Original author: Crush, Biteye core contributor

With such a rich ecology on the chain, the cross-chain bridge has become an indispensable part of the entire ecology. Although the news of cross-chain bridge theft appears frequently, it still facilitates the transfer of users' assets.

With the development of Ethereum's second-tier networks such as Arbitrum and Optimism , some cross-chain bridges focusing on asset transfer between L2s have gradually emerged. In today's article, I will introduce to you two very practical cross-chain bridges - Orbiter and Layerswap.

Through the introduction of the principle, operation and some details of these two cross-chain bridges, we can see the big from the small, so as to help everyone understand the current status of the two-layer cross-chain bridge, and also facilitate themselves to make the best choice when crossing the chain.

01 Why choose Layerswap and Orbiter

Some readers may wonder, there are so many cross-chain bridges on the market at present, why not mention other things, but just introduce these two? There is another deep meaning in it, let me explain in detail.

official endorsement

First of all, what is the most important thing about the cross-chain bridge? I said it was security, so there should be no objection! As an asset transfer tool, just like the escorts who escorted goods in ancient times, safety is naturally the top priority. In addition to the various thefts of the cross-chain bridge I mentioned at the beginning, an unsafe cross-chain bridge, even if it pays the handling fee, there will be absolutely no users willing to use it.

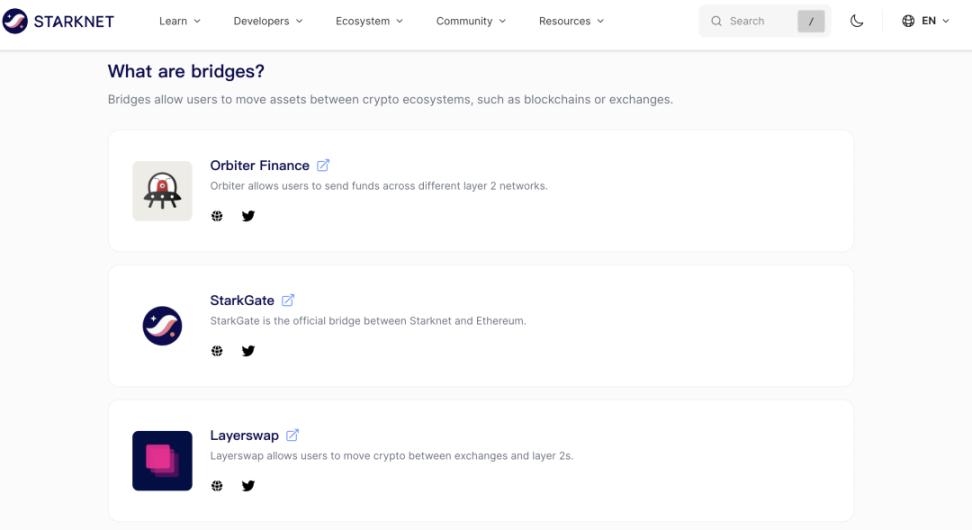

Open the official websites of zkSync and Starknet , and you can clearly see that these two cross-chain bridges are at the top of the official recommendation. With the official endorsement, the credibility will naturally increase.

(zkSync Lite official recommendation)

(Starknet official recommendation, https://www.starknet.io/en/ecosystem/bridges-and-onramps)

AirDrop expectations

As a Web3 user, the AirDrop is an unmissable reward. Among all AirDrop, public chain AirDrop are usually the largest and have the widest coverage. The two most anticipated public chain AirDrop at present should be zkSync and Starknet.

If you want to get the AirDrop of these two chains, you must experience their ecology, and both Orbiter and Layerswap have deployed these two chains early, and users can transfer assets from other chains to zkSync and Starknet very conveniently.

In addition, these two projects themselves have never been AirDrop. If users use them first when they experience the new chain, they can achieve the effect of one fish eating more, and get two AirDrop for the public chain and the cross-chain bridge.

02 Principle and operation

Principle introduction

1.Orbiter

As users, although we don't need to fully understand every step of the operation of the cross-chain bridge, we can still learn the basic principles. After all, it involves the security of our own funds. After understanding it, we can use it with more confidence.

When Orbiter is cross-chain, there are two roles: Sender (sender) and Maker (market maker). Before providing services for cross-chain initiators, market makers need to deposit excess margin in Orbiter's market maker margin contract and deposit Liquidity funds in the Maker address to ensure that Sender's funds can cross-chain normally.

(Note: The Maker address here is an EOA address configured by the Maker itself, and only the Maker can control it.)

Assuming that we now have a fund of 0.1 ETH that needs to be transferred from Arbitrum to zkSync, the normal process is that the Sender sends the fund to the Maker on Arbitrum, and the Maker needs to know the target network, that is, which chain the fund will be transferred to. and the amount and type of funding.

After confirmation, Maker will send an asset to your wallet on the target network, here is zkSync, and the entire cross-chain process is completed.

