Welcome to issue #42 of The State of DeFi Lending, a newsletter covering the highlights of lending markets in DeFi.

In this issue we cover:

$1.5bn TVL bridge protocol Multichain experiences outages as founders go missing.

MakerDAO votes to increase the DAI Savings Rate to 3.3% from currently 1%. The increase is funded with proceeds from MakerDAO’s RWA investments.

Dan Elitzer of Nascent Capital provides an interesting thought piece on how lending platforms can reduce externally introduced risks. Part of the solution is referred to as “bring your own oracle” to avoid protocol bad debts.

Binance is launching NFT lending as Blend hits new records.

Read below for more…

News

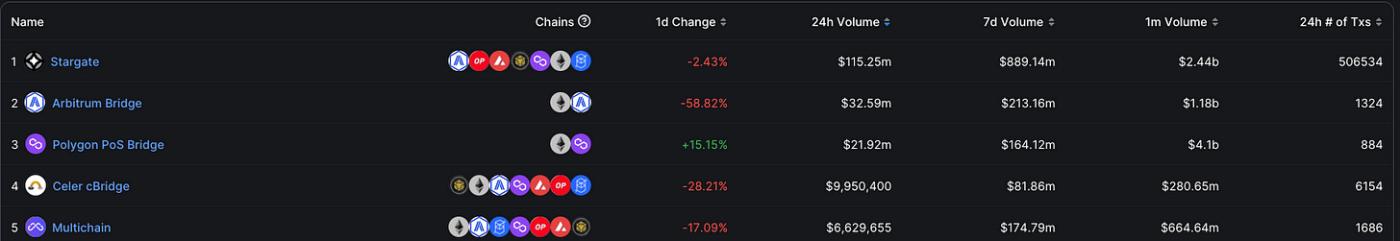

Multichain protocol - one of the Top 5 blockchain bridges with $1.5bn in TVL - has been mired in controversy over stuck transactions amid rumours their team has been arrested in China.

The Multichain protocol ($1.5bn in TVL) has been experiencing issues for several days, with stuck transactions and several cross-chain bridge pathways not yet operational (Kava, zkSync, Polygon zkEVM). The initial explanation for the problems was a system upgrade, but was later vaguely attributed to a "force majeure".

“While most of the cross-chain routes of Multichain protocol are functioning well, some of the cross-chain routes are unavailable due to force majeure, and the time for service to resume is unknown. After service is restored, pending transactions will be credited automatically. Multichain will compensate users who are affected during this process, and the compensation plan will be announced later.” - Source: Multichain Twitter announcement

As of writing, partial downtimes are still being reported. There are rumours that the Multichain team has been arrested in China which have not been confirmed though.

