DeFi has been scarred, but thankfully, projects with Real Yield (Real Yield) like GMX will save it from the fire.

Here are some DeFi projects with stable Real Yield that I have been following, including $ARC, $PENDLE, $LQTY, $FCTR, $RDNT.

Real Yield is a well-designed economy, all participants can get benefits, and the entire economy can continue to develop.

False returns are nothing more than a token inflation dream, and ultimately holders will be out after Liquidity dries up.

So how do these projects we mentioned earn Real Yield?

- $ARC: apply GLP mode to GambleFi

- $PENDLE: Buy and sell future earnings today

- $LQTY: Earn rates from Stablecoin users

- $FCTR: Earn management fees from asset holders

- $RDNT: a P2P Cross-chain bank

(Translator's Note: GMX is a decentralized spot and perpetual contract exchange, $GLP is the basic token used by GMX 's Liquidity pool. GLP in the GLP model refers to a mixed asset pool, through market making /exchange/leverage trading, etc. to obtain Liquidity income, and distribute the income to GMX and GLP holders) 01 @arcadeum_io

$ARC adopts GMX 's GLP model, and uses this model to build a complete GambleFi ecosystem. Their products are:

- sports quiz

- poker game

- turntable game

- 1000 times leverage trading

The key to allowing Arcadeum to earn Real Yield without breaking a sweat is that their ALP mechanism allows users to provide Liquidity for the ecosystem itself.

This gives Arcadeum's Liquidity pool a guaranteed advantage:

- The income of GLP is very dependent on the level of traders in practice, and it may not be profitable on average

- ALP can guarantee profit

They also announced that their perpetual contract trading products can use leverage up to 1000 times, which also attracted a lot of attention for a while. However, from the perspective of obtaining Real Yield, it is just to gain more Liquidity.

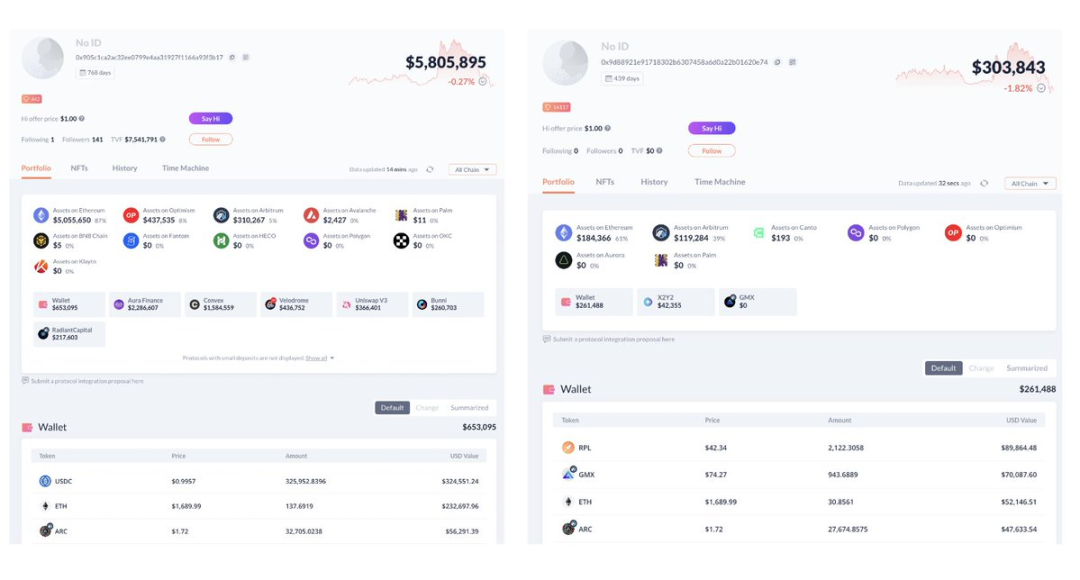

But these have attracted the attention of Crypto Messiah and many hidden whales, and they have all started hoarding $ARC.