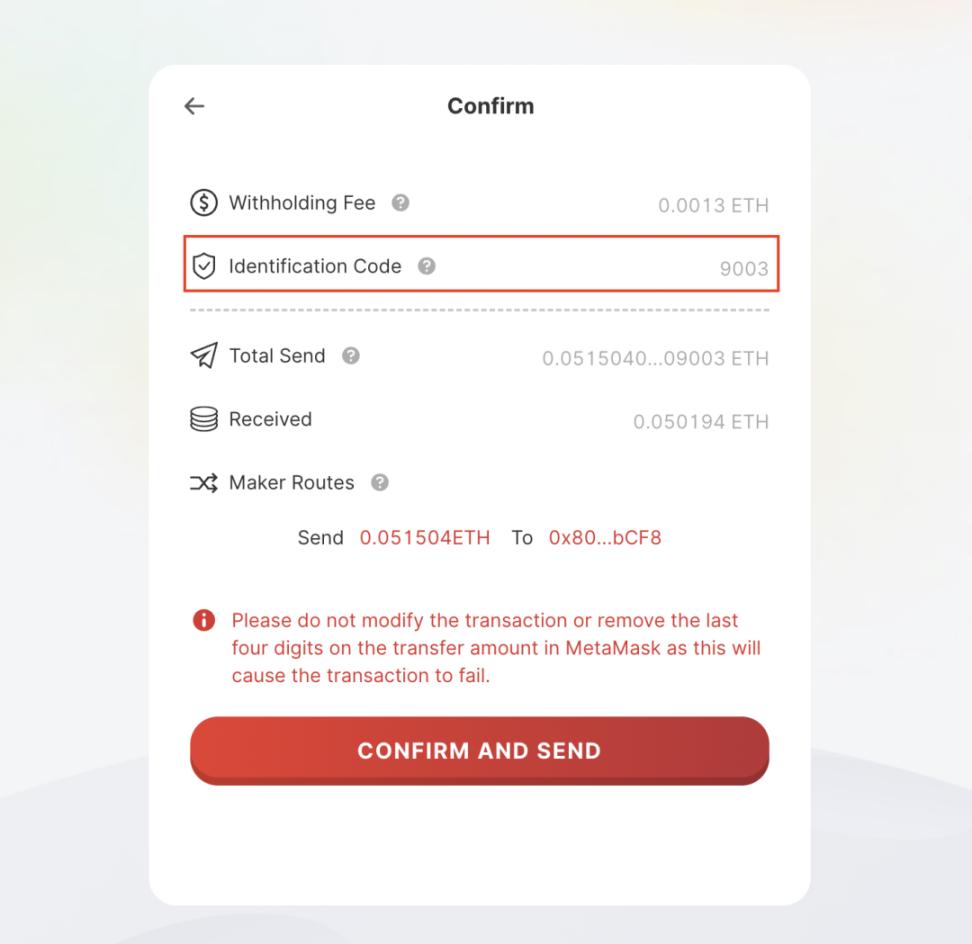

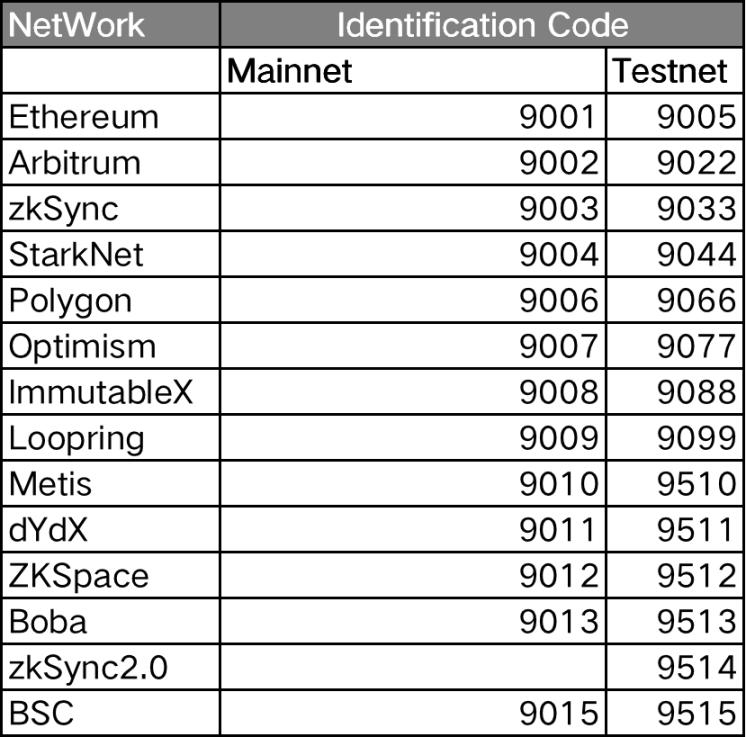

The target network is distinguished by a thing called Identification Code. This identification code will be added to the last four digits of the transfer amount when crossing chains. By checking the identification code, Maker can confirm the target chain.

(Identifier)

(identification codes for different chains)

Maker is equivalent to a fund transfer station in the whole cross-chain process. During this process, if Maker fails to send Sender's assets successfully, Sender can initiate an arbitration request to the Market Maker Margin Contract (MDC) based on the identification code and other information provided by the transaction approval interface to obtain excess compensation.

2.Layerswap

Layerswap does not disclose too much about technical principles in its user manual, but judging from its early cross-chain style, Layerswap is still different from Orbiter above.

In the early days of the birth of Layerswap, the second-layer network was not yet mature. Many users wanted to experience the second-layer Arbitrum and Optimism. They could only withdraw funds from the exchange to the ETH mainnet, and then use the official cross-chain bridge from the mainnet to transfer assets chain to the second floor.

