Original: " GMX Challengers "

Produced by: DODO Research

Editor: Lisa

Author: Flamie

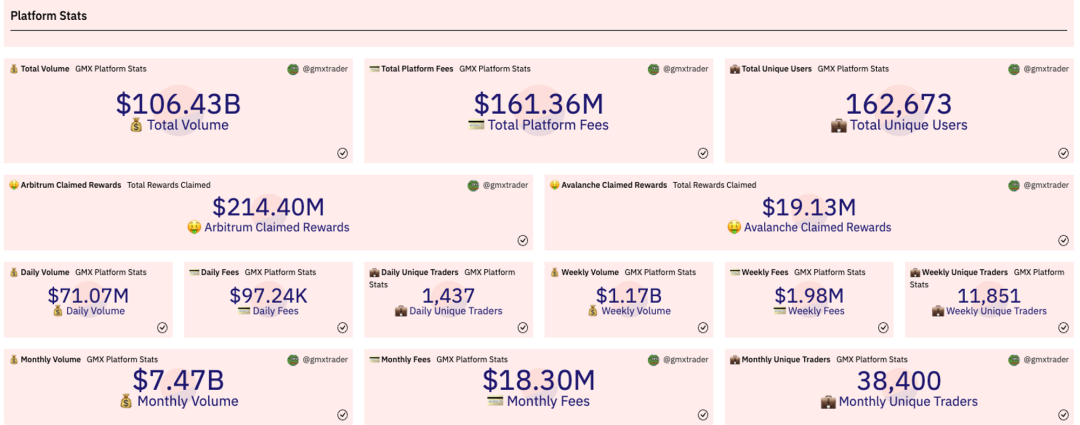

Since the GMX token was listed on Binance in 2022, various data of GMX have hit new highs one after another. Up to now, the total transaction volume of GMX platform has exceeded 100 billion U.S. dollars, AUM has exceeded 1 billion U.S. dollars, independent addresses have exceeded 160,000, and the cost of distribution to users has exceeded 100 million U.S. dollars.

GMX

In the nearly one and a half years since its official launch, GMX has been operating under voices of doubt, but under the narrative of Real Yield yield, GLP's "gambling" model has gradually been accepted by people.

Up to now, there are nearly 20 GMX fork protocols that have been launched according to Defillama statistics, distributed on different chains. Below we will select seven representative projects for inventory.

