Recently I've been studying the greatest traders of all time.

Steve Cohen is one of the most infamous figures on Wall St. The billionaire and Mets owner even has a TV show called Billions written around him. Here are some takeaways on what made him so successful.

[THREAD 1/10]

Cohen had a love for markets from a young age, and after graduating from Wharton traded in the options arbitrage division at Gruntal & Co, generating the firm $100K a day.

Eventually, Cohen decided to launch his own hedge fund SAC Capital in 1992.

SAC Capital grew its AUM from $25 million to $16 billion with an average annual return of 30% -- becoming one of the best-performing hedge funds in the world.

However, in 2013 SAC pleaded guilty to insider trading charges and converted into a family office called Point72.

SAC utilized a combination of fundamental/quant research alongside some other "questionable" data sources.

SAC regularly traded 20 million shares per day in 1999, accounting for approximately 2% of all stock trading by 2006. Cohen personally accounted for 10% of SAC's profits.

Today Steve Cohen is one of the 100 wealthiest people on Earth and now focuses on his ownership of the Mets which he bought back in 2020 for $2.4 billion.

Here are a few quotes on trading/markets from Steve:

Cohen on cutting losers and letting winners ride:

Cohen on how to trade around catalysts, using a short that he put on as an example to describe his thought process:

Cohen on the importance of understanding yourself:

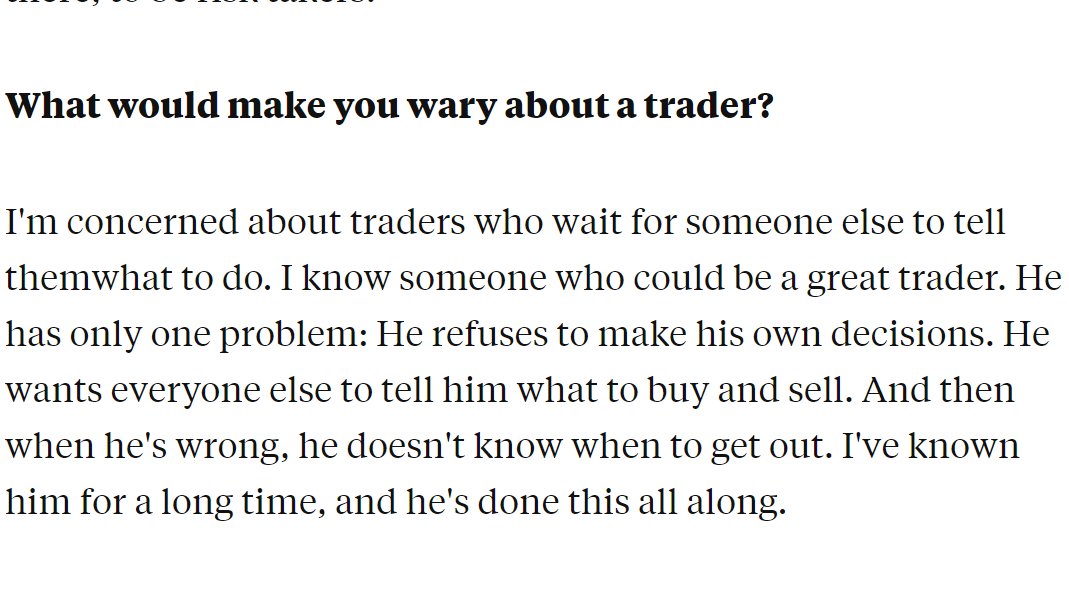

Cohen on the importance of thinking for yourself:

I hope you enjoyed this short thread as much as I did learning while creating it. Let me know what trader/entrepreneur you'd like me to cover next :)

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content