Sei's technical advantages are subverting the traditional DEX network environment.

Author: Daniel Li

The SEC’s lawsuit against Binance was the biggest event in the crypto industry in the past month. Affected by this incident, the prices of most crypto assets have been cut in half in the past few weeks. The crypto market that has just entered Xiaoyangchun once again Caught in the shadow of a bear market. This incident also caused crypto users to lose trust in centralized exchanges (CEX), which further strengthened the need to develop decentralized exchanges (DEX). Sei Network, as a Layer1 public chain built using the Cosmos SDK, aims to become the chain of choice for DEX in DeFi, NFT, and GameFi. Sei's built-in Order-book infrastructure, extremely fast execution speed, deep Liquidity and fully decentralized matching service provide DEX with a more secure, transparent, efficient and trustworthy network, and also bring new innovation and development opportunities.

Sei is built for transactions and aims to be the fastest layer1 public chain

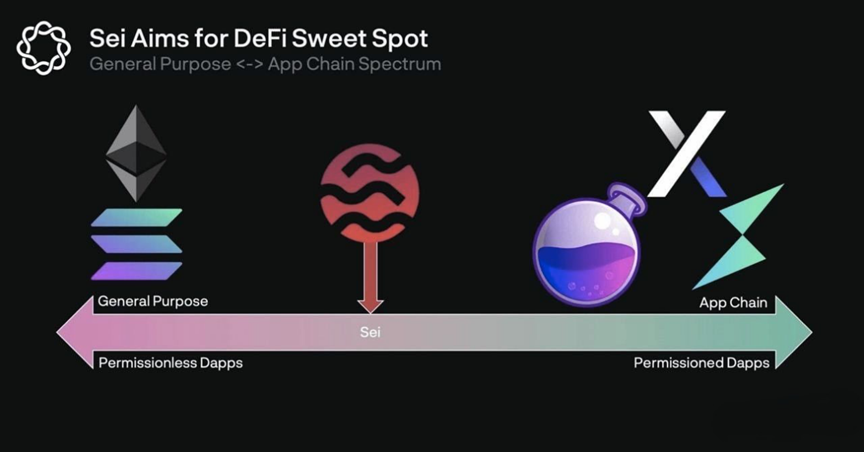

Traditional layer1 public chains can be roughly divided into two categories, one is general-purpose public chains, such as Ethereum, Solana, etc., and the other is application-specific chains, such as dYdX, Osmosis , etc. These public chains have their unique advantages and characteristics in terms of technical implementation, but there are certain limitations in terms of transaction scalability. Sei, as a nascent Layer 1 public chain, is different from other public chains in that it does not choose a side between general-purpose chains and application-specific chains. Instead, Sei finds a middle ground between the two, becoming a public chain purpose-built for transactions. Compared with general public chains, Sei has been optimized at every level of the technology stack to provide the best transaction infrastructure. Compared with application-specific chains, Sei is a relatively general-purpose public chain that can support various transaction applications, rather than only targeting a specific application. This makes Sei a more flexible and customizable trading infrastructure capable of meeting the needs of different types of trading applications.

As a transaction-focused public chain, Sei aims to solve the scalability problems faced by current on-chain transactions and become the fastest Layer 1 public chain. To this end, Sei has implemented several important improvements to its underlying network architecture, including a Twin Turbo consensus mechanism that achieves industry-leading performance levels. Sei's technical success largely comes from the Twin Turbo consensus, which can help Sei achieve a finalization time lower bound of 300 milliseconds, which is 10 times faster than Solana. In addition, Sei also implements an order matching module of a composable architecture, which means that Dapp on Sei are synchronously composable. Through Sei's many bridging partners, the IBC, EVM, and SVM ecosystems will all have asynchronous composability, which enables seamless connection and interoperability between different blockchain ecosystems, and developers can choose more flexibly. The tech stack they need.

Sei also improves throughput by 5-10x through market-based parallelization and supports order batching, which simplifies the process of updating multiple orders across different exchanges. These are innovative features implemented by Sei in optimizing the performance of trading applications. In addition, Sei's Liquidity center and its underlying technology are also very beneficial for the operation of various Dapp . Sei's Liquidity management system can help DeFi, GameFi, and NFT applications provide users with a deeper Liquidity system and cost-effective transaction process while leveraging the agility and efficiency of the Sei blockchain.

Transaction is the most basic application scenario and use case of blockchain technology, and it is also an important force to promote the development of blockchain and Web3. Sei offers a compelling product for developers looking to build applications on top of general-purpose layer 1 by building a dedicated public blockchain for transactions. The emergence of Sei fills the gap in the current transaction-exclusive public chain, brings new opportunities and challenges to the development of blockchain technology and Web3, and also provides more possibilities for the circulation and transaction of digital assets.

