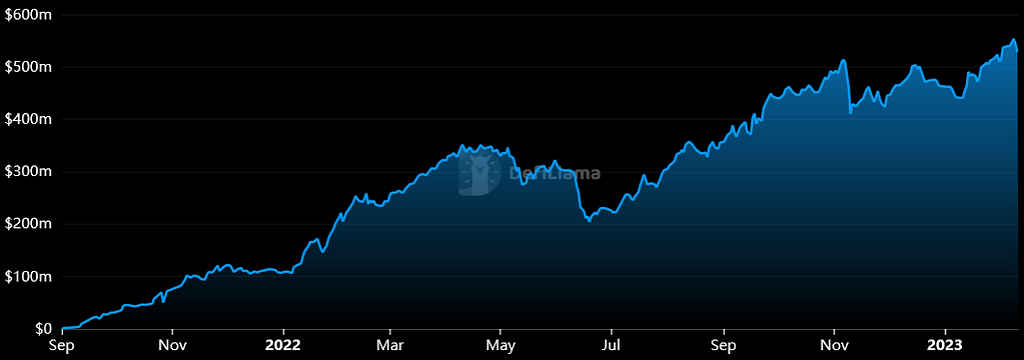

Since the launch of GMX, the market demand for GLP has soared. At present, the total value of locked assets locked by GMX exceeds 500 million US dollars, and it has been growing. The real income narrative triggered by GMX has also been sought after by more and more people. Developers began to build projects on top of GMX, and attracted GLP share, GLP War ensues.

Figure 2: TVL of GMX

Cause of GLP War

Before understanding GLP War, let's briefly sort out GMX and GLP.

GLP is a LPs liquidity pool similar to Uniswap. It is composed of a basket of tokens as shown in the figure below, of which 48% are stable coins and 52% are composed of other currencies. Due to price fluctuations of BTC, ETH and other currencies , the overall value fluctuates accordingly. Users are incentivized to stake GLP to profit from traders' losses, while earning esGMX and sharing 70% of the platform's transaction fees.

Due to market risks, GLP pledgers may also suffer losses while gaining income. The chart below compares GLP's returns to earnings. Since inception, GLP has returned -13%.

In addition, GLP income is paid to users in ETH or AVAX, and users must manually claim rewards and perform reinvestment operations. Although the fees of Arbitrum and Avalanche are very low, manual re-investment will inevitably generate corresponding handling fees.

beginning

Various agreements have noticed the problems of GLP and proposed solutions, such as what happens if the risk exposure of GLP is hedged? What happens if the yield is leveraged? What if earnings could be reinvested automatically? What if GLP could be used as collateral? Developers began to look for a breakthrough, and GLP War followed.

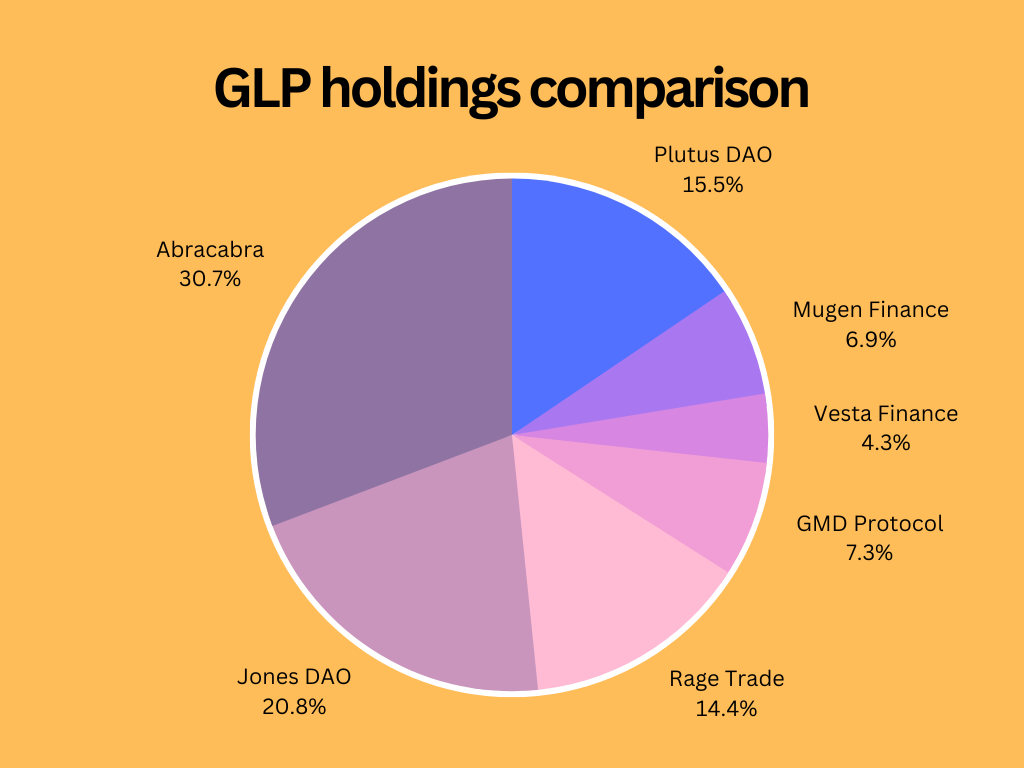

Figure 5: Proportion of various agreements to GLP

GMX ecology

PlutusDAO

PlutusDAO is a revenue aggregator with protocol governance through the native token PLS. It provides liquid staking for veAssets such as veJones, veDPX or veSPA. After integrating GLP, users can deposit GLP to unlock more functional plvGLP.

