Join the 1000’s founders, investors, crypto funds, brokerage firms, and developers in getting free cutting-edge crypto research by subscribing below:

Thanks for reading Decentral Park Research! Subscribe for free to receive new posts and support my work.

Debt Ceiling Push Brings Optimism

In what was a fairly uneventful week, markets ended on a positive note as the White House and Republican congressional leaders push a debt ceiling deal to Congress.

Risk assets kept positive but the moves are subtle indicating much was likely already priced in. NDX futures gained 0.63% on Tuesday after the index’s impressive 2.58% jump on Friday.

However, it’s not quite a done deal yet. Congress will vote on the Fiscal Responsibility Act today and the Senate by Friday.

There was a more pronounced move in the crypto market on Sunday as the global MCAP index bounced off its support put in since March. Market capitalization now sits at the $1.118T level.

Stablecoin dominance models also point to a market that has yet to complete its risk-on period before a more pronounced reset.

But market liquidity remains a concern…

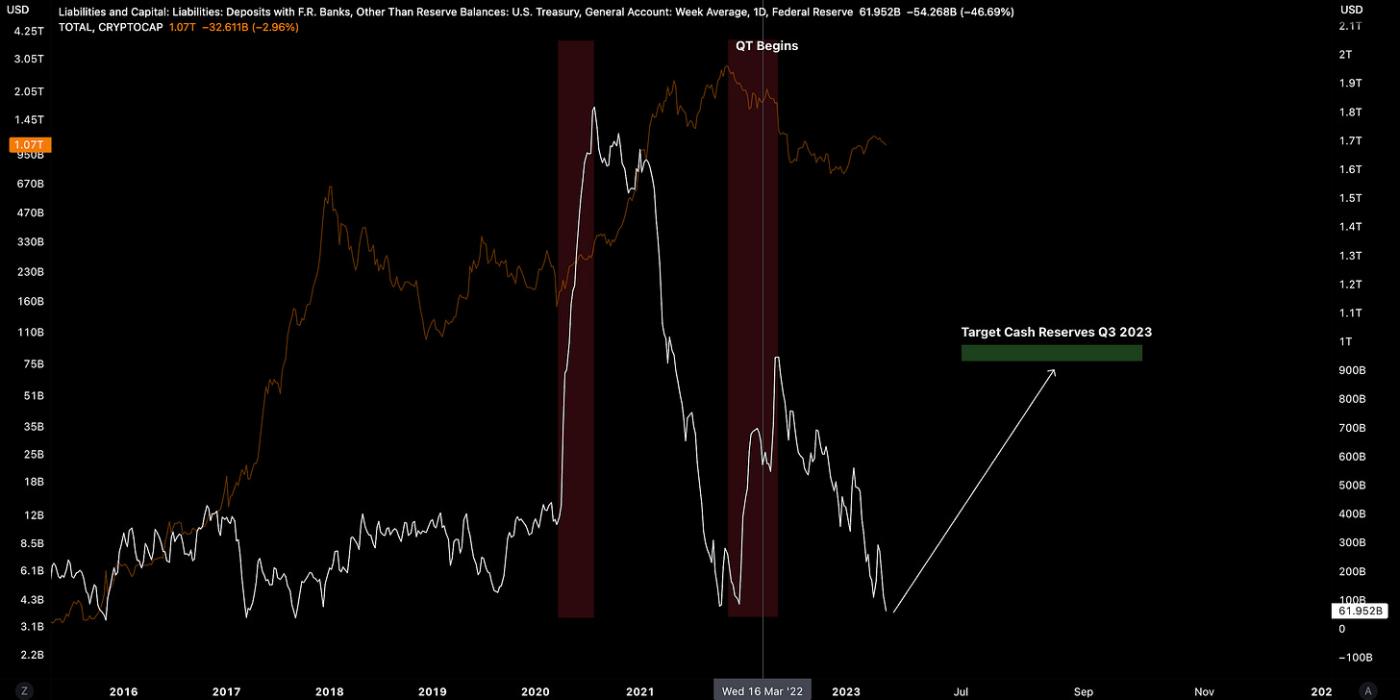

Assuming Congress approves the debt deal, some estimates forecast that the US Treasury may look to sell more than $1T of bills through the end of the 3rd quarter in order to bolster its cash reserves.

Since the Fed began its QT efforts in June 2022, the Treasury has been drawing from its Fed account (TGA) which has helped boost market liquidity and offset the effects of QT.

