Author: Grapefruit, ChainCatcher

Today, the news that "the price of BRC20 token Ordi breaks through $10, and its market value breaks through $200 million" is circulating in various communities. And this token was issued online on March 9, and it was free at the initial stage of issuance. Users only need to pay the Gas fee for casting on the chain to get a large number of ordi tokens. Assuming that the user minted 1,000 ordi at the beginning of the release, the current value is close to 100 million U.

Compared with AirDrop, the myth of BRC20 tokens making wealth is easier. Users do not need to participate in the inversion of operations on the chain, and do not need to worry about not being able to meet the harsh conditions. They only need to mint the tokens at the first time when the tokens are issued. Even when the early Bitcoin chain is not congested, the cost of Gas fee on the chain is only A few U can participate.

Catalyzed by the skyrocketing currency price and the wealth story of minting BRC20 tokens, BRC20 has now become a new narrative story in the encryption market, and has been sought after by a large number of users.

On May 5, encryption KOL Plan B released a vote on BRC20 on Twitter; Wang Feng, founder of NFT market Element, said on social media that Element will develop BRC20 inscription tokens and NFT trading markets that support Bitcoin Ordinals for community users. Today, Huobi (huobi) announced that: BRC20 token ordi won the first place in the fifth round of voting for currency listing with 23.91 million total votes. PEPE named BRC20; Subsequently, OKX tweeted that it is stepping up the analysis of BRC20 and promoting the wallet to support the transaction ordi.

It can be seen that BRC20 is becoming a new track for users, project parties, and CEX to compete for layout. So, what exactly is BRC20? As ordinary users, how should we participate in this new wealth code? What risks will they face?

What is BRC20 ? How to mint BRC20 tokens?

BRC20 is an experimental format standard for issuing homogeneous tokens on the Bitcoin network, created by Twitter user @domodata on March 8, 2023 based on the Ordinal protocol. Similar to the ERC20 standard of Ethereum, it stipulates the name, circulation, transfer and other functions of tokens issued on Ethereum, and all token contracts developed based on Ethereum comply with this standard.

The main difference between BRC20 and ERC20 is that the Bitcoin network does not support smart contracts. It uses the Ordinal protocol to set inscriptions (inscriptions) into JSON data format to deploy token contracts, mint and transfer tokens, that is, developers can pass the Ordinal protocol Create and issue fungible tokens.

What is Ordinal?

Ordinal (ordinal number) was proposed in January this year and is a system for numbering satoshis (sats), the smallest unit of Bitcoin.

1BTC=100 million sats, originally every unit of Satoshi is the same, that is, 1 BTC held by Xiao Ming is the same as 1 BTC held by Xiao Lan.

Through Ordinals, these sats can be arranged in a certain order and assigned a specific ordinal number, that is, the Ordinals protocol assigns a unique number to each Satoshi sats. This gives each satoshi its uniqueness, a numbered identifier that will allow users to track each sats on the blockchain. When the user attaches specific information to the Sats, such as pictures, text, codes, etc., each Satoshi can become unique, which is the so-called Bitcoin NFT. The additional information is called "inscriptions", and the process of adding information to Satoshi sats is called "inscribe", that is, to inscribe "inscriptions" on Satoshi.

User @domodata believes that the Ordinals protocol can be used not only to issue NFTs, but also to issue homogeneous tokens. When the additional information (inscription) is added according to a unified protocol standard (JSON data format), it can become a homogeneous token BRC20. To put it simply, BRC20 can be understood as a mutated Ordinals NFT. The inscriptions on the NFT are pictures, and the inscriptions marked on BRC20 are text data (Text) in a unified JSON format. In BRC20, the inscription is also used as an accounting book for BRC20 tokens, which can be used to track the transfer of each token.