With plvGLP, ETH rewards will be calculated automatically every 8 hours. Due to the automatic reinvestment, the value of plvGLP increases and holders get a higher APY. PLS tokens are also distributed to plvGLP stakers as liquidity mining rewards. Plutus charges 10% of GLP proceeds as a fee.

plvGLP also unlocks composability with other protocols. Conventional GLP can only be pledged on GMX and cannot be integrated with other protocols. plvGLP solves this problem by cooperating with various lending and asset management protocols. Through Lodestar Finance and Vendor Finance, users can use plvGLP to borrow or mortgage, and users can formulate better strategies based on this, such as holding leveraged long or short positions, or manually executing delta neutral strategies by borrowing BTC and ETH . @0xBobdbldr details the relevant strategy here .

Recently, Plutus has also reached a cooperation with FactorDAO to realize asset management. Factor strategists can leverage Plutus products and create new use cases, one potential use case is the Plutus index vault, which aggregates all plsAssets and diversifies revenue streams. They are also exploring further integration opportunities with RodeoDolomite and others.

Mugen Finance

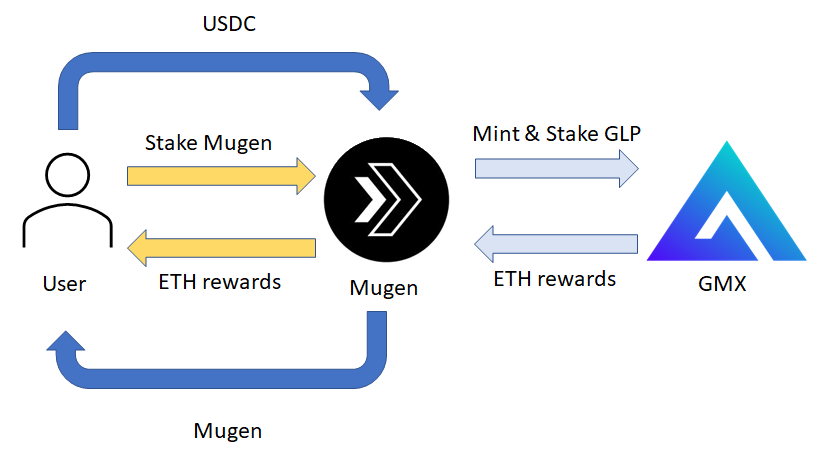

Mugen Finance is one of the earliest projects on GMX. Mugen is a cross-chain revenue aggregator built on LayerZero. Users can benefit from multiple agreements on multiple chains, which can be regarded as Yearn Finance on LayerZero. Currently, there is only one strategy on their platform, the GLP strategy.

The GLP strategy is executed by Mugen's treasury according to the amount of whitelisted funds in the strategy, and the treasury earns income by minting and staking GLP. Users who deposit funds into Mugen will mint the native token MGN, and Mugen pledged in the form of xMugen will receive ETH benefits from the treasury. Users can choose to automatically reinvest the income, and use the ETH income to purchase MGN and mortgage it. This helps improve APY because automatic rerolls occur more often than manual rerolls.

Mugen's strategy, while relatively basic, offers farmers a variety of options and automatic reinvestment of returns. In the future, Mugen will integrate more protocols, and users only need to pledge MGN to obtain income from multiple sources and chains.

Figure 6: Simplified workflow of Mugen Finance

Vesta Finance

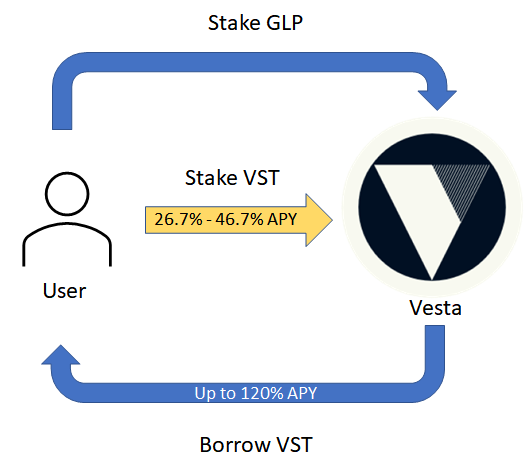

Vesta Finance is a collateralized debt platform where users can lock up collateral and mint Vesta’s stablecoin, VST. GLP is one of the collaterals accepted by Vesta, which adds new usage scenarios for GLP for users. Users can deposit GLP and borrow VST to maximize capital efficiency.

VST can be mortgaged in Vesta's mining pool, and a stable currency rate of return of 10–40% can be obtained depending on the lock-up period. When the mortgage rate is 150%, the yield of VST will be 6.7%-26.7%. Overall, without any direct exposure, the GLP yield could improve to around 46.7%.

Vesta also allows leverage on GLP yields. Similar to Degenbox, users can deposit GLP to get a VST loan, which can then be used to buy more GLP. This process is repeated multiple times to obtain a larger leveraged position. With a 120% collateralization ratio, a 6x leveraged position is possible and the APY will reach nearly 120%.

