Original title: Prisma Finance Overview

Original Author: ASXN

Original source: Substack

Compiled by: Lynn, MarsBit

overview

Prisma Finance is a decentralized stablecoin protocol that enables users to deposit LST as collateral to mint acUSD, a native overcollateralized stablecoin. Prisma is backed by many large investors and founders, including Curve Finance founder, Convex Finance founder, FRAX Finance, Conic Finance, Coingecko founder, OKX Ventures, Swell founder, etc.

acUSD

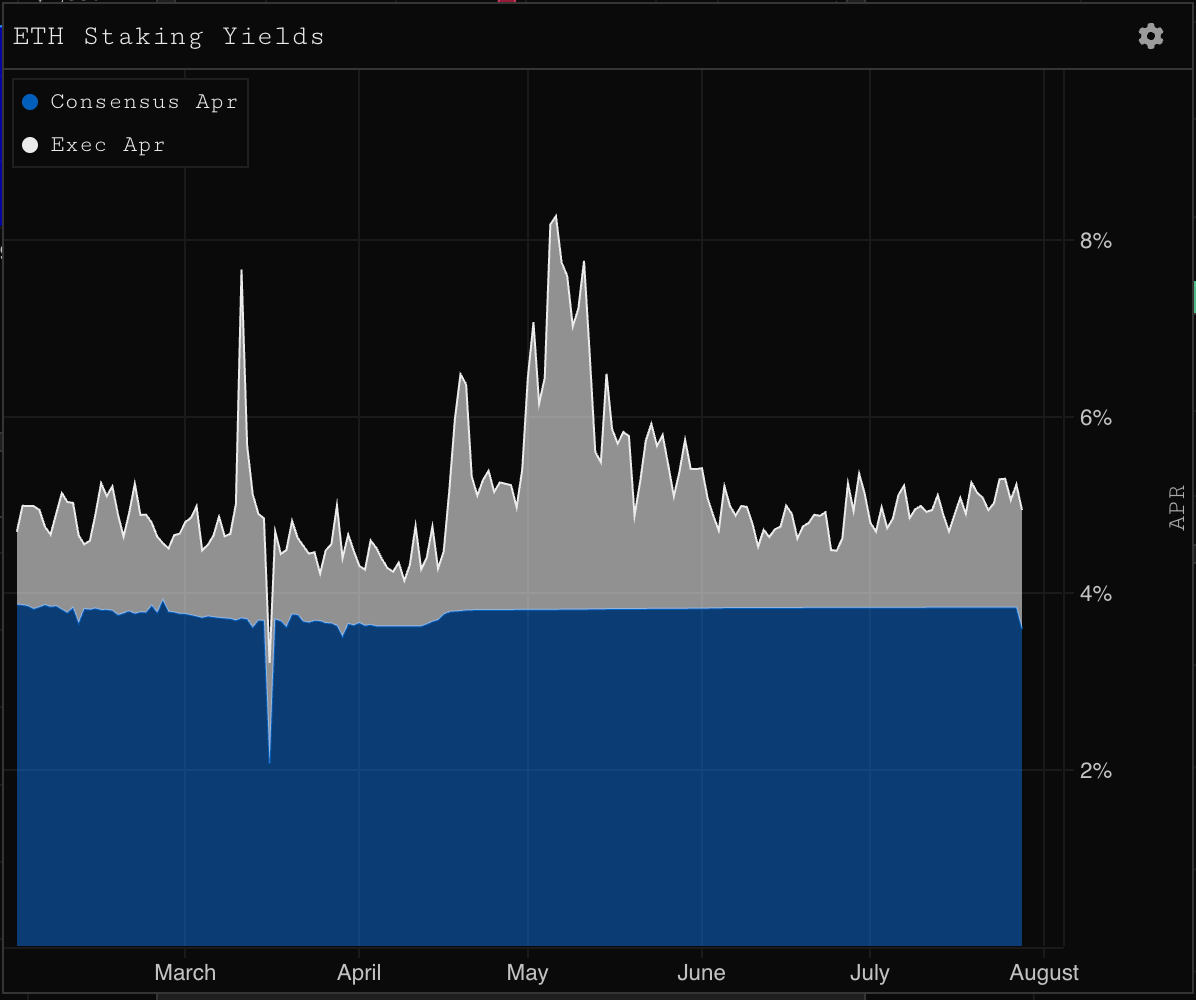

Prisma allows users to mint acUSD, a stablecoin fully collateralized by various LSTs, [over] built on top of the Liquity codebase. acUSD will be incentivized on Curve and Convex so that users can earn transaction fees, CRV and CVX, as well as PRISMA and their Ethereum staking rewards.