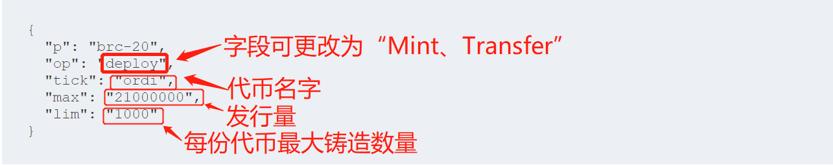

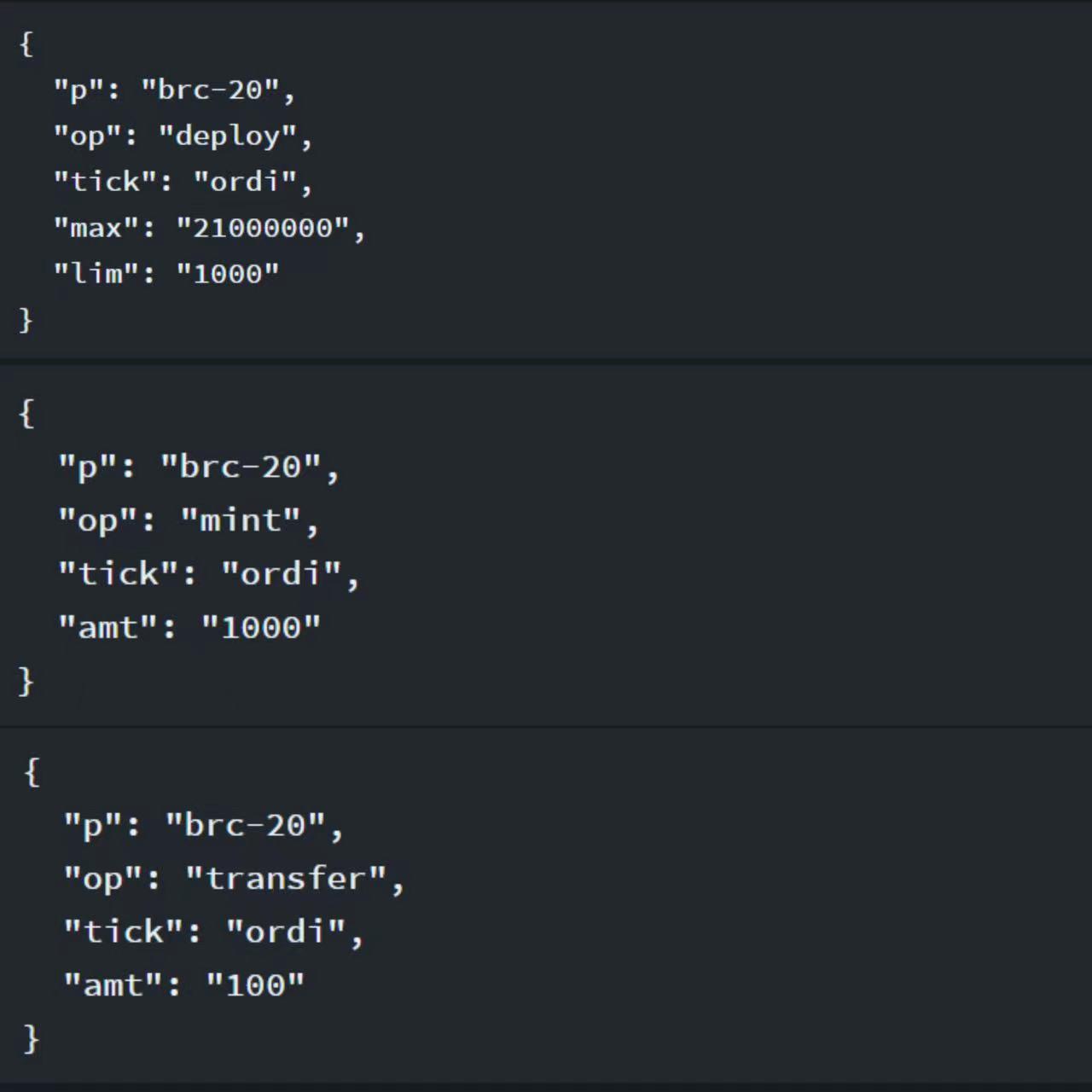

BRC20 mainly provides three standards for the issuance of tokens on the Bitcoin network, including the deployment of BRC20 tokens, minting Mint, and transfer. Developers can complete the creation and issuance of BRC20 tokens by following this standard.

At the same time as the release of the BRC20 standard, @domodata launched the first BRC20 experimental token ordi, with a total issuance of 21 million. Early users only need to pay the Gas fee on the chain to mint. Now users can only buy it in the secondary market, the current price is 10 US dollars, and the market value is 210 million US dollars. However, @domodata also reminds users that this is just an implementation standard and does not have any investment value.