Figure 7: GLP Yield Leverage Operation Diagram

However, this strategy can be affected by fluctuations in the price of assets such as BTC and ETH, creating liquidation risks. Risk DAO has a great article about the risks of Vesta Finance and the security of its current configuration.

Unstoppable Finance

Unstoppable Finance provides GLP holders with a completely free automatic reinvestment device. Compared with other protocols that charge a certain percentage of fees based on earnings or deposits, using the automatic reinvestor does not charge any fees, so users can save gas costs. The protocol's vaults are built using the ERC-4626 tokenized vault standard, and anyone can build on top of their vaults.

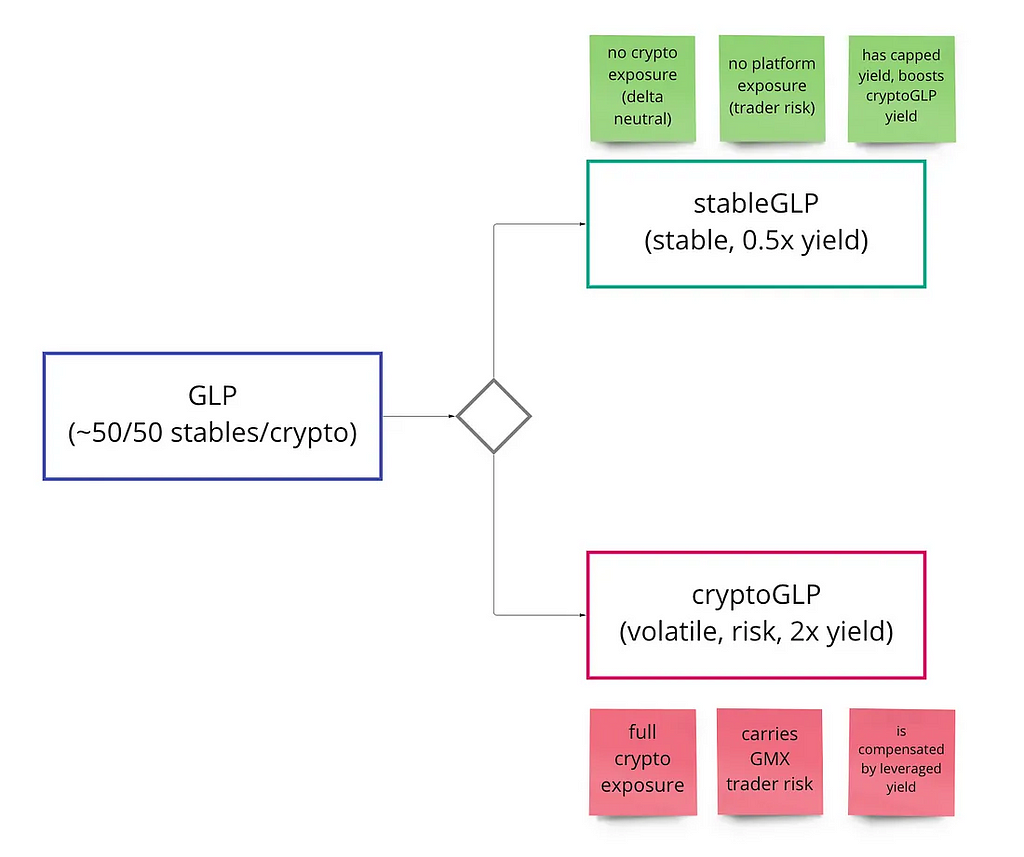

They also have a new mechanism called TriGLP still in development. This mechanism tokenizes GLP into stableGLP and cryptoGLP, earning different amounts of benefits based on the risks they take. Their goal is to create a delta-neutral stablecoin-like position with ~10% APR that isn't exposed to volatility; and a cryptocurrency-like position with ~30% APR while maintaining full ETH/ BTC exposure.