Users can stake their stablecoins and get rewarded with CRV and CVX. These rewards are expected to be high, as Prisma will heavily incentivize stakers by participating in the Curve Wars. As the Ethereum staking rewards increase, LST-guaranteed loans gradually repay themselves, providing users with a self-repayment mechanism.

Liquidity overview and mechanics:

To recap, Liquity is a decentralized protocol that allows users to deposit ETH and borrow stable LUSD with no interest payments. Users can lock up ETH as collateral in a smart contract and create a position called a "trove." Each treasury must be collateralized with at least 110% LTV so users can mint LUSD with their ETH collateral. Users can redeem collateral at any time.

stable pool

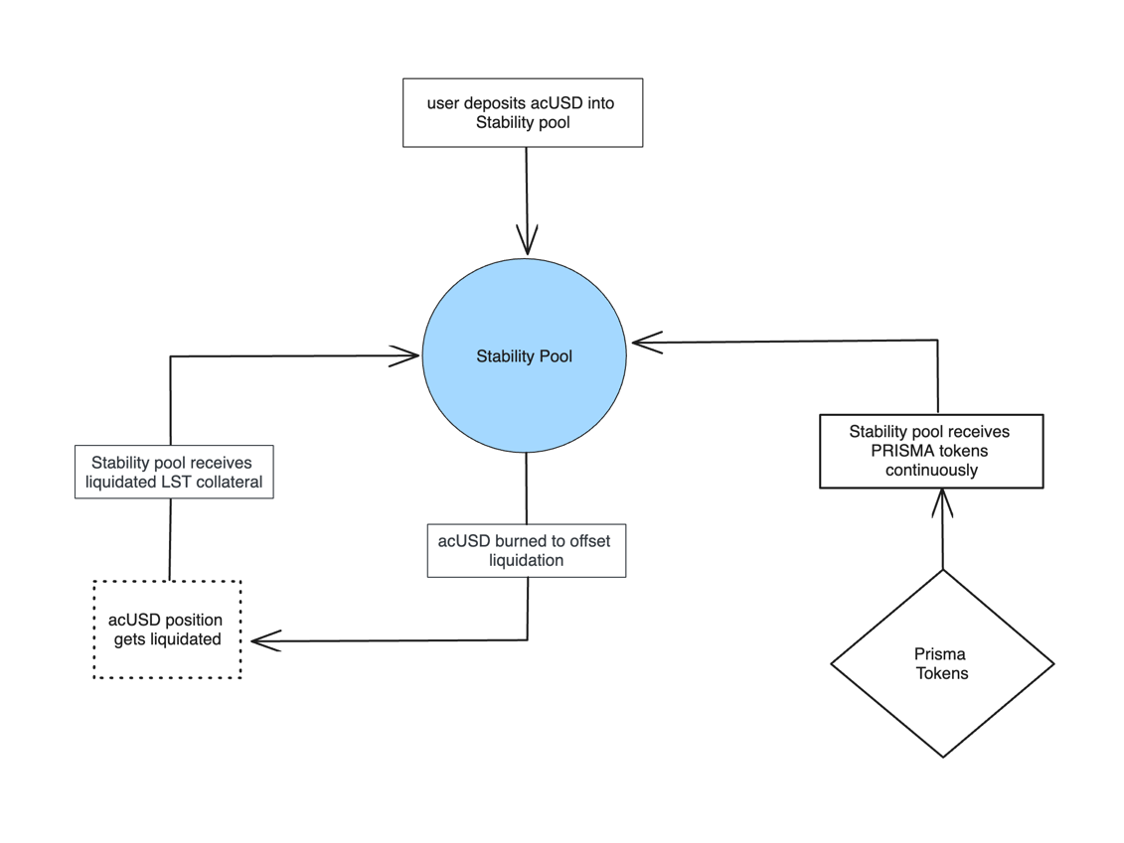

Prisma uses a stable pool mechanism that acts as a safety net to ensure the solvency of acUSD and Prisma Finance. Prisma has a shared "stable pool" but still allows users to borrow independently from different collateral.

