L2 Summer is in full swing!

How do we start? Participating in crypto's most anticipated airdrop, of course: ARB.

True believers have predicted this day; pessimists say it will never come!

The dynamics between Ethereum’s two most popular layer 2 rollup solutions are fundamentally changing. Last week’s ARB announcement also shed light on how the Arbitrum team intends to scale the Arbitrum network, and the future of Ethereum.

Arbitrum will allow permissionless creation of L3 chains - rollups settle to Arbitrum - while requiring DAO approval to use Arbitrum IP to create L2. This is in stark contrast to the OP Stack "hyperchain" vision, a model of open-source Optimism code for permissionless creation of L2s using a shared set of orderers.

Today, we're exploring the current competitive landscape between Arbitrum and Optimism, considering how ARBs are changing the current paradigm, and comparing their different approaches to achieving scale.

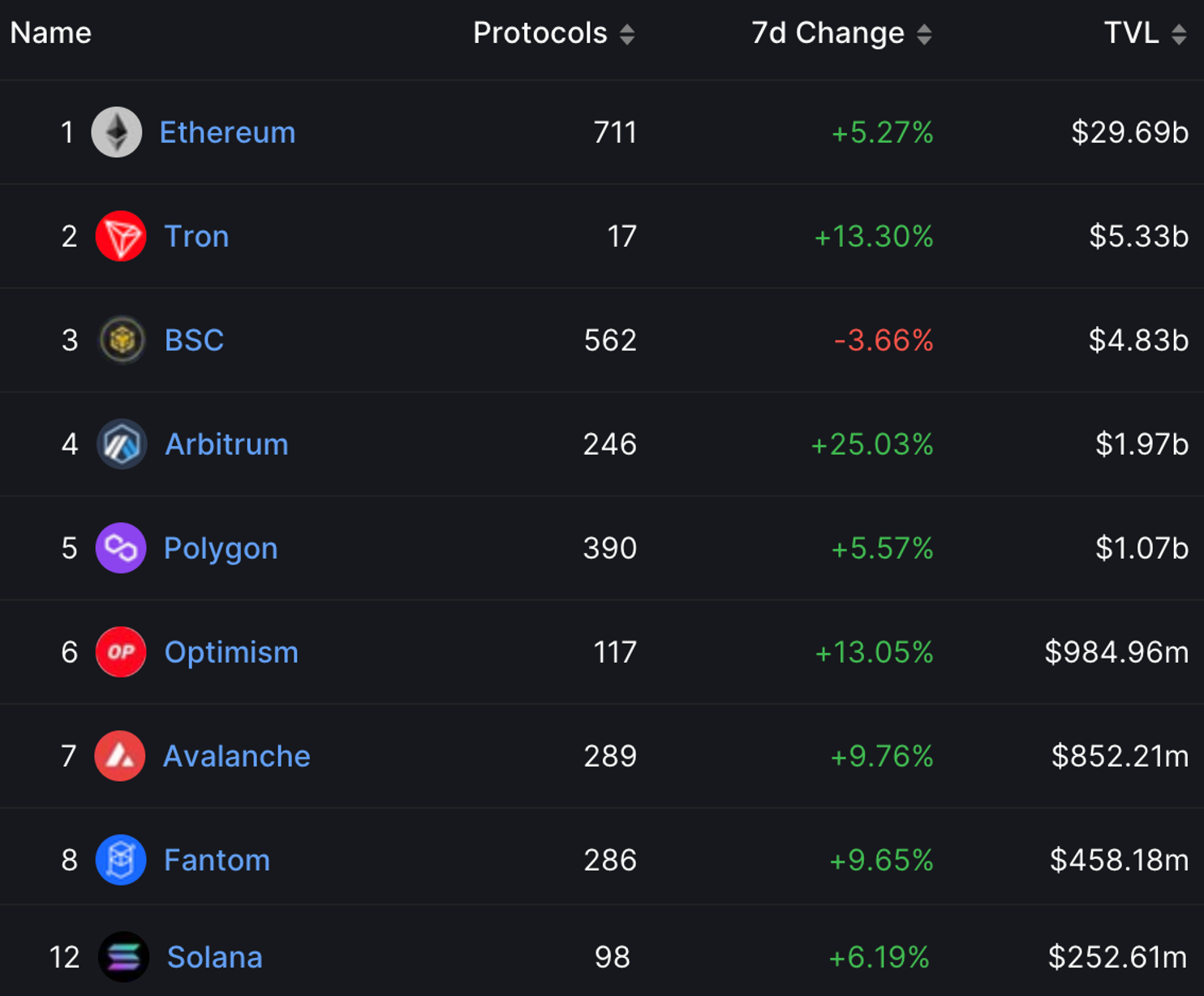

Arbitrum and Optimism are not just Ethereum heavyweights. They are one of TVL's largest encrypted chains.

Arbitrum and Optimism are fourth and sixth respectively, surpassing many of the most popular L1s in the bull market in terms of TVL, including Avalanche, Fantom, and sonala.

vision

While other projects have seen their TVL increase as the broader crypto market booms, Arbitrum's 25% TVL increase over the past seven days is notable. Liquidity is flowing to the chain in anticipation of ARB drop.