At that time, Layerswap launched a Brasfer tool and registered its own accounts on major exchanges. If users need to cross-chain ETH to the second-tier network, they only need to transfer the assets to the Layerswap exchange account, and then they will send a sum of funds to your target address on the second-tier network.

Since there is no handling fee for transfers within the exchange, all you need to pay is almost only the transfer fee on the second layer, plus some fees charged by Layerswap itself, which can be said to be very cheap.

And how to confirm the internal transfer? Bransfer is used here. Users need to apply for a read-only API on the exchange. Layerswap can read your transfer data after getting your API.

(Bransfer connection interface)

With the development of the second layer, most exchanges have already supported the deposit and withdrawal of Arbitrum and Optimism, and even zkSync and Starknet, which have not yet issued coins, are also supported one after another.

Once the exchange supports these second layers, Layerswap seems to lose its advantages. Therefore, in the latest v2 version, Layerswap migrated Bransfer to become a built-in function, and users no longer need to register for Brasfer.

In addition, due to the merger of the two, their transaction history has also been unified, and users can view it directly on Layerswap.

From the history of Layerswap’s development, combined with the current cross-chain capital restrictions, we can guess that it will most likely use its own funds to help users cross-chain, thereby earning fees.

Actual operation

1. Orbiter

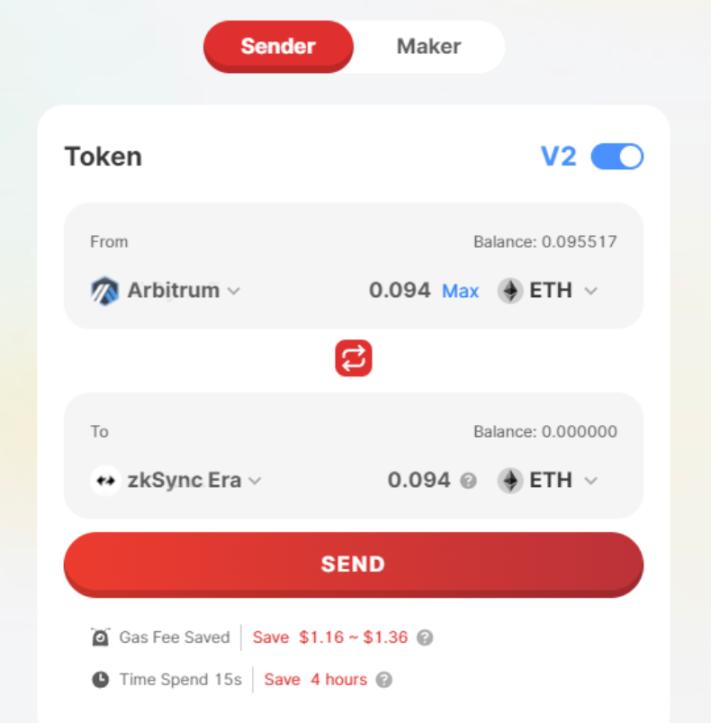

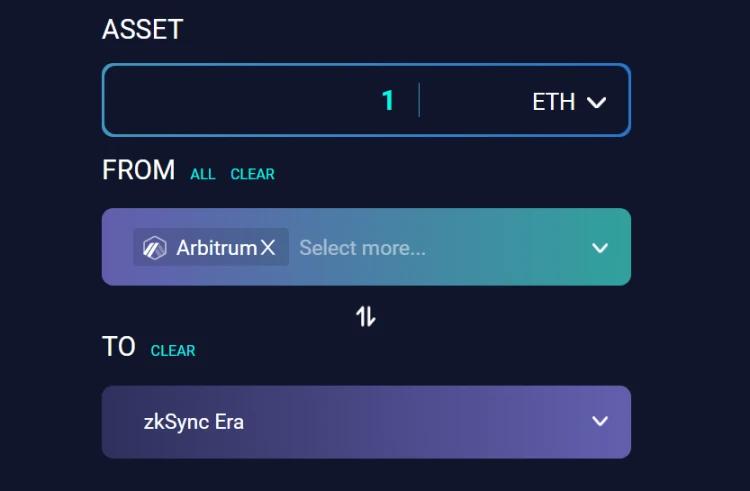

Here I use Arbitrum cross-chain to zkSync Era for demonstration. First of all, we open the Orbiter website, where the V2 version is directly used, and there will be more cross-chain tokens.

(Orbiter cross-chain interface)

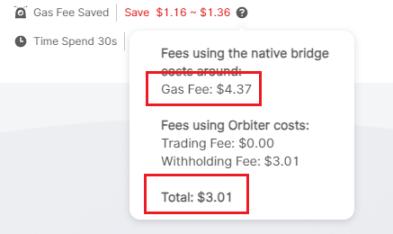

As shown in the figure, the interface is very simple, just select the corresponding chain and token, and fill in the quantity. The bottom will show how much gas fee and time you have saved. If you want to see the actual cost, put the mouse pointer on the question mark to display the cost of the official cross-chain bridge and the cost of using Orbiter.