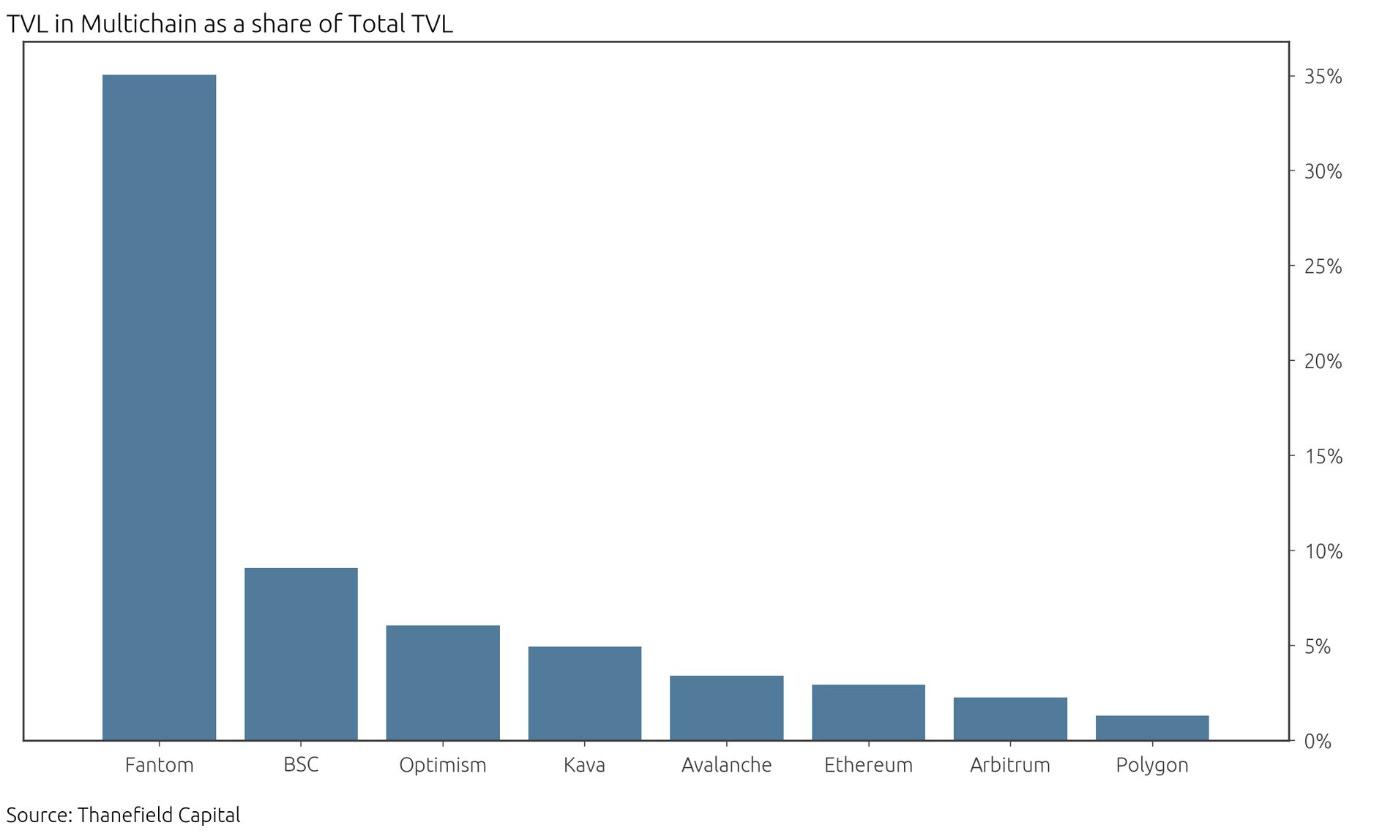

As a bridging protocol, some L1s & L2s are more severely exposed to Multichain: Fantom is the most exposed with 35% of its TVL being locked on Multichain, followed by BSC (10%) and Optimism (8%).

However, Fantom representative Andre Cronje said he wasn't particularly concerned about the incident because the assets are secured by the multi-party computation protocol and the Fantom bridge is unaffected. "If something did happen, it would impact multichain-issued USDC, DAI, and wBTC. Everything else of significance is natively issued," according to Cronje.

MakerDAO is attempting to position DAI as the central yielding stablecoin with proposed increase in the DAI Savings Rate.

MakerDAO’s core development team has proposed to increase the DAI Savings Rate (DSR) to 3.3% which currently stands at 1%.

The idea is to bring the DSR closer to the Fed Fund Rate of 5-5.25% creating a higher on-chain yield. MakerDAO is planning to improve DAI’s position as the leading decentralised stablecoin in DeFi by gradually increasing the Savings Rate, effectively passing on interest income from their RWA investments to DAI holder.

Some critics of this move point to higher borrowing costs for DAI which could impact the adoption of DAI across DeFi. As a first sign, MakerDAO’s lending protocol Spark will be impacted and needs to increase DAI borrow rates to 3.3.% in line with the Savings Rate.

Dan Elitzer of VC firm Nascent Capital explores ideas around oracle-free lending.