02 @pendle_fi

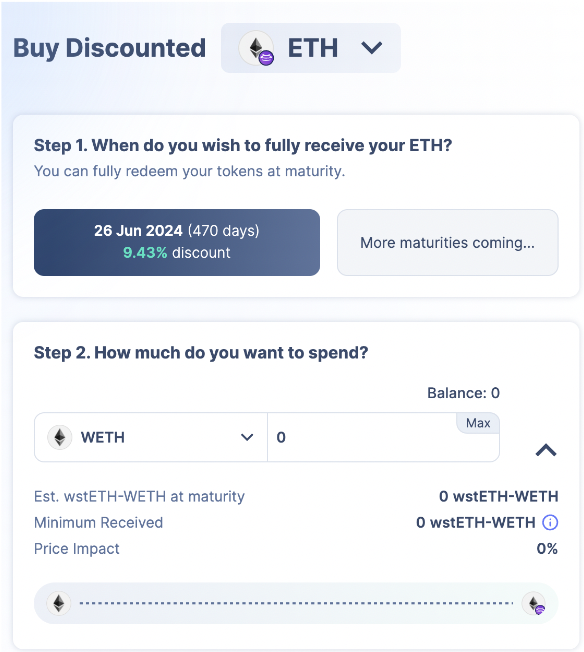

Pendle is a protocol where users can sell future earnings at a fixed rate. The parties to the transaction here are:

Earnings seller: sell future earnings at a fixed price, so as to obtain a discounted price of ETH on the day

Yield Buyer: Bet on future yield by trading yield on GLP/ ETH

Since future income can be converted into underlying assets immediately, I classify it as a Real Yield agreement.

Are you Bullish on GLP fees?

You can also choose to save money: buy ETH at the discounted price of the day.

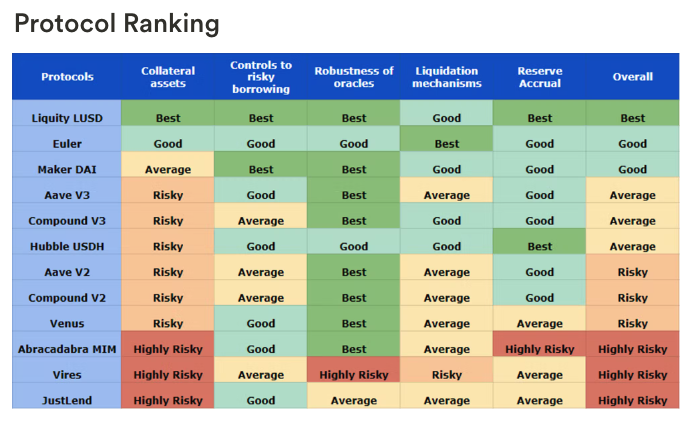

03 @LiquityProtocol

After a crazy week of Stablecoin, we definitely felt the need to mine alternatives to USDC or USDT.

Then maybe we should look at $LQTY, the project’s Stablecoin$LUSD that creates cash for token holders.

Even in the huge fluctuations of Stablecoin, the anchor performance of $LUSD is surprisingly good, and it still maintains its decentralized and unregulated nature.

(Translator's Note: $LUSD is rated as the most resilient Stablecoin that can only be minted by ETH )

Under the design framework of this agreement, all participants in this ecology must pay LQTY holders the following fees:

- borrowing fee

- Excess funds after liquidation

04 @FactorDAO

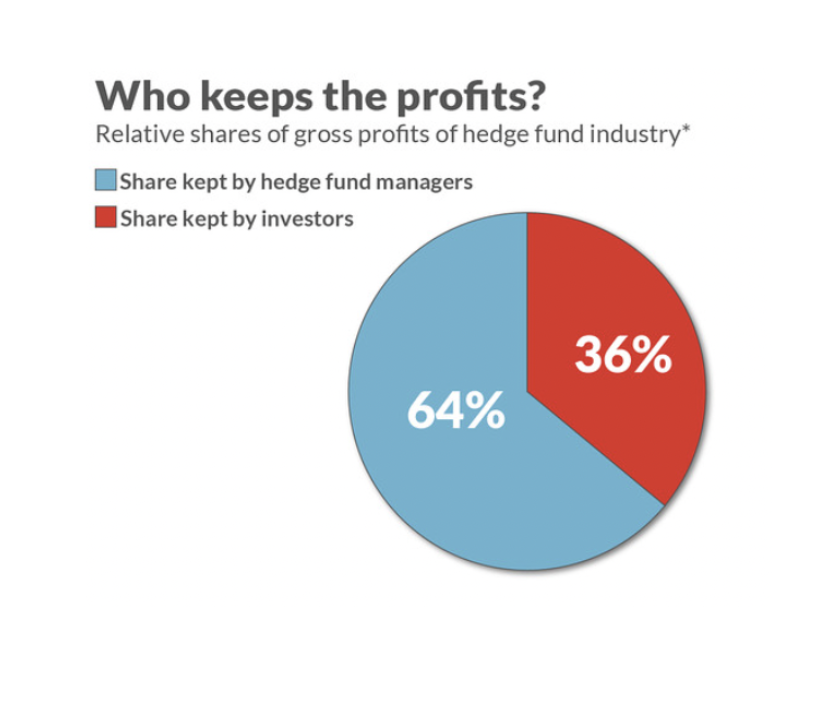

In traditional finance, about 66% of funds are actively managed (translator's note: active management, active management, that is, handing over money to professional fund managers/management teams for professional investment), which also generates millions of dollars per year. Fund management fees.