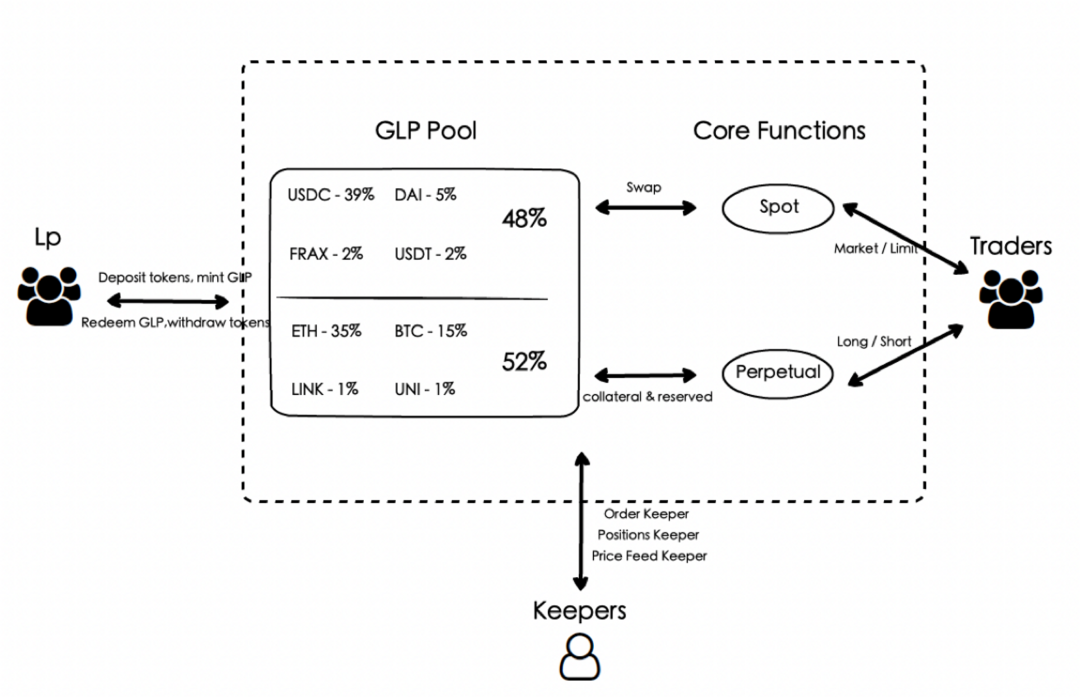

Diagram of GMX Mechanism

forks of GMX

1. Mummy Finance

Mummy Finance is a fork of GMX supported by the Fantom Foundation. In terms of mechanism, Mummy Finance added the use of NFT to issue esMMY in the distribution of cold start tokens and gave NFT holders 80% of the national treasury FTM dividend. Reduce the proportion of MLP from 70% to 60% in fee allocation, of which 5% is allocated to the development team, and 5% is used to repurchase and add Equalizer (Solidly fork) MMY- FTM LP. In addition, except that there is FTM in the MLP as a package of assets, the rest of the mechanism is the same as GMX .

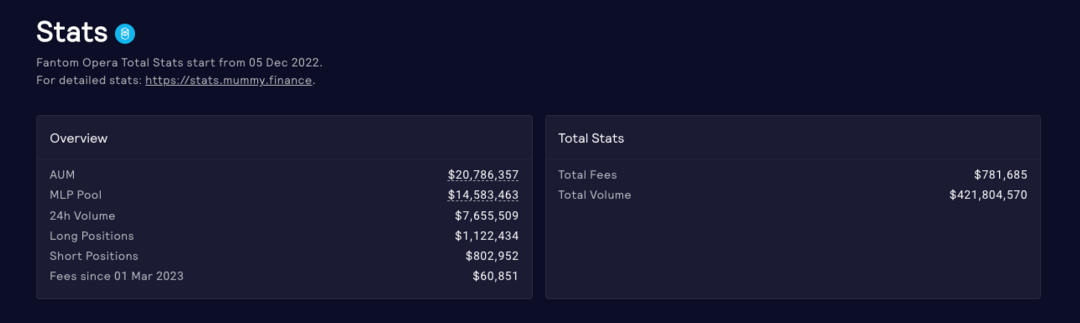

As of now (the data are all on March 5th), Mummy finance's platform transaction volume has exceeded 400 million US dollars, MLP has a TVL of nearly 15 million US dollars, and generated about 780,000 US dollars in fees. The data is not impressive.

https://app.mummy.finance/#/dashboard

2. Vela Exchange

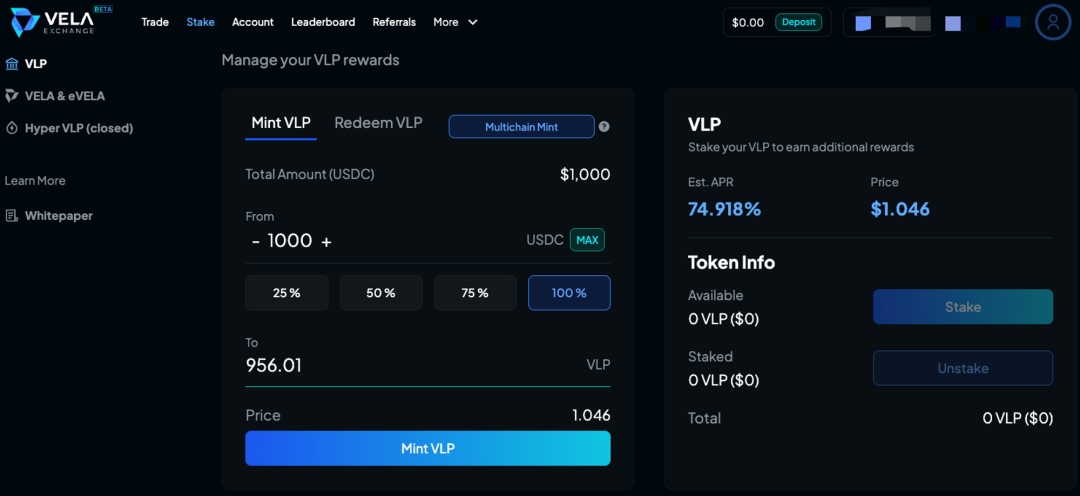

The predecessor of Vela Exchange is Dexpool, an OTC market. Strictly speaking, Vela is not exactly a GMX fork, it also incorporates the Gains Network mechanism. Vela imitates Gains' gDAI, uses USDC to mint VLP and can further mortgage to obtain eVELA. Vela allows users to trade multiple types of assets, and supports users to manage more functions of positions, such as multiple take-profits for current positions, changing the amount of collateral in positions at any time, increasing the leverage of open positions at any time, and so on.