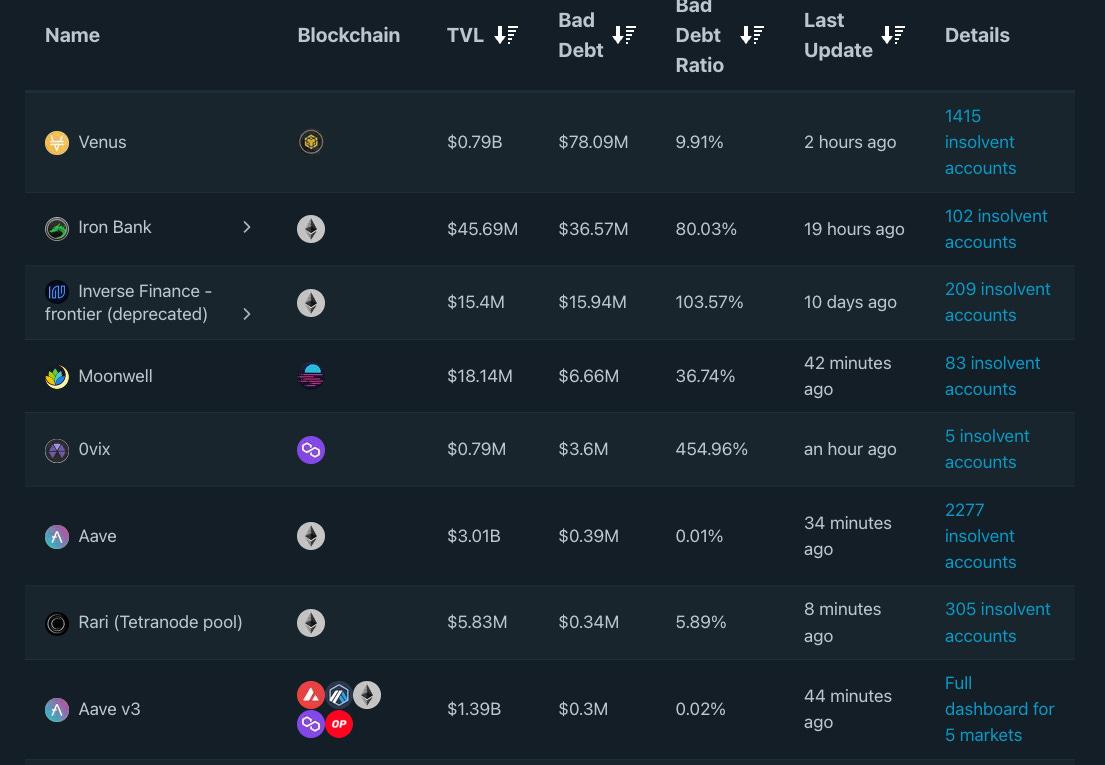

In a recent blogpost, Dan identifies several issues with DeFi primitives in their external dependencies, such as governance & oracles. He points to oracles in particular as a source of vulnerability given the reliance on a handful - if not less - service provider and the complexities of bringing external data on-chain.

For lending protocols specifically, Dan lays out a vision where oracles are removed from the protocol. Instead, lenders have to take care of the underwriting and risk management process and should “bring their own oracle”. This would have the added benefit that protocol bad debt cannot arise - which is a multimillion dollar problem according to the RiskDAO bad debt dashboard.

This would also enable external service providers like DeFiSaver and other to gain more traction as a tool to actively manage risks.

By expanding the number of external service provider, there is less concentration risk if one provider (eg Chainlink) goes offline.

The entire thread/blogpost is worth a read and can be found here.

