Written by: Jarseed|Jarseed

Since the currency market has entered the MEME season, countless benefit myths and overnight return to zero are constantly being staged. Everyone sighed with emotion about the hundred-fold and thousand-fold increase of $PEPE, $Turbo, $AIDOGE and $MILADY, but when they bought MEME, they lost money once they bought it, and returned to zero when they took it. Many people despise MEME as worthless, but some people say that speculating in MEME means speculating in emotions and attention. These two statements inevitably have some mechanical epistemology. Today I will analyze MEME tokens from the perspective of chip allocation and how to query the address association on the chain, and give some support for you to choose to speculate on MEME tokens. It may not be able to help you choose the best ones, but there are It may be able to help you identify which ones are worse.

If we regard token issuance as a business, then we need to recognize the following points:

The project party is creating a product. Although the entire product has no specific use, the project party has to find a way to get more people to buy it.

Any business needs to consider the ratio of input to output. The project party can choose to take more tokens during the initial distribution (level 1), and then dump them when the time is right; they can also distribute them to the public at a low price at the beginning, and then buy them back from them (level 2); Lost, laundered money and ran away.

Some MEME tokens will even change dealers. The tokens in the hands of the early project parties have been dumped, but the enthusiasm for hype has not faded. If there is funds to continue the hype, then the story can continue to be told.

So how do you start this business? I think the following issues need to be addressed:

Lock Seed User

There are many cases at this stage, such as $AIDOGE based on whether Arbitrum is eligible to receive air investment, such vampire attack methods; or through various IDO platforms or Alpha communities to set up Presale or LGE/TGE (Liquidity Generate Event/Token Generate Event); or fake batch distribution (examples will be given below).

Create initial liquidity

If the assets on the chain want to be able to circulate and trade, they need funds to provide initial liquidity. The project party will use tokens and ETH (usually) to create a liquidity pool through the Uniswap factory function, so that everyone can buy and sell tokens through this liquidity pool.

Media Matrix Overlay

If everyone in our CT information flow is talking about a certain MEME token, then curiosity will definitely drive us to take a look. The KOLs who bring the goods include tap water blog traffic, some collect money for work, and some try to cater to deconstruction socialist ideology to sell other products.

Both volume and price rise

In order to facilitate shipments, the project party held a large number of tokens in the early days in order to achieve the effect of controlling the market. With the trading volume and price soaring, major quotation websites such as Dextool and Dexscreen will recommend tokens to the Gains list and enter the field of vision of retail investors.

Then, next, I will give you two specific cases to see how these two project parties locked the seed users to distribute the tokens of the cold start project, and under such circumstances, what kind of tokens will develop trend. It needs to be specially stated that none of the tokens mentioned below have any investment advice, and I hope everyone is responsible for their investment.

Case number one:

Simpson

Contract address:

0x44aad22afbb2606d7828ca1f8f9e5af00e779ae1

Main trading pool:

0x7945819d6cab17f94c4089c28767e164ed4acf3e

Contract deployment address:

0xC43b6eCaF08b515001d58f4f427e03A4CE4758dd

Total Tokens: 420,000,000,000,000,000

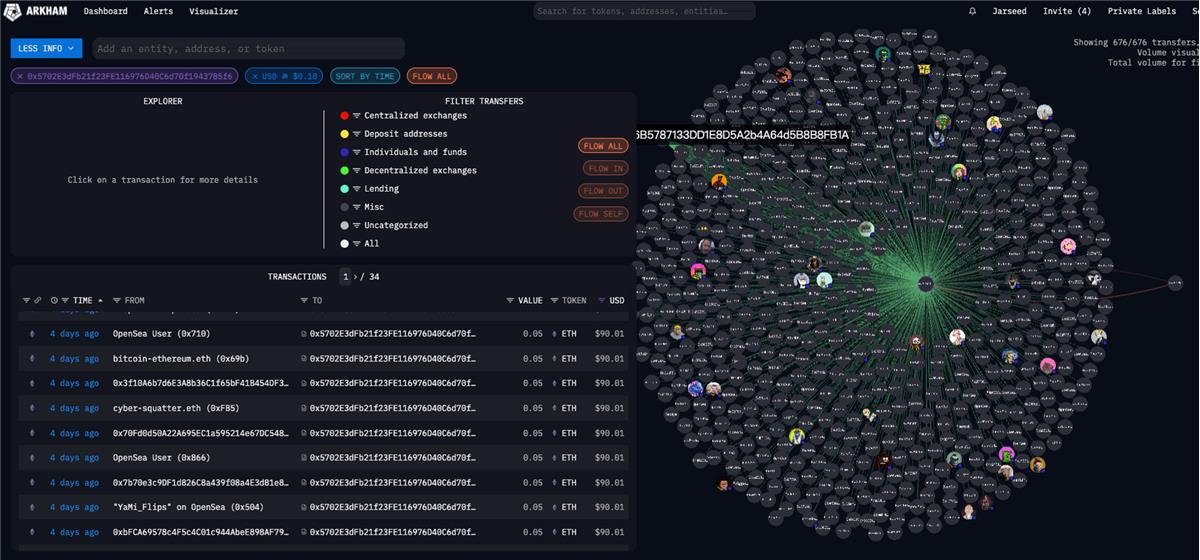

Let's try to use Arkham to interpret the initial distribution of the Simpson token:

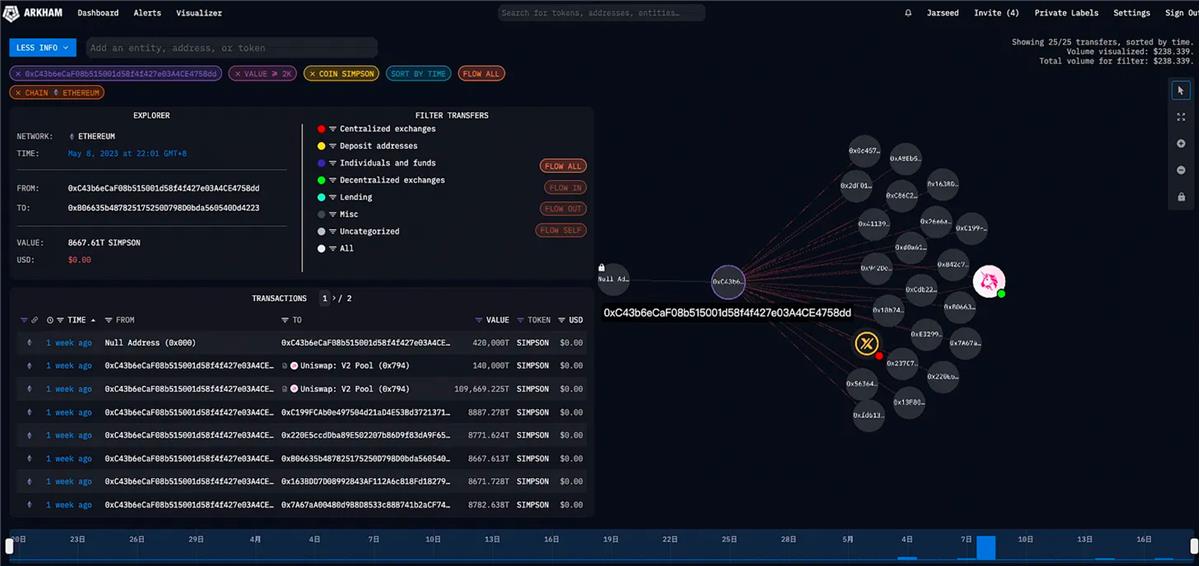

Simpson creator address distributes tokens

You can see from the above figure:

The Simpson token creator deployed about 1/3 of the initial tokens in the Uniswap liquidity pool.

The token creator distributed 8800T Simpson tokens to each of 20 addresses, and each address holds about 2% of the total amount of tokens, totaling 40%.

After this operation, 70% of the tokens have been distributed, and the next step is the token creator’s show operation time.

