Recently, with the upcoming upgrade of Ethereum in Shanghai, DVT technology leader SSV Network has received more and more attention, and its secondary market performance has also attracted everyone's attention. Many people have given the valuation of the SSV protocol. own calculations.

Today, I also combined some blockchain projects to give SSV pulse and estimate value from different dimensions.

1. BTC

If Satoshi Nakamoto found you with a white paper, how would you value Bitcoin? Obviously, Bitcoin itself does not generate profits, so if you use traditional company valuation methods to calculate, you can only come to the conclusion that this thing is worthless.

But anyone who understands Bitcoin will certainly not regard it as a company for valuation.

means of payment

First of all, the most popular is to use BTC as an emerging payment method, then it will eat away a certain market share of those traditional payment processors, and at the same time, it can be evaluated according to the payment network for the first time. value.

scale of value

Secondly, if it is recognized that BTC can be used as a means of payment, then naturally, BTC can also be used as a measure of value to measure the price of goods or services, so it can be evaluated for the second time by adding the level of value measure value.

store of value

Finally, if you are an investor with a larger structure, then you can already foresee that BTC can be used as a means of value storage, because the output of each BTC is generated through indiscriminate calculations, and private The existence of the key can realize the protection of private property, which can be perfectly compared with the gold in the real world, so that the third valuation of BTC can be compared with gold.

2. Doge Coin

Dogecoin is a special one among blockchain projects, because its birth was originally a joke. In 2013, Palmer bought the domain name dogecoin.com, hoping to make Dogecoin a reality. Marcus contacted Palmer, and spent 3 hours modifying 3 parameters in the Bitcoin code (font, total amount of 100 billion, mine changed to dig, because dogs can only dig) released the dog currency.

Now, Dogecoin ranks 9th among all digital currencies, with a market value of 11.3 billion US dollars. Of course, there have been many twists and turns in the process, and it has nothing to do with Musk's support.

Brand Value

If you were asked to value Dogecoin, what model would you use for the valuation? Is it an analogy to Bitcoin for valuation? Certainly not, the valuation of Dogecoin should obviously be valued according to the brand value.

It is no exaggeration to say that Dogecoin is second only to Bitcoin in popularity among blockchain projects, and its popularity outside the circle even surpasses that of Ethereum. Therefore, Dogecoin is suitable for brand value valuation, and many NFT projects are also suitable for brand value valuation methods.

3. UNI Swap

In March 2018, V God released a paper: "Improving front running resistance of x*y=k market makers". At the same time, Siemens laid-off employee Hayden Adams is learning Ethereum programming under the advice of his friends, and is starting to design AMM products according to V God's vision.

We all know the later story. The birth of Uniswap turned the idea in V God’s paper into reality. Based on the classic mathematical model of "x * y = k", AMM broke the inherent thinking of order book + matching DEX in the past It has successfully liberated DEX from its dependence on CEX model reproduction and quotation, and also broke CEX’s monopoly on the cryptocurrency trading market, making unlicensed, open, free, simple and efficient on-chain transactions a reality .

We all know the later story. The birth of Uniswap turned the idea in V God’s paper into reality. Based on the classic mathematical model of "x * y = k", AMM broke the inherent thinking of order book + matching DEX in the past It has successfully liberated DEX from its dependence on CEX model reproduction and quotation, and also broke CEX’s monopoly on the cryptocurrency trading market, making unlicensed, open, free, simple and efficient on-chain transactions a reality .

At the same time, Uniswap’s project token UNI is also the most typical governance token, holding UNI can only vote.

So, how to value the governance token UNI?

