This study will introduce three current kings in the derivatives space: dYdX, GMX and SNX. We'll explore the basics, key stats, and token economics of each project.

Cover: Photo by Shubham's Web3 on Unsplash

wxya

1. Basic overview

dYdX is a decentralized order book derivatives contract exchange based on Ethereum. The project was established in August 2017.

dYdX has conducted four rounds of financing since 2017, raising a total of 87 million US dollars. The investment list includes A16Z, Paradigm, Polychain Capital, Kronos, etc., with a strong lineup of investors and sufficient funds for project development.

2. Project team

Antonio Juliano — CEO . Graduated from Princeton University in 2015, majoring in computer science. Worked at Uber and in 2017 created a search engine for the decentralized web called Weipoint.

George Xian Zeng — COO . Graduated from Princeton University in the United States, he has worked at McKinsey, Facebook, and Moonship, and will join dYdX in 2022.

David Gogel — VP . Graduated from the University of Pennsylvania, worked in AIG, RelayNode, GogelX, joined dYdX in 2020.

Arthur Cheong — Chairman . Graduated from Nanyang Technological University, worked at JST Capital and Zilliqa, and joined dYdX in 2021.

3. Project details

- development path

2. Development Status

An on-chain exchange built on the StarkEX L2 solution provided by StarkWare

- Compared with the earlier version built on L1, the one built on L2 provides lower transaction fees, better transaction performance, higher leverage (4x-25x), and supports more trading pairs.

- During the transaction process, every order transaction will be on the chain, but the order placement and pending order will not be on the chain. It is carried out on the dYdX server, and the degree of decentralization is limited.

- Gas is only required when depositing funds and redeeming funds, and not required for subsequent transactions.

- The V4 version on Cosmos is currently being prepared, which aims to greatly increase the degree of decentralization; and distribute the transaction commission generated by the agreement to the holders of dYdX.

dYdX currently only provides perpetual contract trading on Layer 2

- dYdX supports 8 different order types - Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders, Trailing Stop Orders, Take Profit Market Orders, Take Profit Limit Orders and Basket Orders.

- Provide up to 20 times the long-short side trading function, the minimum leverage change ratio is 0.01.

- transaction mode. In the form of an order book, liquidity is provided by professional market makers such as Wintermute and Altonomy.

- Funding rate. Funding rates are determined by transaction volume and dYdX token holdings. The larger the trading volume or dYdX token holdings, the lower the funding rate.

- Provide iOS APP

- Not currently available to US users

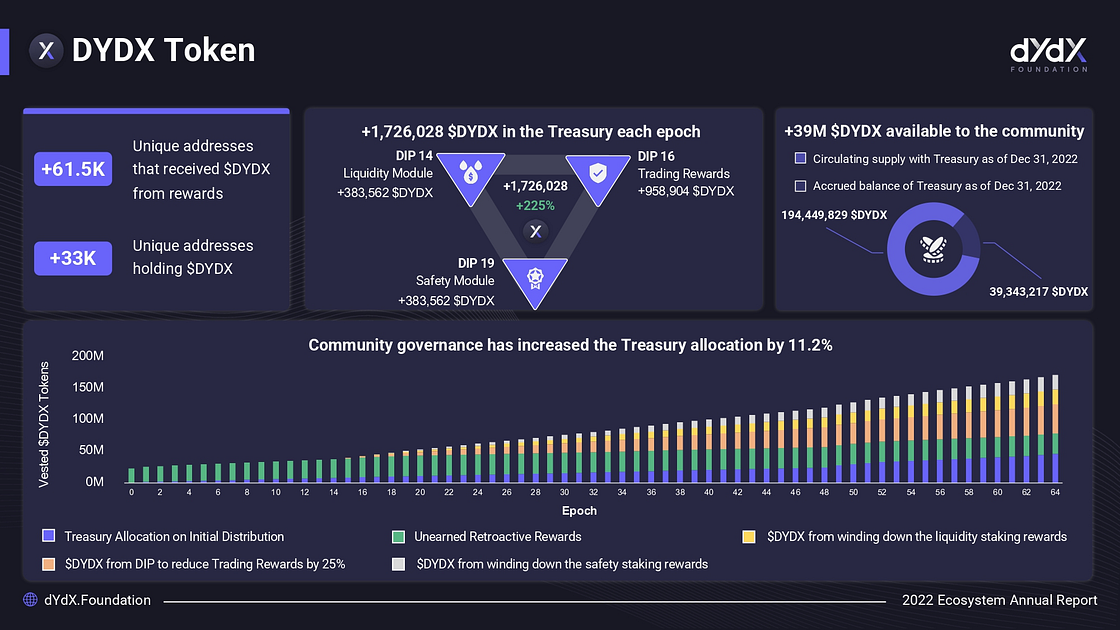

3. Token economics

The roles traded on the dYdX platform are divided into the following three categories:

a. Traders: trade perpetual contracts on dYdX.

