Deflationary models provide price support

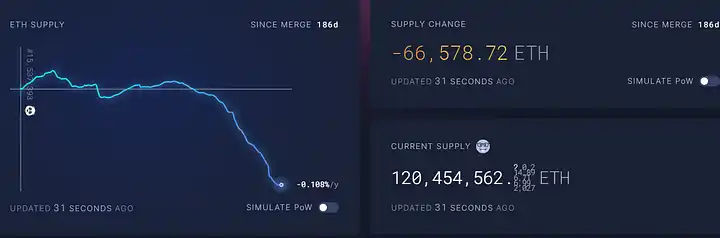

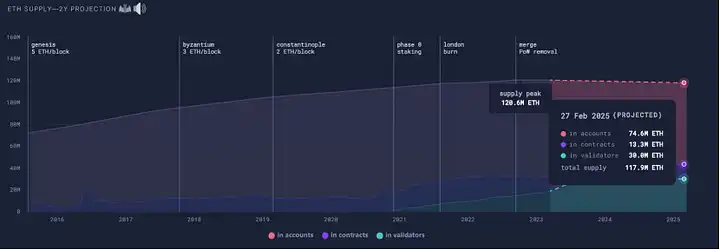

Since the merger, the total supply of ETH has decreased by more than 66,000 tokens, and the current supply is 120.4 million tokens, with an annual inflation rate of -0.109%.

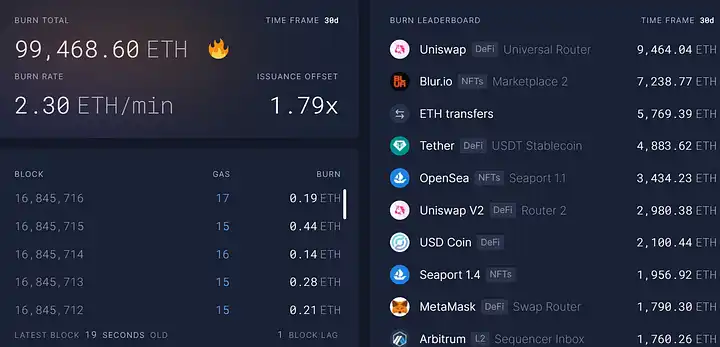

Applications that have contributed the most to ETH burns recently include Uniswap, Tether, and the recently hyped Blur Airdrop and Arbitrum, triggering a surge in activity on the Ethereum network.

At the current pace, the ETH supply is expected to drop to 118.1 million by 2025. Overall, as long as the Ethereum network maintains its dominant position in the Defi and NFT ecosystems, the deflationary economic model of Ethereum will continue to provide strong support for ETH prices.

Testnet Preview "Shanghai Upgrade"

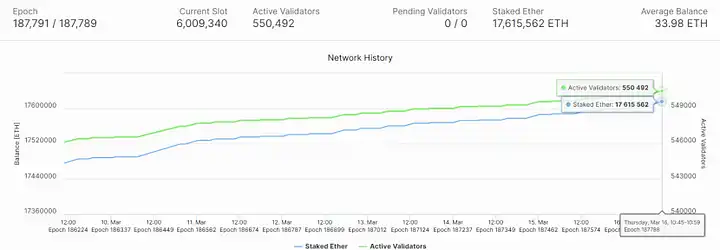

At present, about 17.61 million ETH have participated in the Ethereum PoS pledge (accounting for 14.67% of the current total ETH circulation), and there are more than 550,000 active verifiers.

In order for the "Shanghai upgrade" to be completed smoothly, the Goerli testnet, which has the most validators and most closely mimics the Ethereum blockchain, simulated the "Shanghai upgrade" so that developers can patch potential vulnerabilities before deploying the upgrade . According to multiple ethereum core developers, some validators running older versions of the client were causing brief delays. However, these validators joined quickly, allowing the testnet to successfully perform the upgrade.

According to the latest news disclosed by Ethereum core developers, the Ethereum network will complete the "Shanghai upgrade" on April 12. At that time, the Ethereum network will upgrade the consensus layer of the beacon chain through Capella and introduce functions related to the verification extractor , allowing stakers to withdraw locked ETH.

In order to make the "Shanghai Upgrade" go smoothly, the Ethereum Foundation has introduced a mechanism that can prevent a large amount of ETH supply from flooding the market in a short period of time: this is related to the current mortgage scale, and the daily allowed withdrawal amount is about 57,600 ETH, accounting for only 57,600 ETH. The total amount of ETH pledged is about 0.3~0.4%, so the selling pressure caused by the withdrawn ETH in a short period of time is relatively predictable. After a validator opts out of staking, they enter a withdrawal period that can last weeks or months.

