For Meta, integrating NFTs into core products may not be worth the candle.

Original: Meta's Botched NFT Plans (Decentralised.co)

By Joel John

Compiled by: Leah, Foresight News

Cover: Photo by Dima Solomin on Unsplash

As I mentioned in the last article, Meta abandoned plans to integrate NFTs into their core products Facebook and Instagram. If the market hadn't been spooked by the crisis in the banking sector, this event would have attracted considerable attention. Like most thunderstorms in bear markets, we don't like to discuss them, but it is necessary to learn from them.

First, it's worth thinking about why Web2 is so important for tools like NFTs. The average person spends a lot of time on platforms like Facebook and Instagram. To understand the impact of these platforms on users, we can first turn our attention to a few years ago, when Instagram "copied" Snapchat by adding a feature. Before then, Snapchat was a place for teens to share their lives, and the pictures they uploaded would only stay on the platform for one day.

After two failed acquisitions of startups, Meta began rolling out Stories features on Instagram and WhatsApp. Consumers (myself included) started using these products to share stories and memes as our social circles started to build on these apps. A few years later, when India banned TikTok, Instagram steadily rolled out Reels, an attempt to replicate TikTok by allowing users to scroll through short videos.

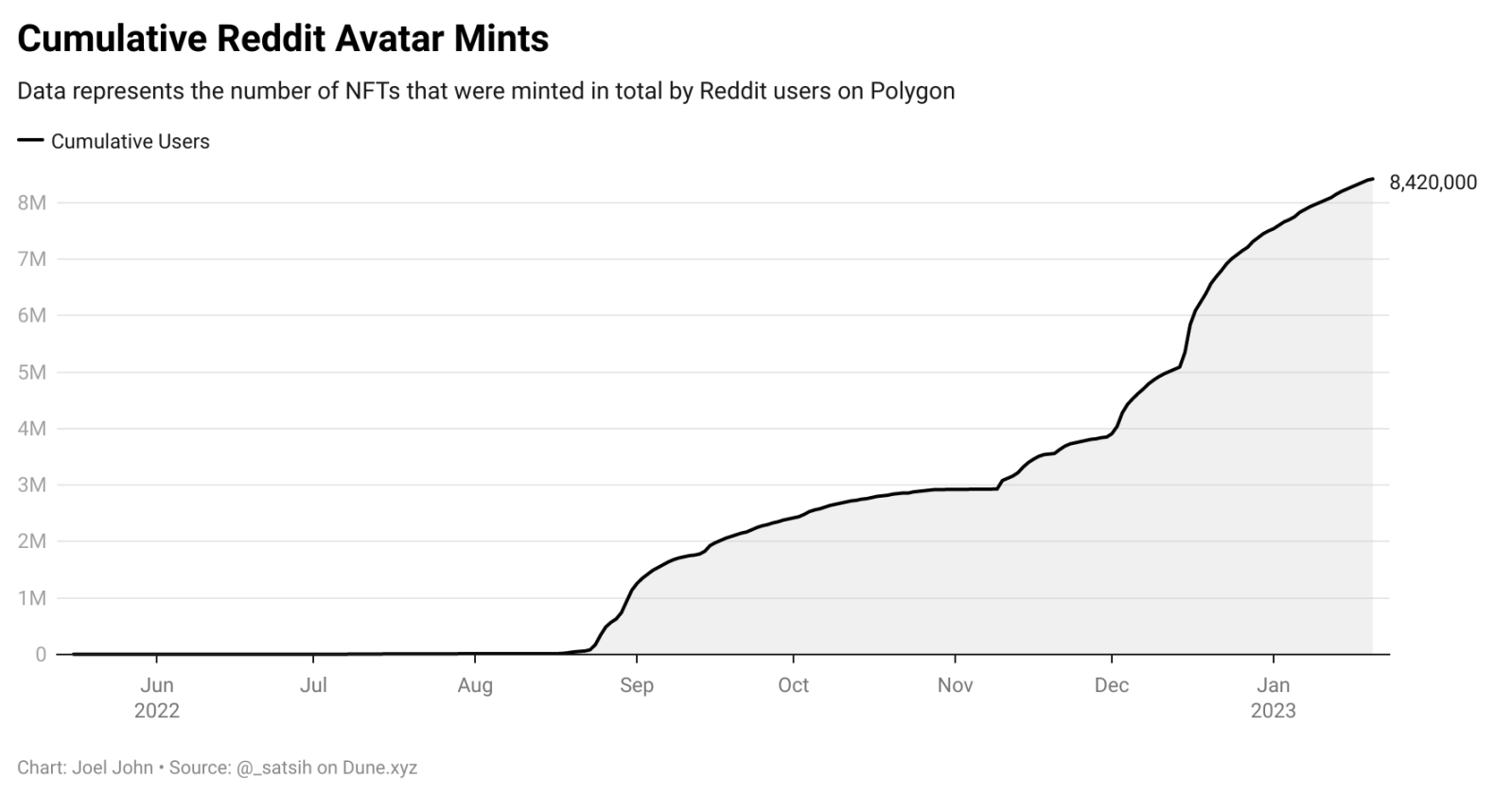

Do you see a trend here? Big platforms can drive user behavior, so allowing users to verify their NFTs on Twitter or link NFTs to their Instagram profiles is a big deal. (We’ll come back to this later.) To get a feel for the scale of the Web2 platform, recall that Reddit’s NFT has been mint over seven million times on the Polygon network. Web3 products must go where the user is.

But Meta doesn't seem interested in incorporating NFTs into their core strategy. Why?