- Transaction Mining: At the end of each epoch, the dYdX protocol will airdrop 3,835,616 pieces of dYdX, and determine how much reward each trader can share in each epoch based on the transaction fees and open positions generated by the trader.

- Traders receive no share of the fees incurred by dYdX transactions.

b. Professional market makers : Professional market makers Wintermute, Altonomy, etc.

- Liquidity provider mining: At the end of each epoch, the dYdX protocol will airdrop 1.15 million dYdX.

c. dYdX: Charge transaction commission (this part has no share for traders).

d. Stakeholders: Pledge USDC to enter the liquidity pool/security pool for liquidity staking mining. Currently both pools are closed and the remaining rewards will not be distributed but accumulated in the rewards treasury which in turn can be directed by the community.

4. Important data

- Operational data

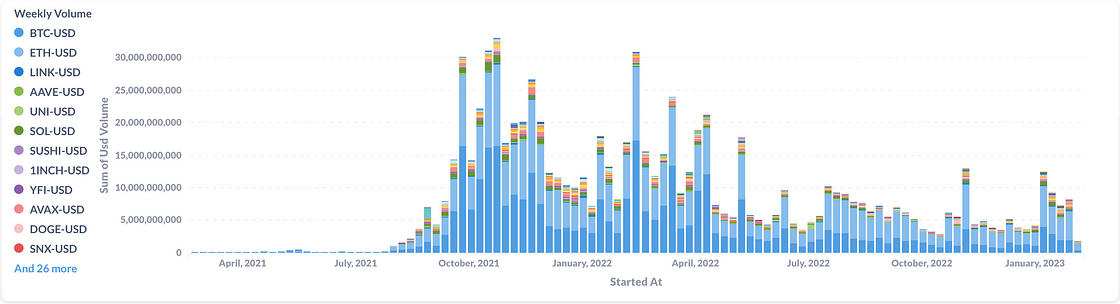

- Trading Volume: dYdX is seeing constant growth in trading volume. As the current epoch draws to a close, the transaction volume of dYdX will surge. It can be seen that traders on dYdX mainly conduct transactions for transaction mining. The annual transaction volume is $484.21b, and the transaction volume on February 6, 2023 is 854.4M, surpassing Uniswap and SNX, and the current transactions are mainly USD-BTC and USD-ETH.

- Annual fee income: $123.59m

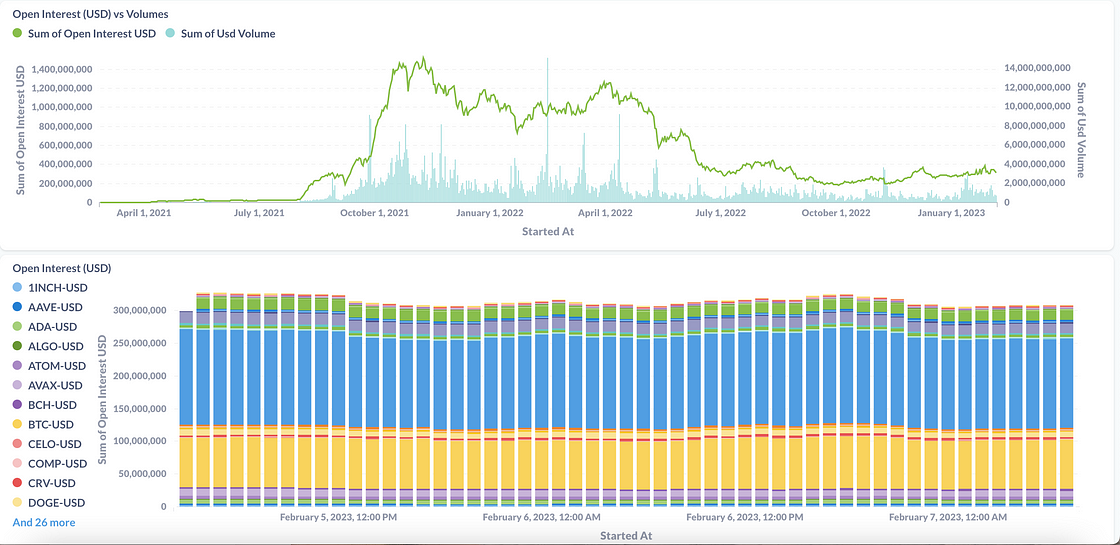

- Open interest: The total amount of open interest on February 6, 2023 is 315.5M. Similarly, the open interest is mainly on the two trading pairs USD-BTC and USD-ETH.