However, it should be noted that the interest of the consensus layer of Ethereum for the two years of the new year does not need to follow the upper limit of 57,600, which brings another layer of implied selling pressure.

Data on the chain is biased Bullish

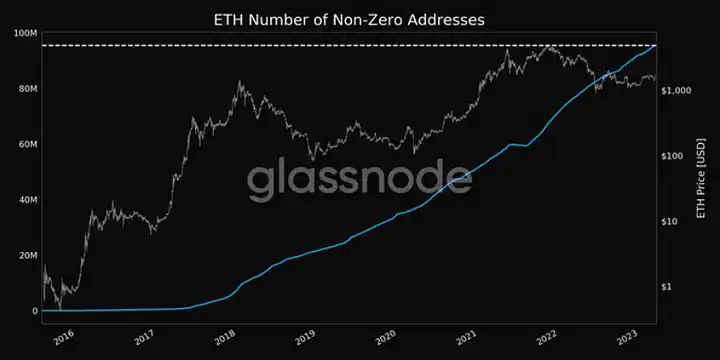

Glassnode data shows that on March 14, the number of Ethereum non-zero addresses reached a historical peak of 95,474,490, which indicates that the fundamentals of the Ethereum network are good and users continue to expand.

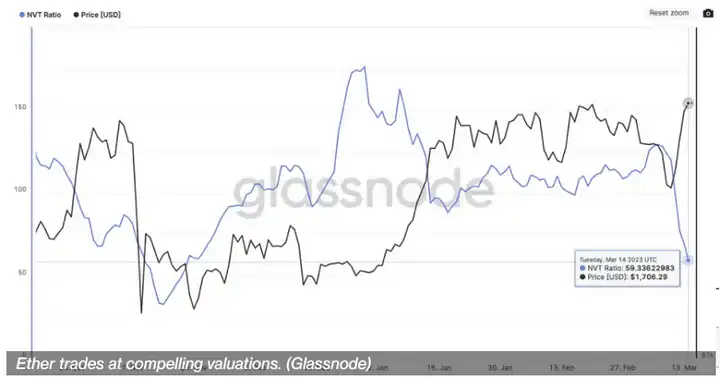

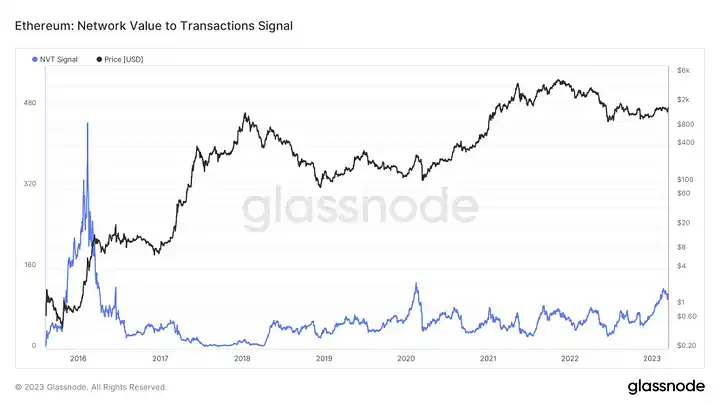

On March 14, the seven-day average of Ethereum’s network-to-value ratio (NVT) fell to 59.3, the lowest value since November 19 last year. NVT is similar to the price/earnings (P/E) ratio widely used in the stock market.

The decrease in NVT value means that the current market capitalization does not fully reflect the growth of network value. That is, relatively speaking, the value processed through the network is higher compared to the market value. Therefore, a lower NVT ratio usually means better value for money investing in Ethereum.

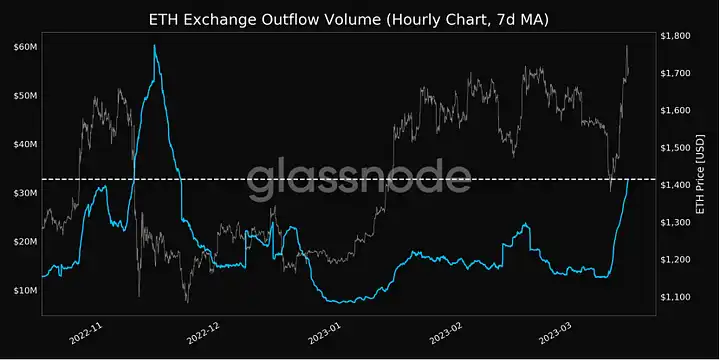

According to Santiment data, since March 9, whale addresses holding 1,000–10,000 ETH have added a total of 400,000 ETH, or about $600 million.

According to Glassnode data, recently, the outflow of ETH on the trading platform (7-day average value) hit the highest value in three months (32,742,895), which coincides with the time node of the above-mentioned increase in holdings of large investors.