(cross-chain fee)

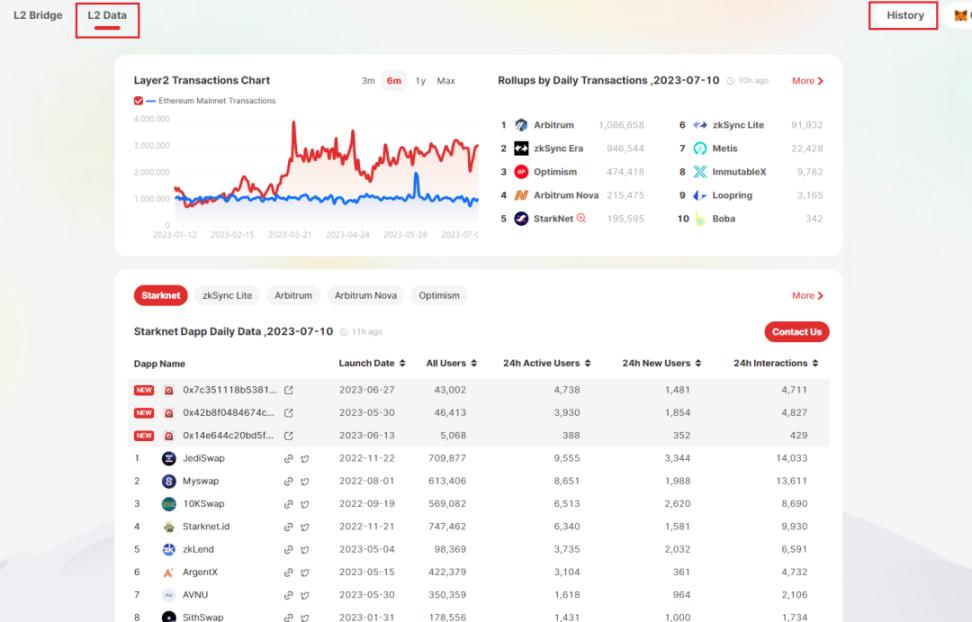

If you want to view your own cross-chain history, you can view it in History in the upper right corner. In addition to the cross-chain function, orbiter also launched a L2 data dashboard. Click on the L2 Data in the upper left corner to see the overall transaction data of the second layer and the individual data of each project.

(L2 Data)

2. Layerswap

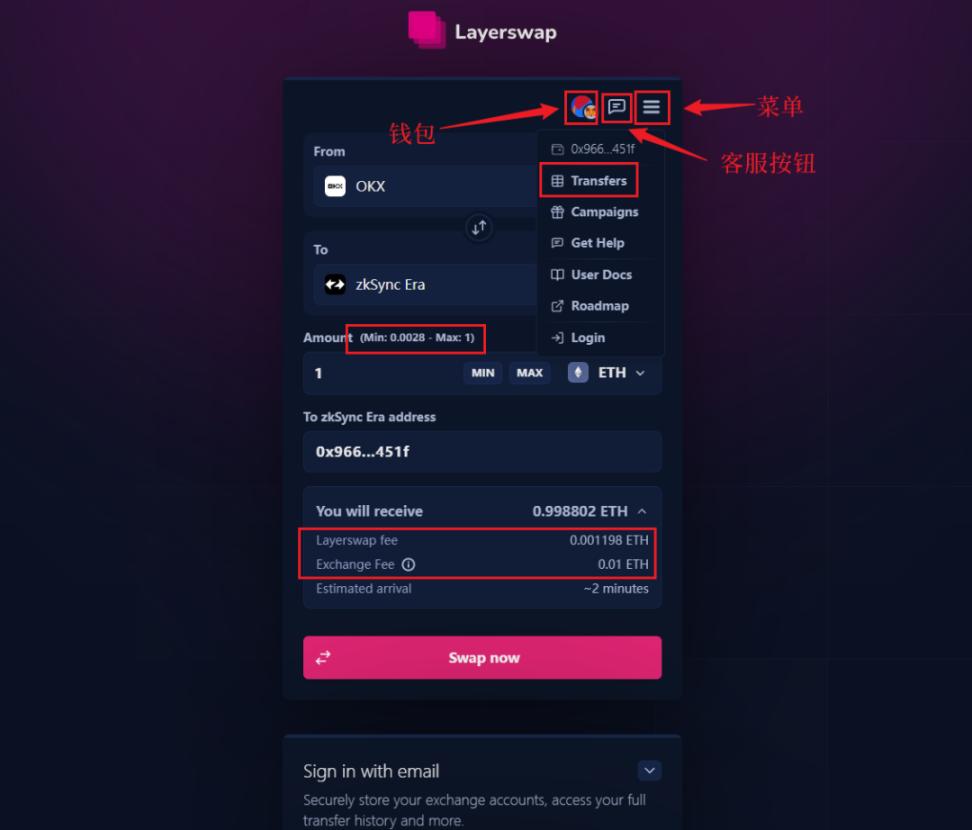

Open the official website of Layerswap, because it supports exchanges directly cross-chain, here we try to cross-chain ETH from OKX to zkSync Era.

(Layerswap cross-chain interface)

After selecting OKX and zkSync Era, enter the amount to be cross-chained. The token type cannot be changed here, only ETH can be selected, and the maximum limit is 1 ETH.

There is a customer service button in the upper right corner. If you have any problems during the cross-chain process, you can contact them directly. You can also see the history in "Transfer".