But that may not be the whole story. Crypto can be guided by both US domestic liquidity but it also trends close to global liquidity too…

Lower global liquidity is also impacting anti-dollar, real yield-sensitive assets like Gold in recent weeks. Access to dollars becomes harder to get…

Just like crypto over the last few weeks, Gold has remained supported at key levels.

The concern for investors post-debt ceiling is the reverse effect once the Treasury starts issuing bonds. A $1T target by Q3 puts the TGA balance trajectory on the same incline as when it was drawing from it.

When the Treasury balance last had a period of increasing its balance, the crypto market capitalization fell from $2.7T to $1.2T over 4 months.

We continue to see a drain on market liquidity as being the key short-term headwind for the crypto markets but there are open questions as to how the Fed can edit the RRP rates to soften the impact or how realistic the Treasury can actually bolster its cash reserves swiftly.

After all, the combination of QT with rate increases without the TGA liquidity injection is stress additive than subtractive for the financial industry. Total U.S. bank reserves likely can’t go below the $3T level without needing the use of liquidity facilities.

Specifically, recent troughs of domestic liquidity have coincided with fractures in the system that has warranted liquidity intervention from the Fed.

What’s Moving in Markets

For now, the debt ceiling positive impulse on Sunday also drives idiosyncratic performance within the crypto market.

Bitcoin dominance pushed higher towards 49% and indicates the orange coin remains the market leader for risk-on moves.

The signal for a new market regime for Bitcoin dominance (BTC extended outperformance) is a break of 50% which the index has failed to achieve since May 2021.

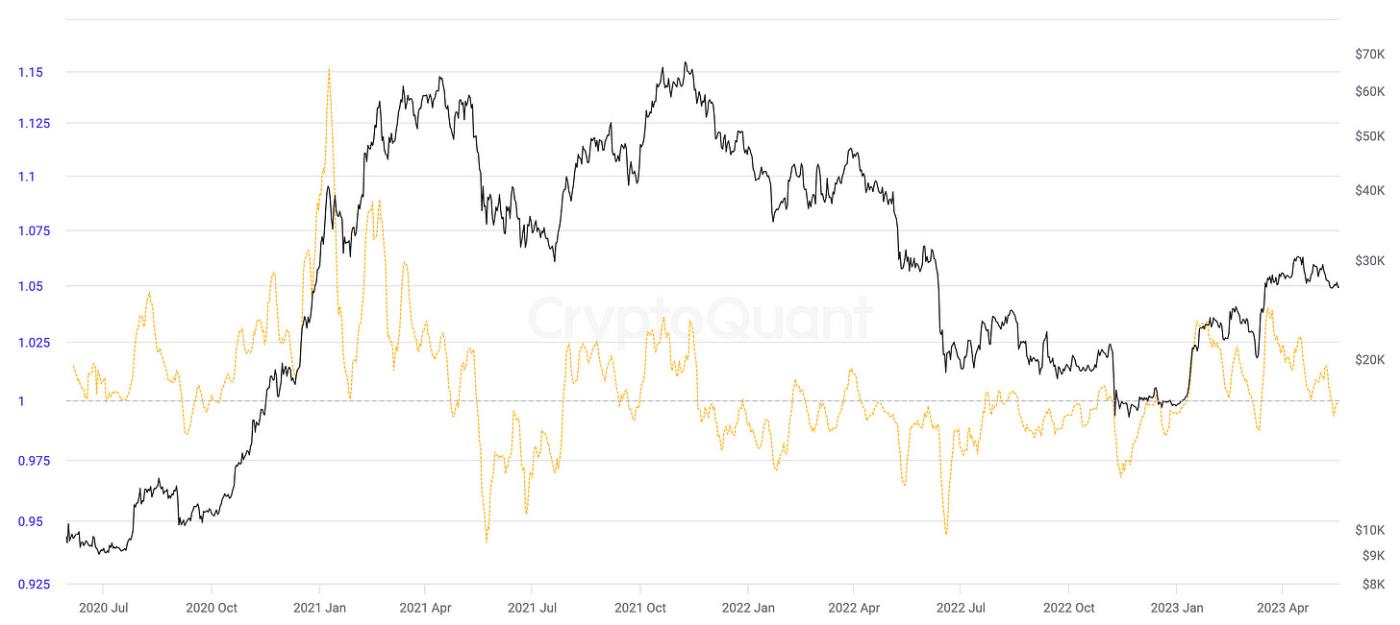

On-chain measures also point to capitulation by short-term traders. Bitcoin STH-SOPR looks to move back above 1 where short-term holders will start to sell at a profit once again.