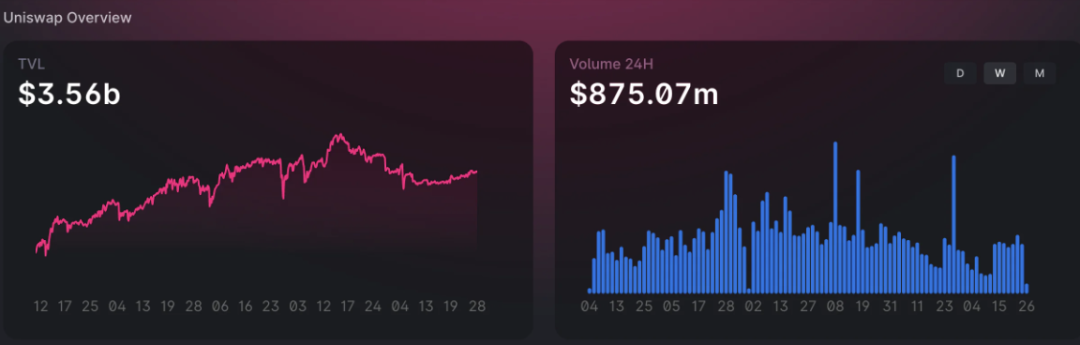

UNI currently has a fully diluted market cap of $6.4 billion. The Uniswap protocol has a lock-up volume of 4 billion US dollars, and there is still no good method for how to value such governance tokens. The voting power represented by governance tokens is important, but it does not seem to be quantifiable for valuation.

If you have any good ideas on how to value governance tokens like UNI, please let me know.

4. Chainlink

Chainlink is the leader of the oracle track and has become an integral part of DeFi, and I don't even know who the second place in this track is.

LINK’s market cap is also high, with a circulating market cap of $3.5 billion and a fully diluted market cap of $7.2 billion, but what is Chainlink’s annual revenue?

According to Market.link data, in the past month, Chainlink has performed 300 million price feed updates, completed 895,000 VRF requests, 940,000 direct requests, and 60,000 Keepers operations.

Node rewards totaled 740,000 LINK, calculated at a price of $7.23. In the past month, nodes received a reward of $5.35 million. If multiplied by 12 months, the annual node reward was $64 million .

We can regard the 64 million US dollars of LINK as Chainlink's gross profit. If the cost is removed, Chainlink’s PE may be close to 100 times based on traditional PE calculations.

It can be seen that, as a star currency with the highest increase of nearly 400 times, if we value it according to business income, we will miss this opportunity of several hundred times the income.

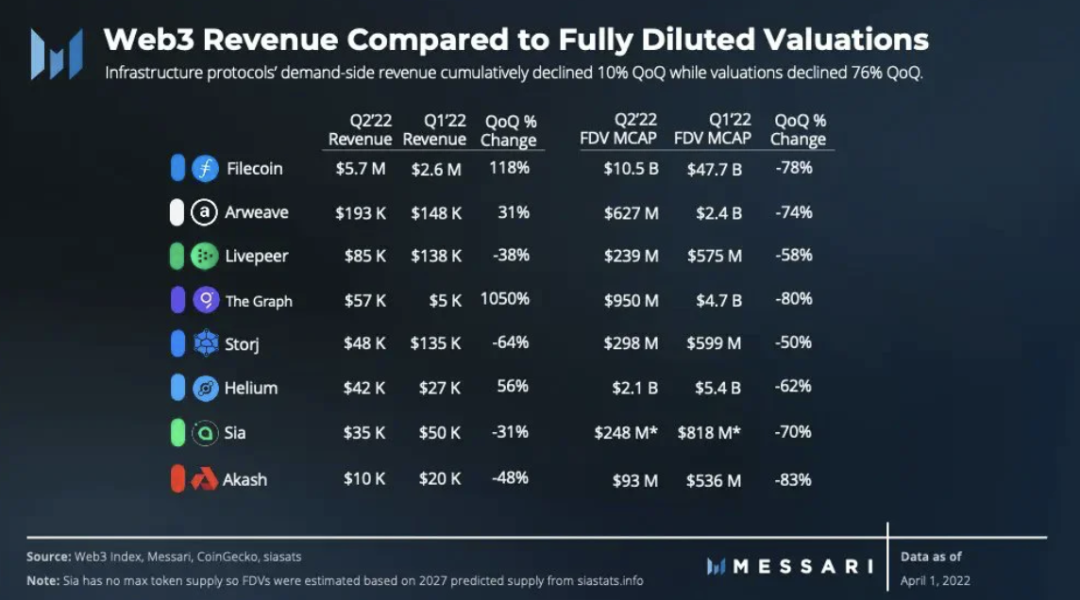

Similarly, there is also the storage track. The leader and second child are Filecoin and Arweave respectively. The annual revenue in 2022 is expected to be 16 million US dollars and 680,000 US dollars respectively, while the circulation market value is 2.7 billion US dollars and 500 million US dollars respectively. .