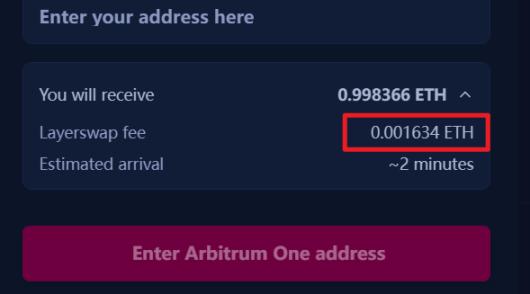

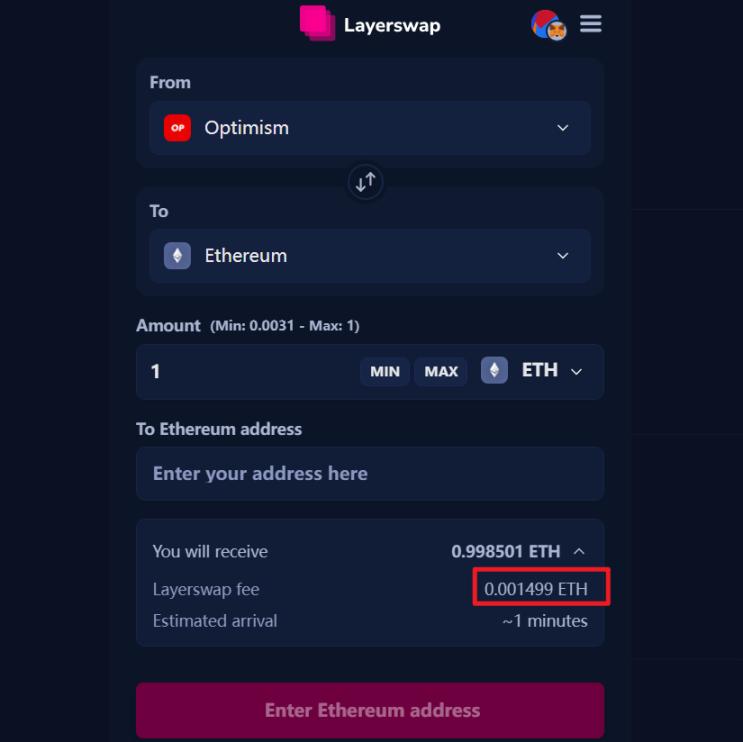

The bottom will show the number of tokens you will receive, here it shows that I will receive 0.99802 ETH. Including Layerswap Fee of 0.001198 ETH and Exchange Fee of 0.01.

For the receiving address, you can fill in the same address as the sending address, or you can customize another address, which is more convenient.

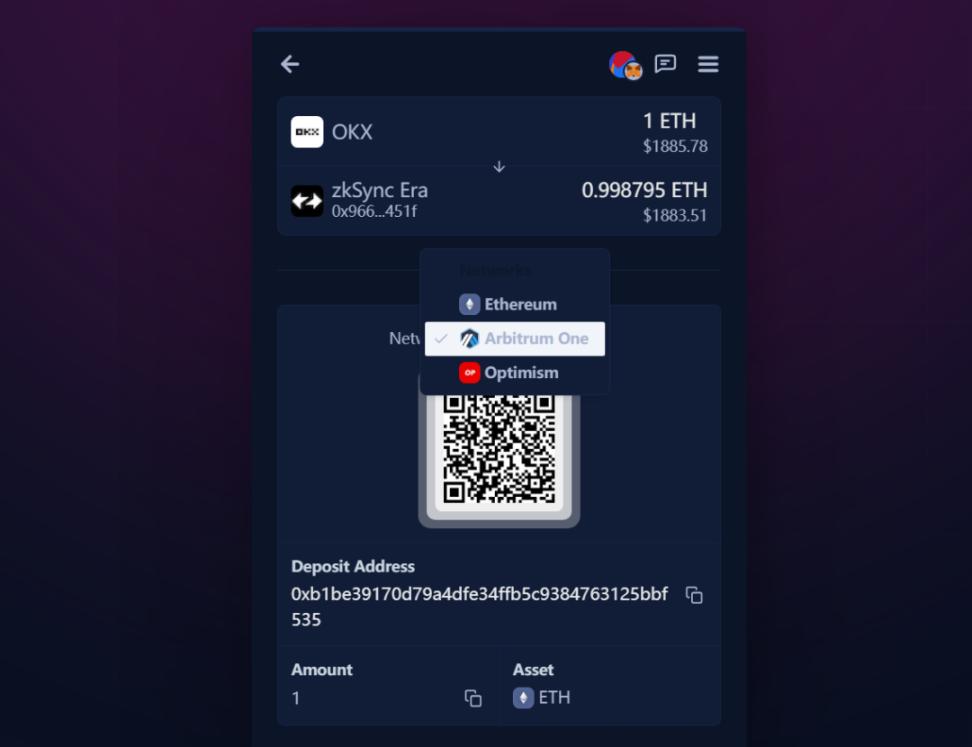

After clicking " Swap Now", you will enter the transfer interface. You need to withdraw 1 ETH in OKX and send it to the receiving address it provides you. The public chain sent here is optional, and the default is Arbitrum, which saves handling fees.

(Transfer page)

When you have completed the operation of withdrawing funds from the exchange to this address, this interface will automatically detect that the funds have arrived, and then transfer the funds to your zkSync Era address.