Sei's technical advantages are subverting the traditional DEX network environment

With the rapid development of Web3, the exchange as a centralized place for asset transactions has become more and more important. At present, exchanges are mainly divided into centralized exchanges and decentralized exchanges. In the past, centralized exchanges have dominated. However, as the leading centralized exchange, Binance, is being sued by regulators, higher regulatory pressure on centralized exchanges will push the market to turn to decentralized exchanges. This requires DEXs to scale and accommodate huge waves of adoption.

Given that DEXs have unique requirements for speed, throughput, reliability, and front-running transactions, specialized infrastructure needs to be built to address these issues. Sei was born for exactly this, providing a solution to the DEX scalability problem and enabling exchange applications to scale efficiently while maintaining decentralization and capital efficiency. Sei's technical advantages mainly include the following aspects:

Order Matching Engine

Sei is a Layer1 public chain based on the Cosmos ecology. Like Ethereum, Sei also allows users to transfer assets and deploy smart contracts. However, Sei is unique in that it also creates an order placement and matching engine at the chain level. This order matching engine is one of Sei's core features as it makes it easy for anyone who wants to build an exchange to use this engine to create an Order-book based exchange. This means builders can omit the step of building an Order-book from scratch, making it more technically and cost-efficient.

Additionally, Sei's order matching engine provides a limit order design space similar to regular centralized exchanges such as Binance and Coinbase. It creates a set of orders at different prices and allows asset values to be updated based on executed orders. The benefit of using an Order-book exchange is that it provides higher Liquidity and better price discovery mechanisms. While technically, launching an Order-book-based exchange and providing it with Liquidity is more challenging than on an AMM DEX, Sei aims to provide a platform for developers and users of decentralized applications built on the network. cost-effective system. This way, they can build Order-book based exchanges more efficiently without losing security and reliability.

Parallel Order Execution

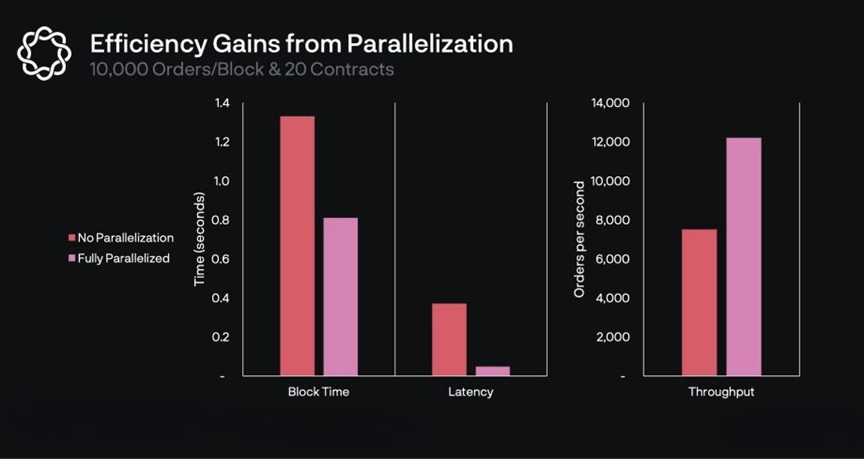

Sei's parallel order execution is a major improvement. It is able to process orders within the same market sequentially, while simultaneously processing orders from different markets. This approach significantly increases Sei's throughput while ensuring deterministic behavior among validators. In traditional blockchains, order processing occurs sequentially, meaning that each order must be processed in the exact order it was received, regardless of the asset or market it interacts with. Sei's approach is different, allowing orders from independent markets to be processed simultaneously, which results in Sei achieving faster block times, lower latency, and higher throughput at all load levels. This marginal improvement is especially noticeable at high loads.

According to Sei internal test data, in the case of 10,000 orders/blocks and 20 different contracts (markets), parallelism can reduce block generation time from 1.33 seconds to 0.81 seconds, and delay from 371 milliseconds to 48 milliseconds , the throughput increased from 7500 orders/s to 12200 orders/s. As the load increases, the degree of marginal optimization becomes more significant.

Twin-Turbo Consensus Mechanism

Sei's Twin-Turbo consensus mechanism optimizes and upgrades Cosmos' ABCI, making each step of the consensus programmable. This consensus mechanism consists of two parts: one is intelligent block propagation, and the other is optimistic block processing.

Smart block propagation is designed to improve block processing speed and efficiency. On Sei Network, block proposers can send compressed block proposals containing only transaction hashes rather than detailed block content. During the block broadcast phase, if a validator has all the transactions in the proposal in its local mempool, it will rebuild the entire block from its mempool without waiting for all block parts to arrive. This process significantly reduces the total time validators spend waiting to receive blocks. If no transaction exists in a validator's mempool, the validator can simply revert to waiting for the uncompressed detailed proposal to arrive. According to Sei's tests, in more than 99.9% of cases, each validator already has a transaction in its local mempool due to the network's gossip mechanism. Therefore, this intelligent block propagation method can greatly speed up the throughput of Sei, while still ensuring the validity of transactions.