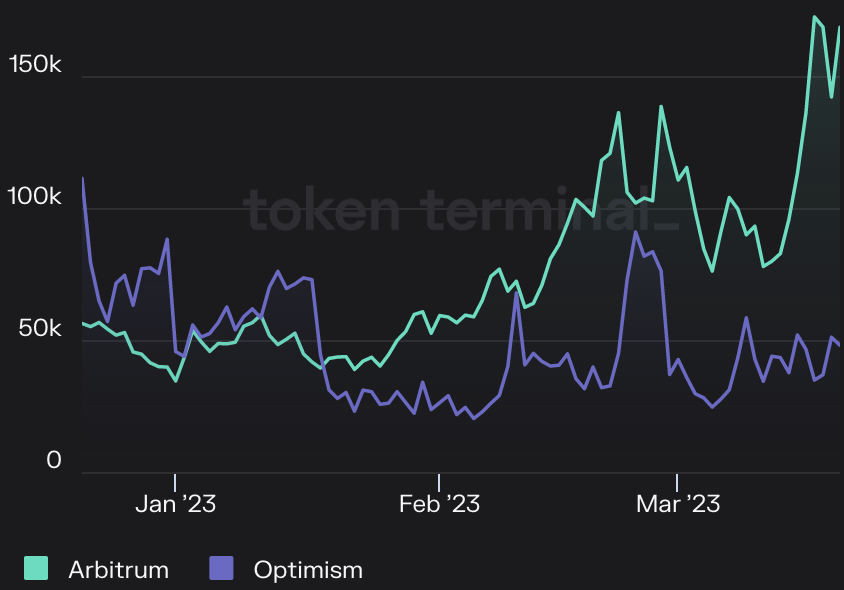

But it’s not just a shift in liquidity, we’ve also seen a massive increase in Arbitrum’s daily user count, hitting an all-time high of 172.4k active addresses on March 17th. Arbitrum's DeFi core combined with March's wild price action was the factor behind rollup's dominance for the month, with 188% more average daily active users than Optimism.

We all remember the transactions on Arbitrum that flipped Ethereum L1 in late February. Far from being a one-off event, the Arbitrum transaction upended Ethereum again on March 16, and it has held steady around the 1 million mark ever since.

OP is clearly lagging behind, having fallen well below its all-time high of 800,000 transactions in January. The network was unable to break past 300,000 daily transactions in March.

token prankThe BLUR airdrop is huge.

Arbitrum will reduce 12.75% of the total ARB supply to early users and the 137 DAOs that have Arbitrum.

Many Twitter big Vs issued predictions, including: "We will soon see the transaction price of $ARB from $0.30 to an amazing $10" and so on! While these rather outlandish early predictions sound good, a more reasonable (and quantitatively based) valuation framework sees the coin likely trading at or near the $1 to $2 range, which is exactly what the $ARB A position that appears to have stabilized after an early choppy trade.

Even assuming a conservative $1 forecast as the base case, over $1 billion in value has been injected into the Arbitrum ecosystem.