Different from GMX, Vela's asset price feed is relatively decentralized. Only some contract addresses have administrator status, which relatively reduces the risk of doing evil, and the price will fluctuate by more than 0.1% every minute or when the price fluctuates by more than 0.1% (forex is 0.02%) is refreshed. Vela also adds the real-time funding rate that GMX does not have, which is calculated in real time after the user opens a position and is automatically deducted from the position.

Since there are no volatile assets, VLP holders only lose money when traders make money. 50% of the protocol fee is allocated to VLP holders in USDC, 10% to VLP stakers in eVELA, 5% to VELA stakers in USDC, 10% to VELA stakers in eVELA, and the remaining 25% % is owned by the project.

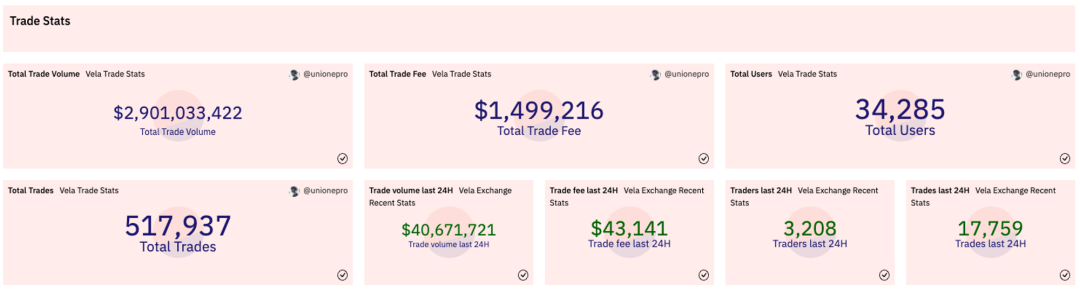

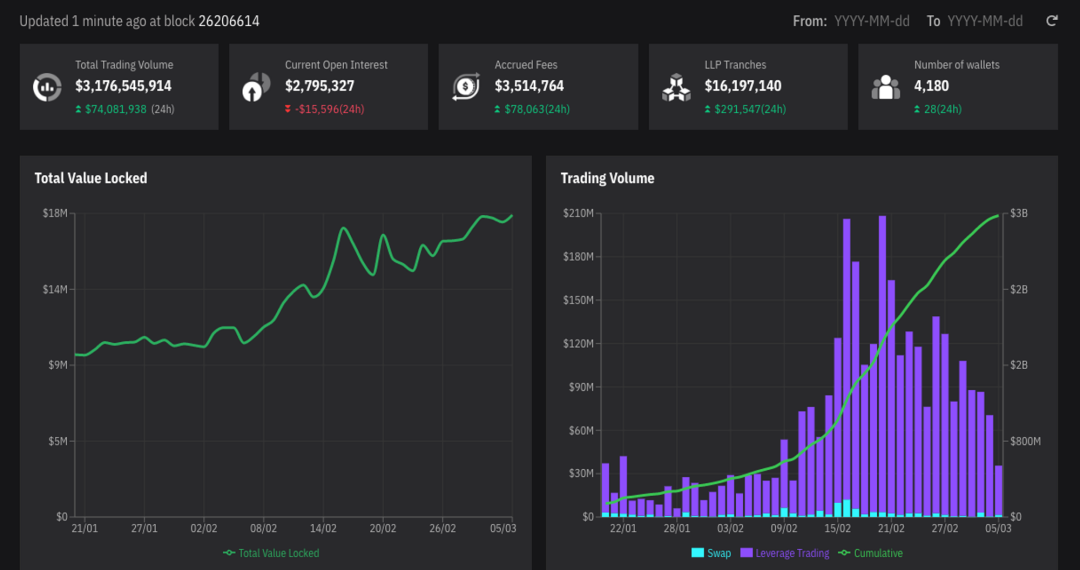

As of now, Vela, which has VC support, has a transaction volume of nearly 3 billion US dollars in just a few weeks of going online, generating only 1.5 million US dollars in transaction fees. In line with the recent transaction incentives, Vela data still shows a clear upward trend.

