Velodrome: The DeFi Engine of Optimism

Note: This article mainly analyzes Velodrome's economic model from the perspective of data, and does not serve as any investment advice.

Optimism is a Layer 2 expansion solution based on Ethereum. Its performance this year has been amazing. Both TVL and token price have increased by more than 100%. Recently, it has announced a number of positive expectations:

The Bedrock Mainnet will be upgraded on March 16, and the ecology will be migrated to it. According to Optimism officials, Bedrock's goal is to build the best summary architecture to date, with both modularity and simplicity. After the upgrade, the deposit time from L1 to L2 can be shortened by 4 times, and the cost of data submission to L1 can be reduced by about 20%;

Optimism will upgrade its positioning from a single L2 to a Multichain L2 platform based on OP Stack. OP stack decouples different functional levels and combines all levels in the form of API software stack, which greatly simplifies the process of modular blockchain construction;

Coinbase has reached a cooperation with Optimism to build its own L2 "Base" based on OP Stack. As a member of the OP Multichain platform, Base will return part of the transaction fee income to the Optimism Collective treasury;

Optimism has committed to allocate 19% of the total initial token supply to AirDrop. After the end of Drops 1 and 2, 13.73% (approximately 590 million OP) of the Drops allocation has not been issued. Since the ecology on the OP has not yet been established when Drops1 was issued, the effect on promoting the ecology is limited. At present, more than 100 protocols are running on OP , including various sectors such as dex, lending, and Yield. The ecological layout has been initially improved, and future Drops will have a more direct incentive effect on ecological development;

With the upcoming upgrade of Ethereum Shanghai, Layer 2 is rapidly catching up with other public chains. Currently, Arbitrum and Optimism rank 4th and 6th in TVL among all public chains, and ecological projects on them are constantly emerging.

(Source: defilama)

(Source: defilama)

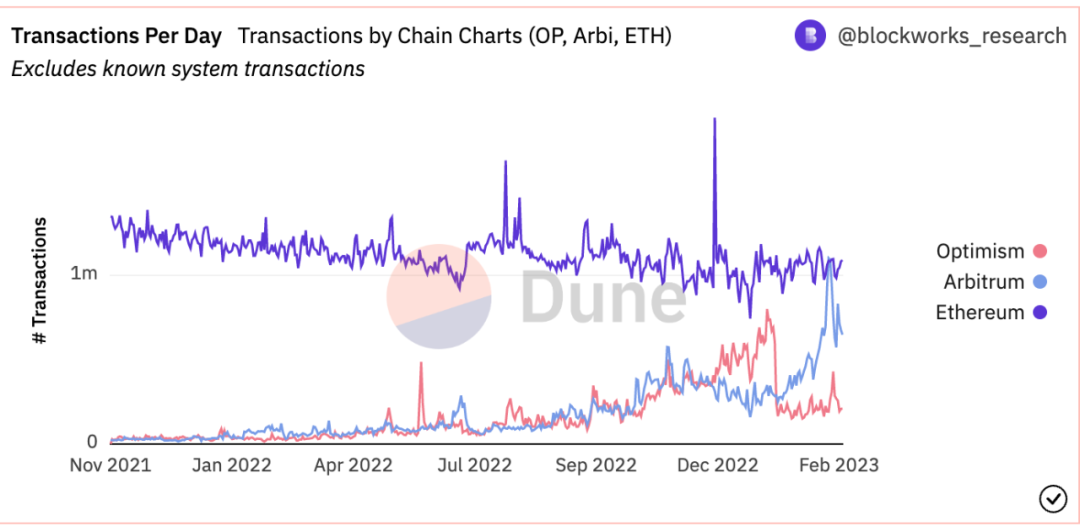

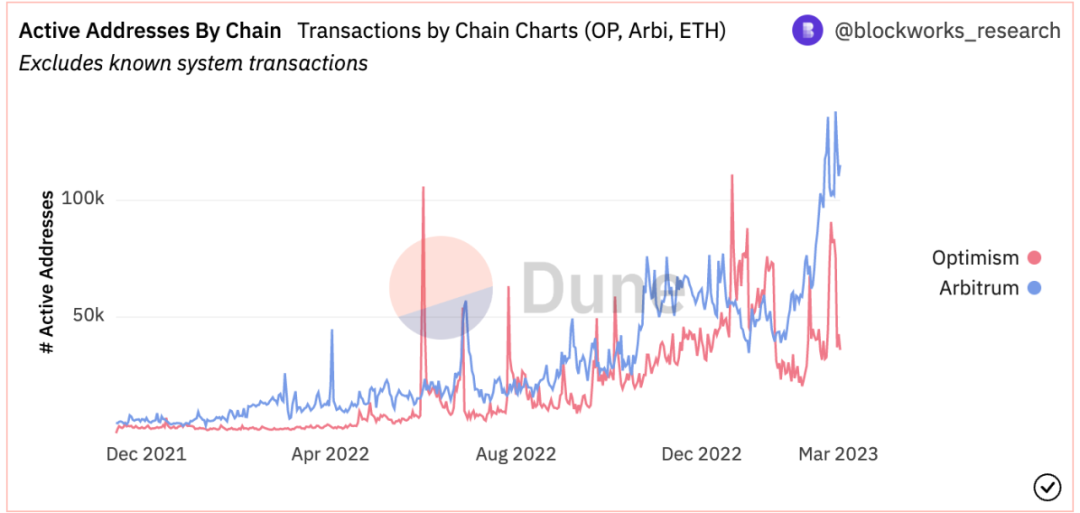

The competition in the L2 track is close to intense. Arbitrum has accumulated a large advantage in the early stage of launch, and OP is catching up with Arbitrum by issuing tokens. At present, in terms of TVL, number of transfers, and number of active addresses, Arbitrum has a lead of about 1 times over Optimism.