- TVL: dYdX’s TVL on February 6, 2023 is $401.39m, ranking second among derivatives agreements of its type, lower than GMX’s TVL

*Data collected until February 8, 2022

2. Token Issuance

a. to issue

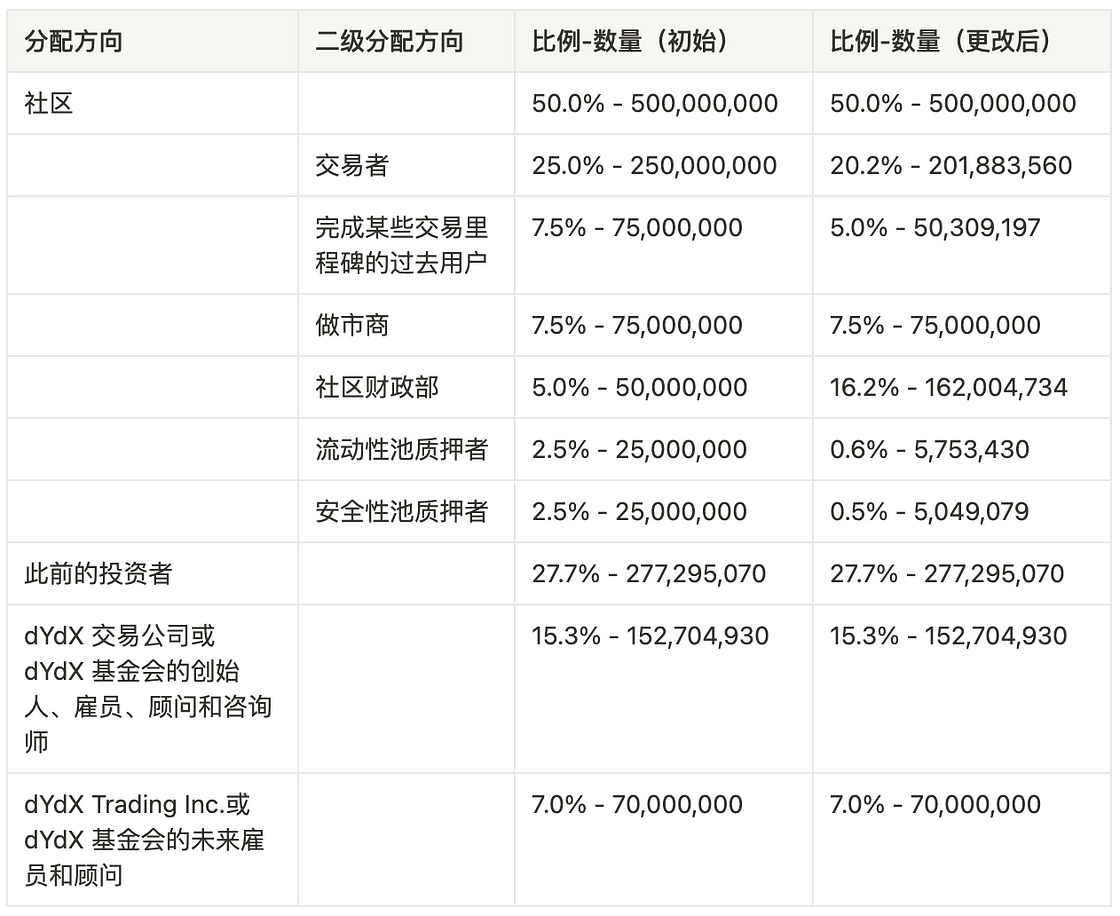

- The total amount of DYDX is 1 billion pieces, which will be distributed within five years. After five years, an annual inflation of up to 2% will be initiated through the governance mechanism.

- Token distribution rules can be modified by dYdX token holders through community voting. Since the team holds a large number of dYdX tokens, the voting results can be directly determined.

- Starting from 15:00:00 UTC on August 3, 2021, each epoch is 28 days. There are 60 epochs in total and the duration is 5 years. The total supply for the first five years $DYDX is distributed as follows.

