The liquidity conditions of NFT today are very special, and there is no free lunch in the world.

Written by: Teng Yan, Delphi Digital NFT Researcher

Compilation: Overnight porridge

Time flies, Q1 2023 is coming to an end.

If you don't have time to keep up with the NFT space, don't worry, I'll help you.

I'll distill the main events that happened in February, the trends I'm most excited about, and my thoughts on the BLUR token launch. A huge market battle is raging.

1. More and more museums are embracing and displaying NFT

This is an important trend that few people pay attention to. In February alone, two museums made announcements about NFTs. They're not MoMA or TATE, but it's a good start.

The Center Pompidou, home to Europe's richest collection of modern and contemporary art and visited by more than 1.5 million visitors a year, has announced a permanent NFT exhibition featuring CryptoPunks, Autoglyphs, and works by several French artists.

The Los Angeles County Museum of Art (LACMA), the largest art museum in the western United States, received 22 NFT artworks from Cozomo de' Medici as gifts, including CryptoPunks, Dmitri Cherniak's Ringers, and AI artwork by Claire Silver and Pindar Van Arman.

The traditional art world has been slow to embrace and accept NFTs, partly because many traditional art collectors are older, wealthy individuals who are less familiar with new technologies. A change in mindset is underway, but it will take time. The Center Pompidou's acceptance of NFT art is just the beginning of a new trend for museums to collect and display NFT art. While museum leaders may be reluctant to be the first to do so, they are likely to follow in the footsteps of these pioneers once they see their success. As more and more NFT artworks are displayed in physical exhibitions, their cultural value will increase.

Look out for CryptoPunks and Chromie Squiggles.

2. Professional e-sports player Mongraal won the Dookey Dash key and sold it for $1.6 million

As I outlined in my previous post, the market has moved from luck-based casting to skill-based casting. We really didn't expect a professional gamer (Mongraal in this case) to win the top spot in Yuga Labs' game NFT minting event?

However, what is jaw-dropping is the bonus: 1,000 ETH ($1.6 million).

That's more than Mongraal's total winnings from the 77 games he's won in his entire Fortnite career. While this may be a special case, it will certainly attract more interest in NFTs from professional gamers. And professional gamers bring their audiences (Mongraal has more than 2 million Twitter followers).

Overall, this is a positive for the Web3 gaming space in my opinion.

3. Spotify and Reddit take the lead in Web3

In the integration of Web2 and Web3, two things caught my attention:

Spotify is rolling out its token-gated playlist feature. This allows members to access exclusive playlists while holding certain NFTs. Two partners in the pilot include KINGSHIP (the virtual band owned by Universal Music) and Overlord (with Seth Green).

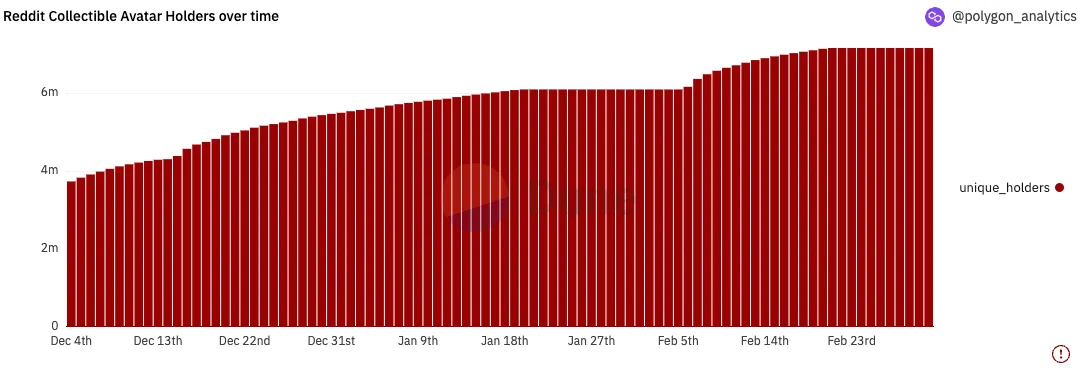

In February of this year, Reddit partnered with the NFL to launch the Super Bowl LVII collectible avatar project. In a matter of weeks, users created more than 1 million Super Bowl NFT avatars. This brings the total number of Reddit avatars to over 10 million and the number of unique holders to 6 million.