(Source: dune)

(Source: dune)

In essence, both OP and AR adopt Optimism Rollup, and there are no major technical barriers. From the data point of view, Optimsm lags behind Arbitrum for the time being, but its goal of becoming a Multichain L2 platform constitutes a grand narrative. Bedrock will undergo a major upgrade and there will be more rounds of Drops incentives. It is worth adding more to it focus on.

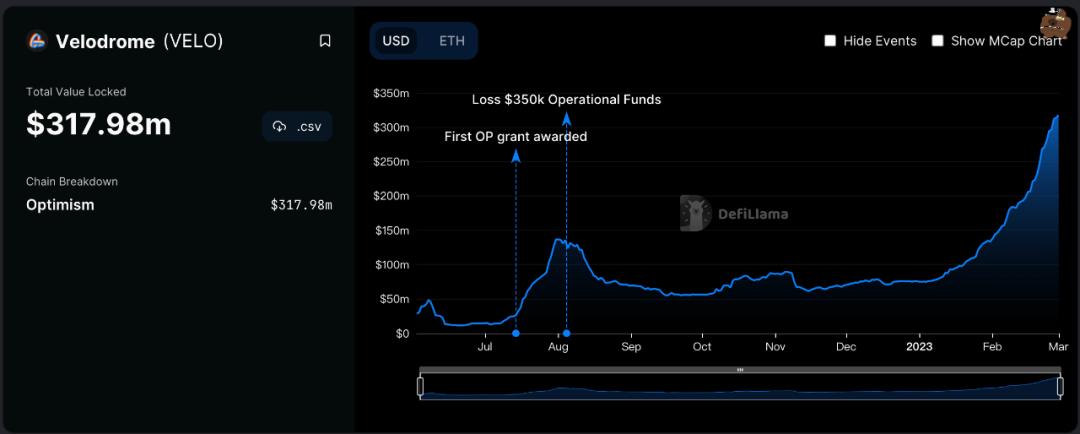

Velodrome is currently the dex protocol with the largest TVL on Optimism. The current TVL is $310 million, accounting for 34% of the entire Optimism ecological TVL. Velodrome is mainly folked from Solidly created by Andre Cronje (dex on fantom, TVL was as high as 2B$). After the disintegration of Solidly, its largest protocol participant, the veDAO team, learned lessons and made some improvements to Solidly's mechanism, and founded Velodrome on Optimism in June 2022.

(Source: defilama)

(Source: defilama)

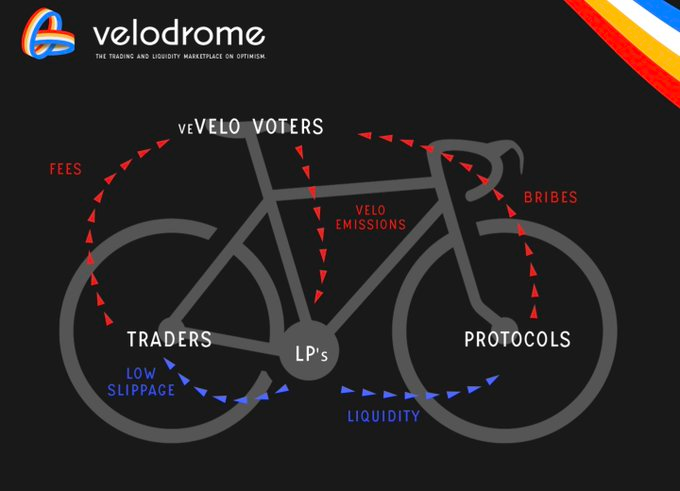

1. Velodrome Mechanism Introduction

The core of Velodrome adopts the ve(3,3) mechanism proposed by AC. This mechanism mainly encourages users to lock up tokens. It is believed that when everyone pledges tokens instead of selling them, everyone's income will be higher.

(Source: Velodrome official website)

(Source: Velodrome official website)