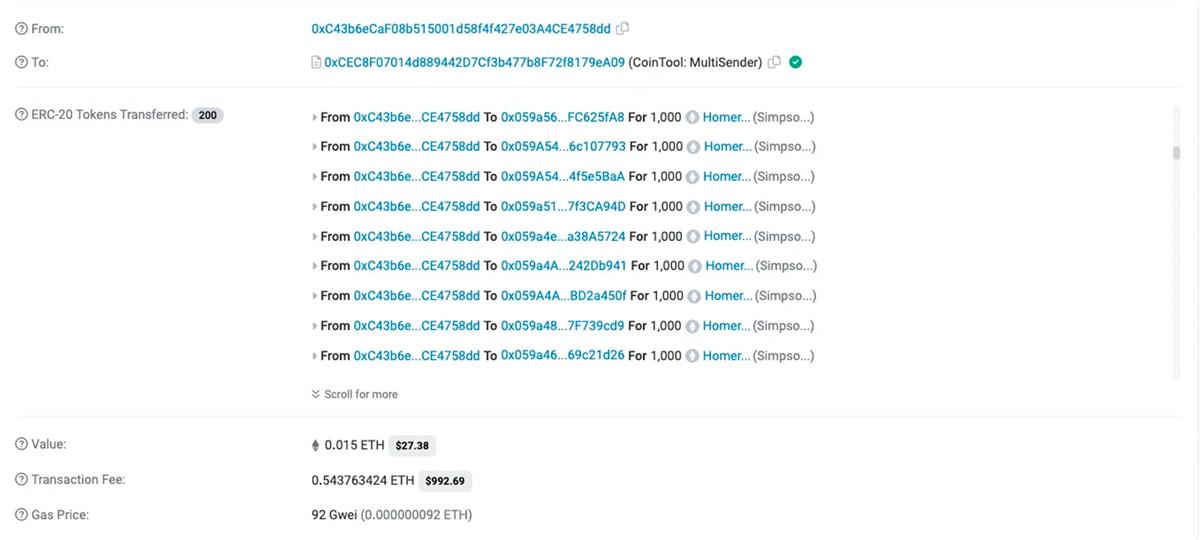

It can be seen from the behavior on the chain that the creator of the token has used the Multisender function of the tool CoinTool. Friends who are familiar with the data on the chain may be familiar with the tool CoinTool. It has dominated the ETH Gas consumption list for a long time. In the list, token creators use CoinTool to distribute Simpson tokens to a large number of addresses. Through the browser tool, we can see that token creators have used CoinTool 4 times in total, and issued a total of 800 addresses. Each address sent 1000 Simpson tokens.

And we can find that these addresses sent by the token creators have a common feature, these addresses start with 0x059a, then friends who are familiar with the hash algorithm will understand that this is a mass-produced address, or some addresses even the project side Don't know the private key, just distributed randomly, because 1000 Simpson tokens are nothing compared to the total amount of 420Q. But such an operation allowed the project to have 800 on-chain currency holding addresses at the time of cold start.

We also know the follow-up story. As Binance launched $PEPE on May 5, the MEME token once again ignited the enthusiasm of the majority of speculators, and everyone began to frantically look for the next $PEPE. What is the standard that people generally look for? The new currency has a certain number of currency-holding addresses, a certain transaction volume, a simple and easy-to-spread image and a good social media performance.

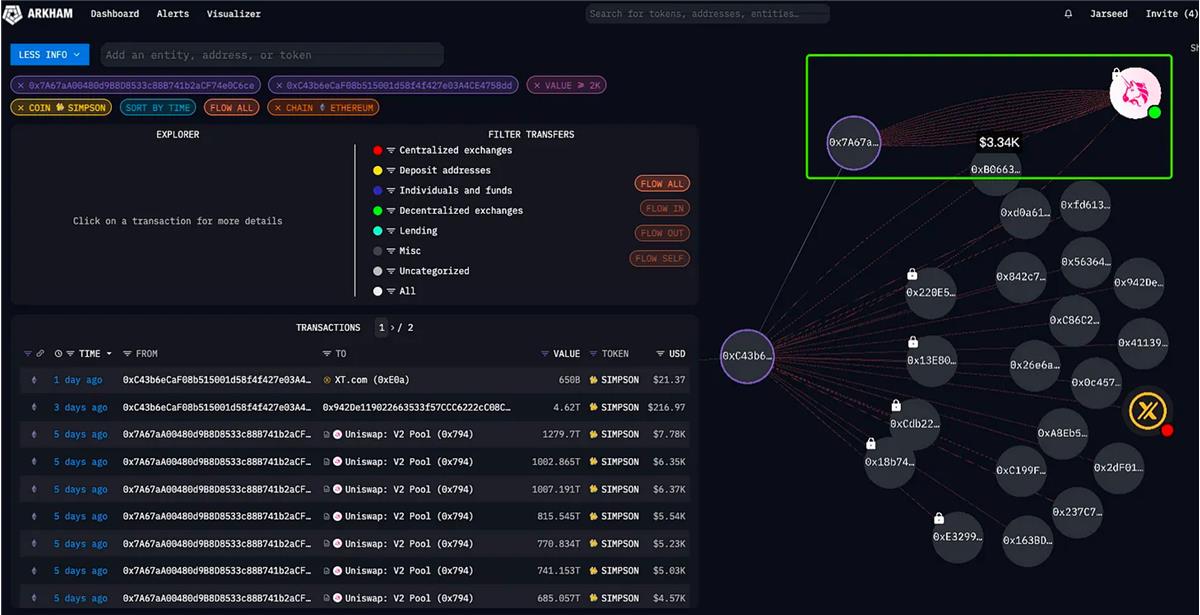

However, when the buyer is dreaming of getting rich, the chips in the previous layout have already dumped these tokens to cold hard cash.