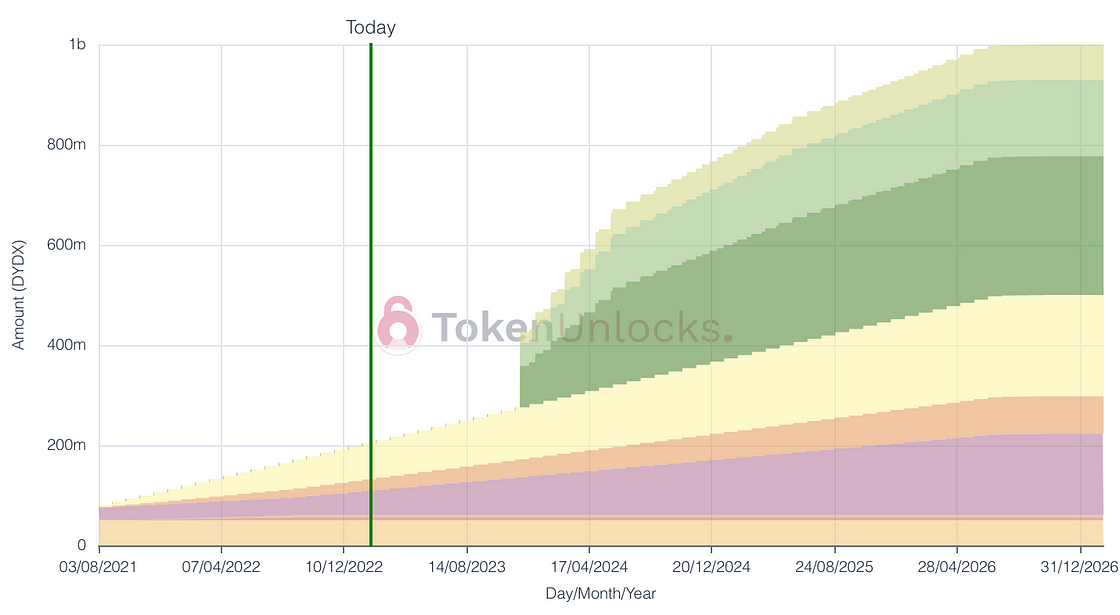

b. to unlock

The dYdX team initially planned to unlock 50% of the tokens allocated to investors, companies and foundations on a large scale 18 months after the dYdX token was issued (March 2023). But on January 25, 2023, the dYdX Foundation announced that the initial release date for this part was postponed to December 1, 2023.

The new unlocking scheme is:

On December 1, 2023 (new initial unlock date), unlock 30%;

40% in equal monthly installments on the first day of each month from 1 January 2024 to 1 June 2024;

20% in equal installments on the first day of each month from 1 July 2024 to 1 June 2025;

10% in equal installments on the first day of each month from 1 July 2025 to 1 June 2026.

Before this postponement, the price of dYdX dropped from $2.5 on November 25, 2022 to $1.0 on December 30, 2022, and then rose to $1.5 on January 25, 2023. After the unlock delay, the price of dYdX keeps climbing to $3.1 on February 7, 2023

