Note: This article is from @CryptoGirlNova Twitter, and MarsBit organizes it as follows:

1) Do you want to know how to find the next set of 100x gems?

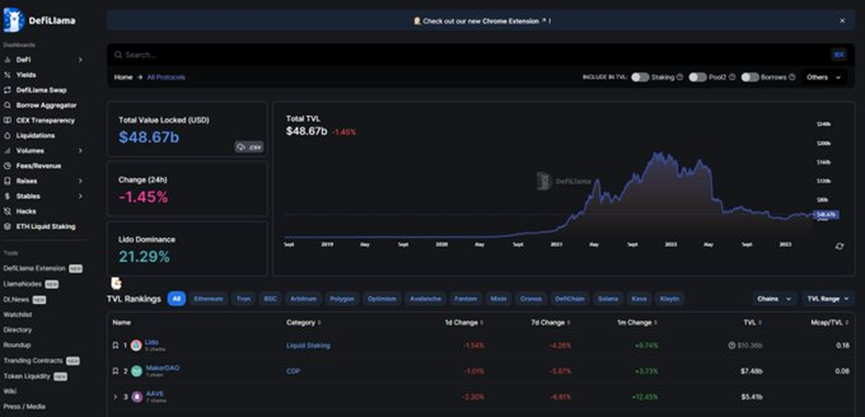

With @DefiLlama you can do all this for free!

Here's a complete step-by-step guide to using what might be called the best tool in the business

(at own risk)

2) It is not an exaggeration that Defillama is probably the best tool in the entire industry.

The amount of Alpha and insights it provides is insane, and any experienced well-informed investor uses it on a daily basis.

I'm here to learn how to navigate this handy tool myself.

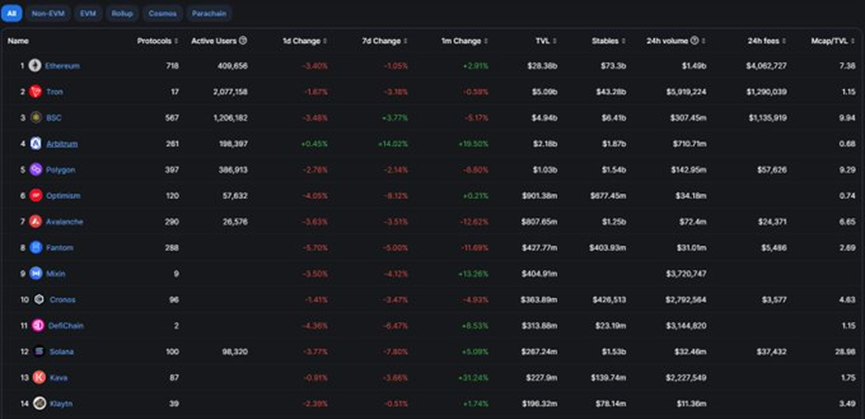

3) Chain growth

There are many features that can be used, but not all of them are required.

Finding your next set of gems starts with choosing the ecosystem of your choice.

Which chain is hot and trending, and see where there are the most opportunities.

Defi Dashboard > Chain

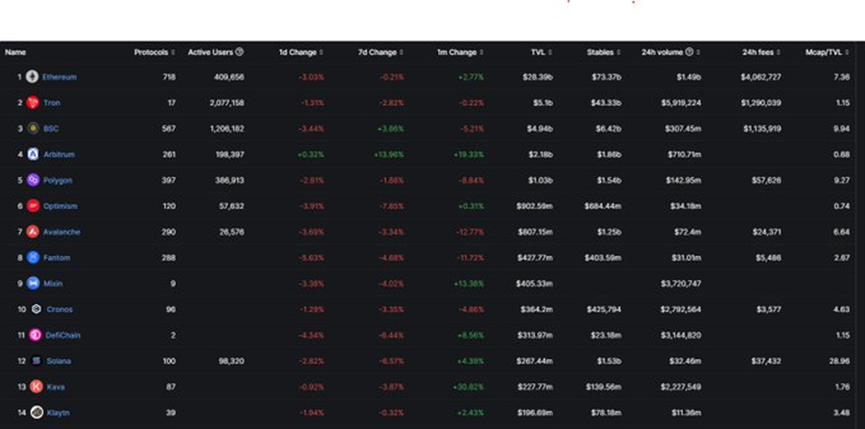

4) #Arbitrum leading the 7-day and monthly changes in a positive way.