In addition to token distribution, we also have another perspective, which is the interaction of transaction pools.

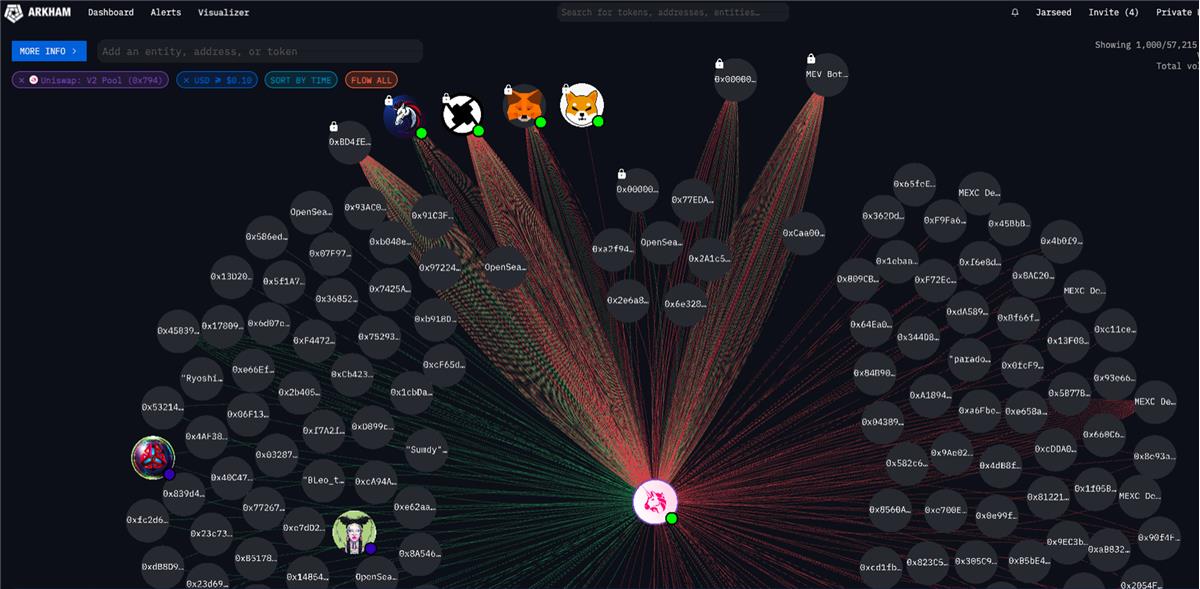

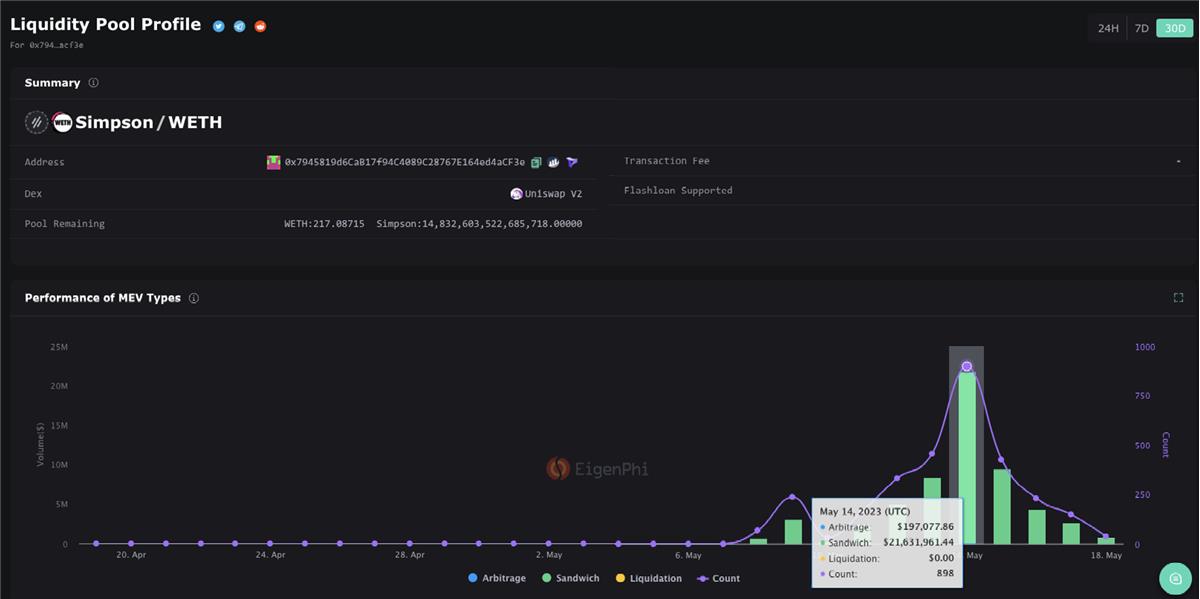

We can see that in addition to some common retail transactions and transaction aggregators, there are also some participants who are also contributing to the MEME boom, that is MEV Bot.

All kinds of MEME tokens have exceeded one million casually, and the average daily trading volume has risen to tens of millions of dollars, mainly due to MEV Bot. It can be said that basically 90% of the transaction volume of most MEME tokens comes from MEV Bot, because some tokens have a transaction tax mechanism. In this case, traders have to increase the transaction slippage, which becomes the fat of MEV. sheep.

Here I recommend a tool Eigenphi to everyone. You can enter the address of the trading pool where you want to trade tokens, and you can see the MEV transaction volume that Eigenphi has counted for you, so as to estimate the transaction volume of the real purchase intention, and go further Horizontally compare the situation between various MEME tokens.

Summarize:

In the case of Simpson, we can summarize the following two points:

In order to play the game well with the project party, we need to calculate the cost of the project party. In this project, the project party spent 6 ETH as the initial liquidity pool, spent 2 ETH as Gas and used CoinTool to create 800 currency holding addresses for itself, and then counting the cost of publicity and pull, we can roughly get the project square cost.

Concentrated shipments. It can be seen that the 20 addresses distributed in the early stage were concentrated on May 13th for cash out. If you continue to participate in this game at this time, it may not be a good choice.

Case two:

Generational Wealth (GEN)

Contract address: 0xcae3faa4b6cf660aef18474074949ba0948bc025

Main transaction pool: 0x1ca4713fc4a95f76fcb498b2a5fe8759c53df1a1

Contract deployment address: 0x6579116367e0090d1cA6F5F712e172996E527E4c

Total Tokens: 420,690,000,000,000

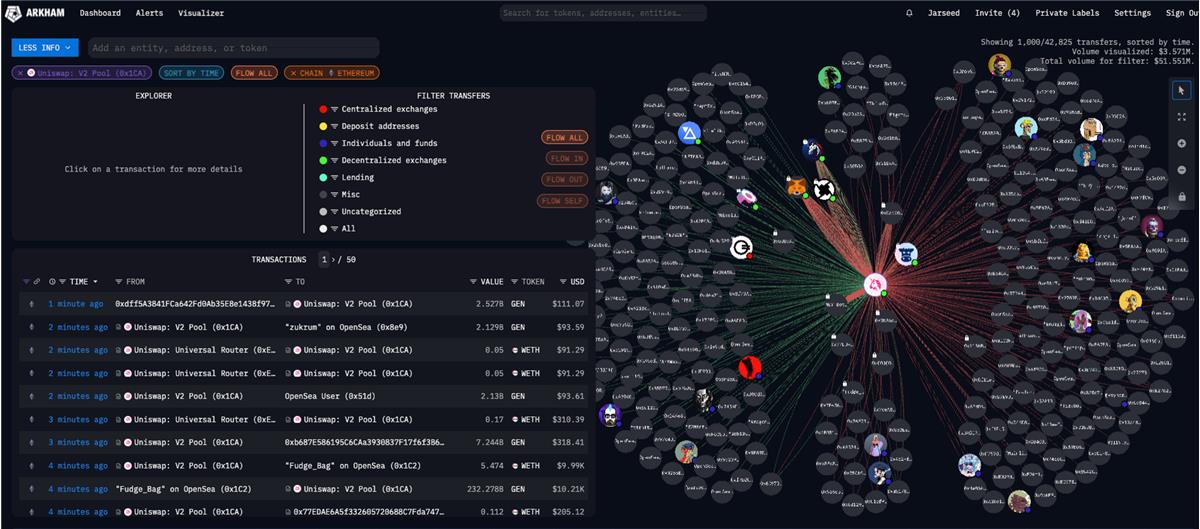

Let's try to use the same method to interpret the initial distribution of the GEN token:

The initial distribution of the GEN token has a Presale process, we first need to find the contract address of the Presale ( contract address link )

According to the project party's description, 15% of GEN tokens will be initially sold through Presale. From the data on the chain, we can see that a total of 672 people participated in the Presale, and each person paid 0.05ETH to obtain 105B GEN tokens.