In short, NFT has an awkward position on the Web2 platform. Social media platforms like Instagram are status-seeking machines. Users compete with filters, places and lifestyle tags to improve their social rankings. We quantify these "ranks" by likes and engagement.

When Meta enabled the NFT access mechanism, it presupposed that NFT would be a mechanism for users to show off assets or demonstrate brand loyalty. But even a large NFT like Bored Apes has only 5,800 holders, so focusing on this niche user base is a hassle and doesn't add much value to Meta.

But why is it said to be in an embarrassing position? NFT has become mainstream, and celebrities have continued to endorse it in the past few years. However, after the FTX incident and the industry’s slew of lawsuits, there is no reason for a celebrity to keep talking about his JPEG images on the blockchain. Therefore, these signs that "NFT has taste" no longer exist. For NFTs to become a sign of taste, they must stand the test of time. Harvard University, Louis Vuitton and Bitcoin have the same reason for flaunting taste - the Lindy effect.

The Lindy Effect describes the idea that the life expectancy of a non-perishable good (such as an idea or a brand) is proportional to its age in existence. From this perspective, religion ranks highest on the Lindy Effect. NFTs such as Bored Apes and many similar animals failed to appeal to a wider user base because only a small group of tech elites who flaunt their wealth can associate those expensive NFTs. ” can be measured in real time.

Another element in the story is that the average person who owns a Boring Ape NFT may not want to prove ownership of their NFT to their social circles, since crypto social circles are different from social networks in offline spaces (school, dating, or work). The crypto circle is often out of the circle due to some negative news, so not everyone is willing to show that they are in the cryptocurrency niche community.

Over the past few years, NFTs are in their infancy. You are in a small circle, and the fraud does not reach ordinary people. A large platform like Meta could give NFT scammers access to your contacts on Facebook. All Web2 platforms have some percentage of bots and fake identities, but authenticating users is relatively simple: they just need to provide real-life credentials. But what do you do when a fake NFT is linked to someone's wallet? What happens when third-party intellectual property is used in an NFT owned by a user?

U.S. law protects platforms from liability for user content. Because of this, Zuckerberg can't be subpoenaed no matter what someone posts in a WhatsApp chat. Brands are largely unlikely to sue platforms directly, but fake NFTs could be used to spread scams. What would that look like? I learned about this from bitsCrunch. If you recall, I mentioned this situation a few months ago in a newsletter during their early launch phase.

The model they developed detected that Coodles' line of collectibles violated the McDonald's brand IP. You might not think that's a big deal, but consider that there are about 434 NFTs in this collection that relate to the McDonald's IP. According to bitsCrunch, these NFTs have generated a total transaction volume of more than 500,000 US dollars, and how much of it can McDonald's get? Probably not at all, as we couldn't find any evidence linking Coodles to McDonald's.

This may not seem like much on the surface, but back before Blur came along, how we thought the NFT business model would work. The idea was that a brand could issue a collection of assets (as NFTs) that would be traded by the community. A portion of the royalties will go back to the brand. From the perspective of a platform like Meta or Twitter, two new challenges will arise:

First, if brands are unable to detect, review, and take down pirated NFTs representing them, then brands will lose the incentive to promote their own NFTs. Imagine you bought a "fake" Nike sneaker NFT on Facebook and showed it to your friends. On the one hand, brands lose money; on the other hand, users feel cheated.

Conversely, there is also a risk that royalty as a concept has collapsed. In this case, building functionality that allows users to trade NFTs on the platform would become pointless. By focusing on payment channels or traditional markets, Facebook gets a cut of every transaction, something Facebook is now doing on a massive scale. This is not to say that NFTs have no future, they still exist, and we are witnessing NFTs moving from "high-priced Veblen goods (Note: The higher the specified price of Veblen goods, the stronger consumer demand for them)" to Transition of "low-priced consumer goods". What will NFT look like after this transition is over?

NFTs must be as ubiquitous and easy to buy as universal media subscriptions are today. You don't think much of it when you subscribe to Netflix, and the same goes for Spotify. In the future, NFTs may be embedded in platforms like event tickets; this is nothing new. NFTs have been around for a while, but have yet to catch on. However, there are two forces that may make NFT tickets possible: celebrity support for NFT tickets and the secure purchase channels provided by social media networks.

Now, imagine a concert without a complex web of attendees behind it. However, now that these tickets can be sold between users (a phenomenon that is already very common), the case for tickets as NFTs on social platforms becomes clearer. Users who have purchased specific tickets can connect with others attending the same event through the NFT. In fact, what better way to show your love for an artist than by showing off a list of tickets to events you can verifiably own on your social media profile? Ticketmaster is already experimenting with this model.

The ability to detect on-chain intellectual property infringement is still in its infancy. The bitsCrunch team showed me a Discord bot that was being used to call attention to brand logos on NFTs. Their system automatically scans NFTs frequently and flags potentially infringing NFTs. While still in its infancy, it will be interesting to see the evolution of NFT-related tools from merely on-chain analysis to scanning the content of the NFT itself.

I spoke to Nameet Potnis from Asset.money about this whole situation. He added that no single player has managed to attract more than 5 million users to the NFT platform. Of course, there are millions of wallets on Reddit, but it is not yet possible to verify that these wallets are real users, and the reason for this is that the wallets are connected and used through other applications. Today, you can only verify that you have a wallet by connecting to an application like Metamask, so the platform has to connect to the wallet in order to integrate itself into the Web3 trend. That leaves them with censorship issues like they did with Libra and Diem.

For Meta's management, these efforts may not pay off.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The content of this article is for information sharing only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of your country or region.