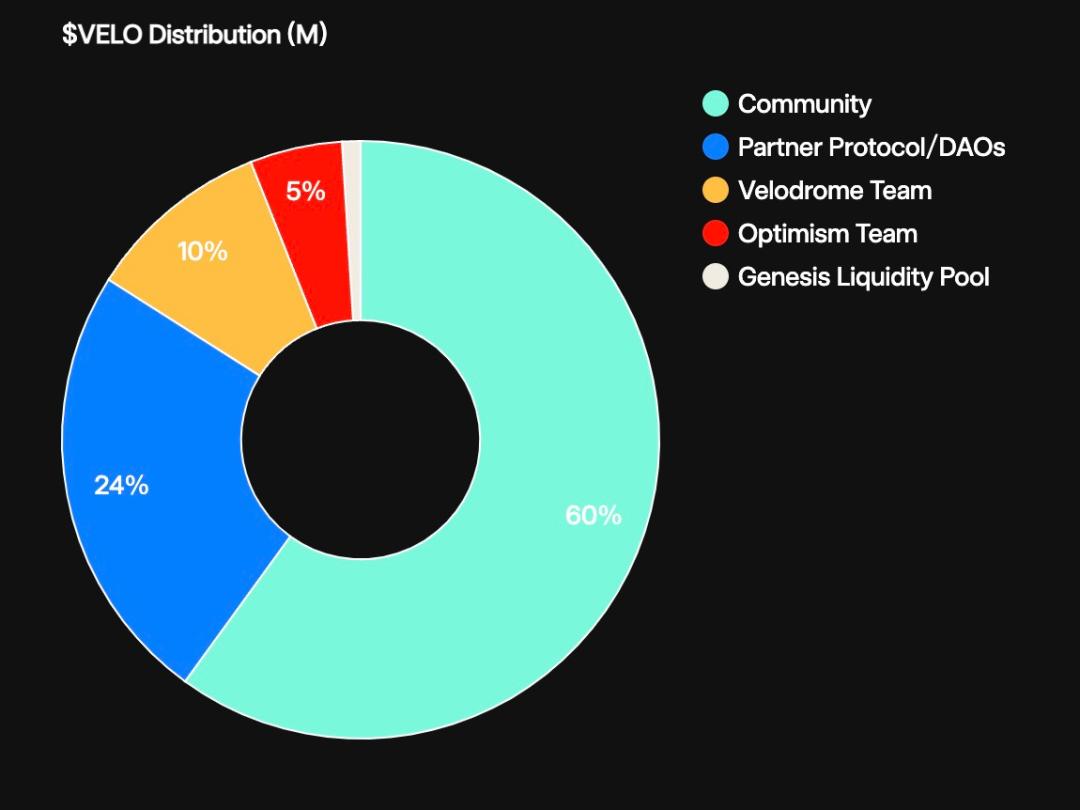

1) The initial supply of VELO is 400M, which will be diversified according to the following proportions:

(Source: Velodrome official website)

(Source: Velodrome official website)

60% (240 million) will be distributed to those who have played the greatest role in incubating Velodrome and those most likely to contribute to its long-term success, including: 27% to WeVe holders; 18% to OP Network users; 15% % For experienced defi users (Curve, Convex, users with deep interaction on Platypus, etc.);

24% (96 million) allocated to protocols that make long-term contributions to Velodrome and Optimism;

10% (40 million) to the Velodrome team;

5% (200 million) to the Optimism team;

1% (0.04 million) is used to provide initial Liquidity;

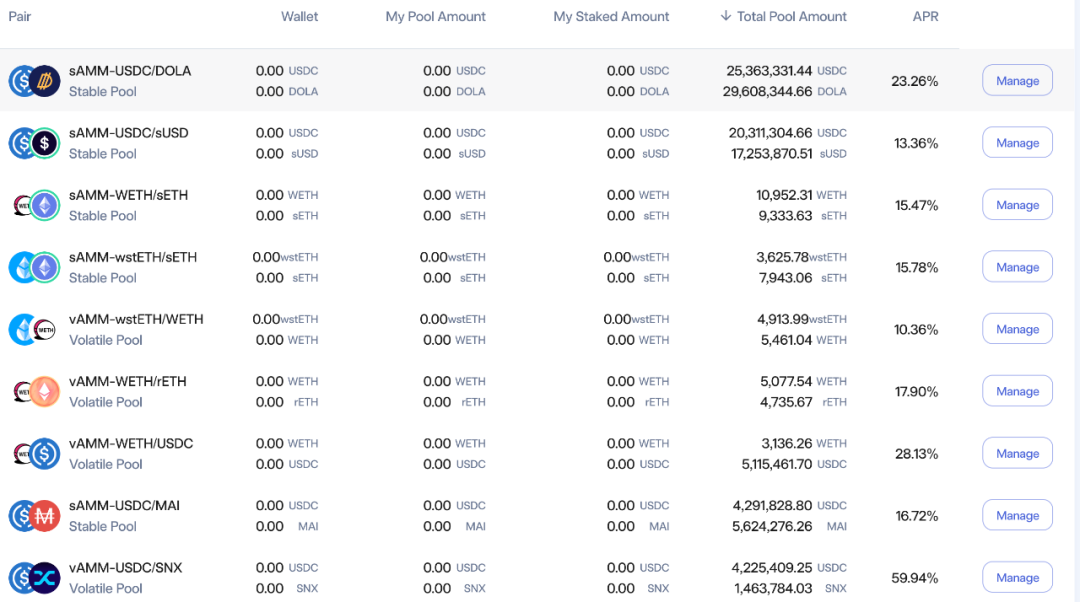

2) VELO will be issued every week (UTC time Wednesday after 23:59), and will decay at a rate of 1% per week starting from 15M. LP holders can only get this part of the additional issuance rewards. The LP APR of several major pools on February 28 is shown in the figure below:

(Source: Velodrome official website)

(Source: Velodrome official website)

3) You can get veVELO by locking VELO, and the amount of veVELO exchanged is proportional to the lock-up time. 1 VELO can be locked for 4 years to get 1 veVELO. Currently there are 4 lock-up time options: 1 week, 1 month, 1 year, and 4 years;