https://dune.com/unionepro/vela-exchange-stats

3. Mycelium

Mycelium is a protocol backed by former BitMEX founder Arthur Hayes, which was merged by TracerDAO. Its GMX fork product is called Perpetual swap. Among them, the economic model of MLP is almost the same as that of GLP, the transaction fee of non- Stablecoin assets is 0.4%, and that of Stablecoin assets is 0.03%. MYC staking rewards come from a 10% platform fee with a 14-day withdrawal time. For esMYC, which is partially rewarded by LP, there is no multiplier reward for reinvestment; and the cycle of linear redemption is shortened, compared to GMX , it becomes 6 months.

In addition, the biggest difference from GMX is that Mycelium claims to have a wider range of tradable varieties, involving foreign exchange, commodity futures, etc., but currently only supports WTI crude oil futures except for BTC and ETH . As of now, the TVL of Perpetual swap is only about 6 million US dollars, but the total transaction volume has reached 1.7 billion US dollars, resulting in more than 1.6 million US dollars in protocol fees.

https://swaps.mycelium.xyz/dashboard

4. MUX Protocol

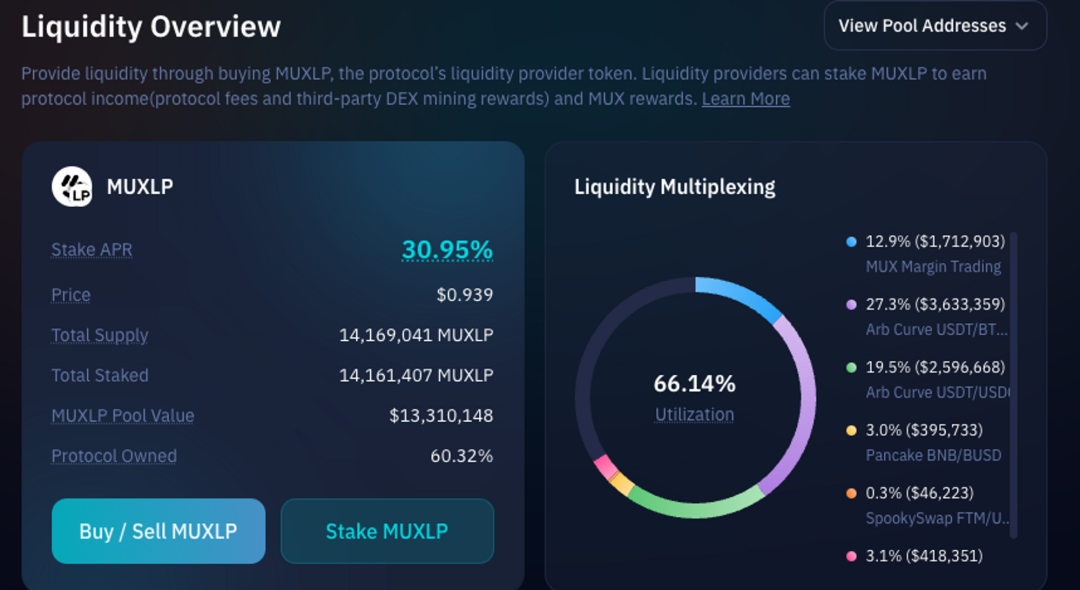

The predecessor of MUX is MCDEX. In the process of completely transforming to GMX fork, the team made a very impressive change in its V2 version, that is, to be a Perp aggregator and build its own Liquidity routing. It allows users to open positions with one click and reasonably allocate leveraged positions to different Derivatives agreements. In the process of aggregating transactions, because the difference in the maximum leverage supported by different platforms is different from the liquidation threshold, MUX provides users with additional margins to protect users from losses.

In addition, MUX also aggregates users' Stablecoin and volatile assets, uses a part of it for the Liquidity of the Derivatives , and puts the rest in other interest-earning agreements to earn extra income for users. In the future V3 version, MUX will also support the function of Cross-chain aggregation, Liquidity of Derivatives among Arbitrum, Optimism, BNB Chain, Avalanche and Fantom.