Take the creation of ORDI tokens as an example, users only need to enter the code below the picture to create the token.

The figure shows that the JSON data text input by deploying ordi tokens, the total issuance is 21 million, and the maximum limit for each minting is 1,000. Among them, the user can change the field after "OP" to represent the operation performed. Deploy represents the deployment of tokens, Mint represents the casting of tokens, and Transfer represents the transfer of tokens; "tick" represents the name of the code being executed. Token, the user can enter the name of the token to be executed.

BRC20 three contract standards

Currently, anyone can deploy BRC20 tokens. It should be noted that the name of the deployed BRC20 token only supports input of 4 characters (English punctuation, English, numbers), and is not case-sensitive (Doge= Doge); Tokens with this name cannot be deployed.

Now users can perform operations such as token deployment and transactions through third-party tools. At present, related activities are mainly carried out through the Unisat wallet.

How to issue a BRC20 token?

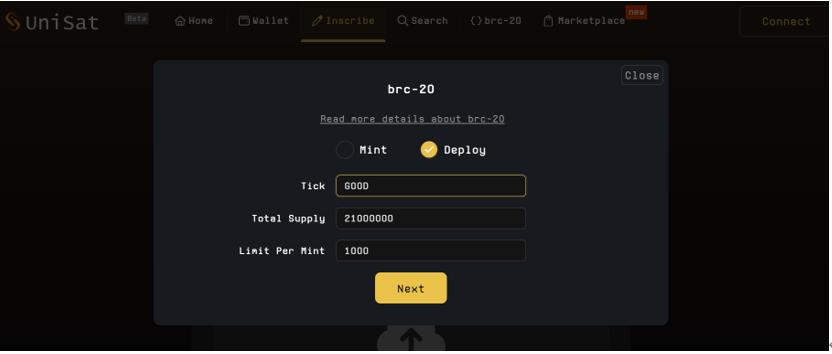

- Users need to install the Unisat wallet (https://unisat.io/), and need to select the "m/86'/0'/0'/0/0" format when setting up the wallet, which supports the acceptance of NFT and BRC20 tokens;

- Withdraw BTC from CEX to Unisat address, the address starts with bc1p;

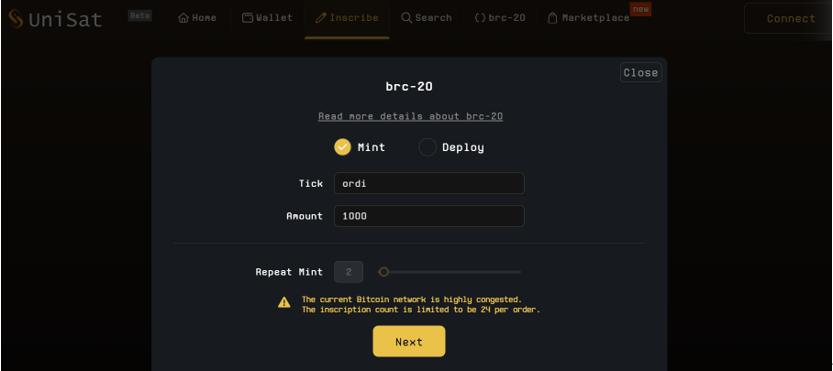

- Click on inscribe (meaning that the inscription of the issued token will be inscribed on Satoshi), and select BRC20;

- Select Deploy, fill in the name of the token you want to issue, the number of issuance, and the limit of each minting amount;

- Submit and pay the Gas fee;

How to buy a BRC20 ?

The purchase of BRC20 tokens can be divided into two situations: including new coins that have not been mint, and tokens that have been mint.

As for the new coins that have not yet been mint , users do not need to buy them, they only need to pay the on-chain Gas fee Mint to mint them.

The specific execution steps, the user uses Unisat to click on inscribe, select BRC20 - select Mint, enter the token name, select the number of copies of Mint to submit, and pay the Gas fee on the chain.