The Stability Pool is the primary source of liquidity for repaying liquidated position liabilities. Liquidation occurs when the collateralization ratio of a position falls below 110%. This ensures that the acUSD supply is always supported.

When a position is liquidated, the acUSD corresponding to the remaining debt of the position will be destroyed in the stability pool balance to repay its debt. In exchange, all collateral on liquidated positions will be transferred to the stability pool. Stability providers (limited partners of the stability pool) are paid through this transferred collateral.

Stable Pool Mechanism

LSTs

At launch, Prisma will support the following assets:

- wstETH (Lido pledges ETH)

- cbETH (Coinbase Parcel Pledge ETH)

- rETH (Rocket Pool ETH)

- sfrxETH (Pledged Frax Financial Ethereum)

- WBETH (Binance package and pledge ETH)

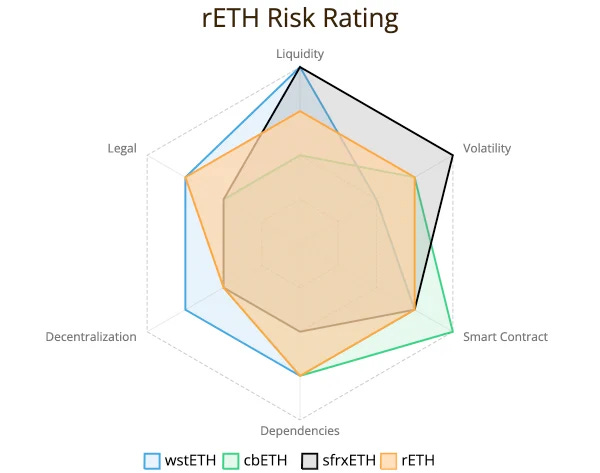

The upper limit of each asset has not yet been determined (PrismaRisk has completed a short-term risk assessment of stETH, cbETH and wbETH), and will be determined based on PrismaRisk's audit and assessment results. Caps will be evaluated by an independent team based on each LST's collateral fee structure, decentralization, and collateral.

Rocket Pool’s ETH (rETH) collateral risk assessment example: link here.

PrismaRisk Collateral Risk Assessment

PRISMA Token

PRISMA will use a voting escrow (ve) token economic model to control multiple aspects of the protocol, including:

- stable pool

- Add or remove collateral

- Collateral Caps and Parameters

- Minting Fees, Lending Fees, and Redemption Fees

- outstanding loan interest rate

- emissions

vePRISMA holders will be able to change the minting and lending fees of any LST collateral and emit PRISMA directly to LP tokens.

Voters can directly emit to incentivize the minting of specific LSTs, keep active borrows with specific LSTs, or be used for LP token pledgers.

Based on this, Prisma Finance's goal is likely to create a flywheel/emissions war dynamic (similar to CVX, CRV, FRAX, etc.):

- By incentivizing the DAO

- By incentivizing LST providers to buy and stake PRISMA to increase liquidity, incentivize minting acUSD with their LST collateral, etc.

vePRISMA voting weight will be based on token lock length, similar to how veCRV works. But unlike veCRV, users can have multiple locks of different lengths in parallel, as well as the ability to "freeze the lock" (to avoid having to constantly relock it due to decay).

Users will receive a boost (up to 2x) in PRISMA rewards based on their voting weight relative to total voting weight. Additionally, users will be able to delegate their votes to a Convex-like protocol to aggregate and sell for a fee.

Since most LST issuers are interested in directing emissions to actions such as minting with their own LST, the bribery layer will complement Prisma governance and its participants. For example, Frax Finance may use its own voting escrow governance system to direct FXS emissions to users minting acUSD with sfrxETH.

LST Stablecoin Landscape

Currently, there are three major protocols offering LST-backed stablecoins: Lybra, Raft, and Gravita. All three protocols work similarly to how liquidity works, using Collateralized Debt Positions (CDPs).