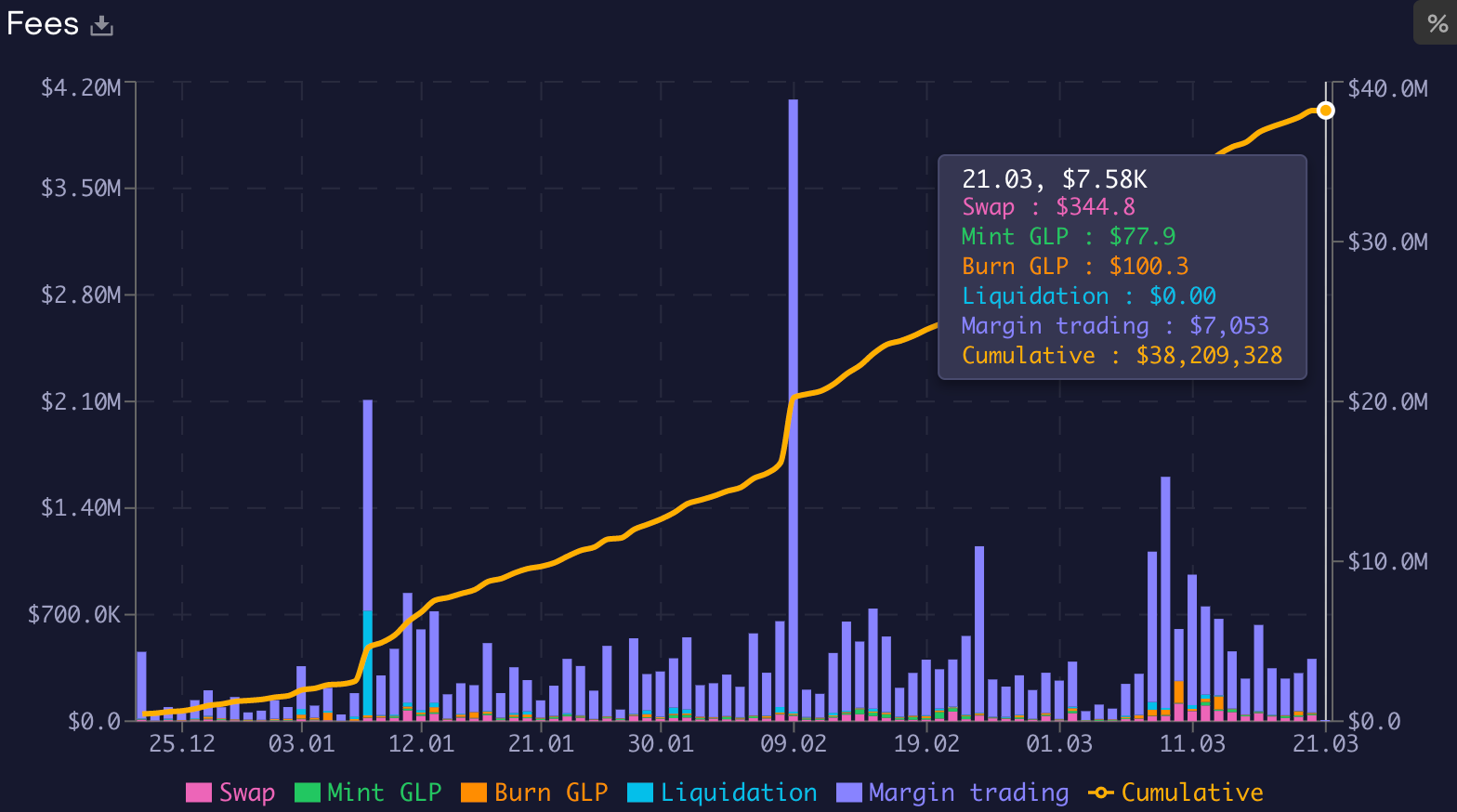

Projects on Optimism have long been rewarding their users with OP tokens thanks to allocations from the Chain Ecosystem Fund. Arbitrum has finally unlocked the ability to provide similar incentives for its protocol. While Arbitrum GMX's dominance has dropped to 25% of Arbitrum TVL, the developer-favorite platform continues to rake in the cash, taking in less than $40 million in fees over the past three months.

Yield farms on Arbitrum outside of GMX continue to provide good harvests, while shitcoins have been generating yield, including Camelot. The emergence of the GambleFi scene on Arbitrum seems promising to provide additional revenue opportunities for developers who are tired of speculating on token prices alone.

