Written by: Terry, Vernacular Blockchain

Unknowingly, with the constant changes of the "atypical bear market", the "halving" narrative that has never faded in the encrypted world is gradually approaching -the current block height is less than a year away from the remaining halving time of Bitcoin, and the halving The time is expected to be April 28, 2024, when the block reward will be reduced from 6.25 BTC to 3.125 BTC.

History always has a similar rhyme, but it is not completely repeated. Facing the end of a new round of halving cycle, will 2023-2024 be a simple replica of 2019-2020?

Bitcoin's "Halving" Narrative

We can briefly understand the basics of Bitcoin halving: the mechanism design of Bitcoin determines that the role of miners is extremely important, and it is the cornerstone of maintaining the transaction operation of the entire system. At present, the income of miners mainly comes from two parts - block rewards and handling fees.

Among them, the initial block reward is 50 bitcoins, and the rule is that it is halved every four years. It has been halved three times, and it is now 6.25. The next halving will be in 2024, and it will continue to decrease until 2140. Coins will no longer have block rewards;

The handling fee will always exist, so after rounds of halving, the block reward will gradually decrease or even approach to nothing, and the income of miners in the future will become very simple, only the handling fee reward.

After the block reward approaches 0, the income model of miners will change completely:

As the block reward gradually decreases until it tends to zero, the importance of handling fees will become higher and higher until it becomes the only source of income (this is also one of the reasons why miners are obsessed with large blocks, because the larger the block Larger, the more transactions that can be packaged in the same time, the higher the handling fee).

Although logically it is possible to make up for the loss of block rewards by increasing the handling fee like a seesaw, but the high handling fee is not conducive to the promotion and use of Bitcoin:

– Miners maintain the network to provide value, which is inseparable from sufficient interest incentives;

– Users use the network to create value and cannot afford the high fees;

The feedback fine-tuning of Bitcoin's entire economic system has always been in such uninterrupted contradictions, but it has always been able to achieve a dynamic equilibrium through sufficient games between all parties.

However, under the background that Bitcoin has experienced three halvings, the block reward has been reduced to 6.25, and the number of mining has reached more than 19 million. In fact, it is time to reconsider many situations and many things from a new perspective.

New Thoughts on "BitcoinFi" Behind BRC20

From the "London Upgrade" of Ethereum in 2021, to "The Merge" in 2022, and the "Shanghai Upgrade" just completed this year and the next round of "Cancun Upgrade" , the major progress of the Ethereum ecology and the borderless The thriving ecology of innovations has almost always occupied the main media coverage.

In stark contrast, the ecological level of Bitcoin has rarely been widely discussed in the market , and even users in many industries have felt that the development of Bitcoin may be at a standstill, which is almost a gradual change in the development process of the Bitcoin network. The truest portrayal of being ignored by the market.

It wasn't until this year that the gameplay represented by Ordinals set off a new wave of "BitcoinFi" that all this began to gradually change.

Especially as a new Bitcoin NFT experiment based on Ordinals, the recent BRC20 narrative has begun to bring something completely different to Bitcoin, which has been developing towards the attribute of "payment currency" for more than ten years (although there were disputes about payment and stored value during the period). Variables, and even began to show signs of ecology similar to Ethereum.

At the same time, all kinds of controversies about "innovations" such as BRC20 are actually constantly sparking heated debates . Some people think that adding programmability to Bitcoin is useless, and colored coins N years ago have already sentenced this road to death.

In fact, since 2020, everyone seems to have gradually acquiesced in the positioning of Bitcoin as "digital gold", and has forgotten the payment attribute of the "global currency" that once sparked debates in the industry and even behind the fork. It seems that the upgrade of technical applications has not So important.

But at that moment, it may not be suitable for this moment. In fact, with the reduction of block rewards after the Bitcoin halving cycle , the scale of the entire Bitcoin network is superimposed, and the maintenance of the Bitcoin network is required. Ecological incentives are objectively growing, which needs to gradually expand beyond block rewards.

The refurbishment of "BitcoinFi" represented by Ordinals is also at the right time to some extent - at least the new ecological possibilities endowed by programmability can be explored. After the block rewards continue to decrease in the future, find a way to Alternative, new miner incentives.