Up to now, the transaction volume of the MUX protocol has shown a healthier and more stable growth trend than other fork protocols. The transaction volume in 7 days exceeded 60 million US dollars, and the number of independent addresses also exceeded 10,000.

https://stats.mux.network/public/dashboard/13f401da-31b4-4d35-8529-bb62ca408de8

5. Level Finance

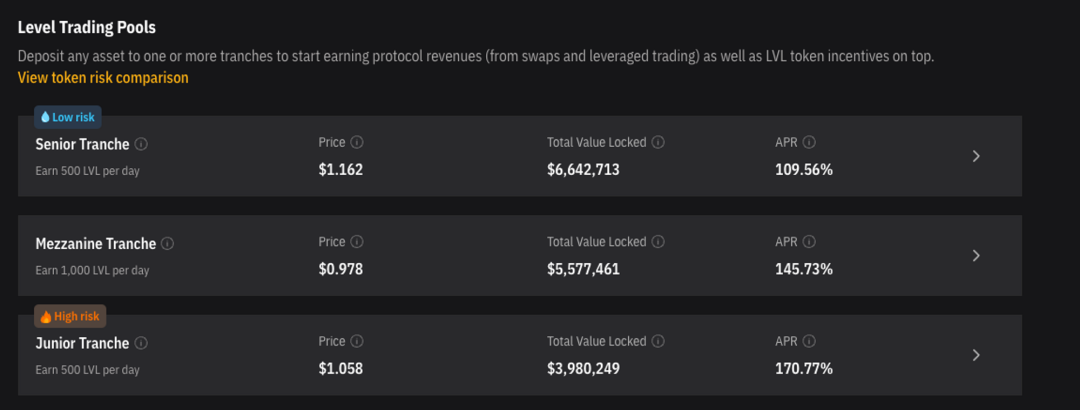

Level Finance on BNBChain is also a very distinctive GMX fork protocol. Level uses the idea of grading funds to give different incentives and income distribution to different proportions of a package of assets, and provides users with a variety of matching ETF options .

https://app.level.finance/

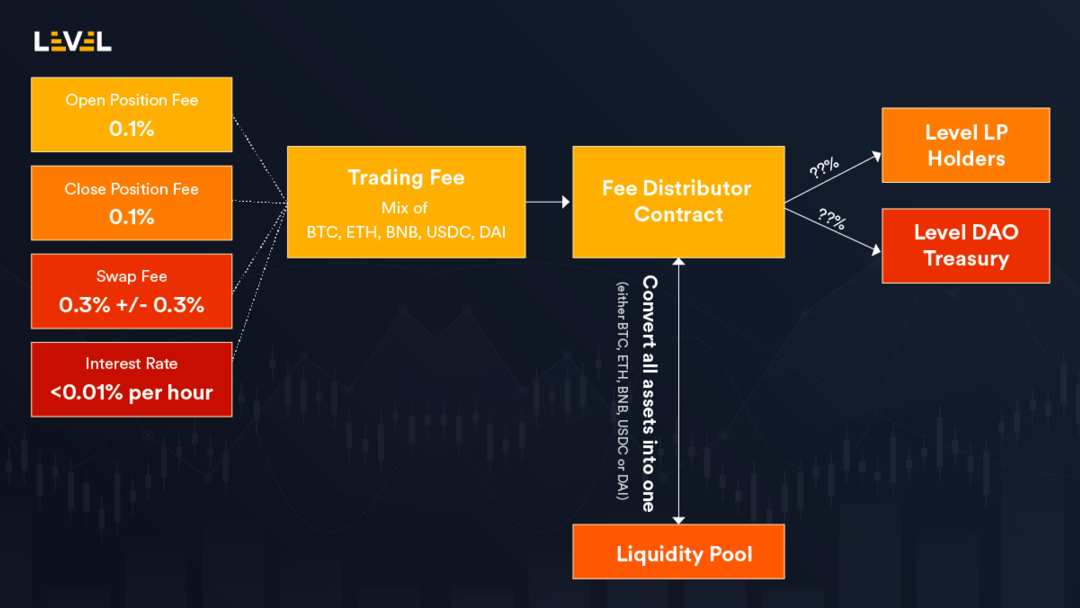

It is worth noting that Level adopts a dual-token model, LVL is used as an incentive token to subsidize all Tranche, and LGO, as a pure governance token, participates in the redistribution of 50% of the protocol fee (the other 50% is distributed to all Tranche through lyLVL). In addition, Level's basic non- Stablecoin assets have a transaction fee of 0.2%, and Stablecoin assets are 0.01%, with a dynamic range of 0 - 0.6%.