SOPR often uses 1 as support in prolonged bull markets as short-term traders see their cost basis as attractive zones for new buying opportunities.

The battle between BTC and ETH appears much closer. Both have their own narrative or fundamental drivers creating this fierce battle:

Bitcoin: Banking crisis, Ordinal theory, emergent MEV drivers, most liquid non-stablecoin in the market.

Ethereum: Sound money (i.e. -143k net issuance of ETH from EIP-1559), NFTs on L2s, ability to hedge ETH staking post-Shanghai (i.e. emergent Web3 risk-free rate).

The ETH/BTC ratio looks to break the resistance but has yet to show a convincing move in either direction. We see a close above its 200d MA as a confirmation signal of a positive momentum swing. What is more clear is that a vol spike appears imminent.

Conversely, altcoin indices that exclude beta and stablecoins printed a 1% loss on Sunday.

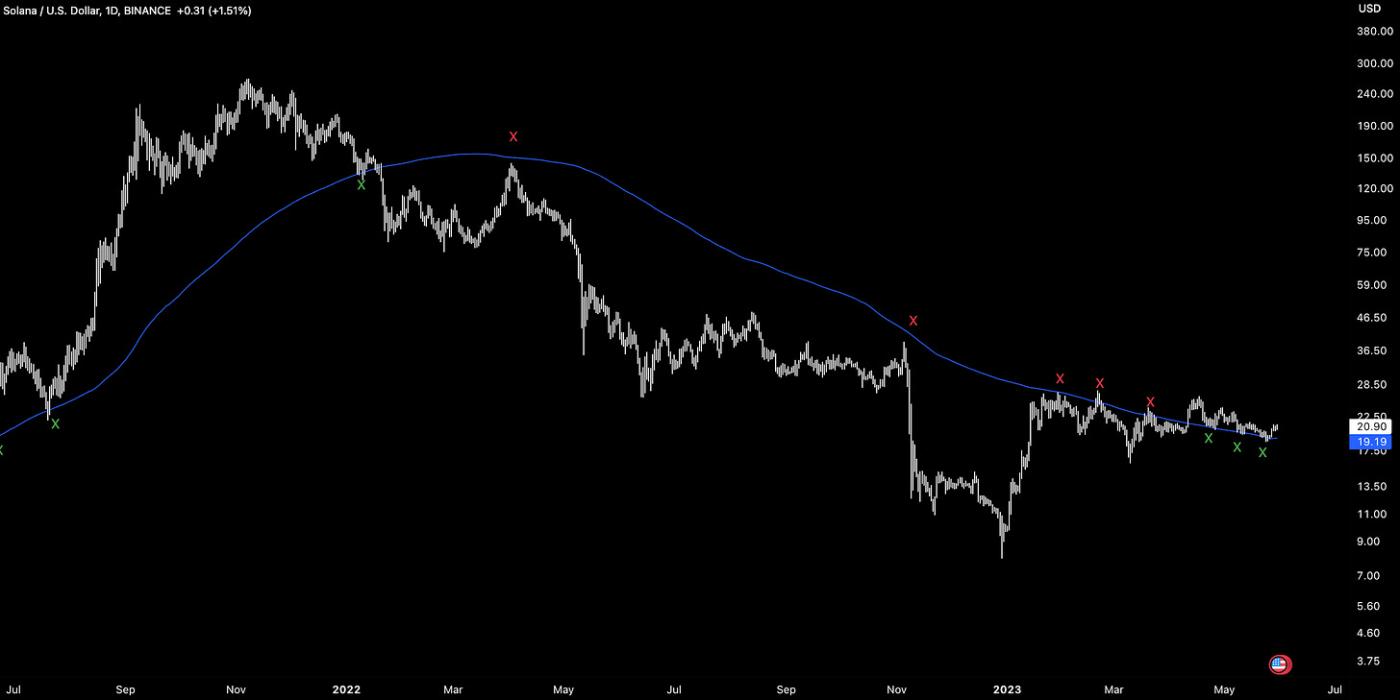

Not all alts are performing equally. SOL has been the strongest outperformer in the smart bucket sector (within the top 27 by MCAP) over the past week at +5.3%.

