Compile:ETH

The launch of BRC-20 tokens and serialized NFTs on Bitcoin has turned the #1 blockchain into a clunkier version of Ethereum in an instant

In November 2021, the core developers and miners signed off on the Taproot upgrade of the network, and they never imagined that this would be the result. Bitcoin now faces many of the same problems that have long plagued ethereum, including scammy meme coins and shitcoins, monkey-picture NFTs taking up block space and causing transaction fees to skyrocket.

The network even has to deal with mining extractable value (MEV) events, meaning miners profit by rearranging pending transactions.

Mati Greenspan, founder of Quantum Economics and a Bitcoin supporter since 2013, said: "I'm a little disturbed that I didn't realize this problem. I didn't realize it until these people started hyping JPEG images on Bitcoin. What did we do?" He said with a wry smile.

Some Bitcoin proponents have claimed on Bitcointalk and Twitter that the impact of Ordinals NFTs and BRC-20 tokens is an attack on Bitcoin, an exploit on Taproot or simply spam clogging the network.

This has sparked a heated debate about whether unforeseen outcomes should be expected as a consequence of a permissionless protocol, or whether steps need to be taken to get rid of them.

Why are Bitcoin transaction fees so high?

The BRC-20 token was launched by anonymous developer Domo on March 8. They use the Ordinal notation of the Ordinals JSON data to deploy token contracts, mint tokens, and transfer tokens. Some consider this extremely inefficient, with transaction fees four times higher than using binary code.

Inefficiency aside, there is a rush to mint memecoins. Someone would deploy a trading pair with a new token and a contract with a maximum supply, and then traders would pre-emptively mint as many tokens as possible, on a "first come, first served" basis, with whatever gives them priority The transaction rate. The market capitalization of these tokens has exceeded $1 billion, although Domo believes that they will be worthless.

But they are here to stay - at least in the short term - as some major wallets have started supporting BRC-20 tokens. And new developments, such as a Uniswap fork that amassed $500,000 in "Smart BRC-20" token (SBRC-20) trading volume in just a few days, point to a permissionless Construction of the new ecosystem will continue.

Transaction fees are prohibitively high, making it difficult to bring the unbanked into the banking system

Greenspan noted that while the surge in interest has seen bitcoin transactions reach an all-time high, the number of unique addresses has plummeted, meaning fewer people are accessing the network. While transaction fee revenue has surpassed block rewards — which many believe is the only way to secure Bitcoin after several other halvings — it has also created a host of problems.

“Yesterday I was talking to a miner and he said he doubled his income which is nice, especially before the halving, so it’s great for miners but terrible for countries like Nigeria and El Salvador because all of a sudden the average fee to send a transaction is $30,” he said. “The dream of using bitcoin for financial inclusion has been put on hold.”

Interestingly, this is not the first time someone has put a token or NFT on Bitcoin. Counterparty pioneered NFTs on Bitcoin, followed by Spells of Genesis in 2015 and Rare Pepes in 2016. The stablecoin Tether also launched its token on Bitcoin in 2014 through the Mastercoin protocol (which later became Omni).

Bitcoin Maximalist Calls for Ban on Spam

On the Bitcointalk forum, there has been a lot of discussion about resisting an "attack on Bitcoin," which some claim is the work of malicious BSV developers. Users are discussing a soft fork to "enforce strict Taproot verification script sizes," how the protocol can filter content they deem "spam," and even a Hard fork to revoke Taproot.

Bitcoin developer Luke Dashjr said, "Action should have been taken months ago. Spam filtering has always been a standard part of Bitcoin core. It is a mistake that the existing filter does not extend to Taproot transactions, because this is a vulnerability. fixes, without actually having to wait for a major release."

But there are also differences of opinion.

Checkmate, Glassnode’s lead chain analyst, told the magazine that he thinks this form of censorship goes against the whole ethos of bitcoin, noting that there are already optional mempool rules that allow node operators to filter out serialization if they choose.

"In my opinion, any attempt to ban or censor these transactions is more offensive to Bitcoin than allowing them to exist. They conform to the consensus rules, which is only when a small group of people want to change the rules to prevent things they don't like." It's a real attack."

