【Summary】

LSD: The growth rate of Ethereum staking on the Beacon Chain increased last week, with a 2.05% growth compared to the previous week. The staking rate has reached 17.92%. LSDFi projects showed mixed performance, with LBR, ZERO, and TENET performing well, while AGI and USH underperformed expectations.

Ethereum L2: The total value locked (TVL) in Ethereum Layer 2 solutions increased by 5% in the past week, reaching a total of $9.05 billion. Among them, zksync had a strong TVL growth in the past two weeks and had the highest bridged ETH amount, with nearly 10,000 ETH. Its on-chain activity also surpassed Arbitrum multiple times.

Derivatives DEX: The overall trading volume of derivatives decentralized exchanges (DEX) slightly rebounded compared to the previous week, with a total trading volume of approximately $6.5 billion across six major protocols, representing a 6.5% increase. Kwenta experienced significant growth in trading volume during the past week, surpassing GMX, mainly due to its strong trading incentives (33,000 OP tokens per week) and lower transaction fees.

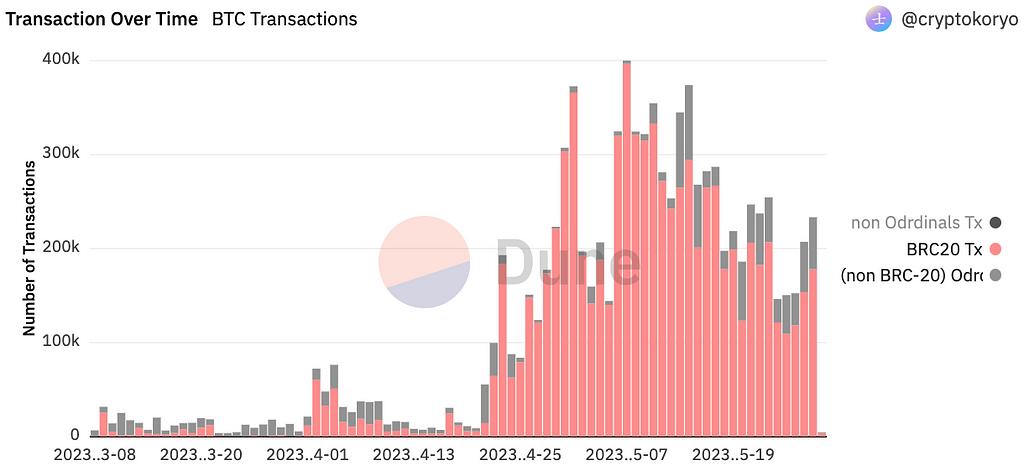

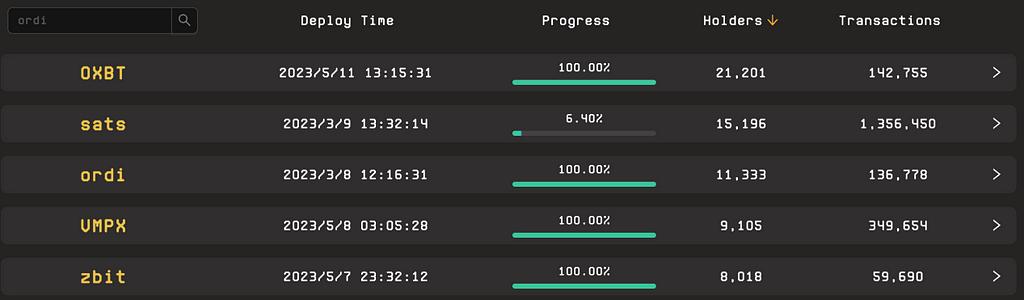

BRC20: The trading volume of BRC-20 related projects showed a downward trend last week, but saw some recovery over the weekend, mainly concentrated on OXBT and ORDI. OXBT has been listed on OKex Ordinals marketplace and Alex BRC20 DEX. The on-chain transaction count and the number of holding addresses have surpassed ORDI.

GameFi: The overall enthusiasm for the sector is not high, but various projects are continuously progressing and announcing updates, which brings market opportunities. It is worth paying attention to Metaverse-related projects before the Apple Developers Conference on June 5th.