Figure 8: Schematic representation of the TriGLP mechanism

GMD Protocol

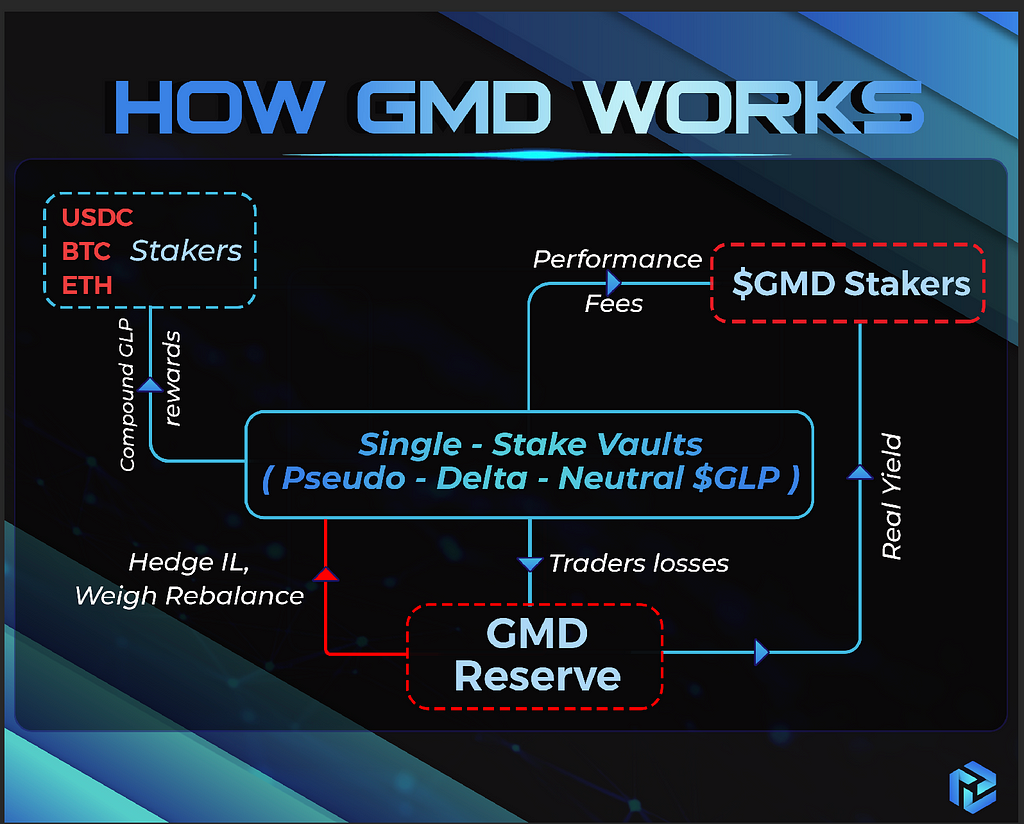

GMD Protocol is another yield aggregator that offers additional functionality, mitigating the problem of direct exposure to GLPs by offering the pseudo-delta-neutral strategy.

GMD provides a single pledge vault for BTC, ETH, and USDC. The deposit limit is based on the relative ratio of GLP to USDC, ETH, and BTC. The assets in the vault are used to mint GLP and earn income. This allows users to maintain pseudo delta neutrality to their deposited assets. For example, a user who wants to earn yield on USDC without exposure to BTC, ETH, or other tokens in GLP can deposit funds into GMD’s USDC vault to earn a portion of GLP earnings. This pseudo-delta-neutral strategy uses a GLP-based ratio consisting of USDC, ETH, and BTC.

Over time, the amounts allocated to the 3 vaults on GMD will need to be manually rebalanced weekly to adjust to the new GLP ratio. The GMD protocol does not rebalance user funds, but it does rebalance by depositing 5–15% of the maximum total value in Delta-Neutral Vaults. This helps alleviate the low reserve issue, since the protocol itself has liquidity to draw from.

In order to further reduce the volatility risk of smaller assets such as Uniswap in GLP, GMD provides an agreement reserve, which contains GLP with a value of 5%-15% of the total TVL. The protocol reserve is funded by the treasury and will be compensated to users when the value of their assets falls below the value of GLP. GMD believes that the protocol reserve will only grow in the long run as it gains value from the losses of GMX traders.

Figure 9: GMD working mechanism

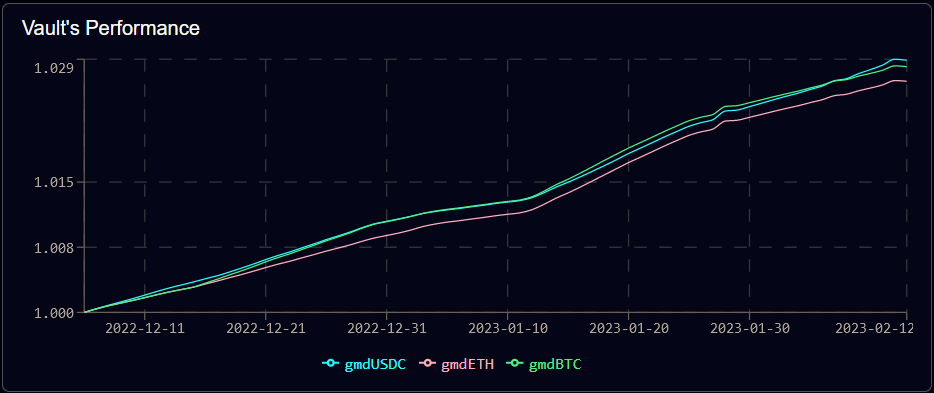

From the perspective of actual performance, the three vaults will have a yield of 2.6%-2.9% from December 11, 2022 to February 12, 2023. Extrapolating from these results, the APY is around 16.6% - 18.7%, slightly lower than the advertised 20% - 26% APY.