But in the cryptocurrency space, most money is not actively managed. As such, Factor DAO is looking to reshape the way money is managed in the cryptocurrency space.

Although the management fees of active management are very high, the top funds are still very popular due to their outstanding performance. But for now, investors don't get much out of active management either.

(Translator's Note: As shown in the figure below, 64% of the investment income is shared by the fund manager team, and 36% of the income is owned by investors.)

But in Factor DAO, holders will earn:

- Part of the agreement fee

- incentive reward

05 @RDNTCapital

Radiant is a Cross-chain money market that functions like a bank:

- Savers can earn interest from borrowers

- Borrowers can find funds across different chains

Radiant uses overcollateralized lending, the simplest form of lending. The interest on the platform will fluctuate with the demand level of various assets.

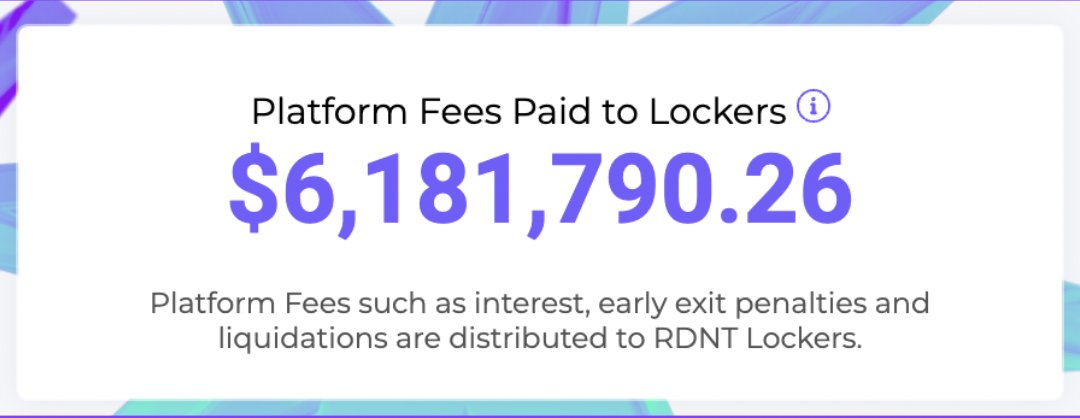

As a holder of $RDNT, the following ways can bring you Real Yield:

- loan interest

- Platform fees

- Penalties for selling $RDNT prematurely

As a platform with a market value of only 69 million US dollars, they have given back more than 6 million US dollars to users. 06 Summary

In the world of cryptocurrencies, some narratives come with user stickiness (such as Real Yield), while others are more like a whirlwind of capital (such as AI coins). Thanks to these protocols that provide Real Yield, it is their success that pushes the Defi world onto a sustainable path. I believe they will shine.

Translator's summary

This article introduces some projects with Real Yield in the DeFi field, which can provide real economic benefits to all participants, such as Arcadeum, Pendle, Liquity, Factor, and RDNT.

These projects have different economic models. For example, Arcadeum adopts GMX 's GLP model to build a complete GambleFi ecosystem, allowing users to provide Liquidity for the ecosystem itself to obtain real benefits.

Pendle is a protocol where users can sell future earnings at a fixed rate. Liquity is a decentralized, unregulated Stablecoin project whose Stablecoin LUSD creates cash for token holders.

Factor earns Real Yield by earning management fees from asset holders. RDNT is a P2P Cross-chain bank.

This article also puts forward a point of view, that is, Real Yield is a well-designed economy, all participants can obtain income, and the entire economy can continue to develop.

False returns are nothing more than a token inflation dream, and ultimately holders will be out after Liquidity dries up. So it's important to look for projects with Real Yield and get involved.

However, it should be noted that the risks of these projects are not low, and the market is highly volatile, requiring investors to carefully assess their risk tolerance.