【LSD and LSDFi】

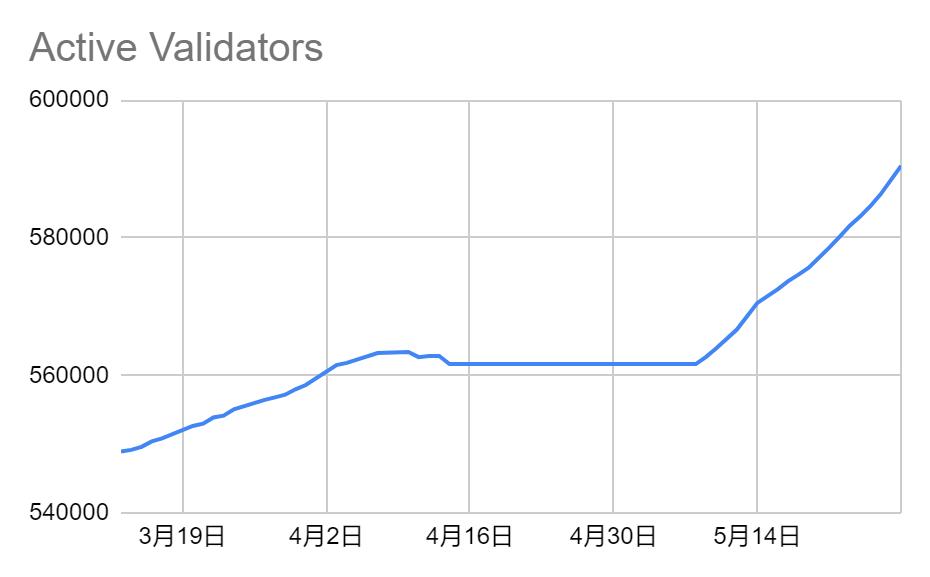

Last week, the staked ETH on the Beacon Chain increased by 2.05% compared to the previous period, entering a faster growth phase. Currently, the staking rate for ETH has reached 17.92%. The staked ETH last week reached 18.8947 million coins, with a 2.05% growth compared to the previous period. The queue for entry into the Beacon Chain increased to 76,900 coins. As of May 28th, the number of validators on the Beacon Chain reached 590,500, with the daily growth limit raised from 1,800 validators to 2,025 validators, entering a faster growth phase.

Image: Accelerated growth of validators on the Beacon Chain

Image: ETH staking yield remains flat compared to last week

Among the three major LSD protocols, Lido has accelerated its growth, while Rocket Pool’s growth has slowed down. Last week, Lido’s staked ETH increased by 5.82%, Rocket Pool’s increased by 4.64%, and Frax’s increased by 8.87%. Currently, Lido has a staked ETH amount of 6.8098 million coins, representing a growth of 14.64% since the Shanghai upgrade. Rocket Pool currently has a staked amount of 711,900 coins, a growth of 53.57% since the Shanghai upgrade, and Frax has a staked amount of 229,600 coins, a growth of 73.53% since the Shanghai upgrade. Comparing the growth data since the Shanghai upgrade with the growth data from last week, it can be observed that Lido’s growth rate is still accelerating despite the high staking base, while Rocket Pool’s growth has significantly slowed down. Currently, Rocket Pool’s dynamic deposit pool remains at zero, with a Minipool queue of 1,091, indicating a potential release of staking demand from the Atlas upgrade. Currently, Frax’s CR (Collateralization Ratio) remains at 94.75%.

The Frax team initiated a proposal to grant Fraxlend AMO (Asset Management Organization) limits to sfrxETH/FRAX on the BSC, Optimism, and Arbitrum chains. The discussion on staking dividends for Lido was denied by the team’s strategic advisor, Hasu. Many stablecoin protocols that mint CDPs distribute the benefits of minting to users, while Frax uses the mechanism of AMO to return the profits from minting back to the protocol. The Frax core team initiated proposals FIP231–233, aiming to grant Fraxlend AMO limits to sfrxETH/ETH on the BSC, Optimism, and Arbitrum chains, with a cap of 5 million FRAX. This move not only expands the protocol’s revenue but also helps lower the borrowing rate for sfrxETH, promoting the growth of Frax ETH staking business. The discussion on staking dividends for Lido was denied by the team’s strategic advisor, Hasu, mainly due to the insufficient treasury reserves to safely sustain team expenses if dividends were enabled. At the current stage, Lido should focus on product development rather than staking dividends.

LSDFi projects showed mixed performance, with LBR, ZERO, and TENET performing well last week, while AGI and USH underperformed expectations. It is important to monitor the continuous development of new projects, timely product delivery, and the magnitude of selling pressure from initial mining on the secondary market. We look forward to the performance of protocols such as Gravita Protocol, Prisma Finance, Tapio Finance, Swell Network, Ion Protocol, Equilibria, and others (based on publicly available information, not investment advice).