5. Lido

Lido is currently a popular fried chicken on the LSD track, and the number of pledges in the entire Ethereum is also the largest. Currently, 5.63 million ETH(about 8 billion U.S. dollars) are pledged, and the market share is 29%.

Lido's business model is simple, taking 5% of the ETH pledge income. Based on the current staking rate of 4%, the ETH pledged in Lido can generate a reward of 320 million U.S. dollars per year, of which Lido can get a handling fee of 16 million U.S. dollars, which is the annual income.

At present, the circulating market value of its token LDO is 2.7 billion U.S. dollars, and the fully diluted market value is 3.2 billion U.S. dollars. Market cap and revenue don't match up either.

Of course, this is static. Many people are optimistic about the upgrade of Ethereum Shanghai, but I personally think that after the completion of the upgrade of Ethereum Shanghai, it may not be good news for Lido.

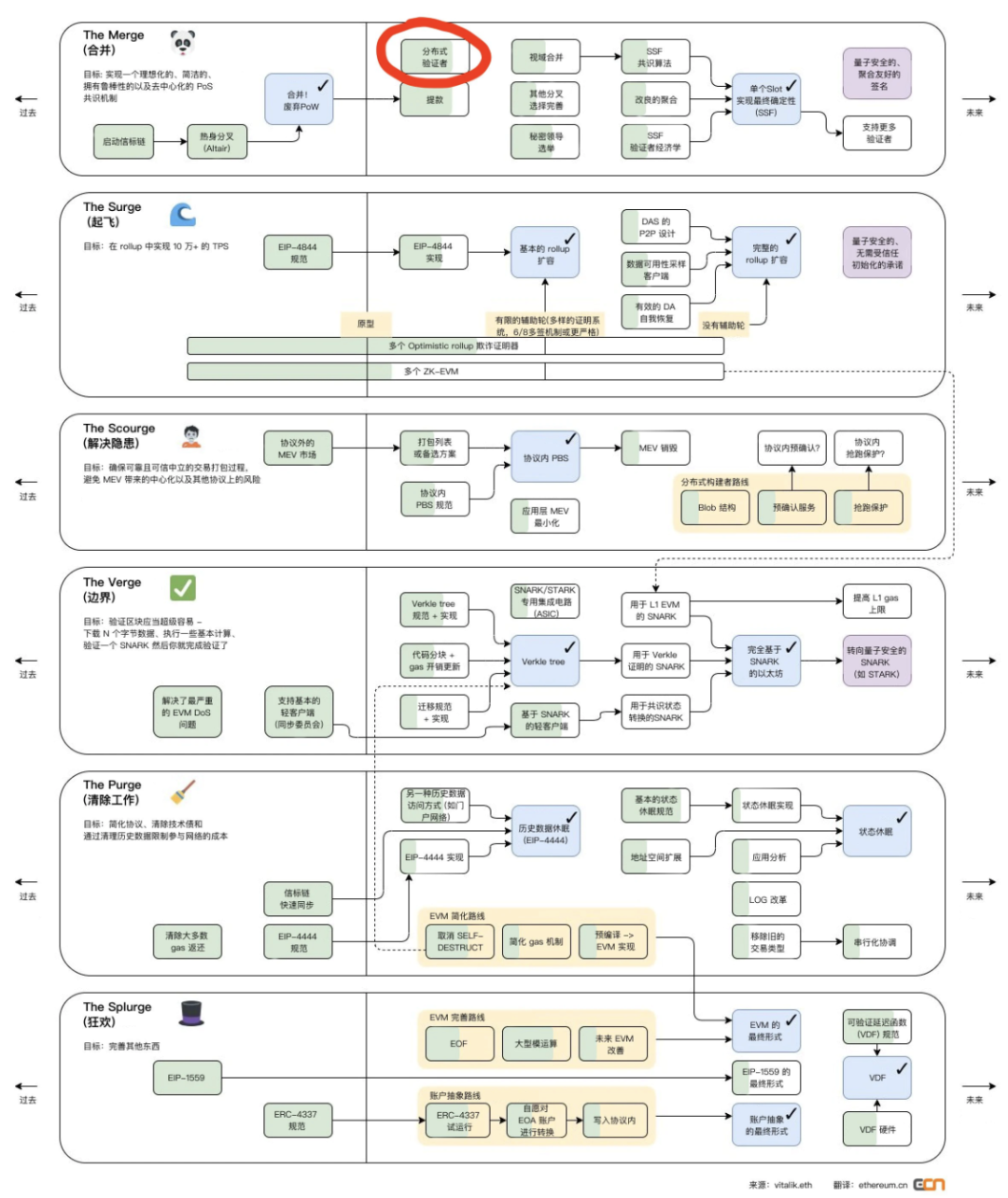

6. SSV

After reading the above 5 projects, let's look at SSV again. First of all, DVT technology is written in the Ethereum roadmap, and it is also a research outsourced by the Ethereum Foundation. It is important for the decentralization and security of Ethereum pledges. very important.

In this track, SSV is currently the most advanced, whether it is the progress of the testnet or the token level.

In this track, SSV is currently the most advanced, whether it is the progress of the testnet or the token level.

Assuming that after the Shanghai upgrade is completed, there are 20 million ETH pledged, and 10% of the ETH pledged using SSV technology (platform), then it is 2 million ETH.

Of course, if the income is counted, the 2 million ETH are calculated at an annualized rate of return of 4% a year, and the price of Ethereum is calculated at $2,000, and the annual dollar income generated is $160 million.

Among the $160 million in revenue, most of the revenue will be distributed to the LSD protocol and the pledge node service provider, which may account for 90%. In this case, the revenue of SSV may only be about $16 million.

Of course, here are a few indicators that I personally think are relatively conservative:

The first point is the number of pledges in Ethereum, which is currently about 17 million. I chose 20 million for calculation, which must be conservative. I am not surprised that the amount of Ethereum pledged has risen to 40 million in the period after the Shanghai upgrade.