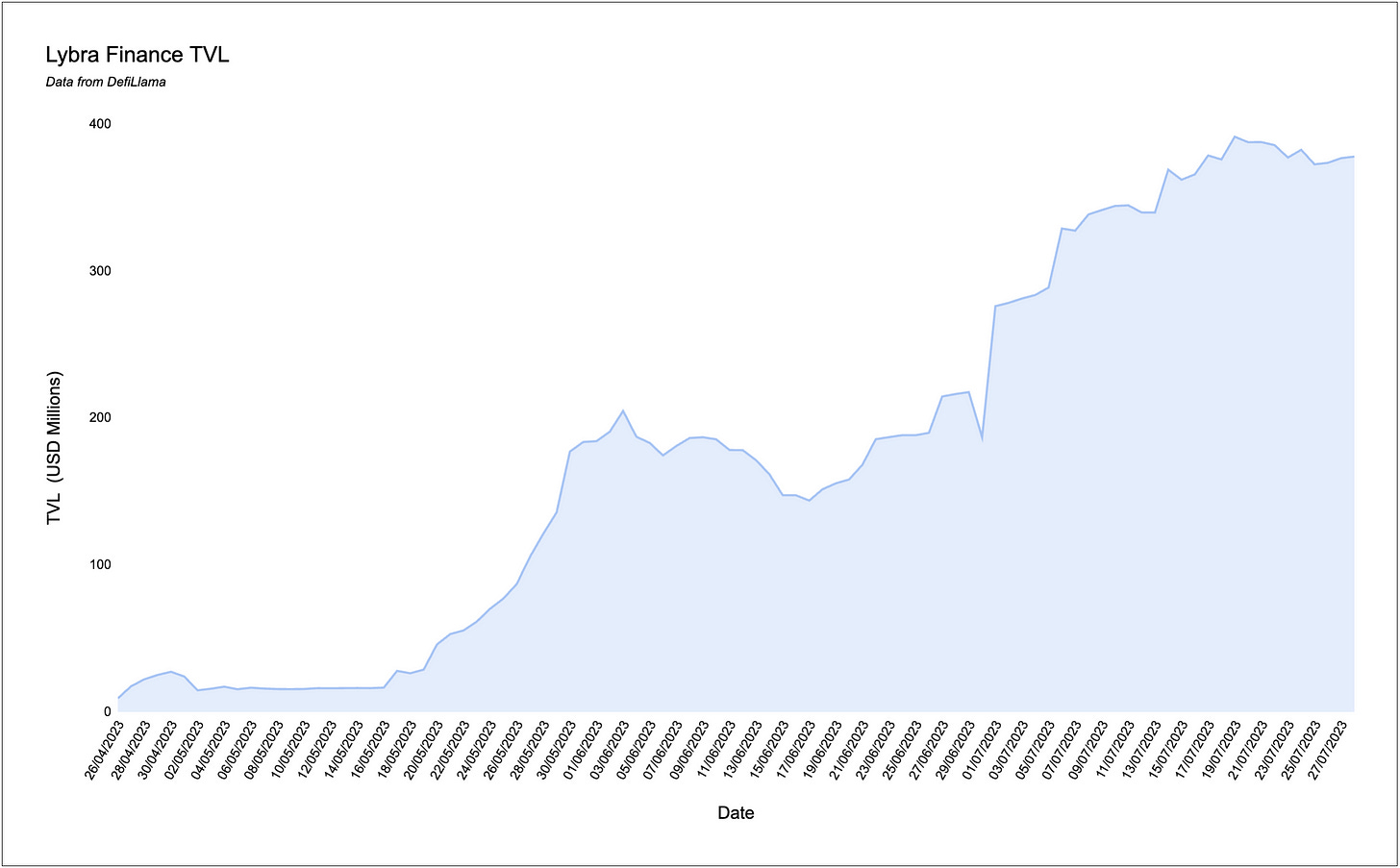

Lybra

Lybra Finance offers eUSD, a profitable over-collateralized LST-backed stablecoin. Lybra has attracted a large number of deposits, and deposits continue to grow. Such a high total value locked is due in part to their aggressive liquidity mining program.

Since Lybra launched its "LBR Phase 2 Mining Plan", Lybra's daily esLBR emissions range from 54,618 to 126,277, depending on each user's lock-in period. Most of it (78%) was discharged to the eUSD loan pool, and the rest was discharged to the LBR/ETH Uniswap V2 LP pool (15%) and the eUSD/USDC Curve LP pool (7%).

