Original Author: [email protected]

Original source: everVision

Recently, from BRC20 to ORC20, from "Wizard" to "Pepe the Frog", these memes of the Bitcoin ecology have been so convincing that the market has completely FOMO. At the same time, in addition to the Ordinals protocol, the forgotten Bitcoin inscription protocol RGB, and various Bitcoin L2 projects have become new hot spots, and some new projects have entered it, hoping to participate in building the Bitcoin ecosystem , a piece of the new narrative.

What is the technical essence of Bitcoin inscriptions (Inscriptions), is it inscribed on "Satoshi"? What's up with Bitcoin L2? Can an ecology be built on Bitcoin? Let's take a look.

What is a Bitcoin "Inscription"

Bitcoin is a decentralized ledger that records every transaction that takes place on it. When each transaction is submitted, in addition to the basic transaction metadata, the Bitcoin network also allows the submission of a string of custom characters, which can be understood as transaction notes. This transaction comment field used to be mainly the "op_return" field, after Taproot upgrade, it can also be the transaction witness field. Wherever it exists, this part is stored on the Bitcoin chain as part of the transaction.

So what is the inscription on "Cong"? In fact, the Ordinal protocol was first used to issue NFT. In the process of mint Ordinal NFT, you will get 1 Satoshi, and the metadata of the NFT is engraved on the transaction of this 1 Satoshi, so that this 1 Satoshi is bound to the NFT. . If you are willing to pay a higher cost, you can also engrave the complete data of the NFT. The witness field supports engraving up to 4M content.

But please note that the Bitcoin network will not recognize the binding relationship between Ordinals NFT and Satoshi. When you transfer 1 Satoshi to someone else, the Bitcoin network will not distinguish whether it is a Satoshi bound to an NFT or an ordinary one. Satoshi. This means that you may accidentally pay this special Satoshi when transferring funds.

As we all know, Bitcoin's ledger is the UTXO model, which is an accounting model that simulates physical cash. What is placed in each person's account is not Bitcoin, but UTXO one by one, just like paper money one by one. When you need to pay others, if you have multiple banknotes in your account, you can choose which banknote to use (optional UTXO). You can use one banknote to pay for a transaction, or you can use multiple banknotes to pay for a transaction. If the amount you want to pay is less than the minimum amount of banknotes in your hand, you can also pay for the banknote at one point For two, one is paid to the other party, and one is paid to oneself (this is what is often referred to as "change" in the UTXO model).

Most Bitcoin wallets do not put the optional UTXO function in a conspicuous position when paying, but hide it in the advanced settings. By default, the wallet will automatically select which one or several to use according to a set of random rules defined by itself. UTXO to pay.

In order to prevent the special satoshi from being mistakenly paid out as ordinary satoshi, "client verification" is required. If the wallet supports the Ordinals protocol, it will avoid special Satoshi when paying. If you want to transfer this special Satoshi, the wallet will also prompt you that you are transferring an NFT. That is to say, wallet clients that support the Ordinals protocol are responsible for maintaining and identifying the binding relationship between NFT and special Satoshi.

The principles of RGB and Ordinals NFT are the same, and both rely on the client to verify the binding relationship between NFT and Satoshi. And this is essentially an off-chain consensus.

Are BRC20 tokens inscribed on "Satoshi"?