V. Defects and risks

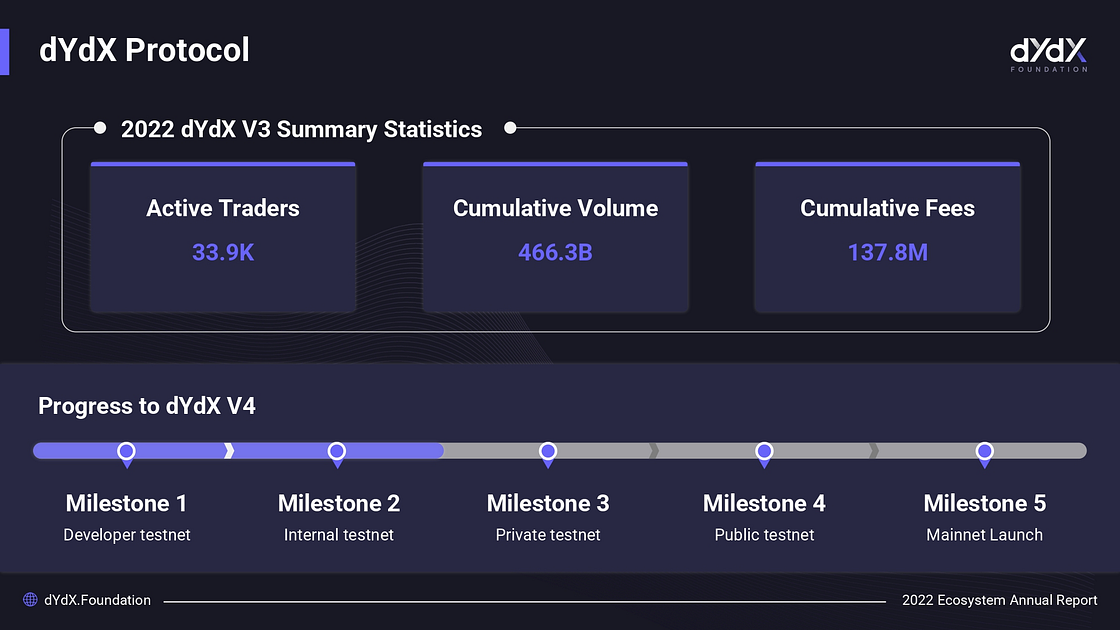

- Insufficient decentralization: Only real transactions are on-chain, and the infrastructure provider Starkware is not open source, and the centralization of the product is still strong. The official has obviously noticed this, and is building V4, claiming that it can achieve complete decentralization.

- The development progress of V4 cannot be determined. The official previously stated that dYdX V4 will be released by the end of 2022, and Milestone 2-internal testing has been completed by January 2023.

- The security of the V4 bridge from ether and to dYdX needs to be guaranteed

- Migration from mainnet to Cosmos may result in loss of some users

- Insufficient performance: the speed of on-chain transactions does not match the speed of placing and taking orders

- Token utility: The transaction fee will not be divided into dYdX holders, and the current transaction motivation of traders is mainly transaction mining.

- Token Price: Insufficient token utility has resulted in a continued decline in the dYdX token price.

6. Thoughts and conclusions

- The staking pool is no longer active, and the overall trading method of dYdX is more biased towards CEX. The increase in trading volume today is mainly due to dYdX rewards brought about by transactions and dYdX’s lower transaction commissions. However, after receiving dYdX rewards, holding dYdX is useless, and traders will sell, resulting in a continued low price of dYdX. Therefore, the official also postponed the unlocking date of a large number of tokens held by investors and company employees from March 2023 to December 2023, in order to avoid selling pressure and maintain the price of dYdX tokens.

- Choosing Cosmos is a trade-off between certainty (maintaining the status quo will not cause user loss) and the continued development of the product in the future. But once it succeeds, it will bring dYdX a milestone development, and it will also encourage more products to use Cosmos.

- To achieve continuous growth, dYdX’s token economics needs to be improved. After the current V4 version leaves Starkware, traders may receive a portion of trading commissions, which will help the protocol continue to develop.

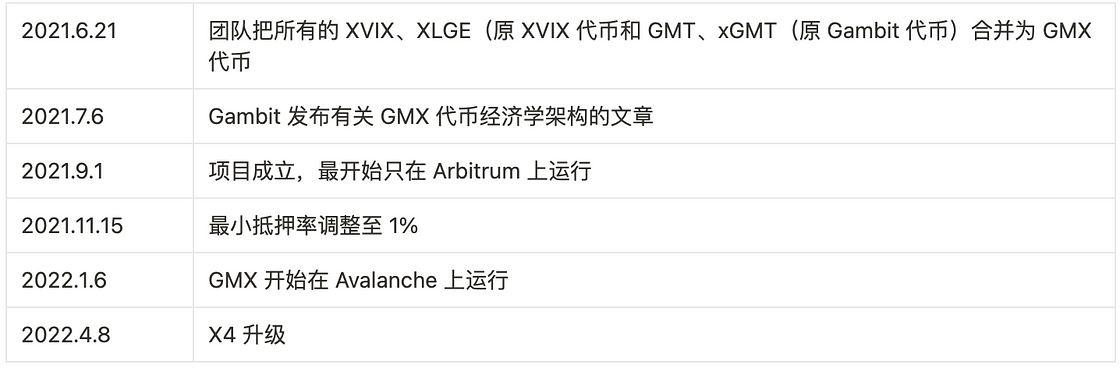

GMX

1. Basic overview

GMX is a decentralized perpetual contract and spot exchange on the Arbitrum and Avalanche chains. The project was established in September 2021. The founding team created the XVIX project on Ethereum in 2020, and later created the Gambit protocol on the BSC chain , GMX is the result of the first iteration of the Gambit protocol.

2. Project team

Anonymous team.