4) veVELO represents the governance rights of the agreement, and decides the weight of VELO issued every week to each Liquidity pool; all transaction fee income will be distributed proportionally to users who vote for the pool, not LP holders;

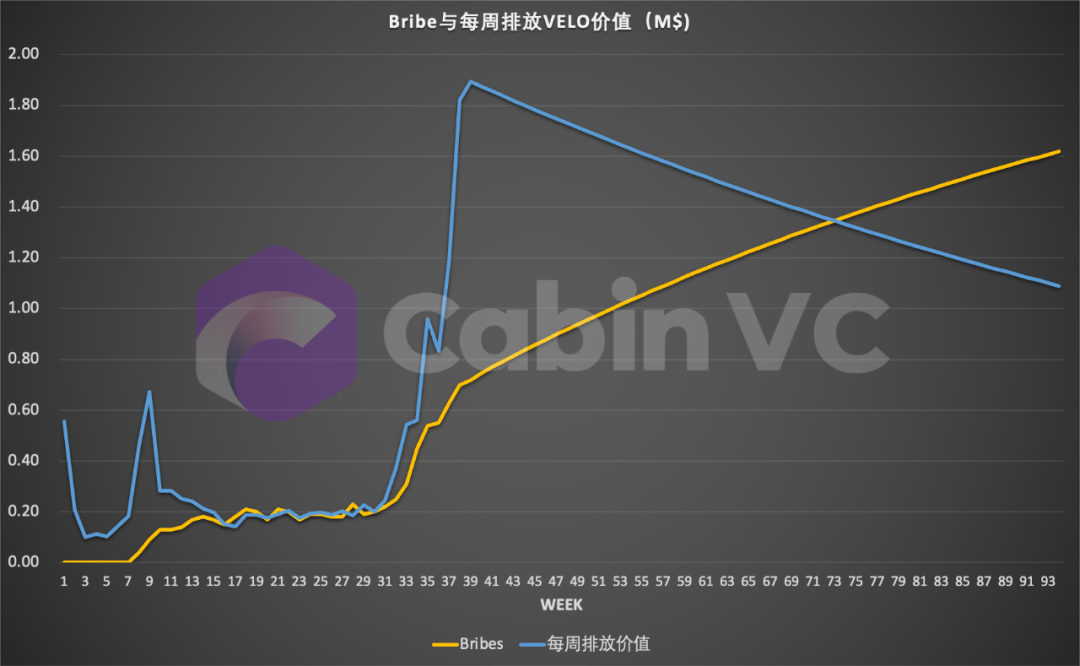

5) Bribe votes, through the built-in Bribe function of Velodrome, bribes can be sent to any pool, and these bribe funds will be distributed to users who voted for the pool in proportion. At present, every USD 1 of bribery can bring 1.5-2 USD in VELO issuance rewards. Protocols can use bribery to leverage VELO rewards to increase their own Liquidity. Therefore, bribery rewards have increased rapidly recently;

6) veVELO is a kind of NFT. Different NFTs are generated according to the number of pledged VELO and the locking time, and the sum of veNFT balance is obtained. Velodrome plans to launch the trade and lending functions of veNFT in Q1 of 2023. At that time, veVELO will be endowed with Liquidity, and users will have more investment options. This is the biggest innovation compared to Curve;

7) veVELO holders will be protected by partial dilution. When VELO is issued every week, veVELO will receive a certain percentage of rebase rewards.

Weekly rebase amount = (veVELO.totalSupply ÷ VELO.totalsupply)³ × 0.5 × emissions

The higher the proportion of locked VELO, the higher the proportion of rebase will be, and the upper limit is 50% of the current emission;

2. Data analysis

After understanding the above mechanism, we can use the data to observe how the flywheel of Velodrome works.

1) TVL and trading volume

(Source: defilama)

(Source: defilama)

Benefiting from the market recovery in January and the hot Layer 2 track, Velodrome’s TVL has grown rapidly, from $75 million on January 1 to the current $318 million, with a TVL increase of 322% this year;