It should be noted that when paying the gas fee on the chain with Mint tokens, during the peak period, users often need to pay a higher Gas fee, otherwise there will be a Gas fee payment, and Mint will not succeed in the end. This is because Bitcoin network miners are sorted according to the Gas fee, and the high gas is more likely to be selected for packaging.

For specific Gas fee, please refer to: https://mempool.space/

For the tokens that have been mint, if the user chooses to continue to execute the Mint function, the tokens that come out will be invalid tokens.

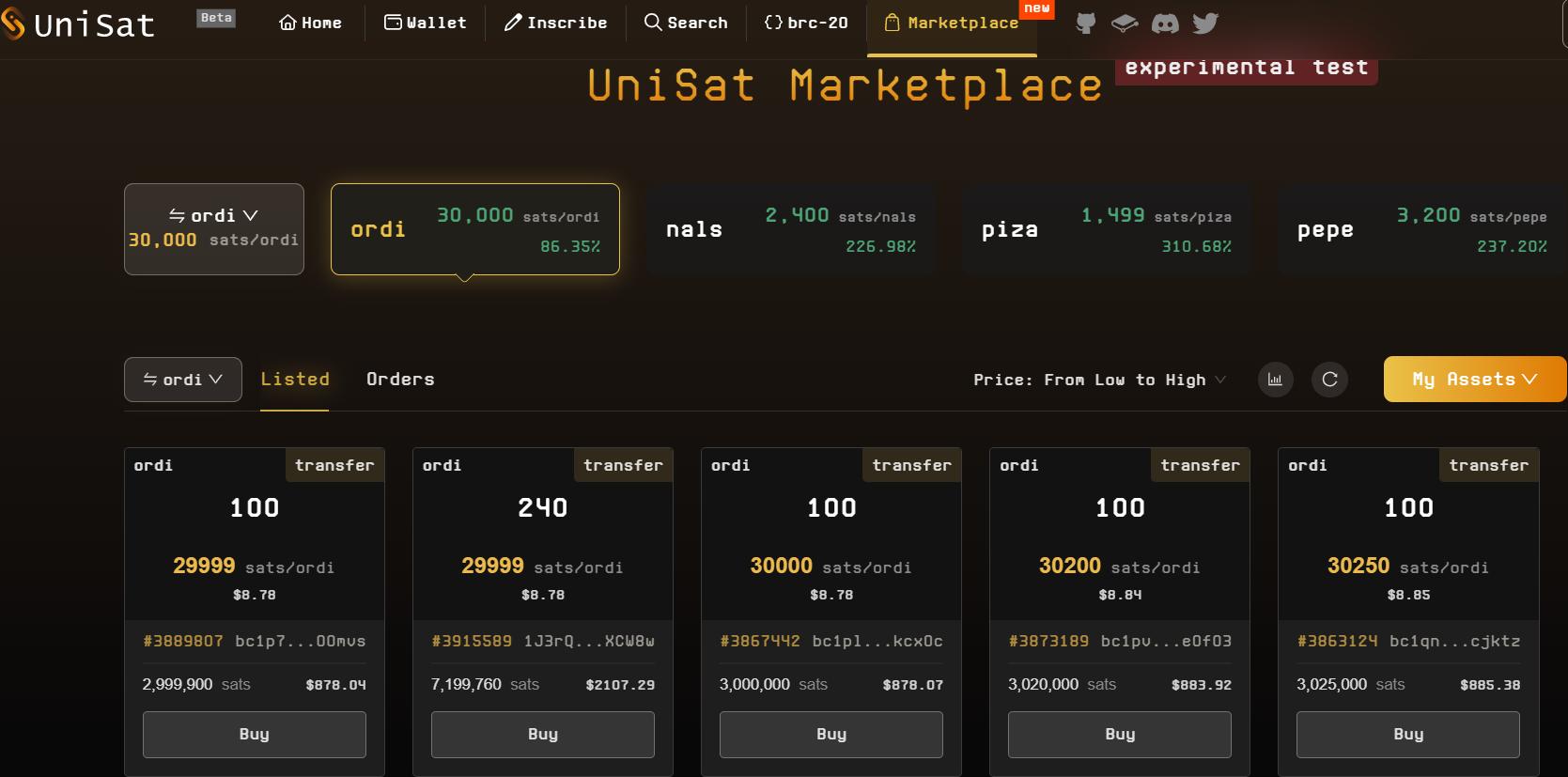

Users who want to obtain the corresponding tokens currently need to purchase through peer-to-peer OTC transactions. There are two main ways: one is to find