3. Project details

- development path

2. Development Status

- Support 50 times leverage for transactions

- Liquidity provided by GLP with significantly better token economics than dYdX

- No slippage transaction, GMX is priced according to a mixture of AMM and oracle, without slippage. It is very friendly to large transactions and reduces the impermanent loss of market makers

- At present, there are other protocols that can freely build products based on GMX, bringing more traffic and demand to GMX

- open source code

- GMX has preliminary ecological applications, such as Vesta Finance, Moremoney, DeCommas, Umami Finance, etc. (Source: https://www.panewslab.com/zh/articledetails/43mbrzzo.html )

3. Token Economics

Image source: https://rileygmi.substack.com/p/gmx

a.LP

- Investors provide liquidity for the asset pool by minting GLP, and the asset pool is a single multi-asset pool.

- Get 70% of transaction fees (ETH on Arbitrum, AVAX on Avalanche).

- GLP is a multi-asset asset pool, and the price of token GLP changes with the price of assets in the asset pool.

b. GMX holders

- Pledge GMX, get 30% transaction fee share, get esGMX\30% transaction fee and Multiplier points.

- esGMX can be vested. After applying for a vest, the GMX and esGMX in the account will be locked and cannot be sold, but rewards will still be generated. esGMX will be unlocked linearly over a period of one year. Locked GMX can be withdrawn at any time, but this action will stop the esGMX vest.

- esGMX has voting rights.

c. Trader Trader

- Assets in the GLP asset pool can be used for trading, and leverage up to 50x can be added.

- Regardless of short / long, you need to pay "Borrow Fee".

- Transaction fees are related to whether the value of assets in the current GLP pool is overvalued/undervalued.

- The GLP pool and the trader are counterparties, and the trader makes a profit, and the GLP pool will remove some of the profitable assets; otherwise, it will increase. GLP and traders are in a zero-sum game relationship.

4. Important data

- Operational data

- Total transaction volume in 2022: $89.52b

- Annual fee income: $175.39m

- OI: $211m

- TVL: $540.88m

- The current composition of the GLP asset pool is: 40.2% USDC, 29.76% ETH, 21.1% BTC, 3.24% DAI, 2.1% FRAX, 1.3% USDT, 1.23% LINK, 1.03% UNI. The main asset is USDC, followed by ETH and BTC, and the volatility of the entire pool will be relatively reduced

- Trader Net Profit/Loss: In GMX, most traders are at a loss, that is, the GLP pool is constantly making money

- GMX has a pledge rate of 79% (strong lock-up mechanism and relatively impressive rate of return)

*Data collected until February 8, 2022

2. Token Issuance Status

The total amount of GMX tokens is 13.25 M, and the configuration is as follows:

- 6M GMX to XVIV, Gambit migraters.

- 2M GMX provides ETH/GMX liquidity on Uniswap

- 2M GMX is reserved for esGMX rewards

- 2M GMX belongs to the bottom price fund

- 1M GMX is reserved for community cooperation and promotion

- 0.25M GMX to the team, unlocked linearly in 2 years

The total amount of esGMX tokens is 2M, and the configuration is as follows

- 100,000 esGMX tokens to GMX traders per month.

- 100,000 esGMX tokens are provided monthly to Arbitrum's GLP holders.

- From January 2022 to March 2022, 50,000 esGMX tokens will be provided to Avalanche's GLP holders per month.

- From April 2022 to December 2022, 25,000 esGMX tokens will be provided to Avalanche's GLP holders per month.

V. Risks and Defects

- esGMX has a strong lock-up mechanism and it takes one year to unlock it. Only a small amount of these esGMX generated by staking will be converted into GMX.

- Although staking GMX can get 30% of the transaction fee, this part of the reward will be divided into two parts: ETH/AVAX and esGMX. Considering the liquidity of esGMX, the return rate of the esGMX part should be given a discount.

- There are more benefits to being a GMX holder than to GLP: GMX does not take risks, but can share 30% of transaction fees (this is one of the reasons why the pledge rate of GMX tokens is so high), while GLP needs to bear currency Asset changes caused by price changes and losses caused by transactions.

- Short traders need to pay funding fees, there will be a phenomenon of long > short in a bull market, and the GLP pool is not sustainable

- Due to the GMX mechanism, both the short side and the long side need to pay borrowing costs to GLP.

- In the rising market stage, there are few short parties in the agreement. At this time, the market will fall, which will lead to the profit of GLP

- In a bull market, GLP lending assets will inevitably lead to losses, but at the same time they also receive liquidity compensation. But once the loss below GLP is compensated, LP may take away liquidity.