【Ethereum L2】

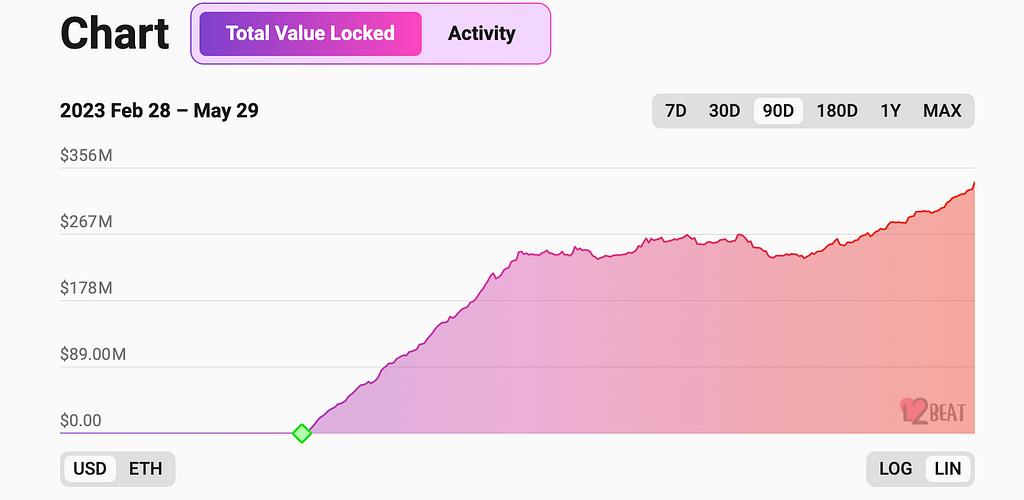

The overall TVL (Total Value Locked) in Layer 2 solutions increased by 5% in the past week, reaching a total locked amount of $9.05 billion.

Among them, zksync has shown strong growth in TVL over the past two weeks.

Starknet’s TVL continues to maintain a stable upward trend.

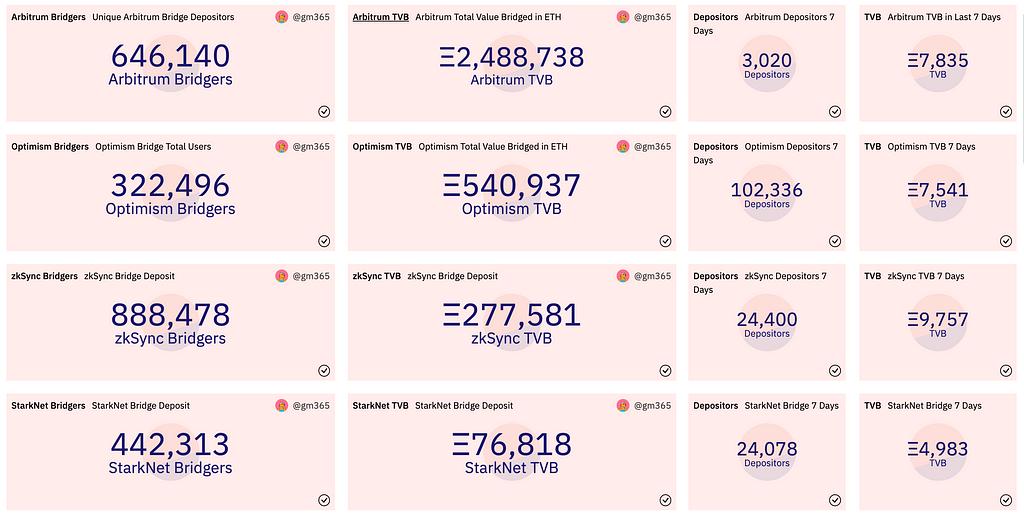

In the past week, the total value bridged on Arbitrum and Optimism was close, with zksync bridging the highest amount, nearly 10,000 ETH. However, starknet experienced a slight decline compared to the previous week.