Here we can see that among the addresses participating in the pre-sale, there are a large number of ENS domain names, and many of them are marked as Opensea users by Arkham. These addresses have various characteristics, and more or less have some active records on the chain , such seed users are healthy and diverse, and are more successful in the initial sale of tokens.

On the other hand, in the large amount of currency holding addresses, you can see:

The GEN token creator deployed 302T GEN tokens accounting for 72% of the circulation to the Uniswap liquidity pool.

The three associated addresses with large holdings are 0x83Fae943b5381eCE611bda1fA44f744966Bc9552, 0xa0F06e6Ab3A999294E4b6B1EF8f4689c5D785482, 0x7E0DaBBC101402880D281f86E51E439f 897A752a accounted for 6.9%, 3.68%, and 2% of the circulation respectively, a total of about 12.5%. Through observation, it can be found that two of the addresses currently do not have ETH, and cannot transfer tokens. currency.

So what have we found in hyping such tokens? What else do we need to pay attention to?

First of all, we found that the seed user group of this token may come from the NFT/Alpha community, or a certain NFT circle KOL calling for orders. Users who participate in Presale participate at a price of 0.05ETH, and have made more than 20 times the profit so far.

Next, we found that the project party has retained 12.5% of the tokens on the surface, but because there is no ETH in the account, we can continue to observe their actions by monitoring these large currency holding addresses.

Is it possible for the project to rug? The action of the token creator is to enter the LP Token into the contract of the GEN token, and there is no next step at present, and it can be continuously monitored.

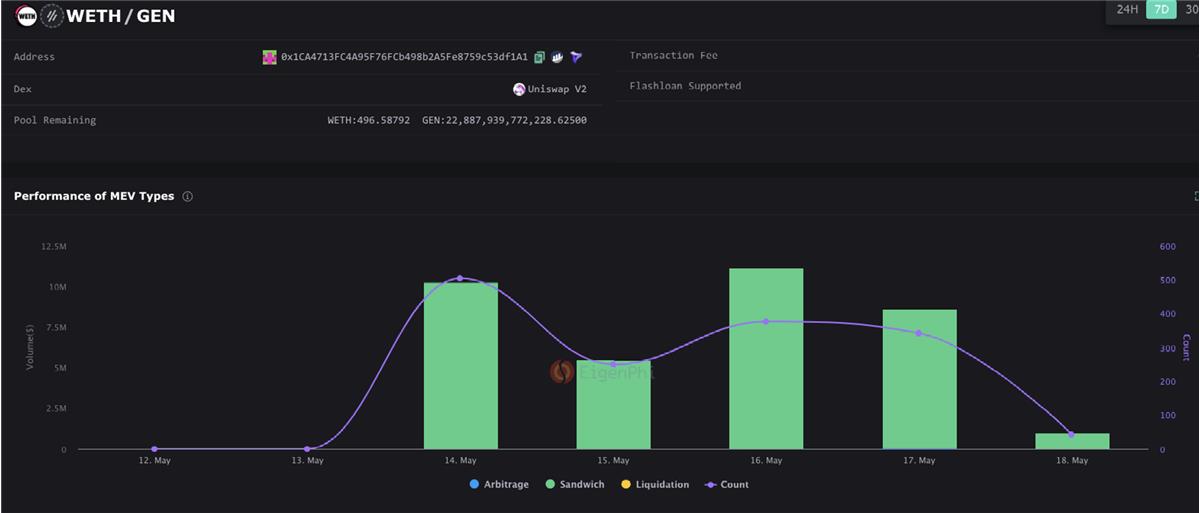

Through Eigenphi, we found that GEN did have strong buying in some time periods.

The degree of interaction of the trading pool is also more active

Summarize:

In the case of GEN, we can summarize the following two points:

The diversity of seed users can bring many surprises to the initial stage of the project, especially with the wealth creation effect.

By excluding the MEV transaction volume to find the real demand transaction volume, it is easier to make horizontal comparisons between MEME projects.