Figure 10: GMD Treasury Performance

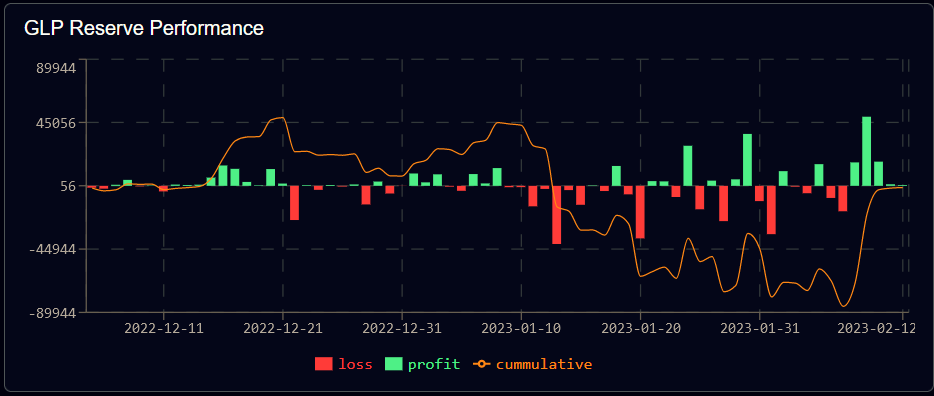

While GMD is trying to be delta neutral, it doesn't have any short exposure to be truly delta neutral. The protocol itself requires reserves as backing for impermanent losses. This limits the scalability of GMD, as the treasury cannot grow too large without sufficient reserves (i.e. 5%-15% of TVL). They can only scale to a larger TVL based on the performance of the protocol reserves. So far, GLP reserves are at breakeven, and GMD will be limited in expanding its coffers.

Figure 11: Performance of GMD reserves

Yield Yak

Yield Yak is an automatic reinvestor based on Avalanche. Every user can get compound rewards from AVAX as long as they click to reinvest. This mechanism is an incentive for users.

Thanks to Avalanche's $180 million incentive program, Avalanche Rush, Yield Yak is able to offer savers even more rewards. GLP strategy depositors will receive up to $300,000 in AVAX from Avalanche Rush. In addition, you can also maximize your GLP rewards by permanently staking esGMX on Yield Yak. To optimize GLP, Yield Yak also upgraded Yak Swap. Yak Swap can automatically choose the best path to exchange assets to GLP, helping to rebalance GLP to the expected index weight. This reduces slippage for users while helping GMX have the right ratio of assets.