Binance launches NFT lending

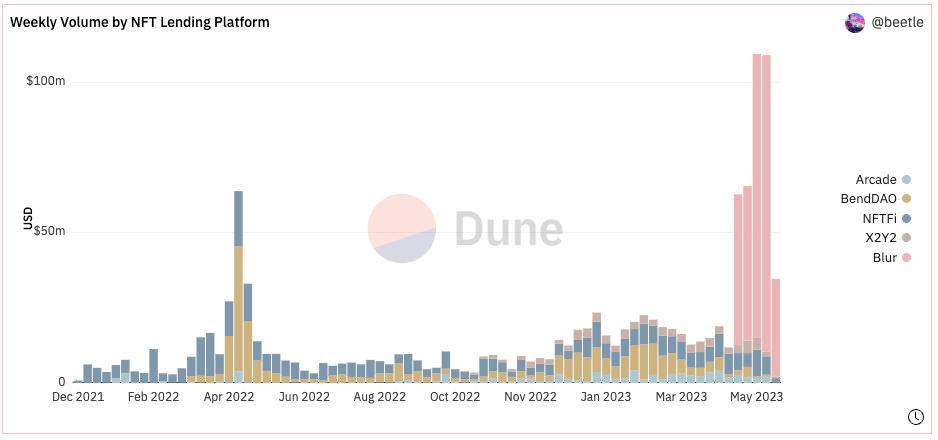

NFT lending is another hotbed of crypto innovation with significant traction. Hot on the heels of Blend’s stellar usage, Binance is launching an NFT lending service.

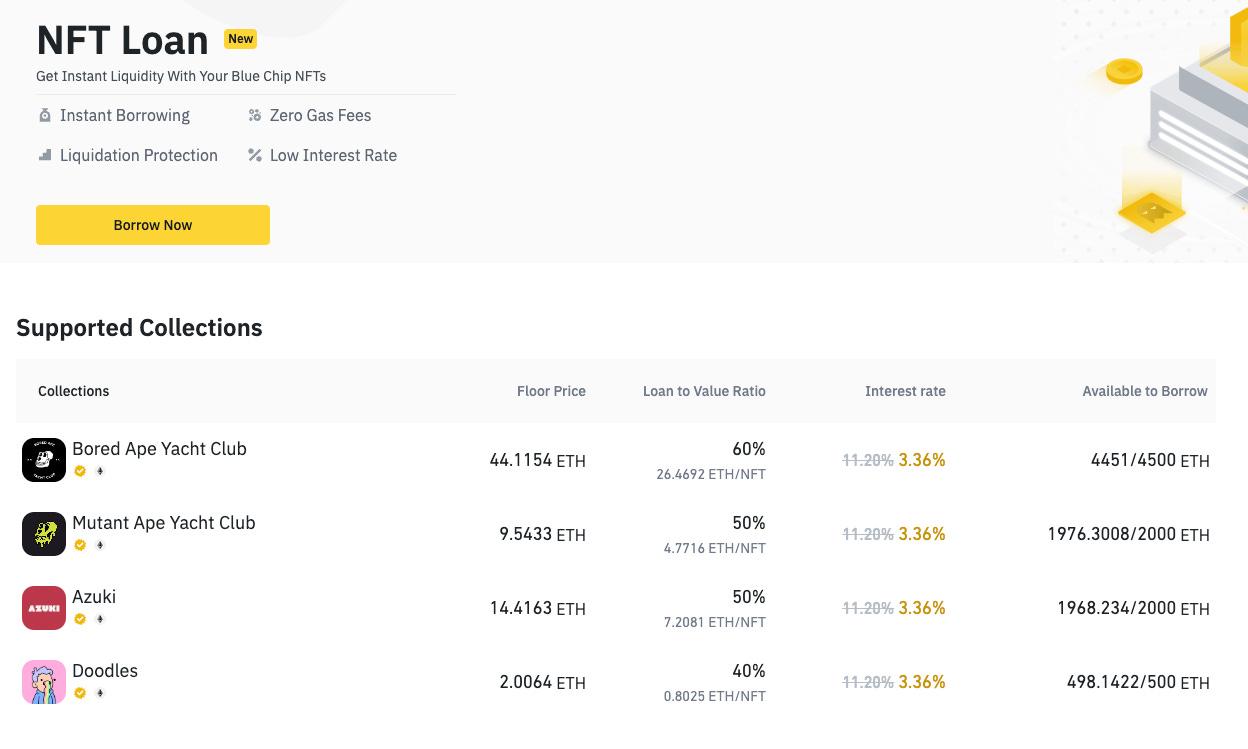

Binance’s NFT lending service is launching with an inaugural collection of blue-chip NFTs such as BAYC, MAYC, Azuki & Doodles. LTVs range from 40-60% at interest rates of ~3.4%.

Short news & announcements

Thanks for reading The State of DeFi Lending! Subscribe for free to receive new posts as they are published.

This post is public so feel free to share it.