ARB incentives on top of these yields could inject additional capital and liquidity into the Arbitrum ecosystem, especially as the 137 allocated projects begin announcing the structure of their liquidity incentives and reward programs.

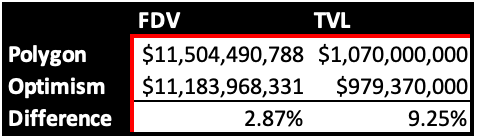

Chains with higher TVL generally require higher FDV. Polygon's MATIC token has a fully diluted value of $11.5B, which is 2.9% higher than Optimism's $11.2B FDV. While the gap between Polygon and Optimism TVL is not perfectly captured in this calculation, it shows a correlation between TVL and Ethereum settlement aggregate valuation.

Between Arbitrum's DAO vaults and Optimism's RetroPGF, ecosystem and future airdrop funds, untapped token incentives are available for both chains to play in a never-ending battle for liquidity.

Liquidity begets liquidity, which in turn begets valuation.

The DAO would benefit from an inflated treasury valuation due to Arbitrum's (assumed) higher valuation, which would have more ammo than Optimism. Efficient use of this treasury should translate into greater spending power, giving the DAO an edge in attracting users and liquidity

Pulled into the orbit of ArbitrumAs mentioned above, Arbitrum's scaling roadmap is fundamentally different from Optimism's.

OP Stack will provide permissionless creation of L2, enabling anyone to build modular chains from a codebase that accepts contributions from Optimism, Coinbase, and other OP Stack developers. Essentially, the OP Stack empowers Optimism competitors. While the future of the OP Stack aims to allow chains to share the ability of the orderer setup to conduct atomic transactions , there is no guarantee that chains will choose this shared security model.

OP has another risk that another application based on their tech stack could always steal liquidity and users directly from the parent chain. There's also little guarantee that the chains will decide to share fee revenue with Optimism.

In contrast, Offchain Labs, the development team behind Arbitrum, delegated the right to create L2 to the Arbitrum DAO while allowing programs to create L3 without permission. Rather than having competitors compete directly with Arbitrum, the DAO has the ability to dictate the terms and even choose to prohibit L2 competitors from forking Arbitrum technology.

Separating IP between permissioned L2 deployments and permissionless L3 deployments seems to give Arbitrum (and L3 developers) the best of both worlds. Developers on Orbit will contribute to the leading L2 codebase while inheriting the compression and programming strengths of Nitro and Stylus .

Unlike OP Stack, Orbit provides ARB token holders with a straightforward value accumulation model: L3 built on Arbitrum must pay fees to the Arbitrum Sequencer. This capture is unique to Arbitrum and is an open source code and novel solution that generates economic benefits.

Forget token empowerment: the latest research in token economics is value accumulation. ARB holders will benefit from a potential, eventually realized fee generator, the deployment of L3 on Arbitrum.

Advantages of ARBs

Advantages of ARBsFor a long time, ARB has not been present in the wallets of cryptocurrency developers.

Competition is the nexus of innovation, and as a consumer, I'm delighted with the huge leaps Arbitrum has made on its roadmap.

Token incentives and future airdrops may prove to be powerful tonics for attracting new users and additional liquidity on-chain. How Optimism and other L2s respond remains to be seen. Arbitrum Orbit is a paradigm shift, showing that it is possible for L2 to align with crypto open source values while embracing internal capitalists and building revenue streams for token holders.

Arbitrum's roadmap is clear: continue to build world-class rollups to attract world-class dApps and L3 (incentivized by deeper liquidity and advanced technology, built on-chain), continue to achieve higher valuations than competitors (due to increased development and user activity combined with higher TVL), and effective use of token incentives and novel airdrop strategies to attract more liquidity! The continuation is the hard part, but with a rock solid development team and a vibrant community, Arbitrum seems to be up to the challenge.

The Arbitrum flywheel has begun. are you ready?

The source of this article is: bankless

https://www.bankless.com/how-arbitrum-beats-optimism

Translated into Chinese by @BTCdayu , "Necessary Tools and Safe URLs in the Currency Circle", please visit dayu.xyz