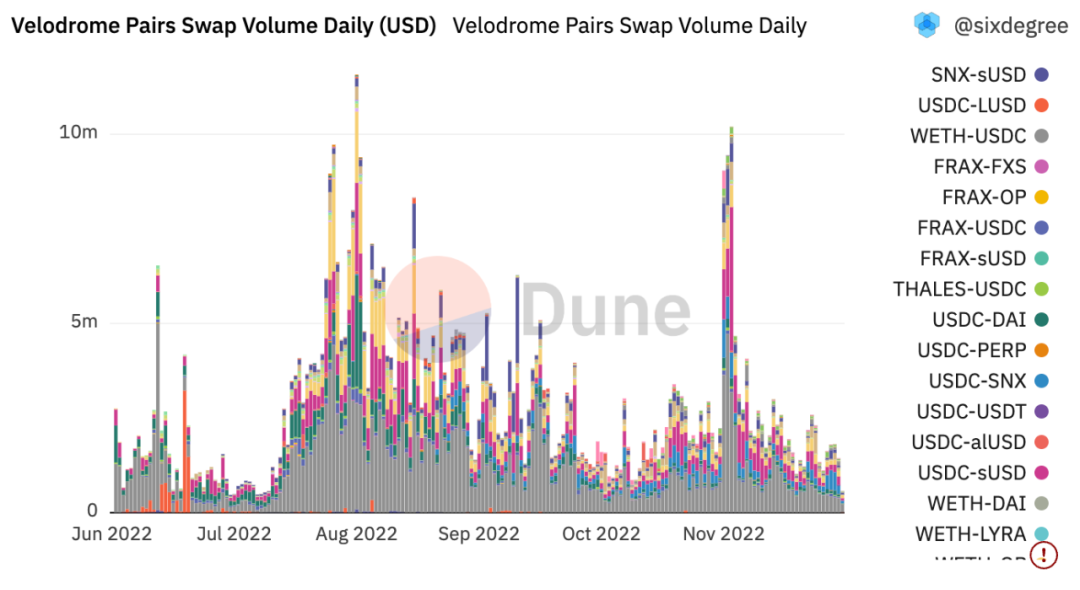

(Source: dune)

(Source: dune)

Velodrome currently has an average daily trading volume of $30 million, and OP, WETH, and VELO account for 60% of USDC's trading volume;