- The risk of price manipulation from oracles. Since GMX adopts the mixed pricing mechanism of oracle machine and AMM, on the one hand, it brings zero slippage, which has a great advantage for assets with strong liquidity; but for assets with low liquidity, it will bring price manipulation risk.

- Anonymous teams have a certain risk of running away.

6. Thoughts and conclusions

- The GMX allocated by the team is very small, only 250,000 GMX (accounting for 1.88% of the total supply), which is linearly unlocked within 2 years. Considering the lock-up mechanism of esGMX, the 2M GMX belonging to the bottom price fund, the GMX circulating on the market will not be the whole of the total GMX issuance, and the supply will be relatively small.

- GMX has good token economics, but in terms of token utility, GMX’s token utility is the highest among the three projects. Due to the high utility of the GMX token, there will be a high demand for a period of time. In addition, the introduction of GMX on other protocols has also driven up demand. Therefore, in the short term, GMX may perform better in the market.

- GLP's contrarian rise has a strong correlation with his product logic. In normal transactions, one of the long and short parties will always pay the funding fee to the other party, but in GMX, no matter whether you are long or short, you will pay the funding fee to the GLP pool. Traders on GMX will only go long in a bull market, resulting in a loss in the GLP pool. If the 70% of the fee received by GLP cannot make up for the loss to GLP due to the rise in currency prices, people will remove assets from the GLP pool , causing the liquidity of GMX to collapse. The long-term stable development of GMX requires the optimization of GMX logic by the team.

- Although many projects have paid attention to GMX or GLP, I think that the current situation may be due to the bright performance of GMX because these protocols are not very sticky to GMX.

Synthetix

1. Basic overview

Synthetix is a synthetic asset protocol on the Optimism and Ethereum chains. The project was established in 2018 and its predecessor was Havven.

2. Project team

Kain Warwick — Founder, created crypto gateway Blueshyft.

Justin Moses—CTO. Graduated from the University of New South Wales in Sydney, he worked as an engineering director at MongoDB.

Clinton Ennis — Former Architect Lead at JPMorgan Chase, currently working as a Smart Contract Engineer at OnChain Technologies.

3. Project details

- development path

2. Development status

- Synthetix is a large product matrix, which currently includes the main agreement Synthetix, derivatives and spot synthetic asset trading platform Kwenta, algorithmic options platform Lyra, binary options and forecasting platform Thales, option income strategy platform Polynominal, and decentralized asset management strategy platform dHEDGE wait.

- Synths can trade with each other without slippage, but fees are charged.

- Regardless of whether the market is going up or down, the price changes of SNX and the changes in the debt pool can be hedged against each other.

- Transactions on Lyra require sUSD, and the transactions of Polynominal, dHedge and other products directly or indirectly provide support for Synthetix's liquidity. By building an ecological flywheel effect to bring more liquidity and demand, it will help it become a Liquidity Layer between multiple chains.

- atomic swap. Atomic swap is a function released by Synthetix in 2021, which allows users to price synthetic assets through a combination of Chianlink and Uniswap V3.

- The core principle of atomic swap is the sBTC, sETH, and sUSD liquidity pool established by Synthetix on Curve. When the comprehensive transaction cost is low, 1inch will choose the Synthetix link to realize (x-sx-sy-y) first-cost exchange .

- Copy the derivative function of CEX through onchain. For example, to short BTC, you don't need to go to CEX to buy a short contract, but you can directly buy iBTC risk in SNX.

3. Token Economics

a. Liquidity users. Various derivatives can be traded, and there is no need for a counterparty, so there are no slippage and liquidity problems that ordinary DEXs will encounter. The transaction fee is generally 3‰.

- Various synthetic assets can be traded on chain without slippage and liquidity issues, and what needs to be paid is the transaction fee.

b. Providers of liquidity. They are also holders of SNX. By staking SNX, they will mint sUSD at a ratio of SNX:sUSD=4:1. When minting sUSD, they will also bear the debts of the system in proportion.

- Liquidity providers will receive 100% transaction fees and will receive SNX rewards generated by SNX inflation.

- You can charge transaction fees and get extra rewards of SNX, but you will face the risk of asset loss due to price fluctuations (this is similar to the impermanent losses faced by Uniswap liquidity providers).

4. Important data

- Operational data

a. Total transaction volume in 2022: $4.94b

b. Annual fee income: $14.81m

c. TVL: $432.50m

The transaction volume and profit of Synthetix are not of the same order of magnitude as the other two projects, but the TVL is of the same order, indicating that there are a large number of assets in the SNX protocol.