SOL/USD looks constructive above its 200d MA and despite being pulled down as a result, the ‘levelling-out effect’ could make ~$20 an established support from here on out.

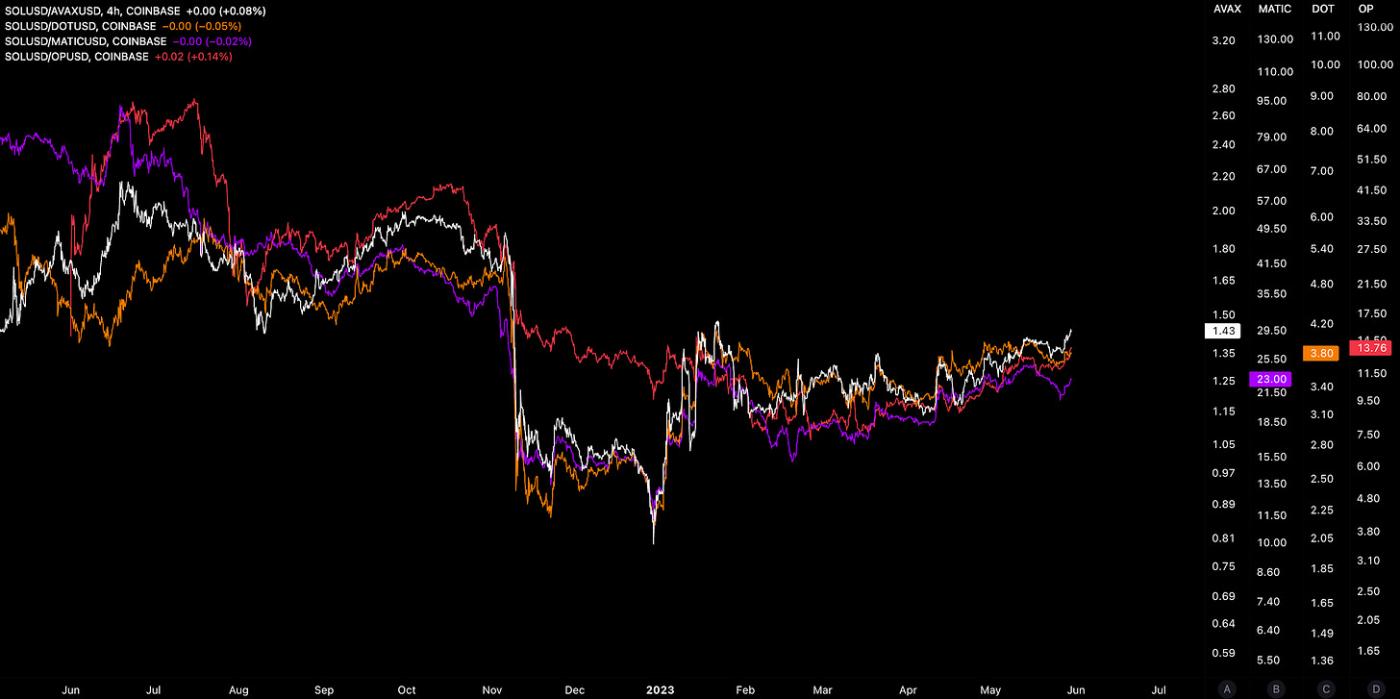

SOL is also gaining relative momentum vs. its alternative L1 competitors and is on track to recover its relative loss following the collapse of FTX within the next 4-5 months.

Its outperformance also carries over to the L2 arena (e.g. SOL/OP) possibly indicating investors are also pricing in Solana’s ability to eat into the L2 market vs. outside of the L2 market.

Optimism’s 9% total supply token unlock on May 31st may also be impacting its ability to outperform as investors limit exposure leading up to and post the event.

Token supply unlocks are likely to carry more weight in a cautious and increasingly illiquid market.

It’s also clear the AI narrative outside of crypto continues to drive select performance within crypto as we start recognising the industries are becoming more interlinked than previously thought.

Render (RNDR), the decentralized GPU-based rendering network has been outperforming the broader crypto market as NVDA climbs to new highs…

A more interesting dynamic unfolding is the market bidding up IoT(Internet of Things)-based DLT networks (e.g. IOTA) as a delayed reaction to the AI momentum.