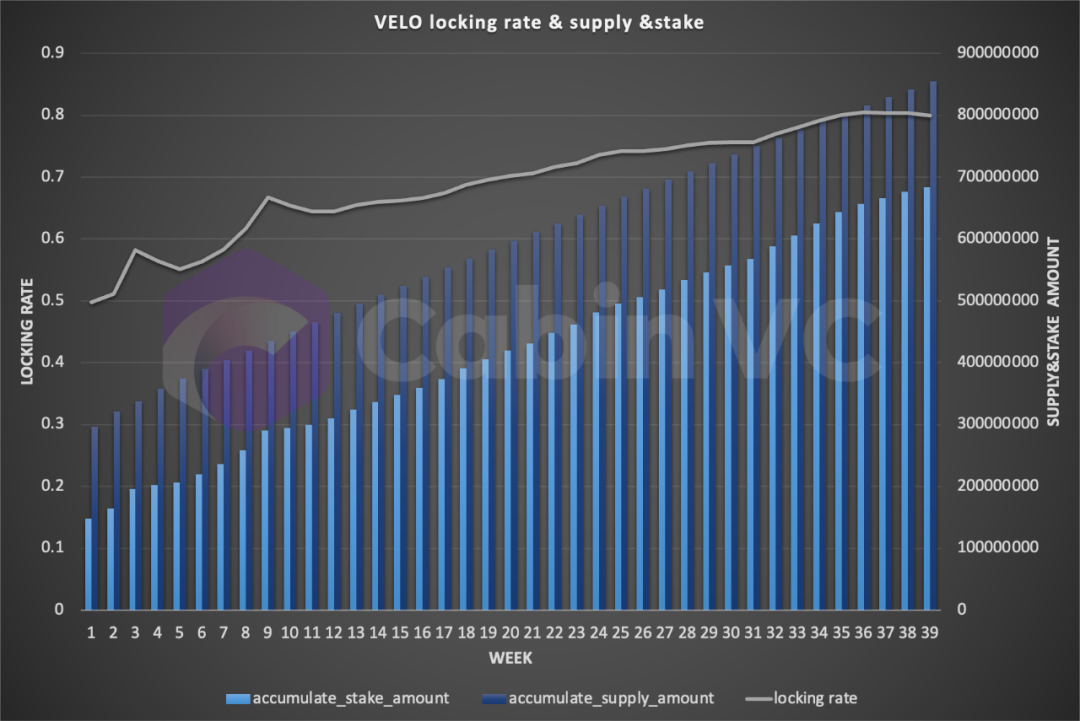

2) Lock-up rate

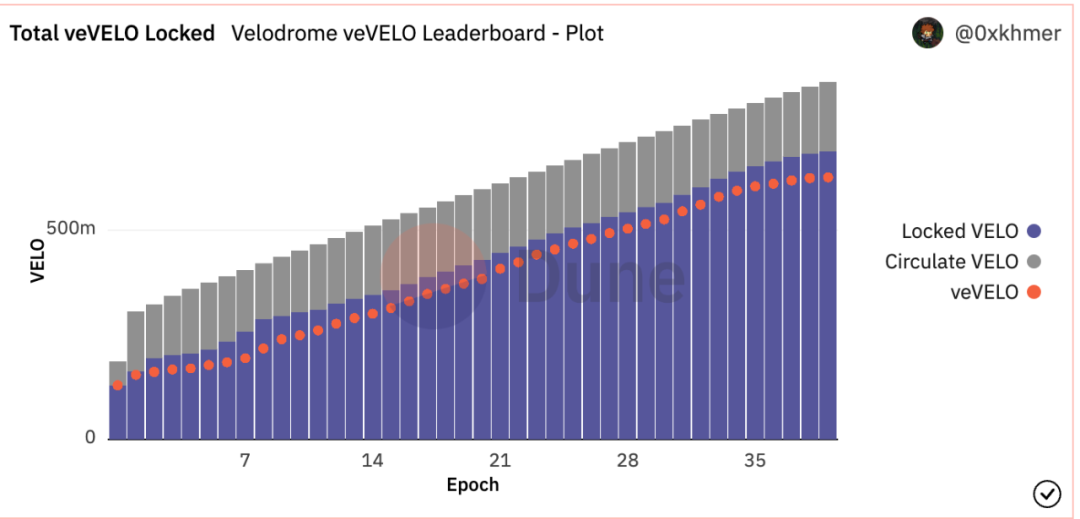

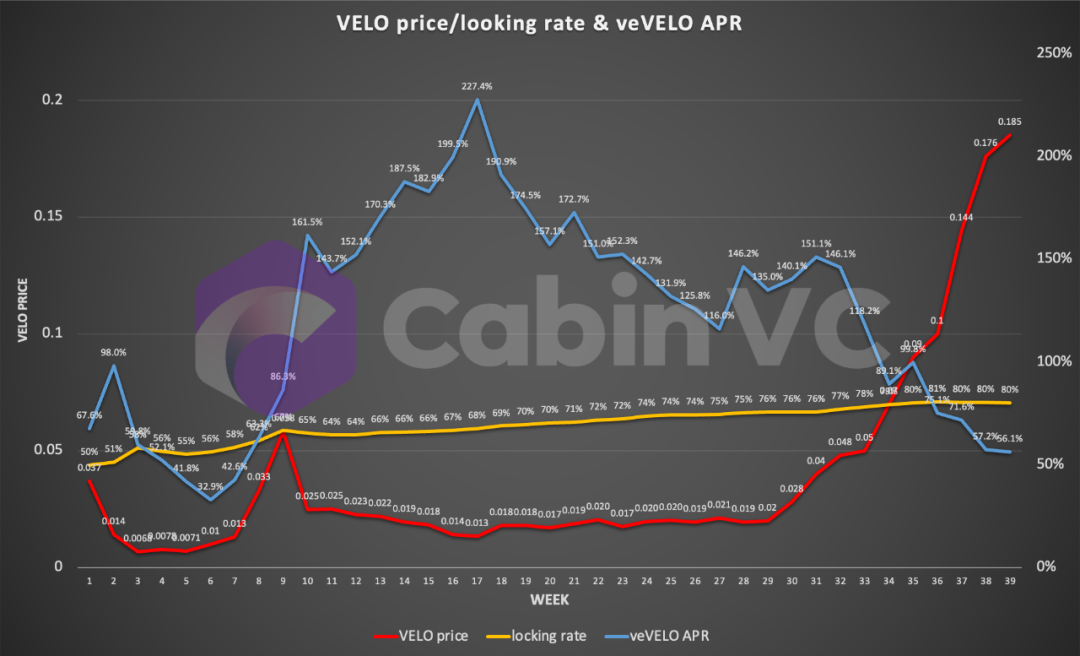

The lock-up rate (the gray line in the figure above) has risen from 50% in June 2022 to 80% at present (the 39th week). The new circulation is small, and more than 90% of the emissions are locked. However, in the past week, the growth rate of lock-ups has begun to slow down, and the new emissions/new lock-ups have dropped to 60%.

(Source: dune)

(Source: dune)

At present, a total of 688.7M VELOs have been locked, and 626.5M veVELOs have been generated. About 90% of the VELOs have been locked for the longest period of 4 years.

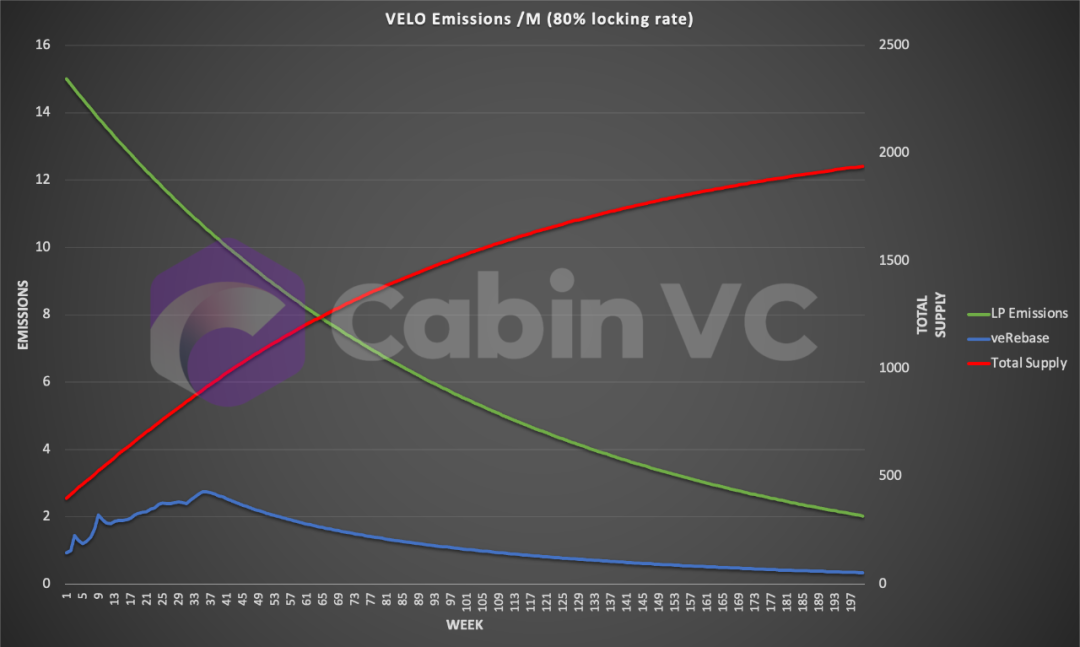

3) Additional issuance and supply curve

It is currently the 39th week and is at the inflection point of rebase (the blue line in the figure above), and the current rabase APR is 15.69%. According to the current 80% lock-up rate, the total supply (red line in the above figure) will reach 2000M in the 200th week, which is currently 854M.