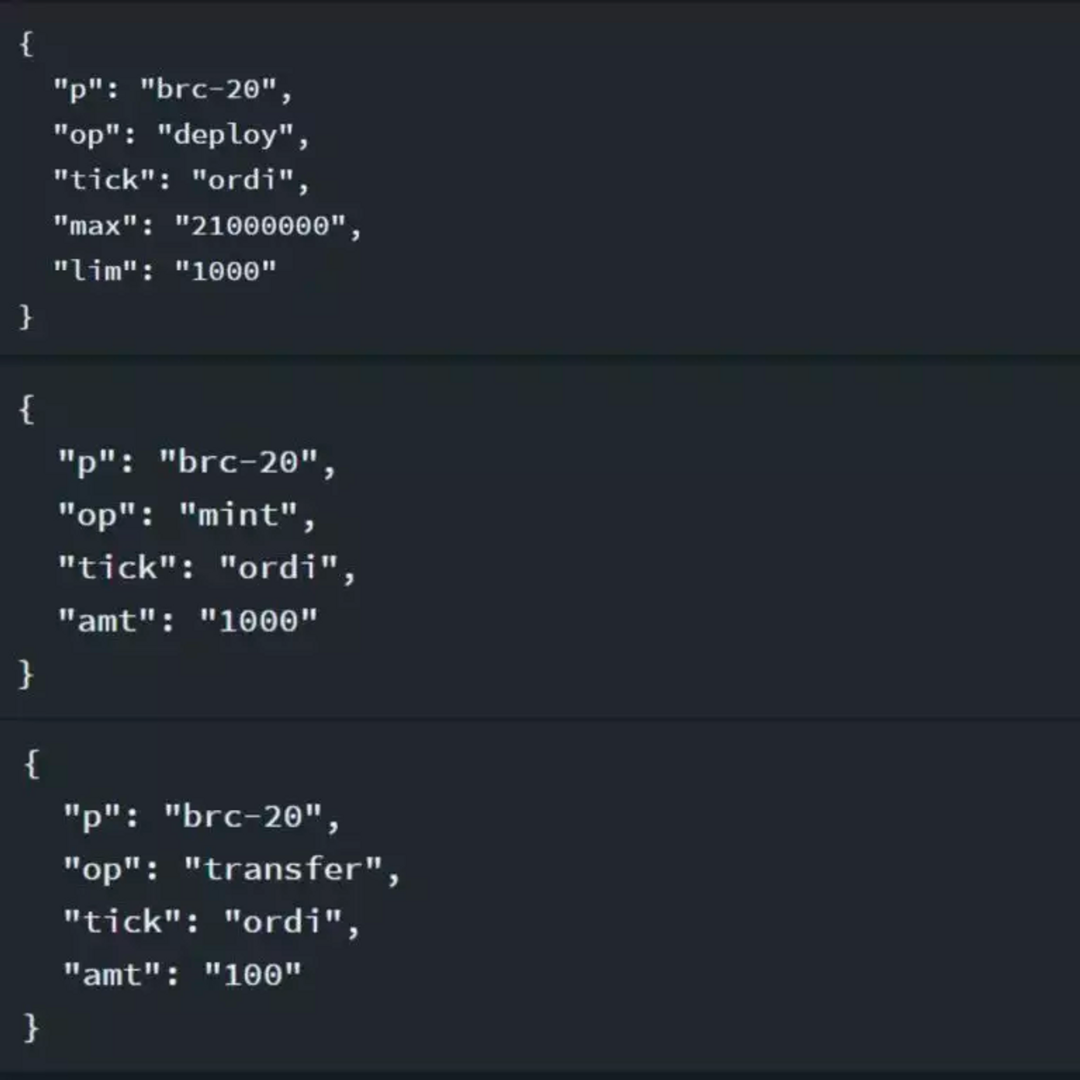

Both Ordnals NFT and BRC20 tokens are essentially inscriptions in Bitcoin transactions, rather than inscriptions on "Satoshi", but Ordinals NFT will establish a binding relationship between NFT and Satoshi. BRC20 tokens are different, there is no binding relationship between tokens and Satoshi. BRC20 tokens implement operations such as deployment, minting, and transfers through inscriptions. Specifically, it is realized by writing state transition data in jason format in bitcoin transactions. As shown below:

Anyone can write on the Bitcoin chain, not necessarily through a specific client. If someone mints BRC20 tokens through the inscription mint, or transfers BRC20 tokens that he does not own. This mint or transfer is invalid. But the Bitcoin chain itself does not process these codes, nor will it verify whether the mint and transfer of BRC20 tokens are valid.

The work of verifying the validity of the inscription is done by the wallet client or browser that supports the Ordinals protocol.