The combination of IoT and AI creates AloT (Artificial Intelligence of Things) that aims to create more efficient IoT processes and improve user interactions. We are only scratching the surface of what is possible when all of these technologies converge and it seems unlikely RNDR will remain the only play in town that will build on this momentum longer-term.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

ICYMI: In The Weeds #13

Global Market Cap

$1.122T; Markets are still within the uptrend YTD with Sunday’s positive impulse attributed to the debt ceiling deal moving to a congressional vote. No technical divergences on D or W.

DeFi MCAP

$43.6B; DeFi sector oscillating near its 200d MA as the sector looks for direction.

Trader Positioning

Funding rates remain positive (0.0084) indicating bullish positioning by traders overall as BTC holds above $27k.

BTC highest call OI at $28k for 31MAY strike with max pain at $27.7k - where BTC spot has been gravitating towards recently.

Short liquidations totalling $109m helped drive upside vol on Sunday with futures markets still impacting the spot market.

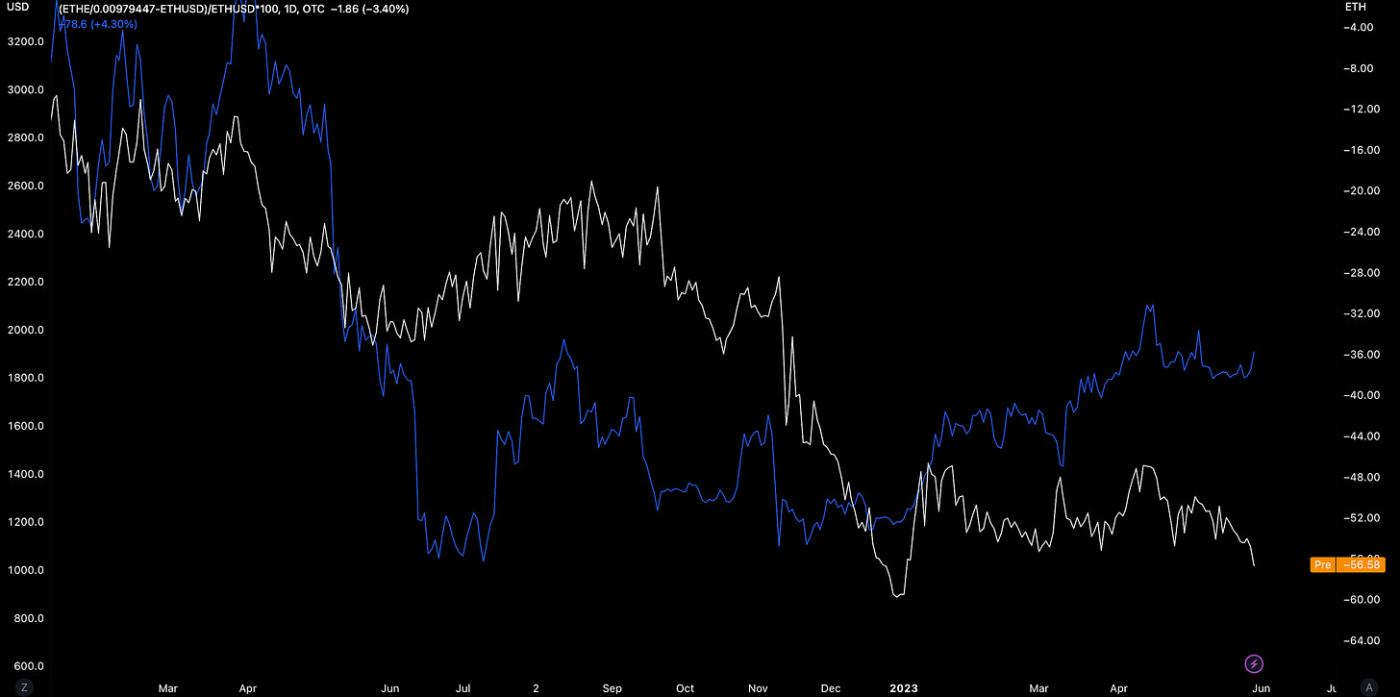

Grayscale Trusts

GBTC discount to NAV is widening at an accelerated rate vs. broader spot indicating specific Trust-related reasons for investors selling. GBTC discount now stands at 43%.

One reason could be the registration of 3 new funds by Grayscale, including a Bitcoin Composite ETF, which could be taken as a signal of a backup plan for Grayscale's high likelihood court battle loss with the SEC with regards to a spot ETF transition for GBTC.