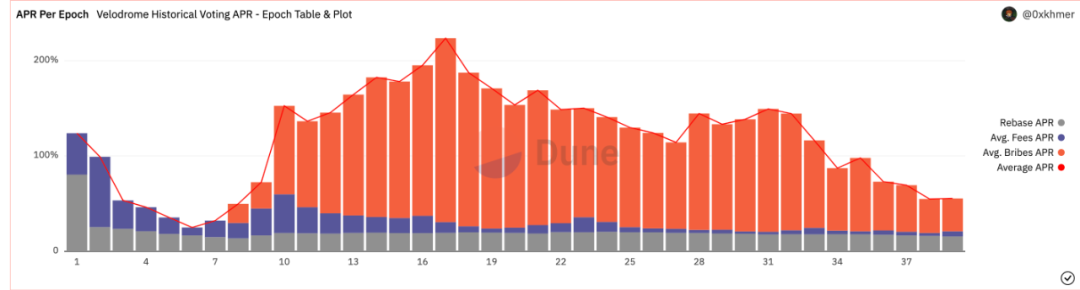

4) veVELO APR

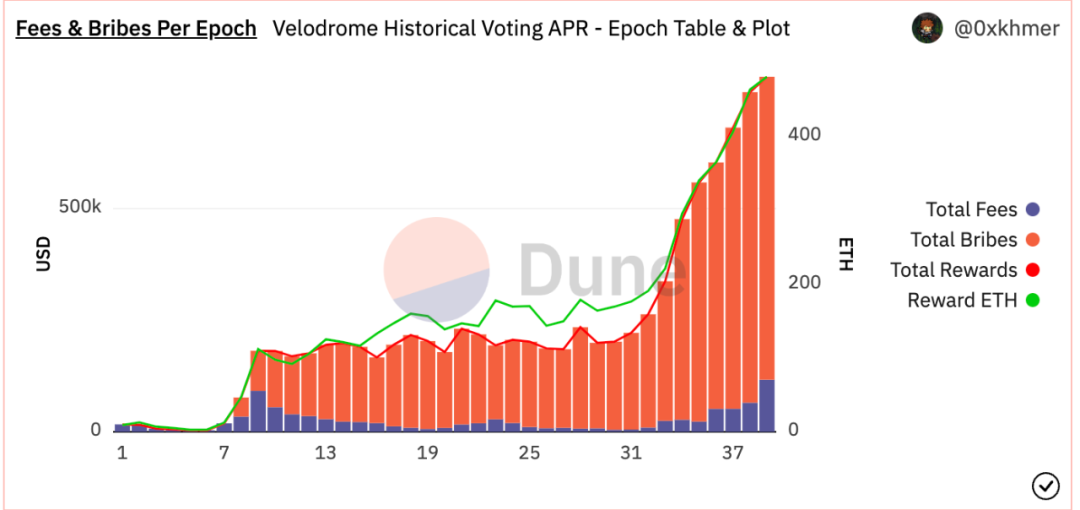

veVELO rewards include three parts: handling fees, rebase rewards, and Bribes. At the beginning of the project, the amount of locked positions is small, and the weekly emission is large, so the contribution of rebase to veVELO APR is relatively high. With vote-buying activated, Bribes rewards become the bulk of veVELO APR.

(Source: dune)

(Source: dune)

During weeks 10-33, veVELO's average APR was consistently above 100%, with peaks exceeding 200%. Although the total rewards have increased rapidly, due to the faster rise of VELO Price, the overall APR has dropped from the 33rd week (early 23rd) to the current 54%;

