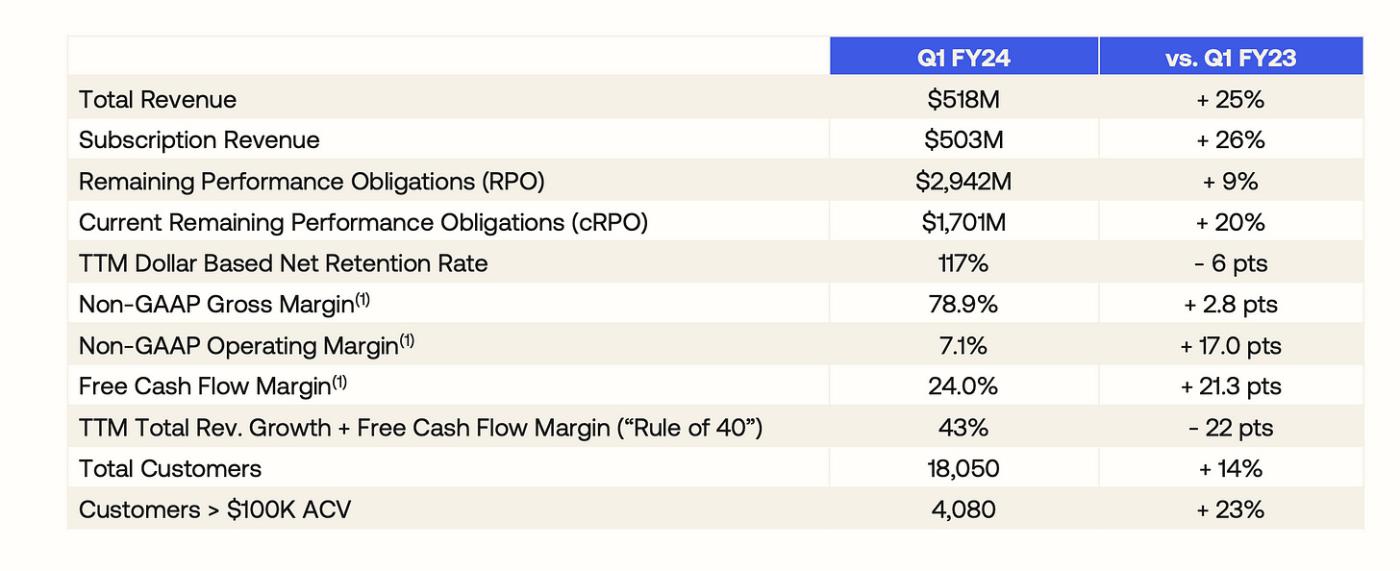

Okta reported earnings after market close yesterday. Revenue was $518M vs. $510M expected. Adjusted EPS was $0.22 vs. $0.12 expected. Revenue grew 25% YoY while subscription revenue grew 26% YoY. It seems like a pretty good quarter but Okta stock tanked after the report. OKTA 0.00 went down 18% for today’s trading session.

In the earnings release, Okta CEO made the following statement:

We started the new fiscal year with strong non-GAAP operating profit and record cash flow, which is a testament to the actions we’ve taken to increase efficiency and profitability. Identity is a key building block for projects around the long-term trends of zero trust security, digital transformation, and cloud adoption. As the leading independent and neutral identity partner, Okta is the choice for over 18,000 organizations’ most critical initiatives. While macroeconomic pressures are increasing, we are well positioned to advance our leadership position by delivering valuable product innovation to our customers while delivering non-GAAP profitable growth to our shareholders.

Overall, it was a pretty solid quarter. However, like Zoom, Okta’s stock-based compensation of $166M (32% of revenue) is quite high. Paying stock is not too different from paying cash from the shareholders’ point of view. If a company never runs out of cash but shareholders keep getting diluted, is the company a good investment? I personally think it’s tolerable if the company is growing fast, i.e. 30+% topline growth YoY. But if the stock based compensation (SBC) is not used to support growth, it’s not really sustainable. These formerly high growth companies really need to scale back SBC and make actual profits. Hopefully, this common disease of outrageous SBC for growth stocks will be gradually cured through this white-collar recession.