Seeing the long English article written by @JackNiewold , "What will DeFi 3.0 look like?" Which cryptocurrency projects will lead the way? "Not bad, translated into Chinese long tweets with ChatGPT.

Which protocols are pioneering so-called DeFi 3.0?

Multichain lending marketplace: #Radiant , #TapiocaDAO

Rapid iteration of perpetual contract decentralized exchanges: #Vela , #Gains , GMX , #Perennial

Passive Liquidity projects: #Thales , #Arcadeum

Stable forked protocol: #Satin , #Velodrome

understand deeper

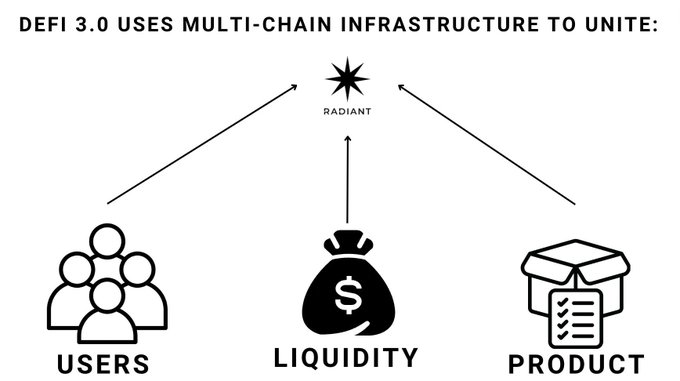

A. Multichain

Representative of DeFi 3.0: #RADIANT ( $RDNT )

Protocols face difficulties in unifying Liquidity and vision:

• Teams are spread across multiple chains

• Product usage is divided

• Liquidity is also segmented.

how to solve this problem?

Unity: A look at Radiant

In Radiant's case, the upcoming V2 allows you to:

• Deposit native collateral (eg USDC on Arbitrum)

• Loan the USDC and lend ETH on the new chain

• sell it to another property

At the product level, Radiant becomes the main page rather than the main body of a specific chain.

What fundamental problems does Radiant's full-chain unified model solve? Unification of Liquidity: Protocols that attract Liquidity become winners Protocols with a unified model of the entire chain are more likely to attract Liquidity.

B. Capital efficiency

Radiant has also innovated in this area: If I want $1 million in ETH DeFi income, I should deposit my ETH into the lending protocol to get a yield.

Borrowing + Leverage Unlocks Efficiency

C. Incentive redesign

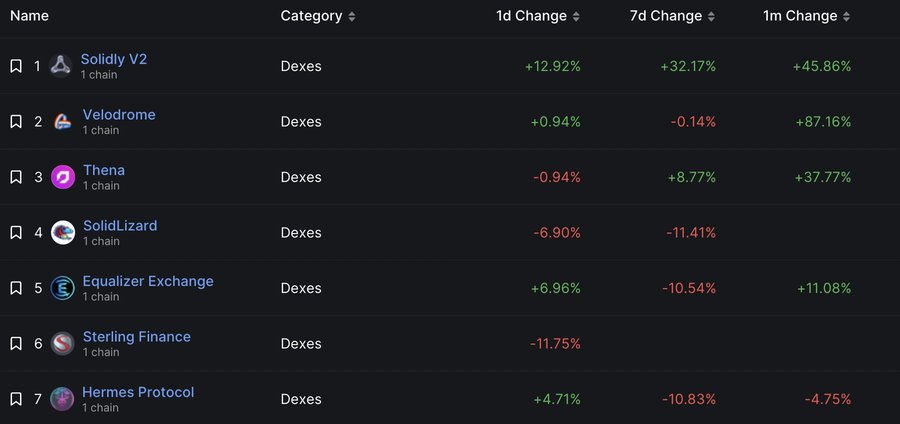

Representative: Solidly Fork

While DeFi 2.0 protocol Solidly’s token model is broken and inflationary, it does pioneer a new type of incentive design.

The now redesigned Solidly fork has found a way for participants to align their interests.

Fork agreement:

@SatinExchange Matic

@VelodromeFi OP

@solidlizardfi Arbitrum

Steadily rising total lockups in 2023 for these Solidly forks.

Why?

These Solidly forked protocols have successfully aligned the interests of different participants in the method of users, ecology, other protocols, Liquidity Provider, team members, and fee income.

At the same time, Uniswap's fork is also struggling (the TVL of the two is shown).

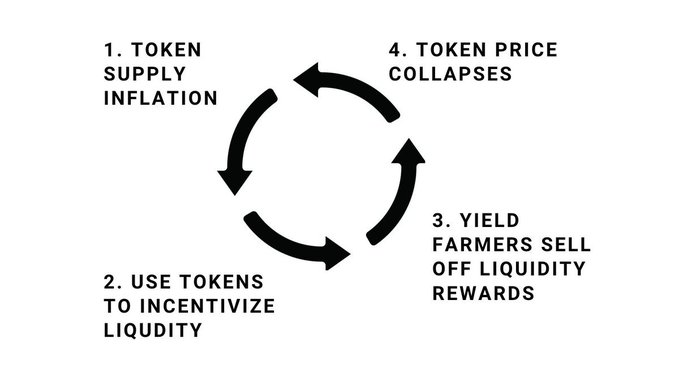

D. Product Liquidity positive cycle

GMX created the last link of DeFi 3.0, which is related to the Liquidity cycle.

DeFi 1.0 and 2.0: Issue tokens, then slowly increase token supply to incentivize Liquidity.

DeFi 3.0: Find a model that can drive Liquidity without token rewards.

GMX and @vela_exchange drive Liquidity without token rewards.

In this model, tokens act as equity rather than inflationary incentives.

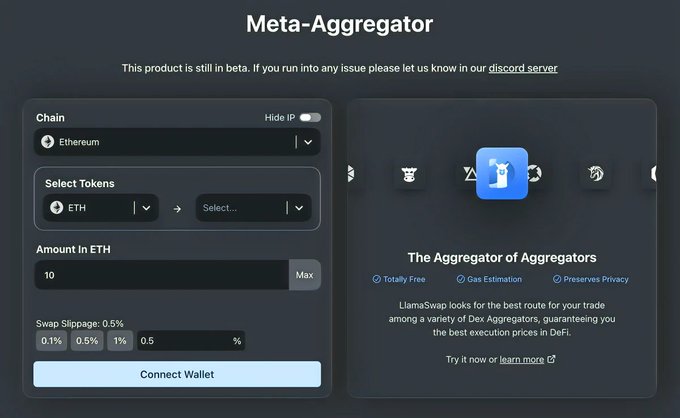

@sentiment_xyz and @DefiLlama proved that huge user base can be achieved without token incentives.

When users pay for Liquidity instead of agreement payments, token holders can enjoy benefits and avoid the death spiral of currency prices caused by continuous issuance of tokens to buy users.