*Data collected until February 8, 2022

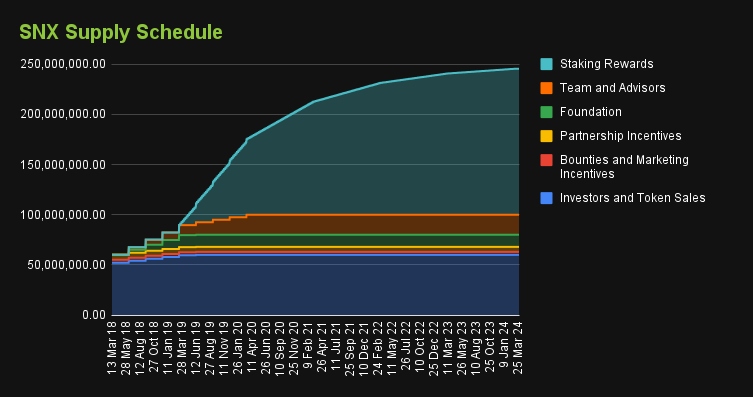

2. Token Issuance

On February 28, 2018, SNX conducted its initial token offering. The total supply of SNX tokens is capped at 282,337,310 plus inflation since the first Epoch. in,

- 60.00% is allocated to investors and token sale

- 3.00% allocated to rewards and marketing incentives

- 5.00% allocated to partners

- 12.00% allocated to the Foundation

- 20.00% allocated to the team and advisors

The supply of SNX is expected to be fully unlocked in March 2024.

V. Defects and risks

- The price of SNX is currently provided through Chainlink, which will face the risk of a third-party oracle.

- The update progress of the V3 version is slow, and the completion time is still uncertain

- The ecology is relatively complex. If it is not managed well, it will increase the potential instability of the system.

- The current liquidity will be linked to the price of SNX and the mortgage rate. The current mortgage rate is 400%, which means that $4 of SNX will get $1 of sUSD. A high mortgage rate will have a greater impact on the liquidity of sSYN assets.

- Synthetix has the highest transaction fee rate among the three, which affects the trading experience of traders

6. Thoughts and conclusions

- The product is unique and logical, which brings great room for imagination. The recent income growth has made investors see the potential of logic.

- The project is relatively complex and the overall structure is grand, so it takes longer to develop and the return on investment period is longer.

- Since the liquidity will be linked to the price of SNX and the mortgage rate, the depth of the asset pool is limited. The team is currently considering increasing the types of collateral to increase the depth of Synthetix's synthetic asset synths. In the V3 version, the logic of multiple collaterals expands the upper limit for the sustainability and development space of the agreement.

- Since synths are linked to real assets, they may face greater regulatory pressure.

- SNX stakers can get 100% of the transaction fees, but they will face losses caused by price fluctuations, and the transaction fees are high, and the utility will be discounted.

- Personally, I still prefer this project. The degree of decentralization of Synthetix is the highest among the three projects. His overall transaction logic is obviously different from the other two, but considering its practical application (mapping real assets into web3) and token economics, the project is still very playable. Complicated mechanism is indeed a problem (but I think it is precisely because of the complex mechanism that it has high playability). Many traders may be discouraged by this. V3 is already considering simplifying the trading mechanism.

Comparative analysis

Summarize

What dYdX needs to overcome most at present is the utility problem of tokens. Whether this problem can be solved needs to wait for the arrival of its V4 Cosmos version, and there is still potential for growth in the long run. At present, dYdX has the highest FDV/TVL among the three projects, at 7.75, and since the core problem is not yet certain, the recent growth may not be sustainable.

The current hidden danger of GMX is the problem of the death spiral of the bull market. But its token utility is the highest of the three. And the project drives the entire Arbitrum ecology.

The core value of SNX is low fees for transactions between synths, which is already reflected in the high transaction volume during atomic swaps. From 2018 to now, the overall transaction data of SNX is not in the same order as the other two, and Synthetix's products are too complicated, and it will take longer to perfect them. The main agreement will also have flaws in liquidity and transaction rates, which will reduce the utility of tokens. Therefore, the investment cycle will be the longest among the three projects.

(End of full text)

Cipholio Research

reference link

- https://craft.co/dydx/executives

- https://antonio-dydx.medium.com/the-history-of-dydx-so-far-68bf46789f86

- https://docs.dydx.community/dydx-governance/start-here/dydx-allocations

- https://rileygmi.substack.com/p/gmx

- https://www.panewslab.com/zh/articledetails/43mbrzzo.html

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.