But podcast host Chris Black said on Twitter that limiting the types of transactions to ensure network health is not censorship.

"If it doesn't depend on the content of the message or who sent it, then it's not censorship," he said.

Hass McCook, a former member of the Bitcoin Mining Council and a staunch believer in Bitcoin, dislikes Ordinals but thinks trying to get rid of them is a step too far, saying: What matters is freedom. My overall view is that I personally don't like it and don't see the value in it. But I don't want to censor it. I think it could go down a very dark path."

"If the protocol allows for something, and someone is willing to pay to do it, then so be it."

Unable to ban Ordinals

Andrew Poelstra, director of research at Blockstream, is one of Taproot's inventors. He also doesn't like the "toxic" offspring of this upgrade, but he doesn't see any practical way to stop them.

“As far as I know, there is no reasonable way to prevent people from storing arbitrary data in validators without incentivizing worse behavior and/or destroying legitimate use cases,” he wrote.

"It's not possible to just ban 'bad data,'" he said, noting that people could hide junk data like NFTs inside useful data like "virtual signatures or public keys."

“Doing this will cost them 2x, but if 2x is enough to incentivize storage, then there is no need to have this discussion because they will be forced to stop due to competition in the fee market.”

ignore them and they will disappear

According to the interviewees for this article, the best-case scenario — and most likely scenario — is that as the meme coin fad dies, so too will the interest in BRC20 and NFTs.

"Congestion on the Bitcoin network is nothing new, right?" Greenspan said. "Usually the hype comes with it, but when the hype ends, it goes away."

Most likely, people will run out of money.

But if Ordinals continue to exert too much influence on the network, there is always the core option, which is to fork Bitcoin to modify or remove Taproot. This possibility has been suggested by Blec and many others, although it seems mostly hypothetical at the moment.

Fork Bitcoin to Get Rid of Ordinals

Greenspan said that while a Hard fork is always possible, “it would split the network. Nobody wants that.”

McCook said the market chose Bitcoin over BCH or BSV in the scaling wars of 2017, predicting that the current version will outperform a fork with Taproot.

"I'd go for Ordinals. So, even though I don't think Ordinals have any value, maybe I need to inscribe something in the future that I need to absolutely protest against censorship," he said.

This can have very powerful effects. Assuming Julian Assange decides to publish his WikiLeaks information as an inscription, this is a very useful thing to do. "

Greenspan also believes that the benefits of using bitcoin to store data are only beginning to be explored.

“People are now realizing that Bitcoin has the ability to store files. I’m excited to see, you know, what visionary developers are going to do with this new tool. Not just creating memes.”

a better token

Domo added when unveiling the BRC-20: "I believe there must have been better design choices and optimization improvements."

Many people agree with this. One of the easiest improvements is to use a binary format instead of JSON, which developer John W. Ratcliff considers "one of the least efficient data formats anyone can use" . He believes this will reduce the BRC-20 token from 89 bytes to 19 bytes.

“That means they paid more than four times more than necessary to submit these BRC-20 tokens,” he said.

Colin Harper, a researcher at Hashrate Index, said that using binary codes "could reduce bandwidth by as much as 80 percent." However, this doesn’t quite solve the problem, as Bitcoin influencer Udi Wertheimer pointed out that the spike in fees is due to token minting bidding fees to get their transactions prioritized to mint or snap up low serial No. tokens in case of insufficient supply.

There is another way to issue assets on Bitcoin, called Taro, which Domo says is a "better solution." The Taproot Asset Presentation Layer is a proposed protocol that allows people to issue digital assets on Bitcoin and transfer them to the Lightning Network for fast, cheap transactions.