The second point is the price of Ethereum, which I calculated based on $2,000. After Ethereum is converted to POS, it has become a deflationary asset that can generate income. After the price enters a positive cycle, it will definitely exceed 2,000 US dollars.

The third point is the ETH share pledged through SSV technology (or platform). There is reason to believe that after the conversion of Ethereum to POS, the adoption rate of DVT technology will gradually increase. Lido is already conducting cooperative testing with SSV, and centralized exchanges will actually integrate to some extent for the sake of reputation and asset security. DVT technology.

In other words, DVT actually plays the role of a mining pool in the POW era. Whether it is personal mining or large-scale mining, it is necessary to access the mining pool for a safe, stable, and high-yield output.

Because for most people, the threshold for POS staking is higher than the previous graphics card mining threshold. Except for the number of Ethereum requirements, the cost of node operation and maintenance, and the time, energy and technical reserves required, most people and companies They are all not available and need to be handed over to DVT.

And if the SSV goes well, it will be the same as the leaders of other tracks, the winner takes all, and will take the largest market share. In the end, the percentage of ETH staked through SSV may increase to 30% or even 50% of the total stake.

And if the ETH pledged through the SSV protocol can be counted into the TVL of SSV, then SSV may become the protocol with the highest TVL in history.

Therefore, if the previous income of 16 million US dollars is calculated according to the price of 40 million ETH+ 4000 US dollars + SSV 20% share, it will become 120 million US dollars in income.

At present, the circulating market value of SSV is 300 million US dollars, and the fully diluted market value is 500 million US dollars. Combining the valuations of the previous 5 projects: BTC($450 billion), Doge($11.3 billion), UNI($4.9 billion), LINK ($3.5 billion), LDO($2.7 billion) and valuation methods, what do you think What is a reasonable valuation for the SSV protocol?

I personally think that even if the valuation is based on the income of 1,600 US dollars, the circulating market value of SSV may reach about 2 billion US dollars. Of course, this is just speculation, and the rest can only be left to the market and time. If you have a better valuation method, please contact me.