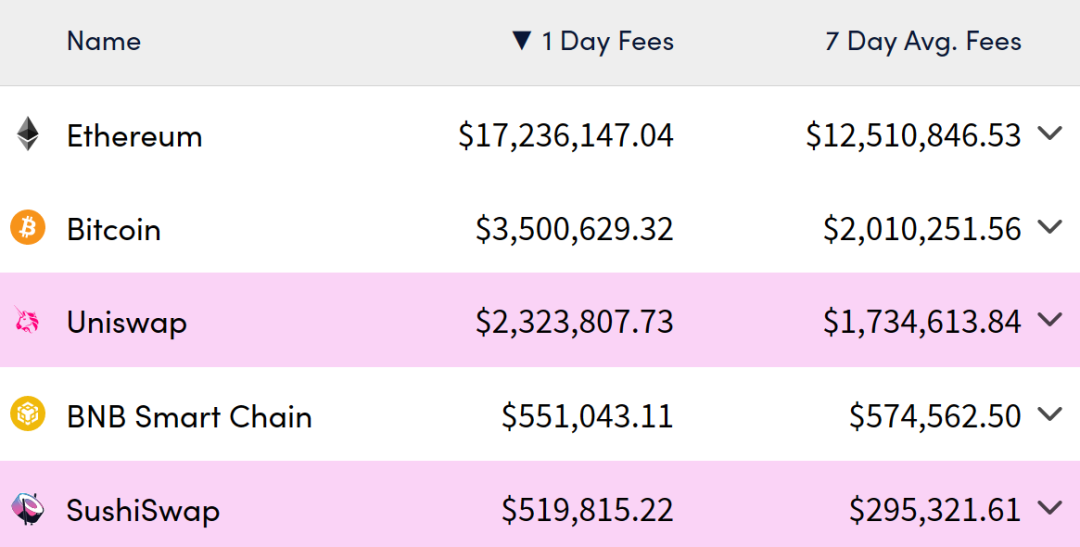

Just on May 3, Crypto Fees data showed that Bitcoin’s single-day transaction fee exceeded US$3.37 million, a new high since May 21, 2021. Compared with about US$370,000 on April 23, it was within 10 days. It soared more than 9 times, and made persistent efforts on May 4, exceeding US$3.5 million.

Crypto Fees May 4 data

It can be said that miners earn a lot of money, which also shows that in addition to block rewards, active ecological innovation and application attempts will greatly promote the pace of transfer of fee rewards to gradually replace block rewards .

After all, after Ethereum switched to PoS, there are still annual inflation rewards and a large enough ecological fee internal cycle to rely on; even Monero, which has "dig out" block rewards last year and still uses PoW, although the miners' income is officially It mainly focuses on handling fees, but also retains a fixed block reward of 0.6 XMR .

As the new round of halving cycle draws to a close, Bitcoin also needs to explore more in advance for future changes and strive for margins. This should also be the proper meaning of "BitcoinFi" refurbishment after a few years.

Bitcoin's "change and constant"

Of course, from another perspective, although most mainstream DeFi is still in the Ethereum ecosystem, the Bitcoin network is still evolving.

In particular, the previous Tarpoot upgrade brought new combinations and possibilities for Bitcoin in terms of performance, privacy, and even smart contracts, as well as more complex programming capabilities that have been gradually explored recently.

Bitcoin Layer 2 ecological overview, source: @hu_zhiwei

In general, in addition to the Layer 2 innovation of the "Lightning Network" that everyone is familiar with, Bitcoin Layer 2 such as side chains, Rollup, and state channels are actually in full bloom:

Such as the RGB protocol, Slashtags (identity account, contacts, communication, and payment that serve the Bitcoin Lightning Network ecosystem), Impervious browser that integrates many P2P services, Taproot-based asset protocol Taro, Lightning Token OmniBOLT, etc. are all worth looking forward to.

Now we are at the end of this round of halving cycle, and there is only less than a year left before the next bitcoin. This may also be the first time (or the first time) for most of this round of practitioners and investors. Second) the Bitcoin halving "event" that I personally witnessed and experienced.

Especially as the Bitcoin block reward dropped to 3.125 pieces, and the total number of Bitcoins mined exceeded 19.35 million pieces, we may be getting closer and closer to the real BTC"mining tail release era". A new variable that we seldom consider in a block reward dominated cycle.

History always has a similar rhyme, but it doesn't always repeat exactly. Therefore, the new halving cycle starting in 2024 may be the biggest difference from 2016 and 2020. From this perspective, this is also the biggest uncertainty of various innovations such as "BitcoinFi".