Rage Trade

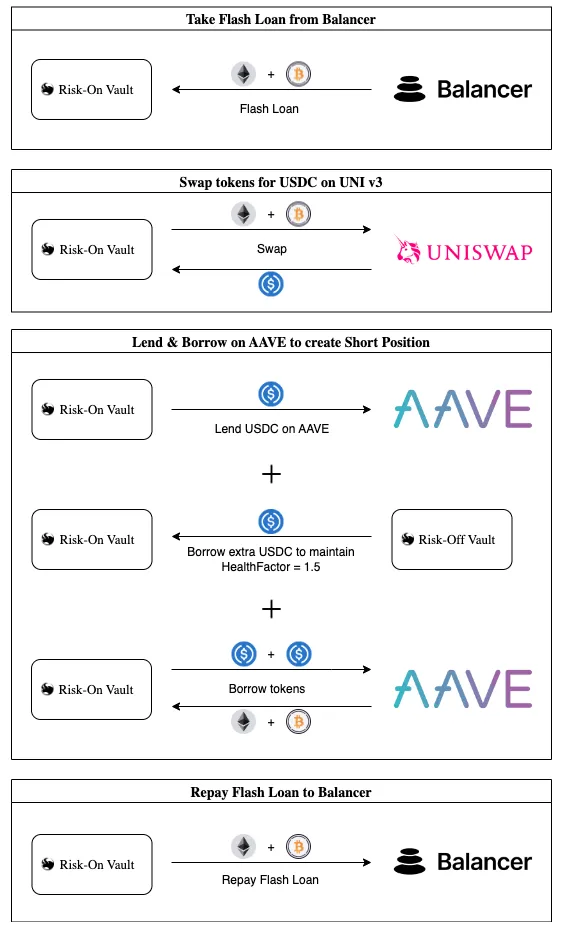

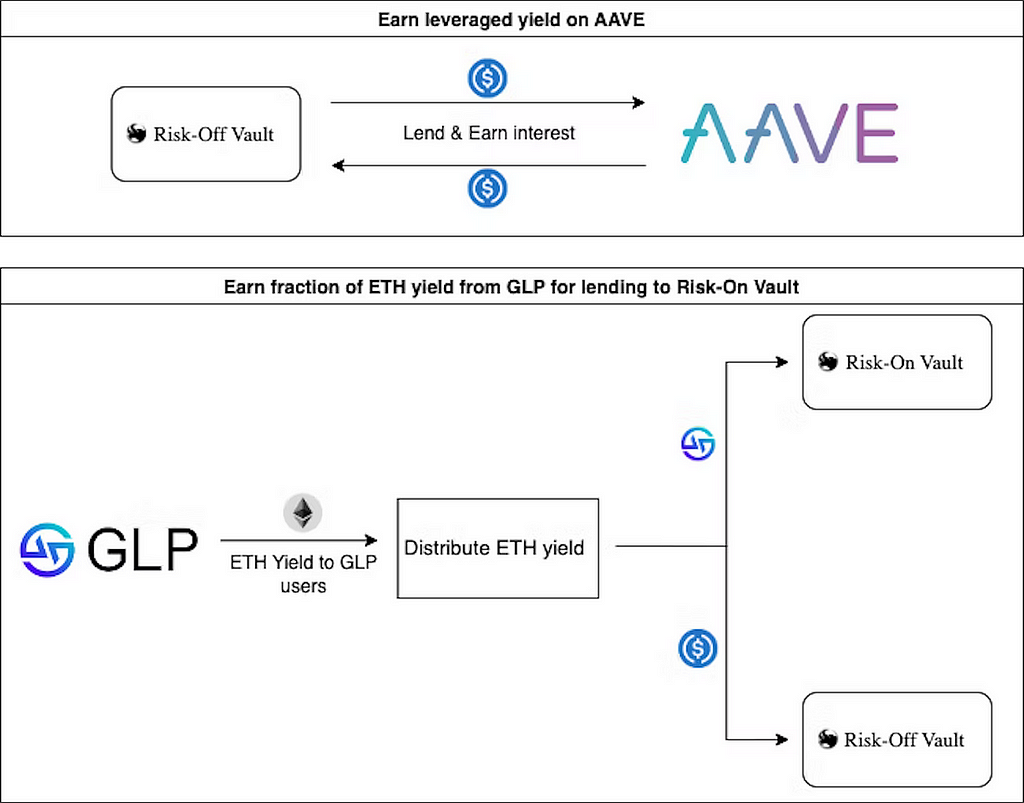

Rage Trade is a perpetual trading platform on Arbitrum that utilizes the underlying layer of LayerZero. They are the first project to launch a dual-vault system to minimize direct market risk, with two vaults, Risk-Off Vault and Risk-On Vault, to minimize BTC and ETH by operating on AAVE and Uniswap risk exposure.

Users deposit sGLP or USDC into Risk-On Vault, which lends BTC and ETH through flash loans on Balancer, and sells them into USDC on Uniswap, and the USDC obtained from the sale together with USDC from Risk-Off Vault will be deposited into AAVE Then lend BTC and ETH, and these BTC and ETH will be used to repay Balancer's flash loan. These actions would have created a short position on AAVE, as the Risk-On Vault now borrows BTC and ETH.

Another important feature of Risk-Off Vault is to provide collateral for Risk-On Vault, which will be used to maintain AAVE's borrowing health factor of 1.5. Every 12 hours, the position is reopened for fees and PnL is rebalanced between shorts on AAVE and GLP collateral, and hedges are rebalanced based on the composition of GLP deposits.

Figure 12: Risk-On Vault Mechanism

Figure 13: Risk-Off Vault Mechanism

Comparing Risk-On Vault's return performance with GLP's, it theoretically has a profit return of about 25%, compared to -13% for GLP.

Figure 13: Comparison of treasury revenue performance

However, with Risk-On Vault currently returning -1.2%, the loss in GLP value is mainly due to the high cost of hedging direct exposure and trader profitability. After Rage Trade completes their second audit and increases their deposit cap, they will be able to significantly reduce hedging costs. To hedge a trader's PnL, Rage Trade will provide the option to partially or fully hedge a trader's PnL. These will be available in separate vaults for users to store if they so choose.

Jones DAO

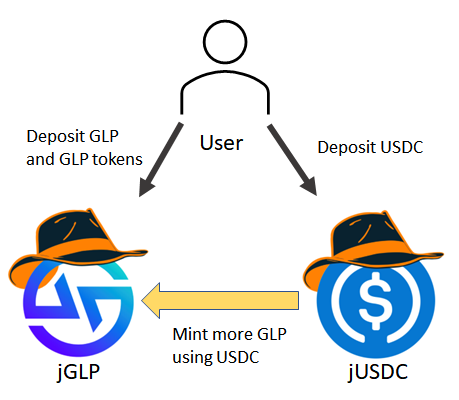

Jones DAO is a yield, strategy and liquidity protocol designed to improve capital efficiency. Relying on the dual vault mechanism to provide users with leveraged income, Jones DAO's jGLP vault allows the storage of GLP and any assets within GLP, and the jUSDC vault accepts USDC deposits.

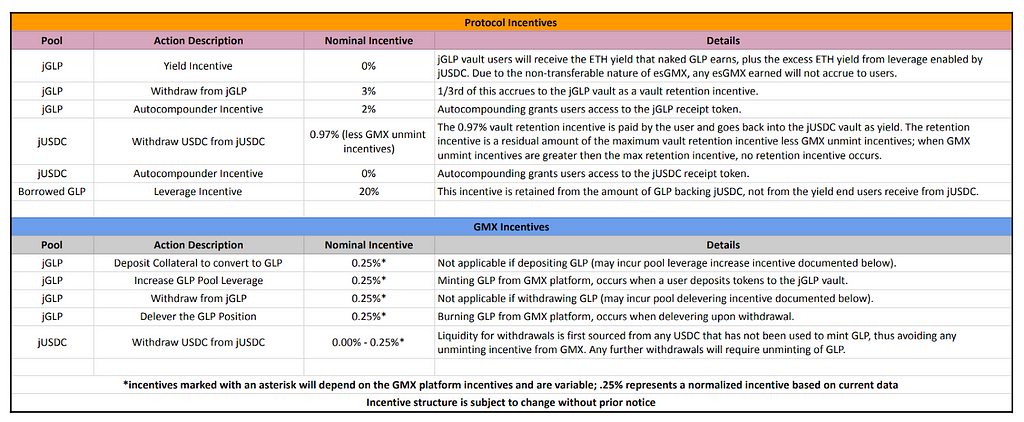

The USDC from the jUSDC vault can be used to mint more GLP and obtain a leveraged position of GLP. Then, the GLP reward will be distributed between jGLP and jUSDC depositors, and they will receive an annualized return of 33% and 11.3% respectively. The jGLP vault will automatically balance its leverage to prevent liquidation, and users can also choose to automatically reinvest.