03 Comparison of details

The number of public chains supported

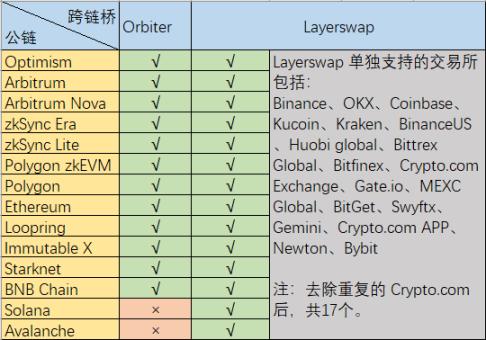

(Number of public chains supported)

From the perspective of the number of supported public chains, Layerswap has two more than Obiter, namely Solana and Avalanche , and supports cross-chain exchange withdrawals separately.

However, a large number does not mean that it is better. After the collapse of FTX , the Solana public chain is far less active than before. Avalanche's entire ecology does not seem to have any particularly eye-catching projects, and the overall activity is relatively average. Therefore, Orbiter lacks the support of these two chains, and the problem is not very big.

Cross-chain speed

In terms of cross-chain speed, we cross from any chain to zkSync Era.

Orbiter’s time is basically around 30 seconds, of which the mainnet is slightly slower, it may take 45 seconds, and if the mainnet is slow, it may take longer. The fastest is the BSC network, and it only takes 15 seconds to cross-chain to zkSync Era.

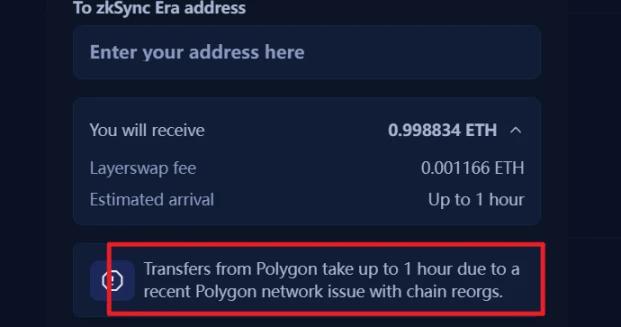

The Layerswap cross-chain speed is generally a little slower, basically around 2 minutes. Among them, the speed of polygon cross-chain to zkSync Era is the slowest, more than 1 hour.

( Polygon cross-chain reminder)

Therefore, in terms of cross-chain speed, Orbiter is still better than Layerswap.

Cross-chain fees

Most of Orbiter’s cross-chain fees between the second layer are between 2 U and 4 U, which are usually fixed. A few cross-chain fees increase with the increase of the cross-chain amount, such as transferring ETH from zkSync Era to cross-chain Back to Arbitrum That's it.

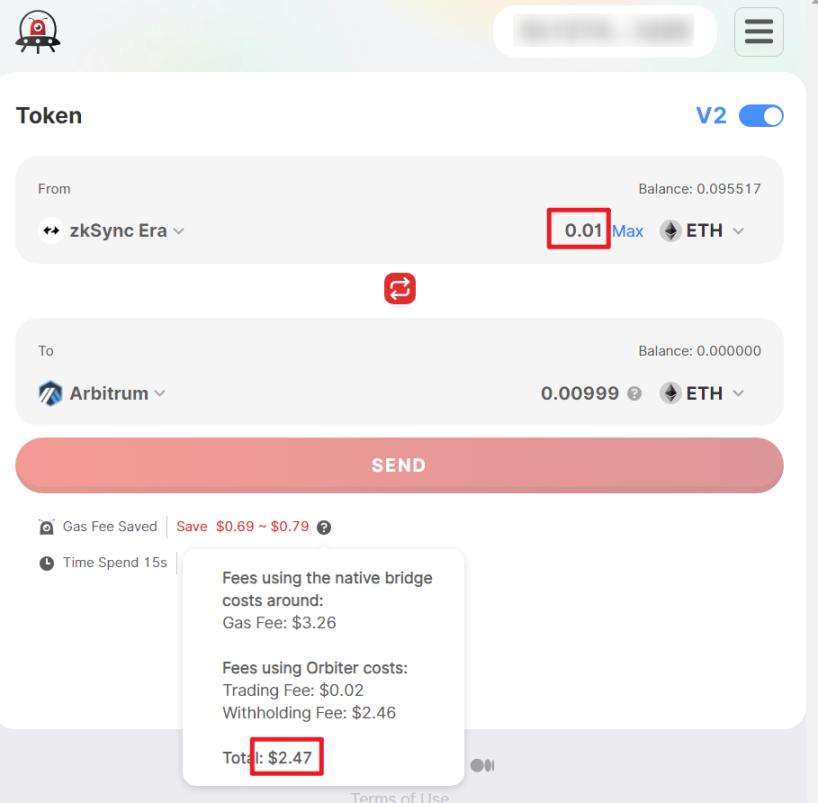

(Handling fee for cross-chain 0.01 E)

When the cross-chain amount is 0.01 ETH , the fee is 2.47 U.

(Handling fee for cross-chain 1 E)

When we tried to increase the cross-chain amount to 1 ETH , the cross-chain handling fee immediately increased to 4.43 U.