a third party to guarantee the transaction privately , and it is easy to encounter scammers such as receiving money and not printing coins, or playing counterfeit coins, etc .; It is to go to a special trading platform to place an order transaction , such as UniSat's Marketplace. This trading market is similar to an NFT trading platform. The seller will place an order on the platform for the quantity and price of the BRC20 tokens that he wants to sell. If the buyer buys, he needs to buy this listed by the seller at one time. You cannot choose the amount you want to trade by yourself.

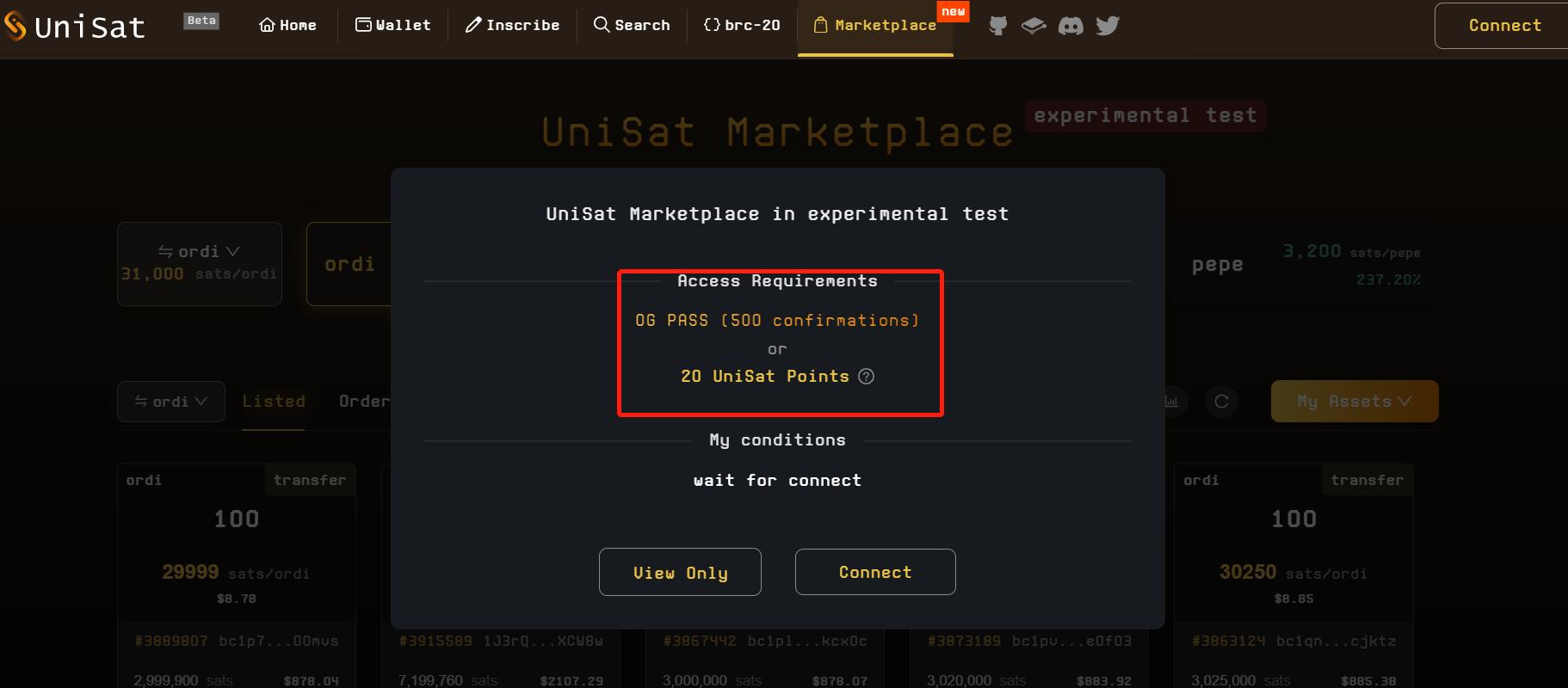

However, the trading market for the first time using Unisat requires a threshold, either an early OG user of Unisat or 20 Unisat points.