Figure 14: The protocol mechanism of Jones DAO

The fee structure of Jones DAO is as follows. They have established a unique fee structure for long-term growth. Users who continue to stake will receive fees from users who cancel their stake, encouraging users to continue staking in Jones DAO.

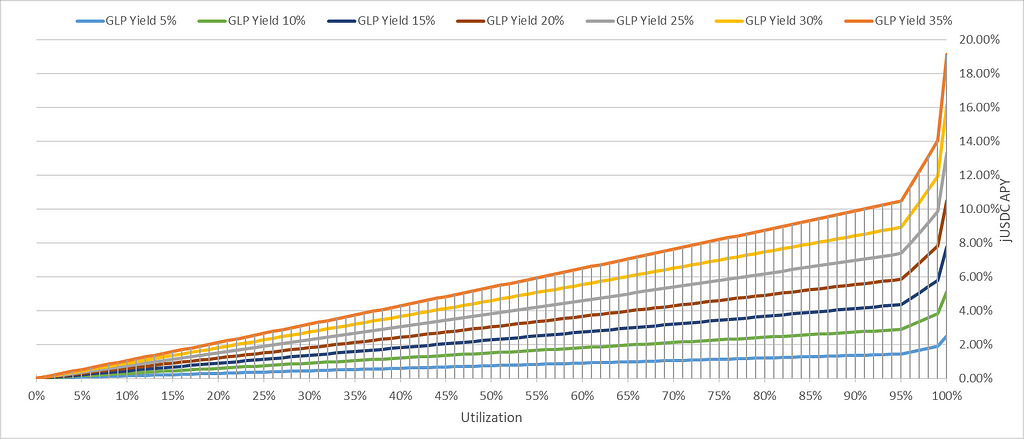

The more USDC deposited into the jUSDC vault, the more GLP can be purchased, resulting in higher leverage. The graph below shows the relationship between jUSDC APY and vault utilization, where the GLP yield is 35%, and due to the increase in leverage, the jUSDC yield can rise to nearly 20%.

Figure 16: Relationship between jUSDC APY and Vault Utilization

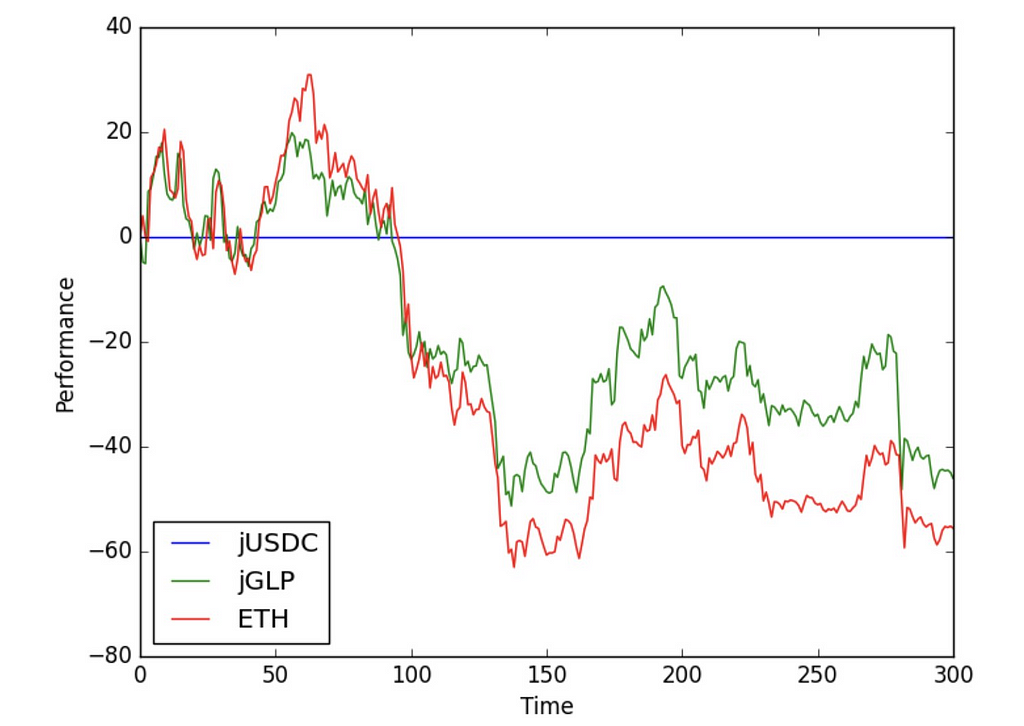

In terms of return performance, jGLP does not hedge market risk, it actually magnifies it. This means that the actual performance of jGLP vaults depends on market conditions. Backtesting against 0% GLP yield and 80% utilization shows that jGLP outperforms ETH. Results could have been better if GLP production had been included.

Figure 17: Performance of jUSDC and jGLP against ETH

Abracadabra

Abracadabra is a lending platform with its own stablecoin, MIM, which can be borrowed using interest-bearing collateral. It introduces magicGLP, an automatic reinvestor for GLP tokens. The ETH proceeds from GLP will be used to buy more GLP, which will then be converted into magicGLP. Using MIM on the platform, users have the option to leverage their positions up to 4% to achieve up to 84% APY on their GLP.