Optimistic block processing is a blockchain verification method that enables a faster and more efficient verification process. Unlike traditional non-optimistic blockchains, optimistic block processing skips the pre-voting and pre-committing steps, allowing validators to directly call the block finalization function, thereby speeding up block verification and voting. On the Sei Network, validators can also optimistically process the first block proposal they receive at any height by initiating parallel processing and writing state candidates to the cache. This greatly reduces latency due to delays in block production, increasing Sei's throughput.

Through the Twin-Turbo consensus mechanism, Sei shortened the block confirmation time from 6 seconds in the Cosmos chain to 500 milliseconds, achieved the fastest final block confirmation time in the entire network, and reached a throughput of 20,000 transactions per second . This efficient consensus mechanism also makes Sei an efficient, scalable and programmable blockchain system, providing DEX with faster and more efficient services.

In addition to the three major improvements above, Sei adds other features in the base layer. These include:

1. Single block order execution: In Sei, orders are allowed to be placed and executed in a single block, while in Serum, multiple blocks are required to complete.

2. Order bundling: Market makers can update prices for multiple markets in one transaction, improving efficiency.

3. Frequent batch auctions: market orders can be aggregated at the end of a block and liquidated at a single price. This approach is designed to try and minimize front-running.

4. Native price oracle: A native price oracle is integrated into Sei's base layer, ensuring reliable price information from on-chain markets.

The introduction of these functions can further improve the efficiency and scalability of Sei, making it a more comprehensive blockchain network and providing better services for DEX.

Sei Network ecological development

The ecological layout has always been the focus of Sei's development, especially after entering 2023. In January and April, Sei received two ecological investment funds. Among them, the USD 20 million encryption ecological fund of the encryption trading platform MEXC and the USD 50 million encryption ecological fund of Foresight Ventures and the cryptocurrency exchange Bitget, plus the Multicoin Capital, Delphi Digital, Hypersphere and many other investment institutions received in September last year and a $50 million investment in market makers. As of now, the total size of the Sei Ecological Fund has soared to 120 million US dollars.

These ecological investment funds provide Sei with more resources and support, helping Sei to further expand its influence and market share in the blockchain field. The participation of many institutions also reflects that all parties are generally optimistic about the prospects of the exclusive trading public chain created by Sei.

Although Sei's Mainnet has not yet been launched, its ecosystem has attracted many well-known projects to join. As of now, more than 150 teams have gathered on Sei Network to develop projects on it, and the project types cover infrastructure, DEX, MEV, Cross-chain, NFT, mortgage lending and other fields. In terms of ecological projects, according to the latest financing report, there are already 120 cooperative projects in the Sei Network ecology. There are currently about 70 cooperation projects disclosed on the official website, among which the key areas covered are decentralized exchanges, infrastructure, wallets and Cross-chain bridges. The addition of these cooperative projects has injected new vitality and impetus into the construction and development of the Sei ecosystem, and at the same time provided users with more choices and services.

Decentralized Exchange (DEX):

- Sushiswap: A DEX based on automatic market making, a decentralized perpetual futures exchange was launched on Sei Network in January 2023.

- Satori: An evolutionary product protocol on the chain built on Polkadot, which provides an evolutionary product protocol on the chain on Sei Network.

infrastructure:

- White Whale: A Cross-chain Liquidity protocol that provides tools for efficient markets through arbitrage, flash loans, and Cross-chain Liquidity pools. AirDrop will be held on Sei Network to reward Sei validators and token holders.

- Kado: Supports basic settings, supports Sei users to use their non-custodial wallet transfer rules and digital assets.

wallet:

- Keplr: A cross-blockchain ecosystem wallet that supports Sei Network's tokens and applications.

- Cosmoscan: Validator node operator and wallet provider, providing Sei Network's block explorer.

Cross-chain bridge:

- Gravity Bridge: A Cross-chain bridge that supports the transmission of assets and messages between Cosmos and Ethereum, providing an open access machine for DeFi projects in the Sei Network ecosystem.

- Axelar: Being able to provide various services including Multichain liquidity pools, enabling Cross-chain Liquidity to enter Cosmos, will make it easier for Sei to obtain Liquidity outside Cosmos.

Summarize

Known as the decentralized Nasdaq, Sei Network aims to build a blockchain focused on DeFi infrastructure. To achieve this goal, Sei has introduced several technical applications to improve the trading experience, including modular order matching, Twin-Turbo consensus, and various base layer functions such as parallel order execution and local price oracles. By synergizing these protocols, systems and algorithms, Sei provides the best infrastructure for trading applications and exchanges. In the fast-paced world of transactions and innovative technologies, speed, scalability and affordability are critical factors. As a high-performance, general-purpose Layer1 public chain, Sei has become the preferred solution for traders, developers, and gaming communities.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.