While this isn't a surprise, people don't always know there's an opportunity here.

Defillama could have shown you months before $ARB was trending.

5) Also, what's hot and trendy now won't stay that way forever.

If anything changes in the future, you know where to look.

Rotate back and forth in an ecosystem for maximum opportunity.

Well, we know we have to look inside #Arbitrum.

What's next?

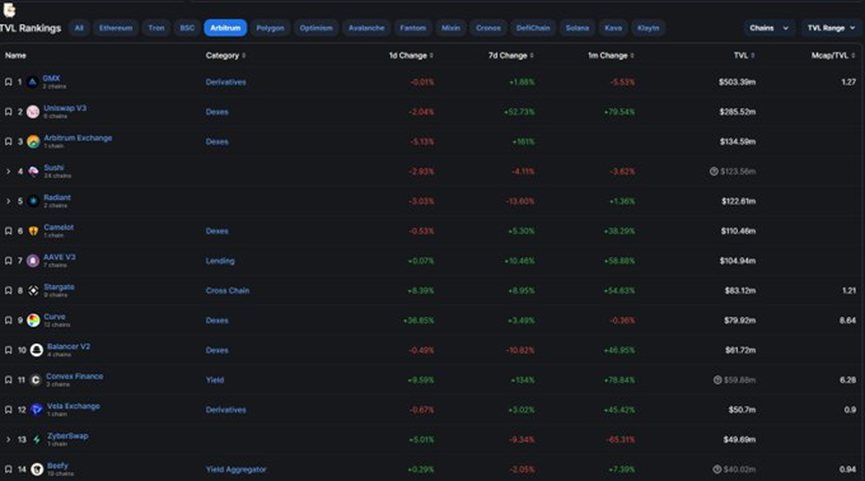

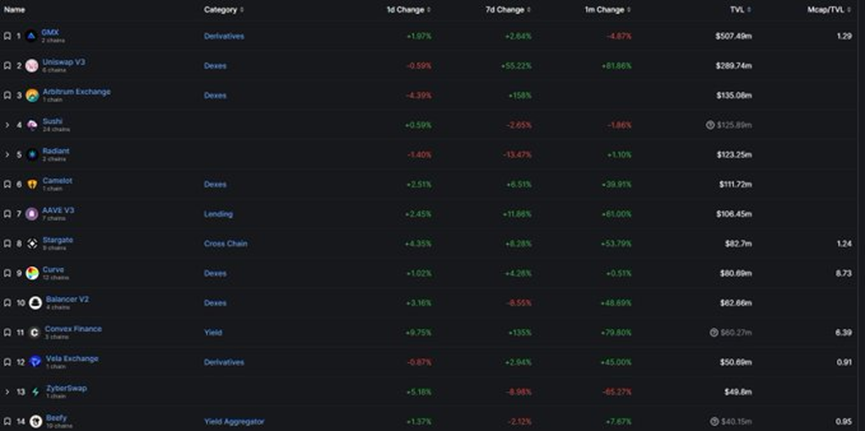

6) Find gems

Just click on #Arbitrum to see the full list of projects deployed here.

Just like before, you want to see positive growth in the TVL numbers, see an uptick in popularity and activity.

Tip: Choose one that is only deployed on one chain.

7) Many leading Dapp are using different chains and will automatically have higher TVL than those deployed on one chain.

You're looking for #Arbitrum native dApps to find potential gems.

Tips: Add the ratio of Mcap/TVL.

8) If the market cap is below TVL, it may be undervalued.

If you see a month of TVL growth like $VELA, and it's below 1 (0.91), that means there may still be gains.

And vice versa, if the Mcap/TVL ratio is really high, then it's probably overvalued.

9) My original intention was to do a comprehensive overview and guide to everything Defillama has to offer.

Not least because its every feature is a game breaker.

I quickly realized that this was going to turn into a huge thread that couldn't be wrapped up in a day.

10) So I'll do it in different parts and focus on each feature at the same time so that each thread doesn't become bloated.

1. Discover gems with growing TVL on defillama today

2. Discover new AirDrop in defillama another day

3. Discover...

Focus on tomorrow!

new star out