Building a Virtual Machine (VM) on Bitcoin

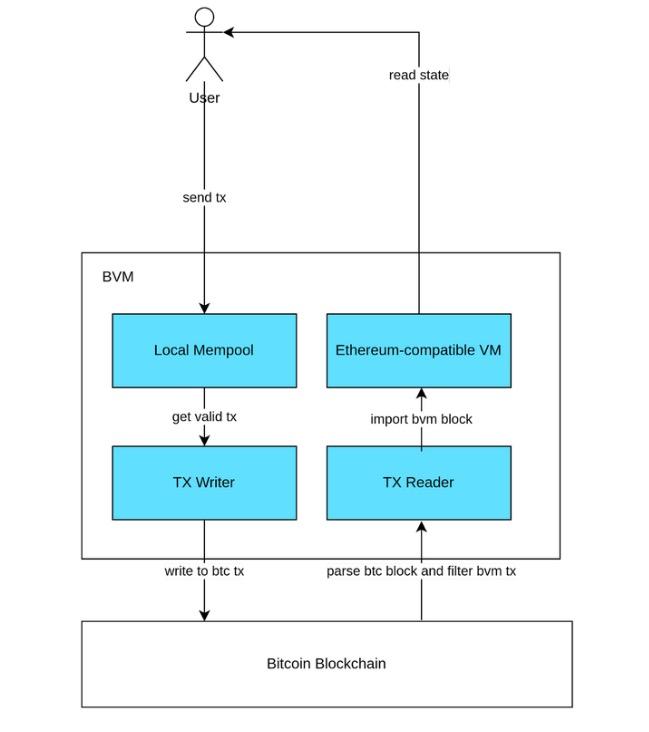

Taking a more aggressive and experimental approach, Trustless Computer, the company behind a fork of Uniswap v2 called Trustless Market, saw $500,000 in transactions in its first three days.

Documentation for the project states that it is developing a Turing-complete virtual machine called BVM, built on top of Bitcoin, to enable the DeFi ecosystem.

Core team member @punk3700 told the magazine that it is "not a Bitcoin Layer 2, but a 'protocol within Layer 1'," which is similar to Ordinals but uses SBRC-20 tokens.

Instead of "writing text files to bitcoins", Trustless Computer writes smart contract transactions to bitcoins. “Original file versus program/logic/application.” This, he claims, can reduce the bandwidth needed for tokens by 80% to 90%.

"I think BRC-20 in its current form (using a text file) is just a blip," he said. "You can't use paper and pencil to build and replace scalable financial instruments."

“Our SBRC-20 implementation is different. We use smart contracts, the same as the ERC-20 smart contracts on Ethereum. It works completely programmatically.”

"Ordinals is possible version 0.1 on Bitcoin. Trustless Computer shows that you can build a whole Dapp ecosystem on Bitcoin."

He expects to see the deployment of MakerDAO, AAVE, Compound and other smart contracts soon, and if it works as he claims, it will have a major impact on Bitcoin.

While the project has received attention from other major cryptocurrency news outlets, this magazine has yet to verify that their technology works as promised, and the extent to which you can integrate smart contracts with Bitcoin is debatable, so proceed with caution .

Can we scale Bitcoin using ZK-rollups?

The emergence of NFTs and token minting on Bitcoin has shown that blockchain still cannot scale to handle growing demand, meaning that the more popular it becomes, the less effective it becomes.

The Lightning Network is often cited as the solution, but Nostr founder Fiatjaf noted that it was unable to cope with the recent surge in fees. “Channels are too fragile, and the cost of opening a channel in a high-fee environment is high, running a routing node, etc. At the same time, users must rely on centralized Lightning network providers.”

Greenspan believes gradual scaling is the only security solution to ensure Bitcoin remains strong

“We’ve seen Segway; we’ve seen Taproot. I mean, it’s all good progress and steady scaling. Usually the best thing for a decentralized network of this size is a robust Expansion. You don't want to rush things because you might break them. As we've seen."

Various parties including StarkWare and blockchain researcher Eric Wall have been investigating scaling bitcoin using zero-knowledge (ZK) Rollups, ethereum's plan to solve its very similar challenges.

But ironically, while the surge in demand caused by Ordinals indicated the need for further scaling, it also made it less likely that the community would agree to a new Hard fork to enable ZK-rollups. After all, they voted for Taproot, so what happened?

"I doubt that will ever happen," Checkmate said.

“I’m even skeptical about soft forks, as the unintended consequences of witness discounting have awakened everyone to the risks of change.”

Original link: https://cointelegraph.com/magazine/ordinals-turned-bitcoin-into-a-worse-version-of-ethereum-can-we-fix-it/