Original Author: Splin Teron

Original source: Twitter

Is the crash of USD stablecoin ($USDT) coming? Before it happens, read this article! Prepare to be amazed.

We will discuss the potential collapse of the USD stablecoin ($USDT) and review the history of stablecoin collapses. Referring to past examples, we will try to understand the possible risks to Tether and what this means for the cryptocurrency market.

A brief recap of the TerraUSD ($UST) crash:

On May 9, Whale sold a large amount of UST, causing its price to drop below $1. Concerns about the stability of UST led to massive withdrawals from Anchor and more UST sales, exacerbating the drop.

In response, a $1.5 billion stabilization fund was used to prop up prices. Terraform Lab’s $1.5 billion stabilization fund is being used for the same purpose.

However, even after trying and possibly spending an additional $2 billion, prices continued to fall. Binance halts UST and LUNA withdrawals while Terraform Labs seeks to secure an additional $1 billion from investors.

Later, the fact that Do Kwon had withdrawn $2.7 billion before the collapse was revealed.

In the latest update, the Montenegrin Supreme Court has revoked the bail and extended Do Kwon's detention until June 16 to bring charges. Both the United States and South Korea are seeking Kwon's extradition.

What conclusions can we draw from this?

• Avoid chasing high interest rates as they may be part of a pyramid scheme.

• Diversify your assets to prevent total loss of capital.

Now, let’s analyze what happened in March 2023 involving $USDC. At its peak, the decoupling reached -25% on some exchanges. It pays to study these situations because they may be of value to us in the future—history tends to repeat itself.

The news that first grabbed the attention was the sudden collapse of Silicon Valley Bank (SVB), a bank that had been a key part of Silicon Valley's financial landscape for years.

The process of depegging the $USDC stablecoin began when the media learned that Circle’s funds were in SVB. It didn't start right away; negative news had started surfacing days before.

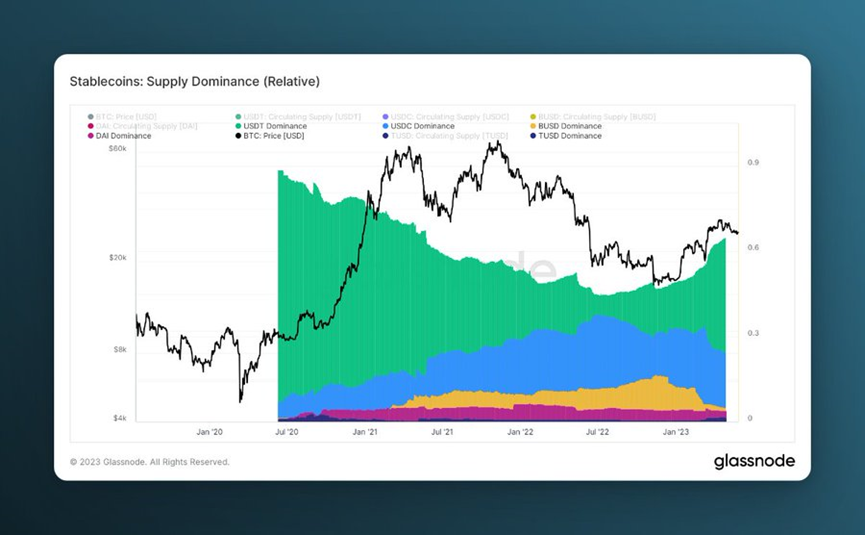

This whole situation has had a notable negative impact on other stablecoins as well. People worried about their finances started switching to cash. All stablecoins, except $USDT, are starting to see massive outflows.

Algorithmic stablecoin $DAI has been most affected. Here's why: the fact that it's backed by 48% of $USDC has a direct mathematical correlation to its value.

Later, Circle CEO @jerallaire brought some positive news. The decoupling process is coming to an end.

$USDC is now equal to one US dollar. What conclusions can we draw?

• Worth watching and analyzing the context of the news; it doesn't happen overnight.

Now, let's discuss the main currency, $USDT. According to the latest data, it accounts for 64.978% of the total number of stablecoins in the cryptocurrency market, which has considerable influence.

$USDT issuer Tether reported net income of $1.5 billion for the first quarter of 2023, bringing the company’s excess reserves to $2.44 billion. In their latest announcement, Tether stated that they will allocate 15% of their monthly profits to invest in $ BTC.

The potential collapse of $USDT has become a talking point in the cryptocurrency community. While the stablecoin has already endured a severe bear market, traditional hedge funds insist its downfall is only a matter of time.

Opponents of the currency argue that Tether artificially inflates the cryptocurrency market, thereby increasing speculation and leaving users with false values.

Proponents refuted these arguments, but it made investors more cautious when dealing with Tether.

Hedge funds have been shorting Tether for years, and now more institutional investors are considering similar moves. This trend is driven by concerns about Tether's financial health and transparency.

Those suspicions were further fueled by a regulatory fine imposed on Tether for inaccurate financial reporting. Many have been eagerly awaiting an update on the audit.

However, Tether was unable to provide this information. If they do, the U.S. government will immediately freeze their funds once they find the banks holding Tether assets. The company insists it is doing a good job. Tether executives view the many speculations about its finances as a stress test.

The decoupling of $USDT has happened before, with 5-10% drops in 2017 and others, but this deviation was short-lived.

The collapse of the largest cryptocurrency by market capitalization, as one of the most widely used assets, would have catastrophic effects on the entire cryptocurrency industry.

However, the best way is to be ready for any situation, keep up with the latest news and react accordingly.

That’s why I’ve compiled a list of various bridging and swapping exchanges to help you when stablecoins are depegged.