Now, most people who claim these avatars, probably don't know they're NFTs yet, so that's a somewhat misleading statistic. But it's still a victory worth celebrating. What matters is how Reddit leverages blockchain to create a unique experience for its avatar holders in the coming months. I can think of lots of cool ways: like rewarding loyal users with perks, unlocking access to certain subreddits, etc.

4. Last but not least: Is Blur a liquidity trap?

Finally, there was the big event in February - the launch of the BLUR token, which intensified the fight between Blur and OpenSea. Over 110,000 participants received airdrops of BLUR tokens worth over $240 million. The huge value created out of thin air has triggered people's BLUR bidding mining frenzy. Today, there is $140 million worth of ETH in the Blur bidding pool:

For NFT collectibles like Rektguys or Moonbirds, you can sell 30-40% of the total NFT supply at close to the floor price with barely moving the floor price. I don't think you can do that with any fungible token today.

But let's take a step back and think about it a little deeper: the current liquidity conditions for NFTs are very special, which is an anomaly. So don't expect this to last forever, the actual level of demand for NFTs today is still limited.

The great economist Milton Friedman once said:

"There is no such thing as a free lunch."

I believe Blur's massive liquidity is likely to taper off from here.

Some people may not realize that these special liquidity conditions come at a cost. Conceptually, BLUR tokens are paid daily to maintain these liquidity levels (even if allocations are timed).

Assuming that the Blur Season 2 incentive campaign lasts for 6 months and distributes 300 million tokens:

300 million / 180 days = 1.66 million tokens per day = $1.3 million at today's prices.

Essentially, the market has indicated the price at which it provides NFT liquidity, which is the sum of everyone's risk-reward expectations for Blur bidding to mine. The market says you need to pay $1.3 million a day to maintain liquidity of about $130 million. That's about 1% per day, and an APR of 365%, which is a hefty fee by any standard.

(Please note that the above are approximations, as Blur has not revealed the length of the Season 2 Incentive, it could be longer or shorter)

Now, whether this is good news or bad news is up to you:

Blur is "paying" for all this liquidity with their token, which is kind of voodoo, they didn't take a dime out of their pockets, but they've been able to use their token as a kind of leverage to make their platform surpass OpenSea in volume. All this liquidity is subsidized by those who buy BLUR tokens on the secondary market.

However, if Blur believes that the future value of its token will increase substantially and that BLUR will become more valuable in the future, it must be very painful to hand it over easily to mercenary capital. Giving up ownership is expensive, and that's a difficult problem.

Some other thoughts:

I think the Blur team would be wise to keep the next airdrop distribution a secret without revealing too much. This is different from many DeFi protocols where APR is transparent, which transfers additional risk to liquidity providers, who have to live with uncertainty.

The first significant drop in liquidity is likely at the end of the doubling of bid/listing point rewards on April 1st. Blur mining has real risks, and for participants without advanced tools, the risk reward will no longer be worth it.

If the BLUR token price falls (as we get closer to investor unlocking, waning attention, or market sentiment swings), the reward-to-risk ratio will drop further and more liquidity will leave. Or some whales will cancel their bids because they are profitable enough.

If you're a whale with 100+ NFTs of a particular collectible, this could be a rare opportunity to unload without disrupting the market. I'm not saying you should, but if you do, then this is a rare window of opportunity.

Side note: Gem is clearly going to be the main focus of OpenSea for the professional trading audience. Gem is gearing up for war, and its founder, Vasa, is very active on Twitter after a period of low profile. Gem may launch tokens (pure speculation). This allows OpenSea to continue to focus on casual collector/retail and creator publishing tools.

The key takeaway IMO is that Blur shows us that the competitive moat in the NFT market is much shallower than we thought. Low switching costs. Retaining users is hard: they will go where there is an incentive.

Did Blur achieve "product-market fit"? Possibly, but let's be clear about what the "market" is, it's not the entire NFT market, it's a specific audience of professional traders and NFT whales. The long tail of NFT users remains on OpenSea.

There are many uncertainties in the future, but one thing is certain. Blur must constantly drive demand for its token in order to maintain these liquidity levels. Tokens will be another product they're going to manage, looking forward to seeing the next trick they pull out of the hat.

Stay safe and best regards, Teng Yan.