How to get 20 Unisat points? You need to use Unisat's Mint function (also known as casting inscriptions), one Mint is one point, and 20 Mints are required. According to the current Bitcoin network Gas fee, the cost of Mint 20 copies is about 160 US dollars. In other words, if users do nothing before entering the Unisat trading market, they need to pay about $160 Satoshisats, which is why BRC20 tokens restrict the use of some users.

In addition, on the Unisat website, users can also view the deployment time of BRC20 tokens, the completion of Mint, the number of wallet addresses held, and the number of completed transactions. The more wallet addresses you hold, the more users buy.

BRC20 Token Representation

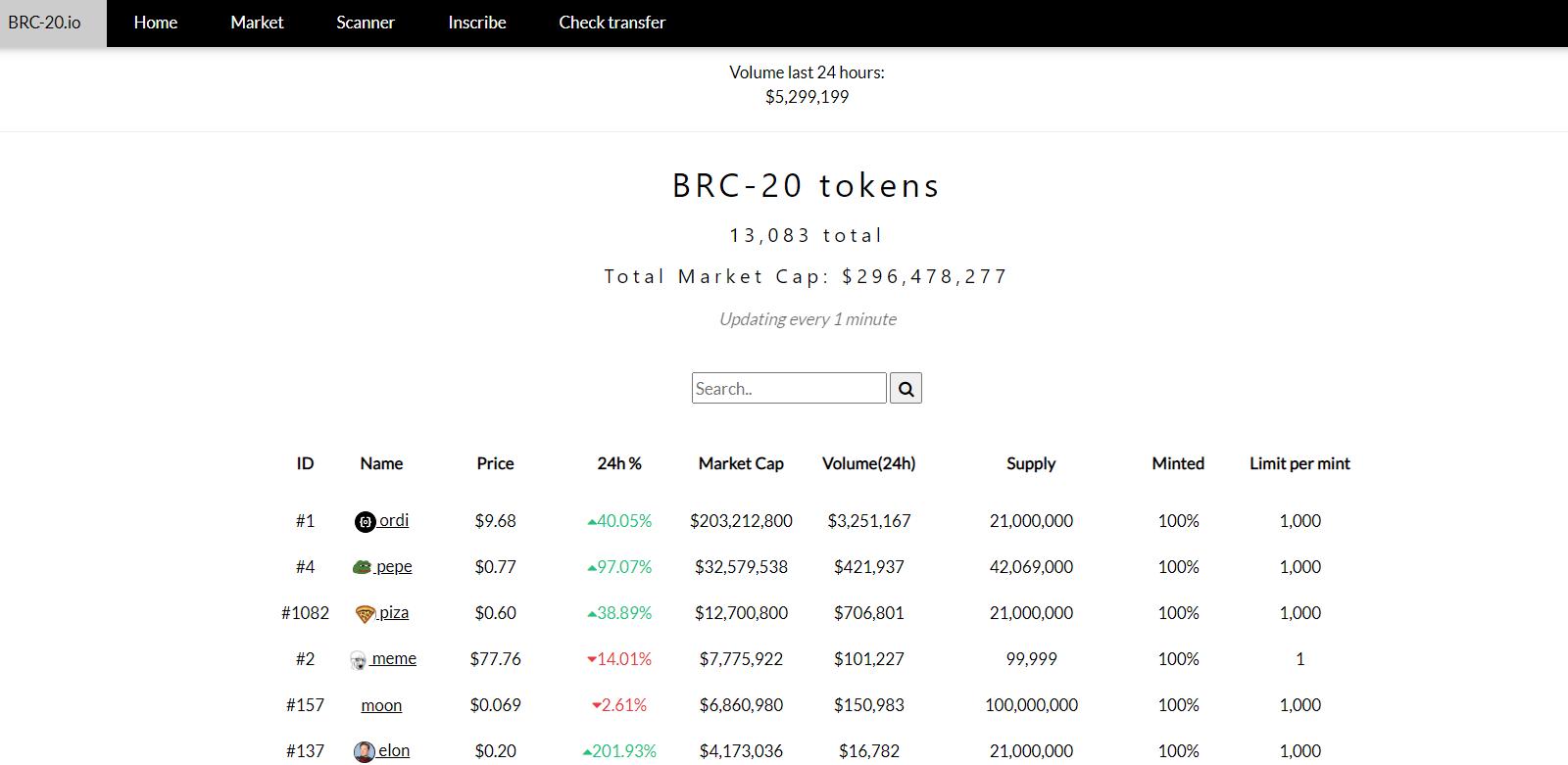

Ordi —— is the first BRC20 token issued by @domodata. It was launched on March 9th, with a total issuance of 21 million and a tentative price of $10. The number of holders is 5,261, and the number of transactions is 62,936.