It can be understood that the Ordinals protocol actually uses the Bitcoin protocol as a hard disk and records its own ledger on the Bitcoin chain, but the interpretation rules for the ledger are local and not on the Bitcoin chain. Or we can use the idea of a modular blockchain to understand: the Bitcoin chain is just the Data Accessiblity Layer (Data Accessiblity Layer) of the BRC20 token, and the Ordinals protocol itself is the real consensus layer. This logic is consistent with the "sovereign Rollup"The concept is very similar.

The difference between BRC20 and Ordinals NFT is that the transfer of Ordinals NFT is not realized through inscriptions, and the transfer function is not required. Just transferring a specific Satoshi is equivalent to transferring the corresponding NFT. This structure naturally supports the Lightning Network. BRC20 tokens are not bound to Satoshi, and transfer information is recorded through inscriptions. Specific compatibility development is required to support the Lightning Network.

Is the "Inscription" token safe?

Whether it is Ordinals NFT or BRC20 tokens, although the ledger exists on Bitcoin, the consensus rules are all off-chain. So "Inscription"-style tokens don't exactly share the security of Bitcoin.

As a data availability layer, the Bitcoin chain does not perform any verification on the inscriptions. Both valid and invalid inscriptions will be submitted. The Bitcoin chain itself has no ability to distinguish whether the inscription is valid or not. Therefore, although the ledger of the Ordinals protocol is stored on Bitcoin, it is a "dirty ledger". All valid data is stored on it, but not all stored data is valid. The filtering of "dirty books" is done through "client verification".

This "filtering rule", or the "interpretation rule" for the validity of the data on the chain, is the ontology of the Ordinals protocol. "Inscription" tokens are only safe if the set of rules defined by the Ordinals protocol itself has a strong social consensus.

Can an ecology be built on Bitcoin?

The Ordinals protocol can only be used to issue Tokens at present, but if Ordinals makes the inscription system, that is, the rule system complex enough, it can be used for DeFi. The spirit is complete, and any contract logic can be implemented.

But I don't think this is the Bitcoin ecology! This is just the Ordinals ecology. If other inscription systems, such as RGB, also make such a set of rules, it is RGB ecology, not Bitcoin ecology. The RGB ecology and the Ordinal ecology are not interoperable, nor can they rely on Bitcoin to provide interoperability. It feels like, one contract on Ethereum cannot access and call another contract...

What is Bitcoin L2?

First of all, we need to define L2. L2 refers to the chain that attaches security to other L1. Bitcoin L2 is a chain whose security is attached to Bitcoin, or Bitcoin L2 is a chain that shares security with Bitcoin.

According to this standard, Rootstock, Liquid, and Stack are not L2 of Bitcoin, but can only be regarded as side chains of Bitcoin. Stack claims that it will implement shared security with Bitcoin in the next version update, but did not disclose the specific plan.

At present, various fancy solutions proposed by various projects that claim to be Bitcoin L2, but are actually side chains, have no way to share security with Bitcoin, including:

- Write the block header on the Bitcoin chain (similar to the Plasma solution that has been eliminated by Ethereum)

- Use Bitcoin as a network pledge token

- Elect block producers on the Bitcoin chain

- Synchronize with the Bitcoin chain to generate blocks

- Incentivize Bitcoin Miners to Become L2 Network Validators

invalid behavior

invalid behavior

It is not impossible to want to share security with Bitcoin. We can imagine, what if the Ordinals protocol not only stores ledger data through inscriptions on the Bitcoin chain, but also puts the entire Ordinals rules defining data validity (ie, the source code of the Ordinals protocol) on the Bitcoin chain?

In this case, although "client verification" is still required to achieve verification during a series of operations. But any subject can run a clean ledger through the "rules" and dirty ledger written on the chain, and get a consistent state transition record and final state.