5) veVELO distribution

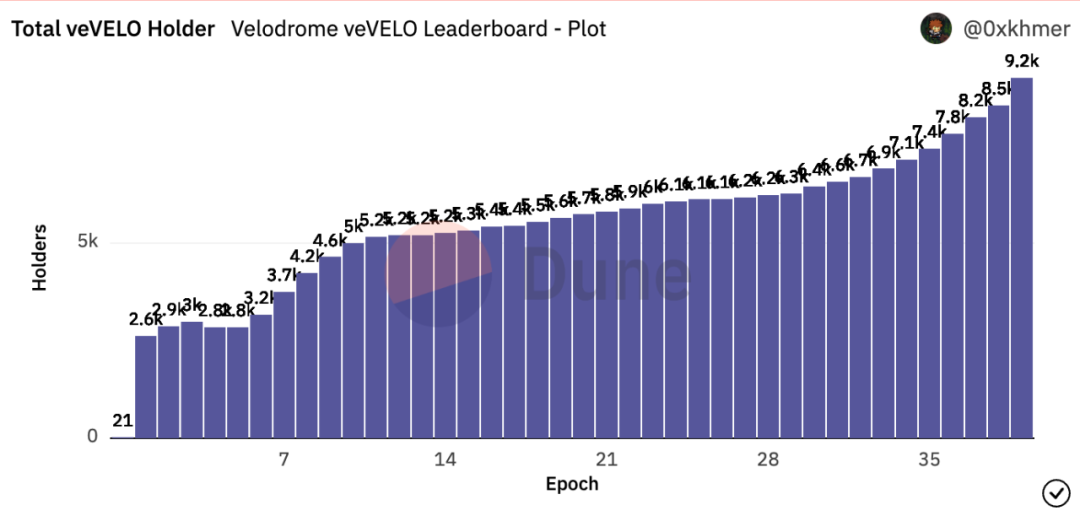

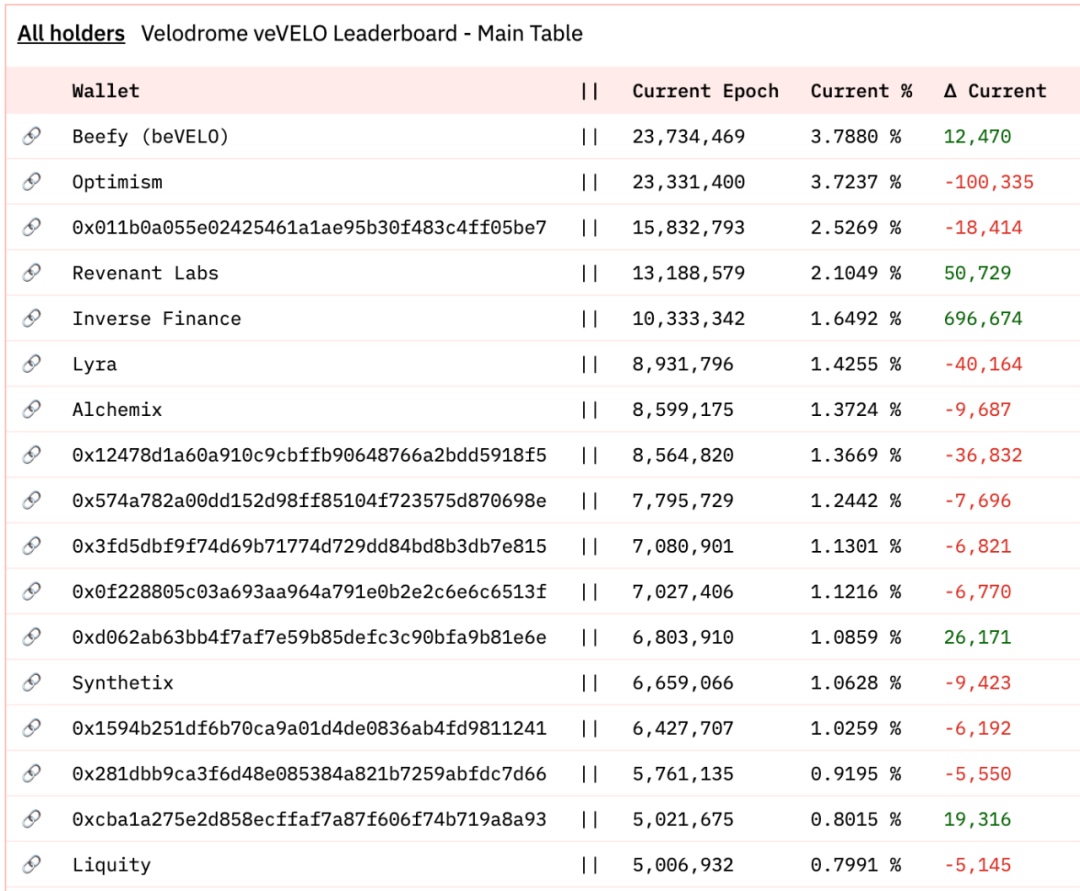

There are currently 626.5M veVELOs distributed across 9.2k addresses. Eight of the top 20 holdings are agreement parties, including Beefy, Optimism, Revenant Labs, Synthetix, and Liquity, which hold nearly 20% of veVELO.

(Source: dune)

(Source: dune)

6) Velodrome's flywheel path

High APR attracts user Farming, TVL growth;

Protocols participate in election bribery and leverage to motivate their own Liquidity pools (for every 1$ bribed by the protocol to veVELO voting users, Velodrome will correspondingly increase 1.5-2$ of VELO rewards to the pool);

High lockup APR attracts more VELO lockups, and the lockup rate increases (90% of VELO lockups get more voting rights for 4 years);

VELO has very little new circulation, and the price rises to maintain Liquidity incentive leverage;

VELO price, lock-up rate & veVELO APR changes:

When the lock-up rate drops, VELO will drop and the lock-up APR will increase. When the lock-up rate rises, VELO will rise and the lock-up APR will decrease. A dynamic balance will be reached among the lock-up rate, lock-up APR, and Price.

Because the rebase rewards are decreasing every week, while the total lockup is increasing, if you want to maintain the current lockup rate of 80%, lockup APR 54%, and VELO Price 0.185, you need to increase the amount of Bribes every week. This is obviously unsustainable, because when Bribes value = weekly emission value, the Liquidity incentive lever does not exist, and the protocols have no incentive to increase bribes.

Only when the VELO Price rises, the amount of Bribes increases, and the lock-up APR decreases, can the flywheel continue to run. As the volume of Velodrome continues to expand, the power required to drive the flywheel is also increasing. The lock rate and Bribes are the best "power indicators" for us to observe the operation of its flywheel.