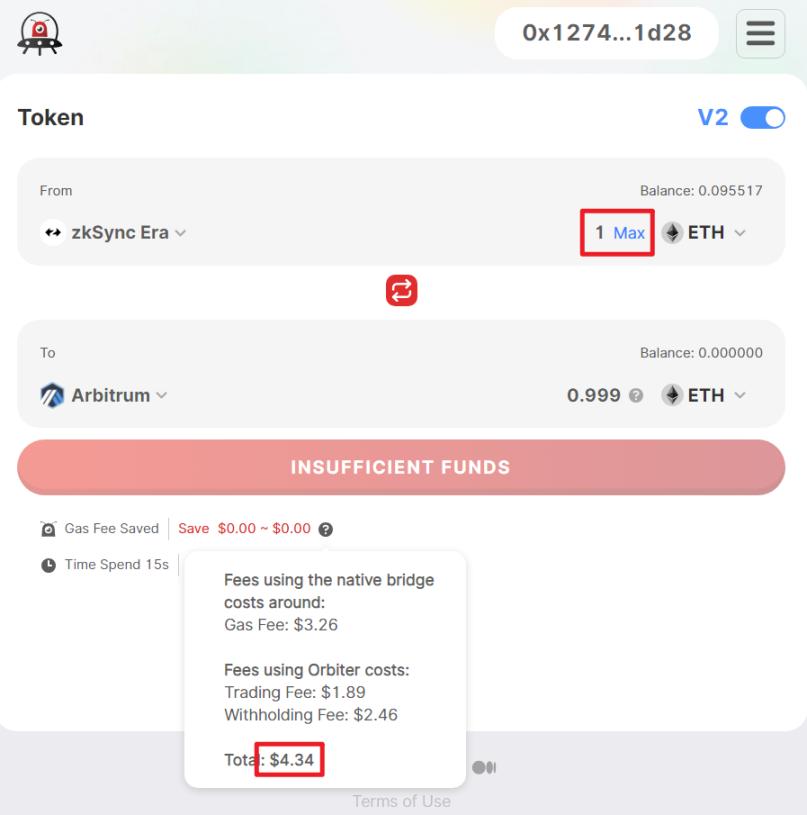

However, the fee for the second layer crossing to the mainnet is high. The starting fee is 14 U. The larger the cross-chain amount, the higher the handling fee. The funds of the mainnet are limited, and the maximum is only 10 E.

(Cross-chain to mainnet handling fee)

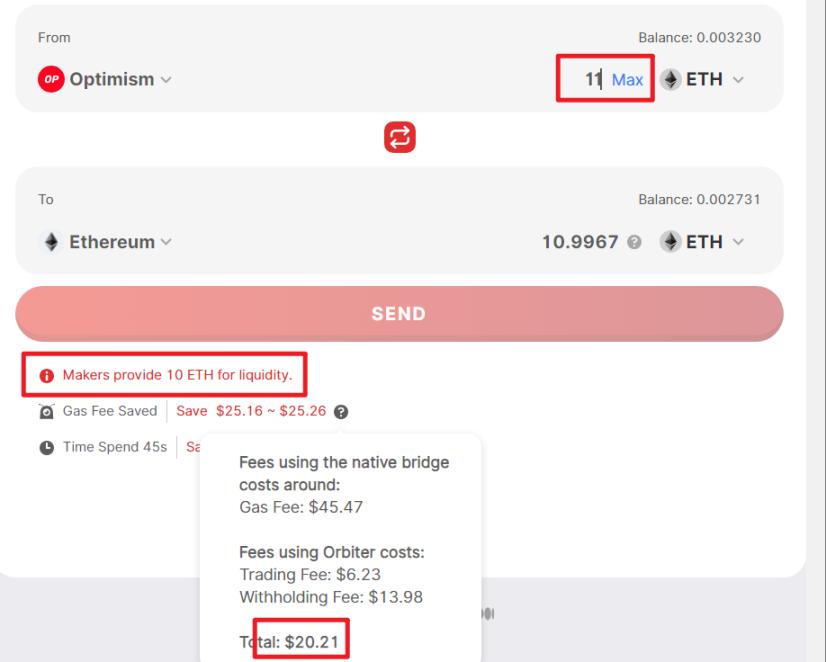

The cost of cross-chain between Layerswap's second layer is basically around 0.0016 E, which is 3 U. No matter how the cross-chain funds change, the handling fee is still relatively stable.

(Cross-chain handling fee between the second layer)

When we tried to transfer funds from the second layer to the Ethereum mainnet, the handling fee was actually cheaper than transferring funds between the second layer. From the overall experience, it can be found that Layerswap’s cross-chain fees are relatively stable, just like the withdrawal fees of exchanges.

(Cross-chain fee from the second layer to the mainnet)

In contrast, in terms of cross-chain fees, Layerswap seems to be slightly better.