On the other hand, on March 15, the NVT (Network Value/Transaction) value was 98.45, according to GlassNode. The data reflects the 90-day moving average trend of daily trading volumes, not daily valuations. The NVT signal has risen significantly compared to recent values, the last time it was at this level was in February 2020. In other words, ETH market capitalization growth has outpaced its on-chain transaction volume growth, so short-term prices appear to be showing signs of a premium.

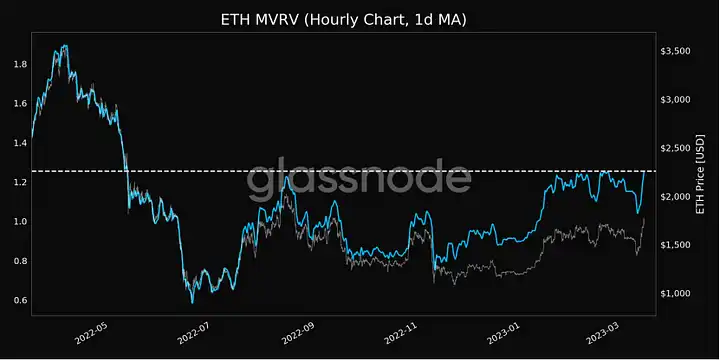

The rise in the Ethereum MVRV ratio indicates that most addresses holding Ethereum are starting to be profitable. If the MVRV ratio continues to rise, then the selling pressure on these profitable addresses may continue to increase.

Recent developments in pledge supervision and pledge service providers

In terms of regulation, there has been a new discussion recently on whether ETH is a security. Previously, the SEC’s main argument for classifying ETH as a security was that ETH raised funds through ICO in the early stage. The SEC believed that investors bought ETH in anticipation of obtaining benefits, which was consistent with the content of the Howey test, and the switch to PoS mechanism greatly changed With the additional issuance of Ethereum, ETH holders can profit by staking.

Unlike the SEC's tendency to judge ETH as a security, CFTC Chairman Rostin Behnam expressed the opposite attitude. He believes that ETH is a commodity because it has been listed by the CFTC trading platform for a long time, and the CTFC has oversight of its derivatives. and underlying market power.

If digital assets such as ETH and Stablecoin are classified as securities, it will mean more restrictions, such as forcing regulated securities to comply with the relevant reporting and registration standards provided by the Securities Act of 1934, which will hinder the industry. innovation. On the other hand, if ETH is classified as a commodity, it means fewer restrictions and growth potential.

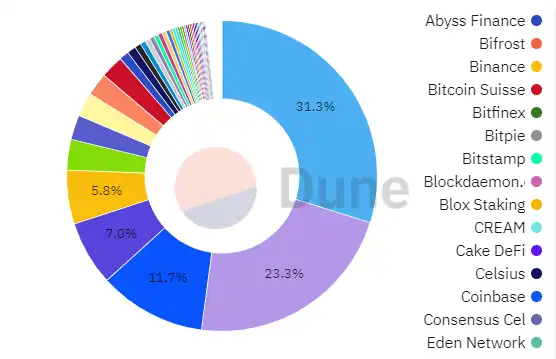

In terms of pledge service providers, the Lido Finance protocol, which controls about one-third of the total ETH pledges, is striving to become more decentralized. Lido expects to complete all audits related to the chain code by the end of April, plus an additional two weeks of security buffer, the current expectation is that ETH Mainnet withdrawals can be performed around mid-May.

Rocketpool is also preparing for an upgrade that will lower the minimum validator node deployment threshold of 16 ETH to 8 ETH. Rocketpool is also exploring other upgrades to further lower the staking threshold for institutional users.

Another major ETH staking service provider, Coinbase, stated that it will start accepting requests to withdraw pledged ETH within 24 hours of the completion of the "Shanghai Upgrade". However, this does not mean that users will be able to withdraw their ETH immediately, because "the process of withdrawing pledges is controlled by the Ethereum protocol, and as a service provider, Coinbase cannot give an exact withdrawal waiting time." Once the staking withdrawal is processed and released on FangChain, Coinbase will immediately confirm that the user has received their staked ETH(including staking rewards).

In addition, Ebunker, a Non-custodial ETH staking service provider, stated that the "Shanghai upgrade" is actually the last step in Ethereum's transformation from PoW to PoS. After the Shanghai upgrade is completed, Ethereum's expansion plans, such as EIP-4844, will be better advanced.

Judging from the data on the Ethereum chain, the withdrawal mechanism formulated by the Ethereum Foundation, and the coping strategies of major ETH pledge service providers, the withdrawal of ETH pledge will be a process that lasts for several weeks or even months. The upgrade” will be completed relatively smoothly, and in the long run, ETH staking will become an important “faucet” for crypto long-termists to pursue stable profits.