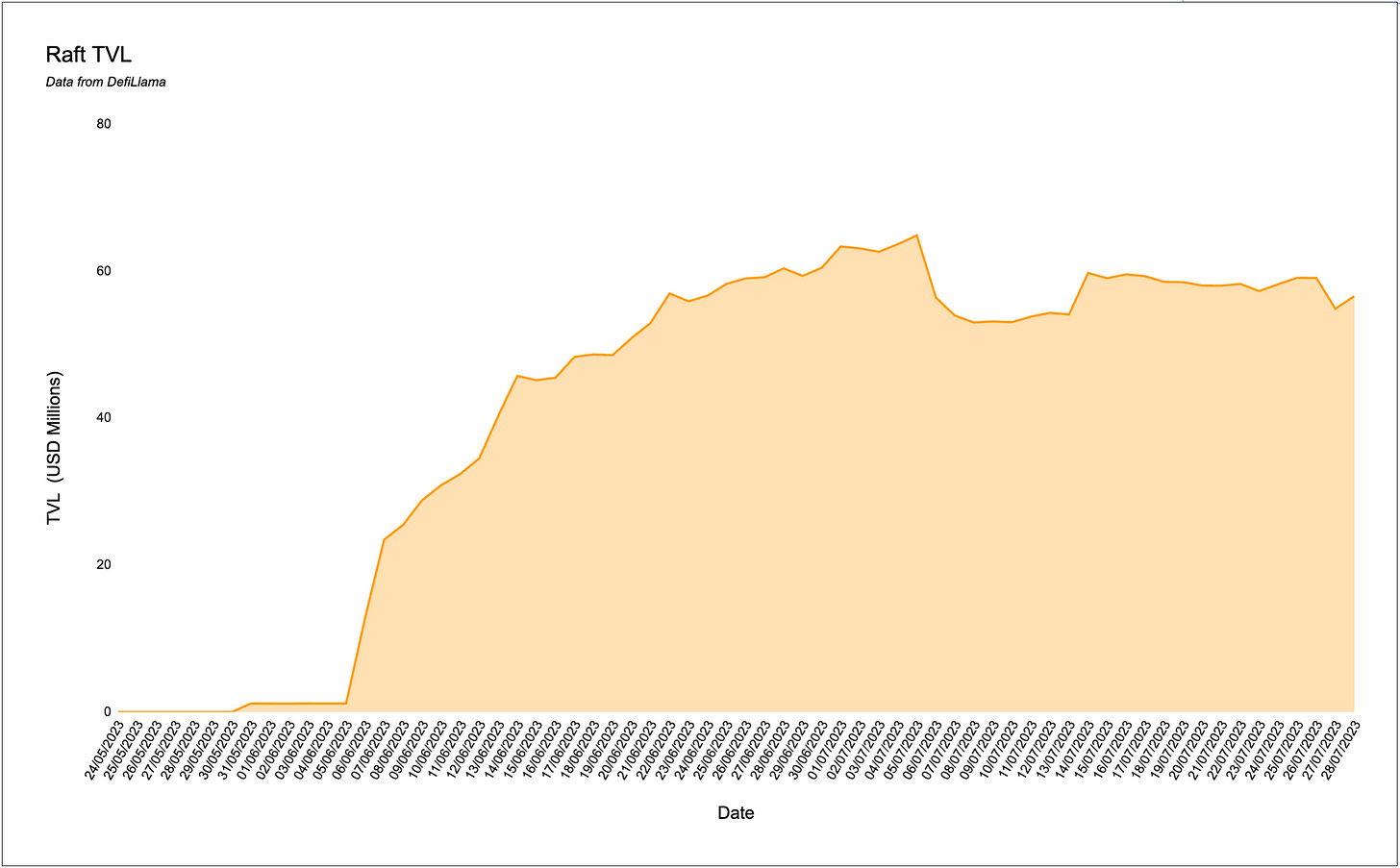

Raft allows users to deposit liquid pegged tokens and pay a one-time fee to generate R, a dollar-pegged stablecoin.

Launched as recently as May, Raft has attracted around $60 million in TVL to date from users depositing stETH and generating R.