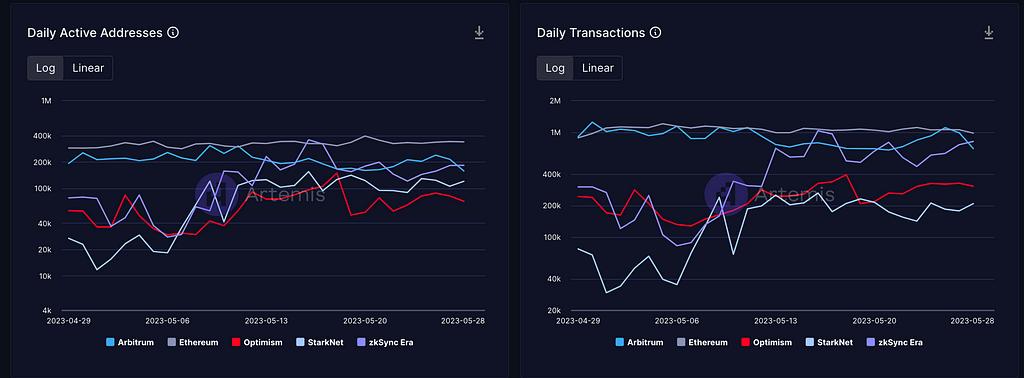

In recent times, the overall on-chain activity has been as follows: Arbitrum > zksync era > Optimism > Starknet. It is worth noting that zksync era has surpassed Arbitrum multiple times in terms of on-chain activity.

【Derivative DEX】

Last week, the overall trading volume of derivative DEXes showed a slight rebound compared to the previous week. The cumulative trading volume of the six major derivative DEX protocols for the previous week (May 15th to 21st) was $6.1 billion, while the cumulative trading volume for last week was approximately $6.5 billion, representing a 6.5% increase.

Among the six major derivative DEX protocols, five exhibited a continuing downward trend, while only Kwenta showed a counter-trend growth. Kwenta, which is built on Synthetix, contributed to over 95% of the trading volume and revenue growth for Synthetix.

Image: Weekly trading volume of major derivative DEX protocols

In the order book model, DYDX continues to dominate nearly half of the market’s trading volume. Among the fund pool model derivative DEXes, Kwenta’s market share in terms of trading volume surpassed GMX for several consecutive days last week. GMX had reached a recent peak in weekly trading volume in mid-April, while Kwenta’s weekly trading volume showed an overall increase in May compared to April.

Image: Market share distribution of fund pool model derivative DEXes

Image: Weekly trading volume changes for GMX

Image:Weekly trading volume changes for Kwenta

Kwenta’s counter-trend growth in trading volume can be attributed to two main factors. Firstly, Kwenta has implemented significant trading incentives. Starting from April 26th, it began rewarding 130,000 OP tokens weekly, and from May 10th to August 30th, it increased the weekly reward to 330,000 OP tokens, valued at approximately $500,000.

Secondly, Kwenta offers lower transaction fees compared to GMX. The current trading fees range from 0.02% to 0.06%, varying for takers and makers. On the other hand, GMX charges a trading fee of 0.1% and additional lending fees based on positions held. In an environment where market trading volume is declining, there are fewer new users, and existing users are primarily seeking better trading solutions. As a result, they have turned to Kwenta for their trading needs.

Image: Kwenta trading incentive rules

However, in terms of Open Interest, GMX still maintains a significant position with a value of around $150 million. On the other hand, Kwenta’s previous Open Interest was approximately $40 million, but recent data regarding its Open Interest has not been disclosed on its official website, making it difficult to observe changes in this regard.

In terms of daily active users, GMX remains the protocol with the highest number of users, with approximately 1,200 individuals. Kwenta, on the other hand, has a daily active user count of around 400.

While trading volume can be easily influenced through trading incentives, Open Interest and daily active user count provide a more accurate reflection of real trading data. Therefore, despite Kwenta surpassing GMX in trading volume this week, GMX still maintains a significant advantage in terms of actual trading volume.

【BRC-20】

Last week, the overall trading volume of BRC-20-related projects showed a downward trend, with a slight recovery over the weekend, primarily concentrated in OXBT and ORDI.

Image:Volume changes

The trading volume of Ordinals BRC20 tokens showed a continuous downward trend last week, but experienced a slight recovery on Saturday and Sunday. The primary trading volume and market attention were concentrated in OXBT and ORDI.

OXBT, led by @BitGod21, originated from a proposal by @Frankdegods to migrate DeGods to BTC and create a related BRC20 token. @Frankdegods is the founder of Solana NFT projects Degods and y00ts. Degods has successfully bridged to the Ethereum network, while y00ts has successfully bridged to Polygon. Both NFT projects have solid community foundations, resulting in naturally high attention for OXBT.