Nals — comes from a stalk. The combination of Nals and ordi is ordinals, which is the full name of the agreement. The token was launched on March 10, and Mint was completed on May 1. The total issuance is 21 million, and the current price is 0.9 US dollars. The number of holding addresses is 1385; the number of transactions is 39546.

PIZA - Circulation 21 million, price $0.43.

Meme - Circulation 99,999, now priced at $91.

PEPE —— the token meme coin derived from ERC20, the current quotation is 0.68 US dollars, and the total circulation is 42.096 million;

What are the BRC20 related tools?

Third-party BRC20 token casting platforms - Idclub; Looksordina; Unisat, etc., the only difference between the three is the handling fee.

BRC-20_io - a data platform where you can view the price and market value of BRC-20 tokens

Unisat - a collection of wallets and marketplaces for BRC-20

Ordiscan ——ordinal browser can view BRC20 transactions, view Inscriptions and Collections addresses

Ordspace — BRC-20 and ordinal NFT data statistics platform, you can check the market value and price of BRC20, etc.

Most of BRC20 are meme coins, please be cautious when buying

According to the BRC20.io website, as of May 6, 128.61 million BRC20 tokens have been issued, with a total market value of US$280 million and a trading volume of US$4.27 million in the past 24 hours.

In addition, judging from the existing BRC20 tokens, except for the first ordi token, the top market capitalization tokens are all Meme tokens, such as MEME, PEPE, PIZA, etc. These tokens are mainly hype-based, and there is no real value. From the perspective of the number of players held, the holders of ordi tokens with the largest market value are only 5,261, which also means that the current number of BRC20 players is very small, and the Liquidity of tokens is relatively poor, and most of them have a price but no market.

The reason why BRC20 is sought after by users is mainly that the issuance method of BRC20 tokens is relatively fair and just. All casting users are treated equally, and the project party cannot reserve and issue additional tokens. Even the issuer wants to obtain the issued BRC20 tokens. In the same way, at the beginning of casting, everyone is truly an equal participant in the ecology.

However, it should be noted that the current BRC20 token is just a token, and it is still unknown where it will go and what application it will have.

Because most of BRC20 projects and tokens have no value and no application scenarios, BRC20 has been opposed by the original users of the Bitcoin community, who believe that doing so only increases the congestion of the Bitcoin network and is not good for Bitcoin.

However, some users believe that this has added new application scenarios to the Bitcoin network, and attracted a new wave of enthusiastic users and developers to join the Bitcoin community, increasing the demand for BTC, which is conducive to the rise of BTC prices, because users are Satoshi is required to purchase any BRC20 tokens on-chain.

Judging from the current results, the emergence of BRC20 is most beneficial to miners and has brought huge income to miners. The Block data shows that the transaction volume of the Bitcoin blockchain jumped from $499.34 in February to $689.68 in March. Bitcoin miners earned at least $718 million in March, the highest since May 2022.

In addition to BRC20, ORC20 and LTC20 tokens were also born.

ORC20 - is an upgraded version of BRC20, which can change the initial supply and maximum coinage; there is no fixed number of characters in the token name (BRC20 tokens only support 4 characters); allows users to cancel transactions; in addition, ORC20 tokens enforce royalties , that is, holding or trading ORC20 tokens requires payment of royalties, similar to NFT.

LTC20 - is the LTC-20 token test standard proposed by the Litecoin community following BRC20, which is developed on top of the Litecoin Ordinals protocol.

However, judging from the current community attention, the popularity of ORC20 and LTC20 is only at the initial stage of launch, and their tokens have not been out of the circle like BRC20 tokens.