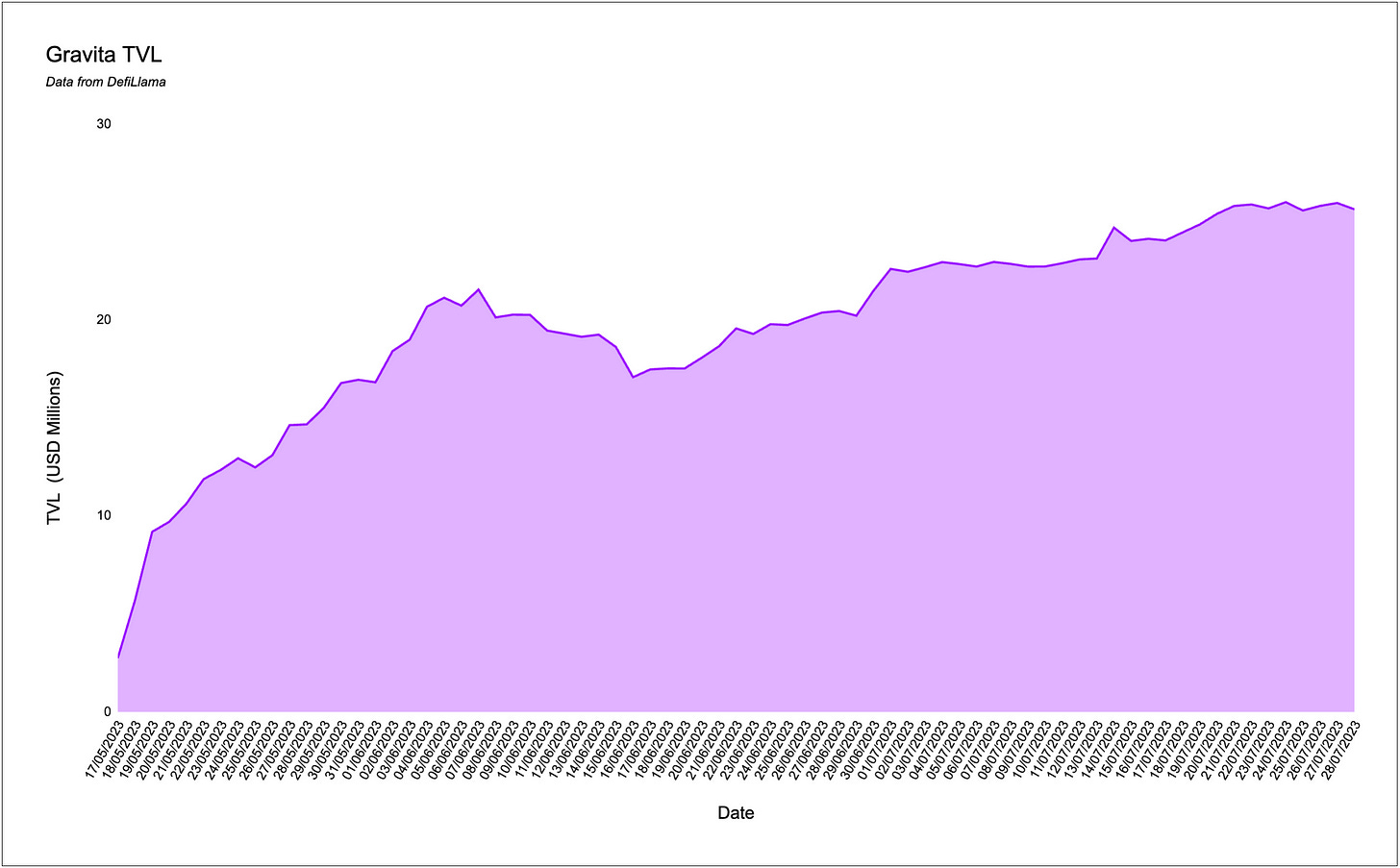

Another competitor in the industry, Gravita Protocol, allows users to deposit collateral and borrow GRAI for a fee of up to 0.5 percent and 0 percent interest on the loan. They recently announced their launch on Arbitrum.

Initially, they will support wETH, rETH and wstETH. Each currency has a relatively small minting cap of 500,000 GRAI.