Currently, OXBT is listed on OKex Ordinals marketplace and Alex BRC20 DEX. The on-chain transaction volume and number of holding addresses have surpassed ORDI.

【GameFi】

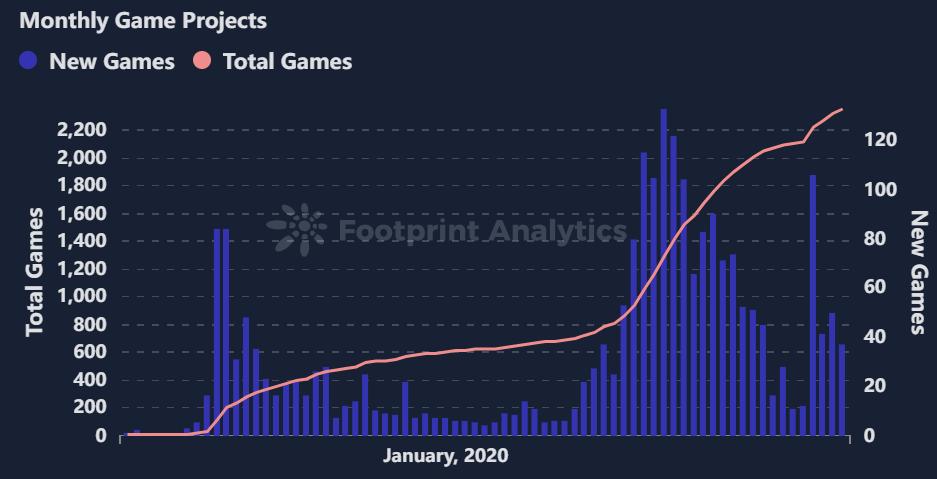

GameFi, after reaching its peak in 2022 and entering a calm period in December of that year, experienced a resurgence in February 2023 as the market conditions improved. The sector saw a significant increase in new game releases, but the actual number of active participants did not show significant improvement.

The most popular GameFi project in the previous week was MoDragon, a new incubation and nurturing game launched by Mobox. The game’s Genesis NFTs were airdropped via a lottery system to addresses that had participated in previous airdrops on the ARB chain and Mobox deep users. On May 25th, the NFT airdrop was distributed, and the game was officially launched.

Currently, the total number of transactions has reached 6,175, with a trading volume of approximately 2,125 ETH, valued at around 4 million USD.

In addition, the COCOS token will be renamed COMBO, and the official token swap timeline has been confirmed. Binance will close the COCOS spot trading pairs on May 29th and reopen trading on June 2nd.

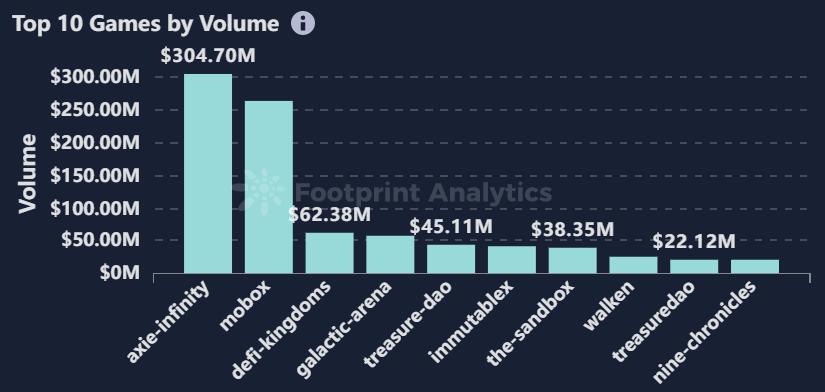

Currently, the top-ranked games in terms of trading volume in the market are still the older generation GameFi projects like Axie Infinity, Mobox, and Kingdoms. The GameFi sector has yet to see breakout projects. It is recommended to pay attention to metaverse-related projects leading up to the Apple Developer Conference on June 5th.

LD Capital is a leading crypto fund who is active in primary and secondary markets, whose sub-funds include dedicated eco fund, FoF, hedge fund and Meta Fund.

LD Capital has a professional global team with deep industrial resources, and focus on develivering superior post-investment services to enhance project value growth, and specializes in long-term value and ecosystem investment.

LD Capital has successively discovered and invested more than 300 companies in Infra/Protocol/Dapp/Privacy/Metaverse/Layer2/DeFi/DAO/GameFi fields since 2016.

website: ldcap.com

twitter: twitter.com/ld_capital

mail: BP@ldcap.com

medium:ld-capital.medium.com