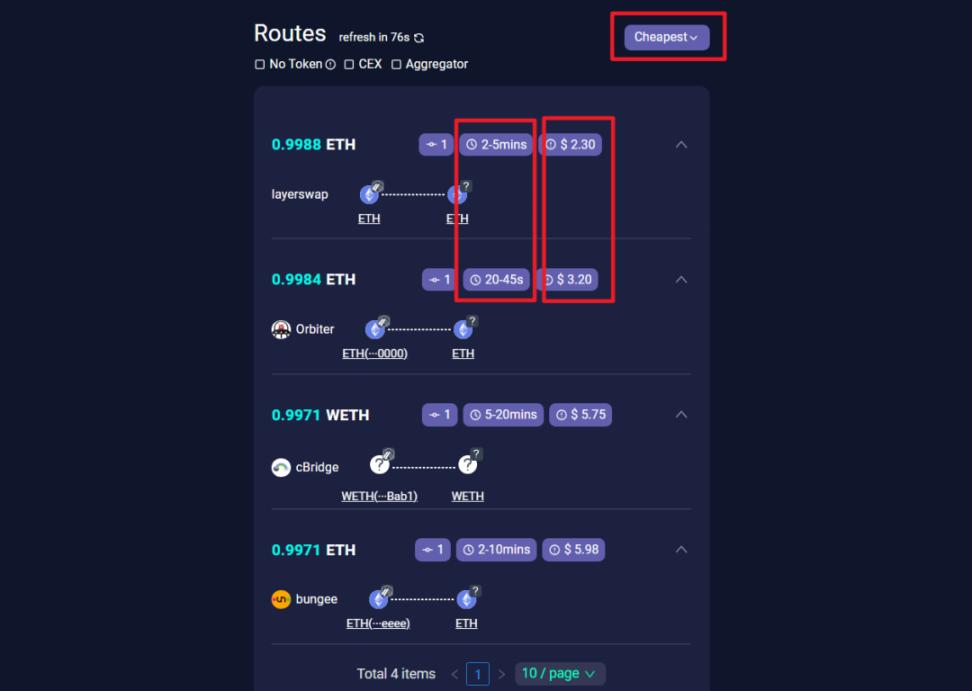

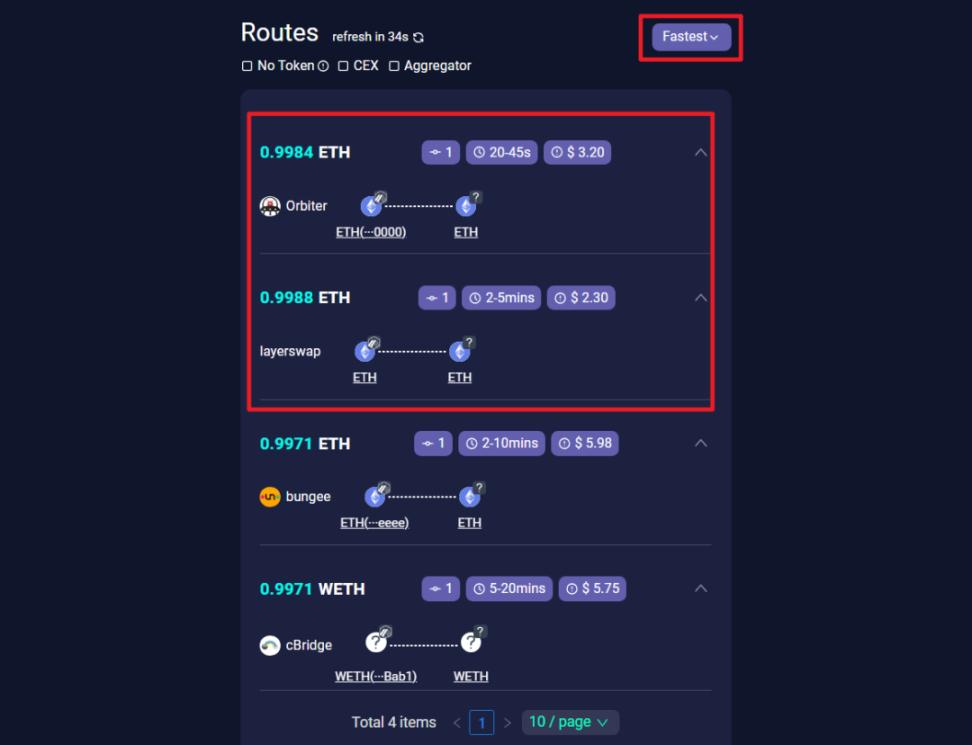

In addition to directly viewing cross-chain fees on the cross-chain bridge, you can also query cross-chain fees using Chaineye .

After opening the tool, enter the relevant information of the cross-chain, and you can query the cost of each cross-chain bridge with one click.

(Chianeye query cross-chain fees)

By default, the tool will rank according to the transaction fee from low to high. You can change "cheapest" in the upper right corner to "fastest". This will display the fastest chain.

(Sorted from low to high according to cross-chain fees)

(Sorted from fastest to slowest)

safety

Judging from the principles mentioned above, Orbiter uses the whitelist mechanism to allow multiple market makers with funds to provide users with cross-chain liquidity in each chain. To ensure the safety of users' funds.

Compared with the liquidity provided by a single entity of Layerswap, the former seems to be more comprehensive in ensuring the safety of user funds.

04 Summary

Generally speaking, we can use the following strategies to complete daily cross-chain:

1. When the cross-chain funds are not large, Layerswap is preferred, its handling fee is lower, but the speed is slightly slower;

2. When the cross-chain funds are large, Orbiter is preferred. Orbiter’s liquidity is obviously more sufficient to meet the cross-chain needs of larger funds, while Layerswap has a limit of 1 ETH ;

3. When it is necessary to cross-chain from the second layer to the mainnet, Layerswap is preferred, and the cost from the second layer to the mainnet is still the cheapest;

4. The funds are in the exchange, and users who want to directly cross-chain to the target chain should choose Layerswap first, after all, only it supports the exchange;

5. Users who care about time and security, but don't care about handling fees, can choose Orbiter first.