https://app.level.finance/

Up to now, traders have contributed more than 3 billion transactions to Level finance. Although the data is not as explosive as Vela, it has been running stably for nearly two months, but its dual-token game design has yet to be tested.

https://app.level.finance/analytics/overview

6. El Dorado Exchange

On BNBChain, in addition to Level finance, there is also a micro-innovative GMX fork — El Dorado Exchange. El Dorado has added the Stablecoin EUSD backed by protocol fees to the concept of Level grading, with 60% allocated to ELP and 40% allocated to gEDE holders.

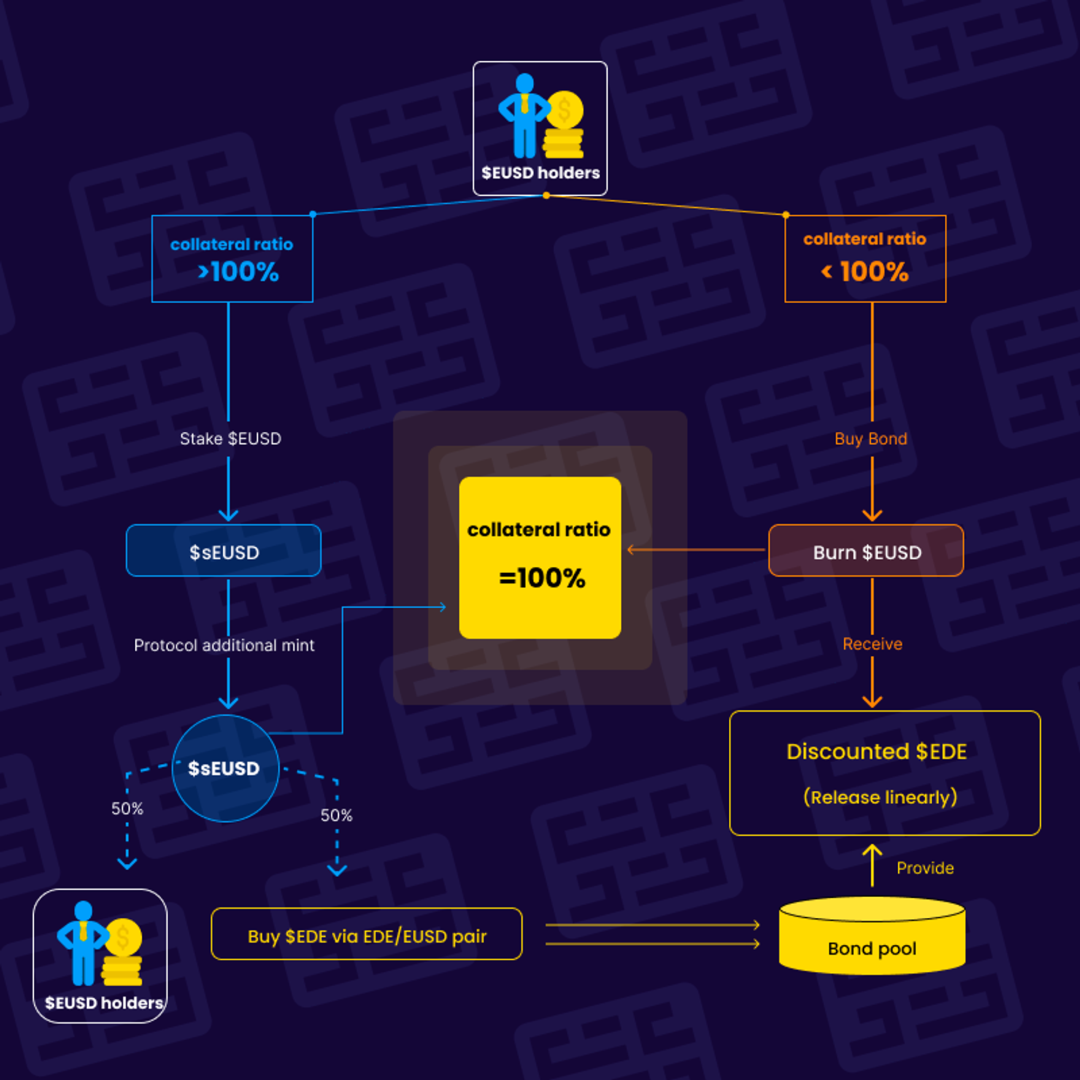

Since EUSD needs to maintain anchoring, there is also a Stake & Bond mechanism to maintain anchoring when the value of the collateral fluctuates:

- When the price rises and the mortgage rate is greater than 100%, the Stake mechanism is enabled, and users pledge EUSD to get interest rewards, the total amount of EUSD increases, and the mortgage rate returns to 100%;

- When the price drops and the mortgage rate is lower than 100%, the Bond mechanism starts, and users sell EUSD to the agreement to obtain discounted EDE tokens. The agreement destroys the EUSD sold by users and gradually brings the mortgage rate back to 100%.

https://docs.ede.finance/tokenomics/usdeusd

In terms of data, El Dorado's data is overwhelmed due to being too homogeneous with Level. El Dorado is already experimenting with Multichain operation and will soon be extended to Arbitrum.