As we’ve highlighted in previous editions of The Weekly, the Trust performance over the coming quarters will likely continue to be driven by the broader spot market but either compounded or suppressed by the market’s perception of an ETF conversion (and ability to redeem shares closer to NAV).

GBTC volumes (30D) have dropped to new lows since March 2019 as investor interest wanes. Investors do not have clear line of sight to perform a hedged discount trade on the Trust.

ETHE’s discount to NAV also diverging with ETH spot - likely for the same reasons as above (Trust-specific drivers for under/overperformance).

Grayscale’s Solana Trust (GSOL) began trading on OTC markets on April 17th. So far, GSOL has been trading at a 120%+ premium to NAV but this may just reflect the limited number of GSOL shares trading on the secondary market - it is unclear how many shares come to market over the coming months which may hamper a premium widening.

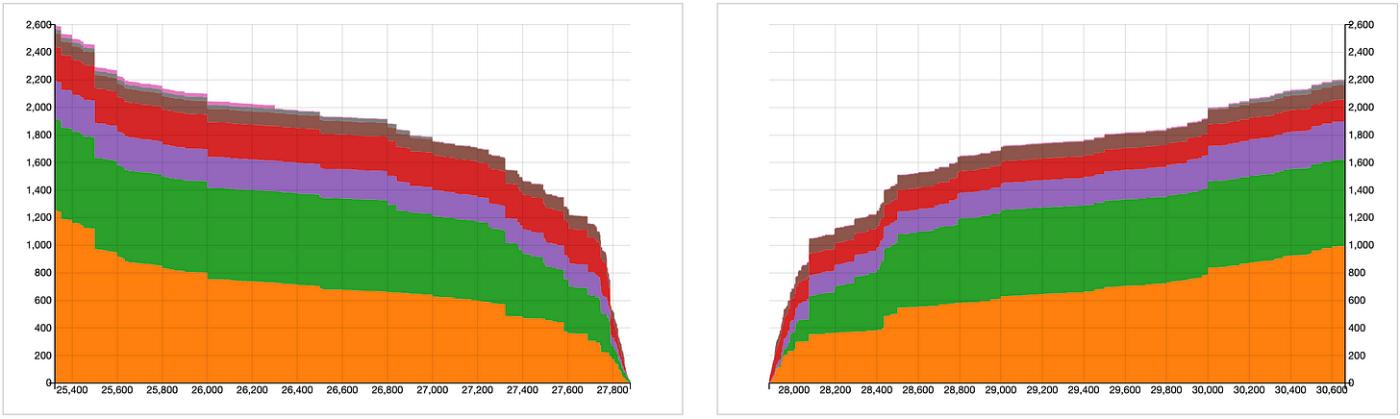

BTC/USD Aggregate Order Books

Order books look fairly even. Good support above $27k and stronger resistance up to $28k (contentious zone).

Miners

Bitcoin hash continues to climb higher with 30d MA climbing 45% YTD (363m TH/s).

Revenue from BRC-20-related activity for miners has flattened to ~12 BTC/daily and marks a 95% drop from all-time-high levels of 251 BTC on May 8th.

Meme-related narratives and token unlocks appear to driving market downside:

Top 100 (7d %):

IOTA (+18.4%)

Injective (+12.3%)

Quant (+9.4%)

Filecoin (+8.3%)

XRP (+8.1%)

Bottom Top 100 MCAPs (7d %):

Pepe (-12.9%)

Optimism (-10.9%)

Fantom (-9.9%)

Radix (-8.9%)

ApeCoin (-7.8%)

> Why Cyril Mathew Left Stripe to Double Down on Crypto [The Scoop]

> The State of Binance [Bankless]

> Ethereum L2s Are About to Be the Hot New Thing in NFTs [Unchained]

> Empire Roundup [Empire]

> Raoul Pal & Sandy Kaul on Tech Megatrends [Real Vision]

> Crypto Storage Firm Qredo's Revamped Self-Custody Wallet Goes Live [Coindesk]

> Genesis, Gemini seek dismissal of SEC lawsuit over lending product [The Block]

> DePin Update [Messari]

> Proposed 30% Crypto Mining Tax Dropped in US Debt Ceiling Deal [Blockworks]

> On Curve’s crvUSD Stablecoin [blocmates]

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.