Steadefi

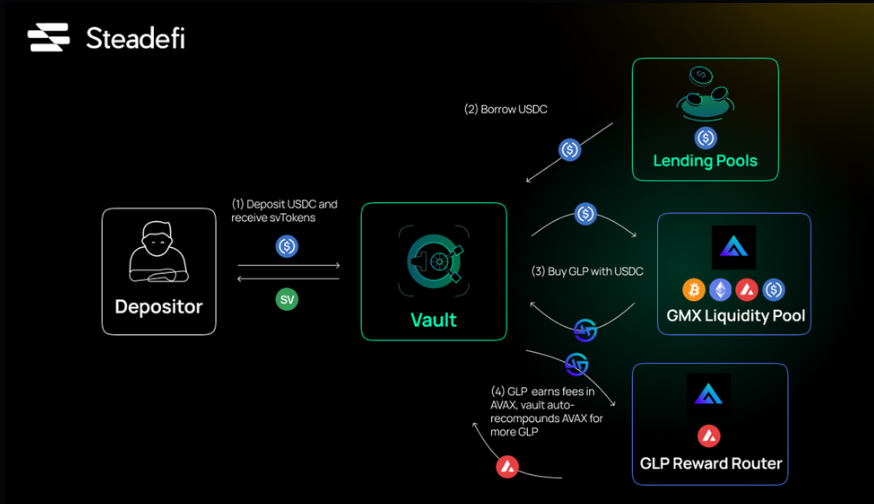

Steadefi is a platform that provides strategies for automatic income leverage. They currently have a vault that can provide 3 times GLP leveraged positions.

For every $1 a user deposits into the vault, $2 is borrowed from the lending pool to mint GLP. This effectively creates a 3x leveraged position that is automatically reinvested over time and rebalanced when necessary.

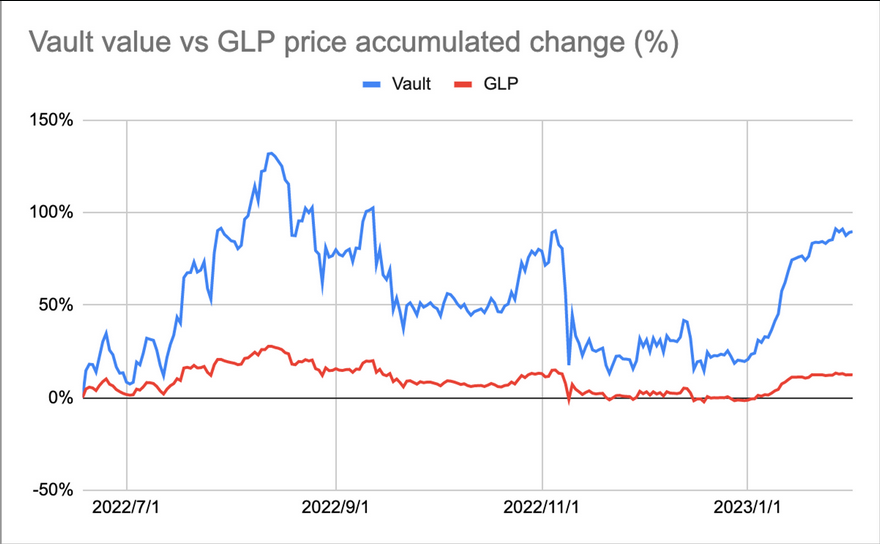

In terms of performance, GLP has a PnL of 12.3%, and Steadefi's vault outperforms GLP with a PnL of 89.8%, a 7x higher yield.

Figure 19: Performance of Steadfi vs. GLP

Protocol key indicators comparison

Remarks: FDV data is intercepted until February 16

potential joiner

Umami Finance

Umami Finance is expected to launch the v2 version of its GLP vault, which will offer an algorithmic hedging strategy. At present, Umami is still conducting background testing and optimizing their treasury. The latest test results show that the annualized rate of return is 26.7%.

Figure 18: Umami test results

Yama Finance

Yama Finance is building a full-chain stablecoin optimized for maximum capital efficiency, speed, and security. It has not yet launched its GLP income leverage product on Arbitrum.

Yama is able to provide leverage up to 101 times, thereby providing better opportunities for income acquisition. For GLP, they capped it at 17x, giving an APY of 333% (assuming a GLP yield of 19.6%). At present, Yama has not detailed the mechanism for obtaining its leveraged GLP liquidity income. This could involve borrowers using GLP collateral to borrow YAMA and take leveraged positions for higher yields.

The future of GLP War

It can be seen that many developers have established many agreements based on GMX, and many agreements have also brought together millions of dollars in TVL. The entire market has a clear demand for GLP-based products.

Due to the composability of DeFi, this Lego-like operation allows GLP to play a role in various agreements, including yield leverage, automatic reinvestment, and lending. As the GMX ecosystem grows, more protocols are expected to integrate GLP into their protocols. Of course, GLP also has the risk of being completely exhausted due to traders earning profits from transactions and withdrawing assets from GLP. Therefore, many protocols may try to hedge traders' PnL in the future to reduce risks.

Disclaimer: The above information does not constitute investment advice. Additionally, the aforementioned project Rage Trade is one of our portfolio investments and you can read more about our research here .