In addition to the above-mentioned protocols, Polygon are Forks that are basically homogeneous with GMX , such as Metavault (Polygon), Madmex (Polygon), Tethys Perpetual (Metis), Lif3 Trade (Fantom), OPX (Optimism), etc., running on their respective ecology. It can be seen that the vast majority of GMX forks are community projects. The "gambling" model between GLP and traders has been recognized by the community, accompanied by high LP incentives. Does such a number of forks remind you of Uniswap V2 in Defi summer? What about the fork wave?

Today's GMX still has many flaws: centralized oracle machine price feeding, no bilateral funding rate, GLP open position limit, possible stampede of unilateral decline in bear market, also happened on Avalanche due to The price of the AVAX depth difference oracle was manipulated, causing GLP to suffer losses. In the past 20 years, UNI V2 has also been criticized: LP can only rely on the agreement to distribute coins to compensate for huge Impermanent Loss, there is not enough moat (Sushiswap Vampire Attack), and the utilization rate of funds is low.

It is foreseeable that the deficiencies of the above mechanism of GMX will soon be iterated by the synthetic asset version of X4 or more flexible innovations will be made by the new protocol. Right now, there are several capital-backed and still under-the-radar protocols worth tracking:

- Lighter, a Derivatives protocol supported by a16z, the mechanism is unknown.

- Vest Exchange, a GMX like fork backed by Jane Street.

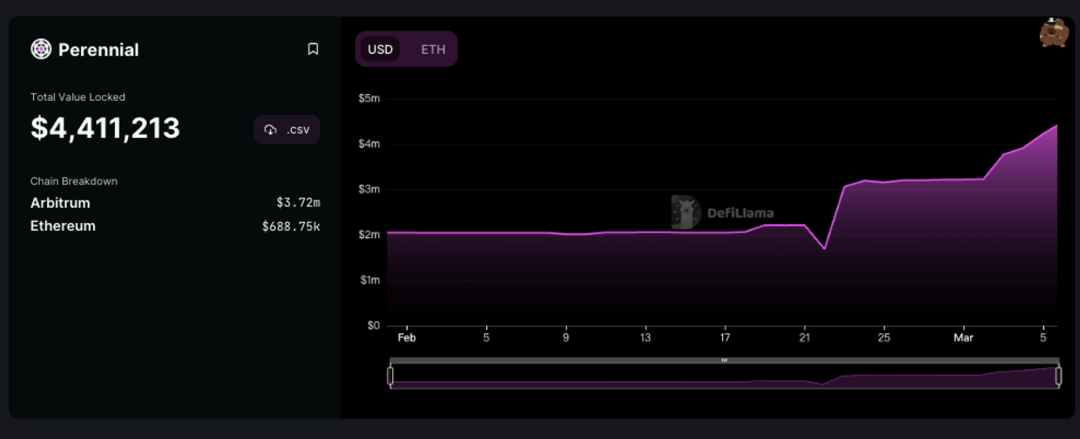

- Perennial Labs, the AMM Derivatives supported by synthetic assets, many mechanisms are very similar to the X4 version of GMX , but the bottom layer is Opyn.