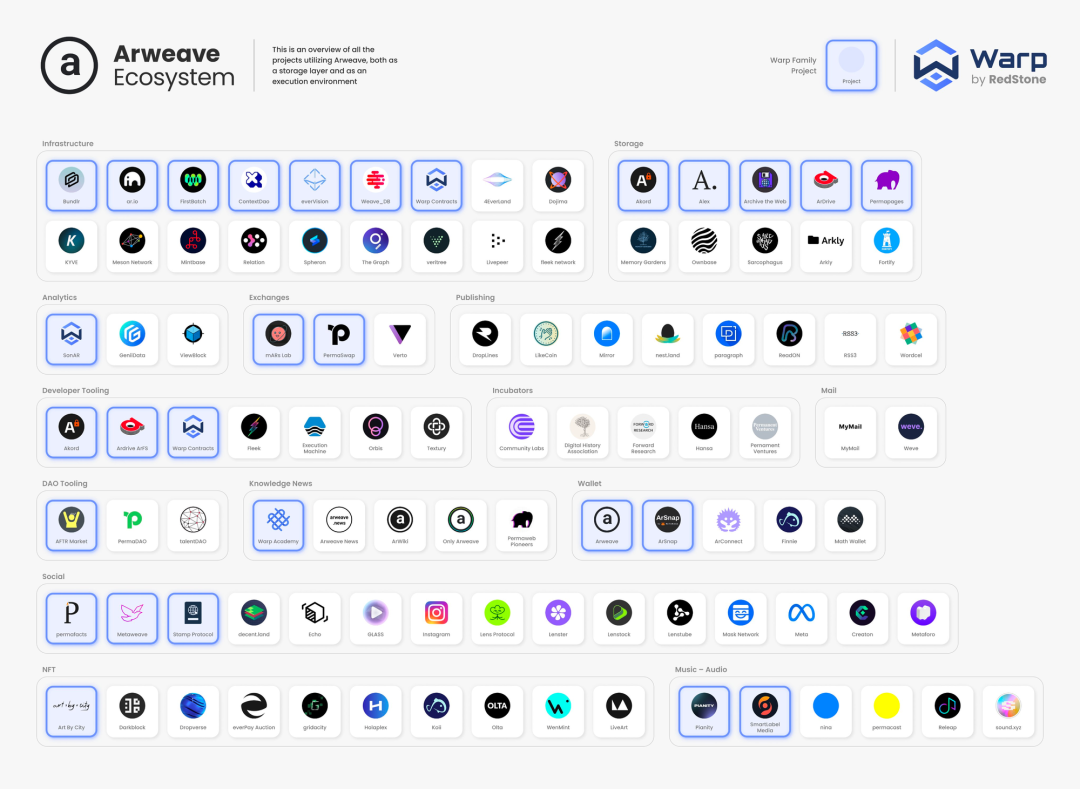

This form is not a new thing, but a storage consensus paradigm proposed by Arweave - SCP , which is suitable for building heavy-duty applications that do not require high interoperability but require high performance. Arweave has been accumulated for many years, and there are already 100+ SCP applications on it.

If you want to build SCP applications based on Bitcoin, it is technically feasible, but economically constrained, you can only build applications with a relatively simple form, because frequent inscriptions on Bitcoin are not generally expensive.

summary

Having said all that, I don't mean to completely dismiss efforts to build various services on top of Bitcoin. I understand that PoW supporters are dissatisfied with the upgrade of Ethereum, and I also understand the need for Bitcoin miners to seek increased income under the expectation of halving. Of course, the Bitcoin network can make some meme tokens and collectibles through inscriptions, but the story should Enough is enough, and no more time should be wasted on replicating the Ethereum ecology on Bitcoin (whether it is the "inscription" method or the L2 method), because this will not create any new value for the entire Web3.

In the final analysis, doing ecology on Bitcoin is equivalent to doing what Ethereum can do in a crappy and more costly way. In the Bitcoin ecology, nothing new can be born. I don't deny that the price miracle and wealth creation myth surrounding the concept of "Bitcoin ecology" may continue, but as a long-termist, I pay more attention to new narratives that can create real value, broaden the usage scenarios of Web3, and let Web3 go out of the circle.