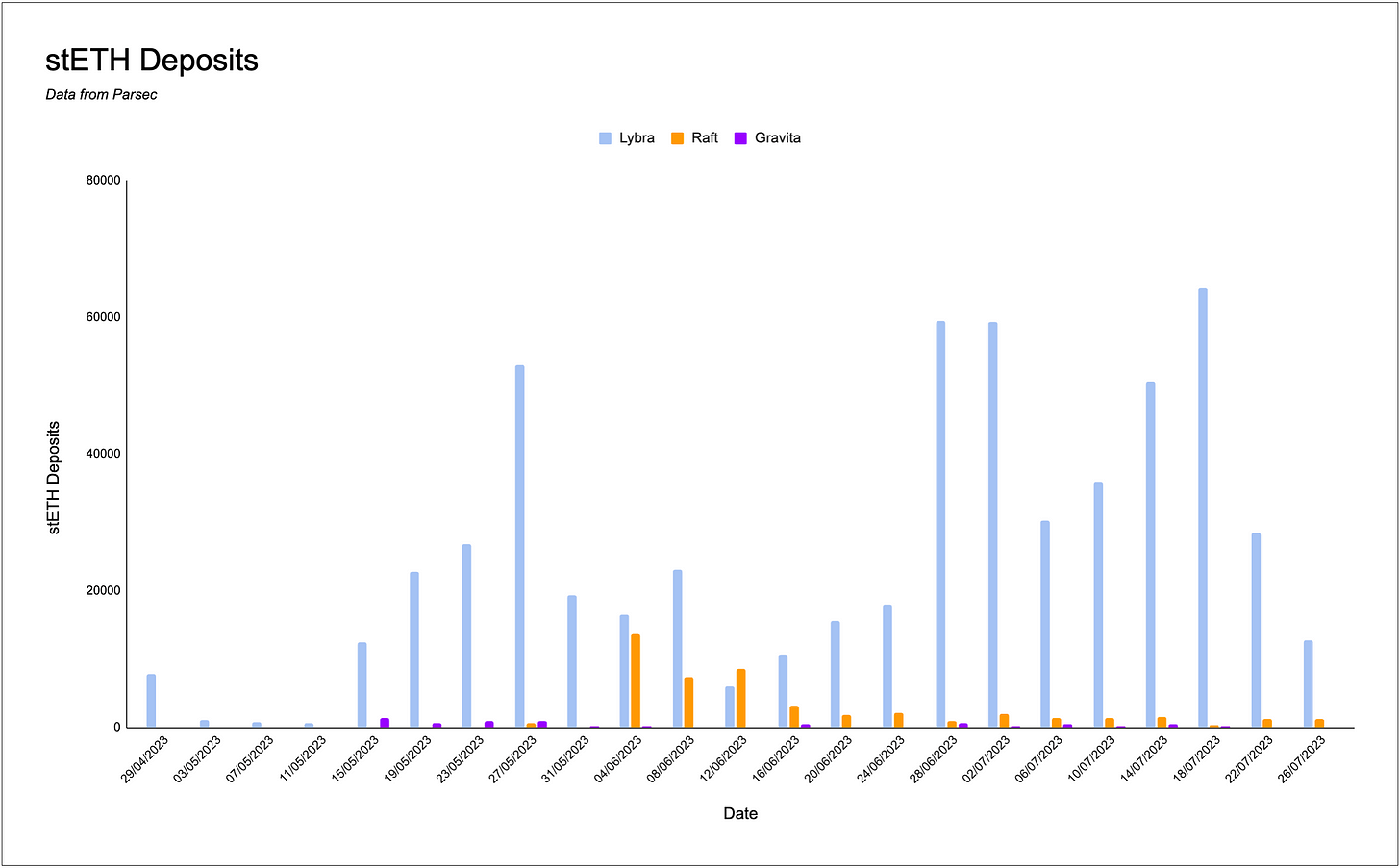

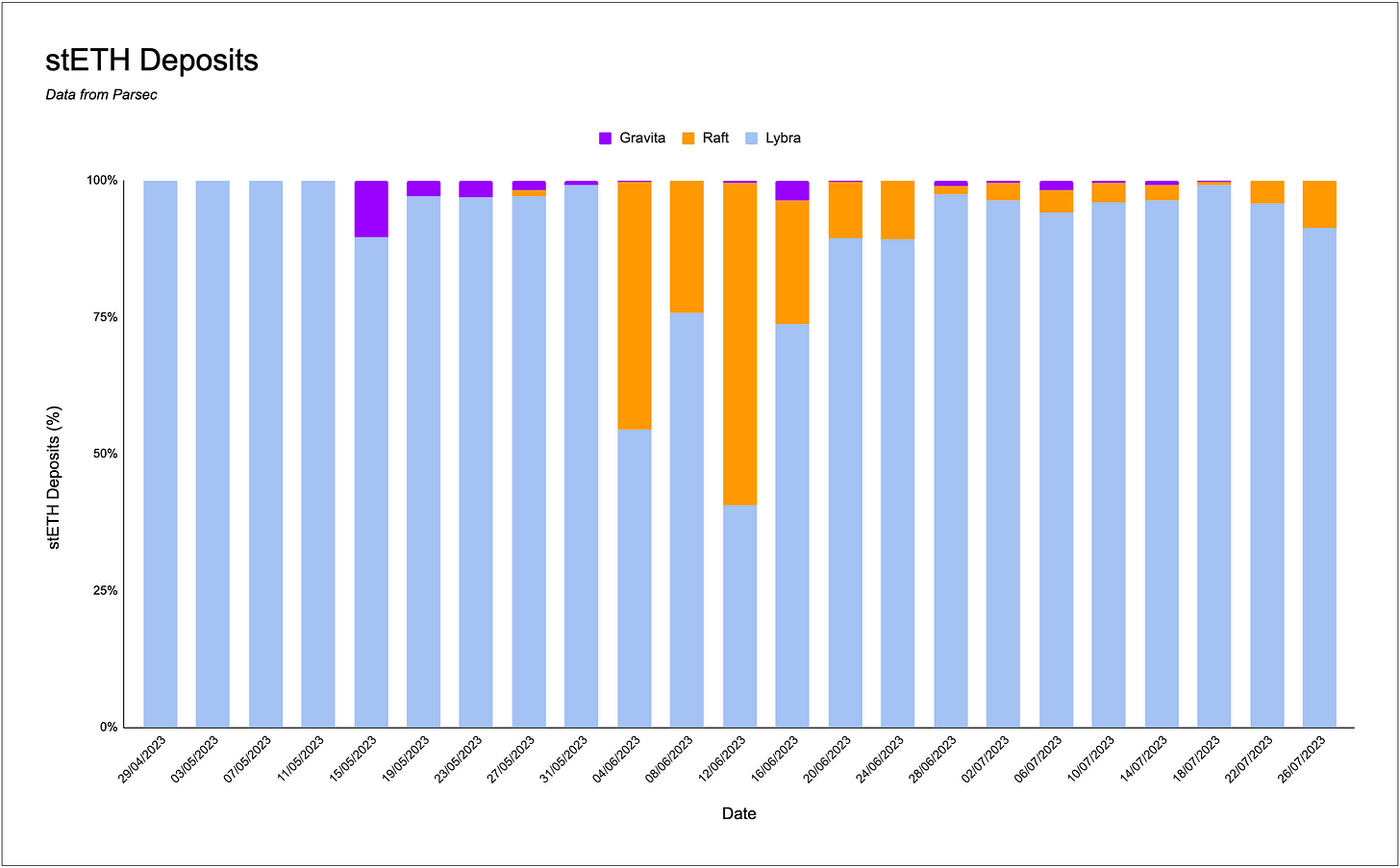

We can see from this data that Lybra dominates both TVL and stablecoin minting. Compared to competitors, Lybra's TVL is ~10x higher and daily stETH deposits are consistently high. In most cases, Prisma's market share of StETH deposits for minting stablecoins is between 75%-100%. This is largely due to the first-mover advantage and investor awareness of the LBR token.

Prisma is the first real contender in this space as they will leverage the Curve ecosystem to offer higher yields to stablecoin holders.

Amount of STETH deposited into each stablecoin protocol

Amount of STETH deposited into each stablecoin protocol

Lybra Dominates StETH Market Share Deposited to Stablecoin Protocols