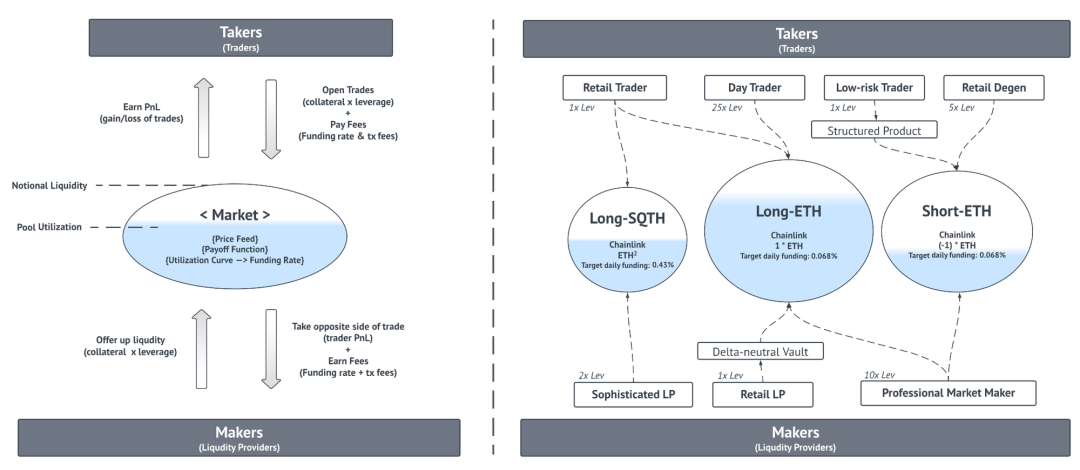

There is nothing to look forward to more than Perennial. Specifically, Perennial provides a permissionless tool for establishing a Derivatives, rather than simply providing a trading market. It sets up a set of trading rules for Derivatives and allows anyone to set the key parameters to build their own market.

https://perennial.finance/

Through the peer-to-pool trading model, Perennial allows each public market to include three roles: market builder, Liquidity Provider, and trader. The document shows that the current Long-SQTH pool is operated by Opyn's multi-signature address. The other two markets: Ethereum's long and short markets, are managed by Perennial multi-signature addresses.

First of all, as a market builder, only a part of the Derivatives fee will be collected as income, and will not be required to provide Liquidity. For market builders, the parameters that need to be set include utilization rate curve, fee structure, leverage and maximum Liquidity. Among them, the fee structure (opening and closing positions) and the maximum Liquidity are relatively easy to understand, and the key is the two parameters of utilization rate curve and leverage.

Utilization rate curve, which is the functional relationship between market utilization rate and funding rate. Perennial said that this parameter refers to the relationship between AAVE and Compound on the loan utilization rate and interest rate. In Perennial, traders need to pay Liquidity Provider a funding fee, and the level of the fee depends on the capital utilization rate (that is, the trader opens The nominal value of the warehouse and the ratio of the nominal value of the Liquidity provider to open the warehouse), the higher the utilization rate, the higher the capital cost, but maintain a low growth rate before 80%, after reaching 80%, in order to balance the Liquidity on both sides of the market , capital costs will rise significantly, and the market is only PvP by both long and short sides, all designs coincide with the concept of GMX X4.

https://perennial.finance/

Currently, Perennial is still in its infancy, and if the GMX X4 comes out, the two will become direct competitors.

In general, GMX was not fully accepted by the community until one and a half years after its launch, and the entire "value" discovery process is very similar to the emergence of Uniswap. Perhaps at some point, it is not that a certain track cannot be run, but that the time has not yet come.

references

https://app.mummy.finance/#/dashboard

https://www.vela.exchange/

https://swaps.mycelium.xyz/dashboard

https://mux.network/

https://app.level.finance/

https://app.ede.finance/#/

https://perennial.finance/

disclaimer

The information in this research report comes from publicly disclosed information, and the opinions in this article are for research purposes only and do not represent any investment opinions. The opinions and forecasts issued in the report are only the analysis and judgment of the date of issuance, and do not have permanent validity.