Arthur Hayes, the former co-founder of BitMEX, believes that we are about to witness the largest bull market in human history, driven by the mass printing of fiat currencies by governments and the arrival of artificial intelligence.

Original title: Double Happiness

Original author: Arthur Hayes

Original source: medium

Compiled by: Kate, MarsBit

This is my last article on the intersection of artificial intelligence and cryptography. On September 13, 2023, I gave a short speech entitled "Double Happiness" at the Token2049 conference in Singapore. Here is a video link to my keynote.

The feeling of happiness at its most basic level is having enough food, a place to sleep, and the opportunity to have children. We need heat, which is converted from the potential energy of the sun and earth into edible food. Would the universe be happy if we rearranged energy into a less entropic form? I have no idea. In any case, our happiness does not appear out of thin air - it is related to our ability to change the energetic nature of the universe. There are no absolutes in the world, and we may find that even the speed of light is not a constant.

Likewise, market conditions are all relative. There can be no bull market without a bear market. In this post, I’ll explore a very specific kind of happiness: When this dreary cryptocurrency bear market ends and we enter an exciting, unprecedented bull market, I hope we all can experience pure nirvana . Namely, a bull market fueled by a surge in fiat liquidity to levels never seen before in human history and excitement surrounding the commercialization of artificial intelligence (AI). To date, we have experienced a cryptocurrency bull run that was driven by either an increase in fiat liquidity or an appreciation of certain aspects of blockchain technology, but not both. A bull run in fiat liquidity and technology will bring a double blessing to the portfolios of loyal investors.

First, I'll walk you through why the world's major central banks - the Federal Reserve (Fed), the People's Bank of China (PBOC), the Bank of Japan (BOJ) and the European Central Bank (ECB) - will be within a 2-3 year window in human history. Together they print the most fiat currency to “save” their respective governments’ bond markets. I will then describe the rush I expect to see around new AI technologies that will be funded in large part by “toilet paper money.” Finally, I’ll explain why I believe a certain shit coin– Filecoin (FIL) – will regain its 2021 all-time highs against the backdrop of these two trends.

formula

Cryptocurrency Price = Fiat Liquidity + Technology

Dirty fiat currency

Without the sorrow of sinners, there can be no happiness for the faithful. In this case, central bankers have to suffer so that we can be happy. They face a difficult choice: They can either protect the purchasing power of their national fiat currencies in energy due to inflationary pressures or ensure the federal government’s ability to service its debt—but they can’t do both. As I have repeatedly stated, governments never voluntarily go bankrupt, which makes it more likely that the world's over-indebted governments will give their central banks the green light to keep bond yields "affordable" at all costs, at the expense of the purchasing power of fiat currencies.

Why do currencies weaken against energy when central banks manipulate bond yields? If the market is willing to lend at 10% and the government can't afford it, the central bank can buy bonds to artificially push interest rates down to a level the government can afford (perhaps closer to 5%). However, in order to purchase these bonds, the central bank must print money to purchase them. Printing money expands the money supply, which means there is more fiat currency chasing limited energy. Therefore, money depreciates relative to the energy it is used to purchase. In our current civilization, the main forms of energy are hydrocarbons, such as oil and natural gas.

To understand why governments are so willing to put their national currencies aside to fund their debt habits, we first need to understand why they have become so dependent on using debt to grow their economies. Raoul Pal has a simple formula for calculating the driving force of economic growth - gross domestic product (GDP).

GDP growth = population growth + productivity growth + debt growth

The creation of stable and liquid credit markets suddenly gave governments the ability to travel through time and space. They started borrowing from the future to build things today. They believe that the things we build today will make us more efficient in the future and more people will use them. If our productivity and population grow faster than the interest on the debt that funds that productivity grows, society's wealth will increase.

population decline

Unfortunately for politicians looking to boost GDP, there's a major obstacle to the "population growth" part of Raoul's formula: rich people aren't fucking around.

Well, that's not entirely true - there's actually a lot going on, but it just doesn't result in many babies being born. In wealthy, developed countries, women now receive reproductive education and access to a variety of contraceptive methods that enable them to decide when, if at all, they will become pregnant. Until then, the preferred method of male contraception—commonly known as “pull and pray”—led to a healthy increase in the global population.

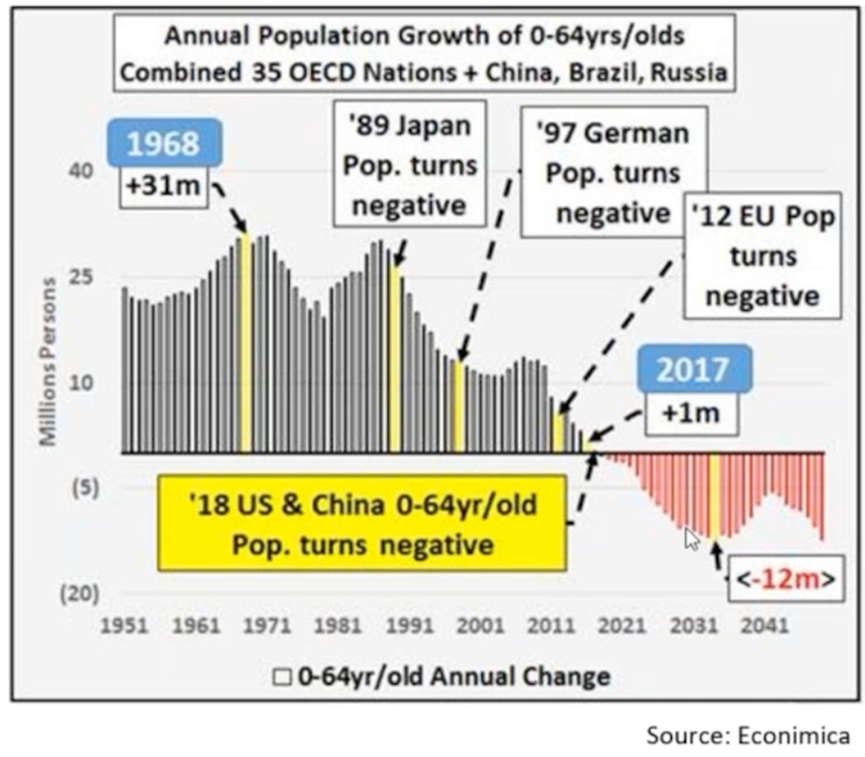

Since the late 1980s, developed countries have been on the verge of extinction. The chart above clearly shows that by the 2010s, the entire world's productive population began to decline. This makes sense - an urban population that earns its living in offices or factories doesn't need children. In fact, children are a net drain on family resources. When the global economy was dominated by agriculture, children represented free labor and were therefore a net economic positive for the family unit.

If the formula for GDP growth is GDP growth = population growth + productivity growth + debt growth, and population growth becomes negative, then the government must redouble its efforts to increase productivity.

Productivity is delayed

Several past megatrends have driven most of our productivity growth so far, and none of them are likely to be repeated. They are:

1. Women enter the labor market.

2. Outsource global manufacturing to China, which underpays its workers and is willing to destroy its environment.

3. Universal adoption of computers and the Internet.

4. Hydrocarbon production expands due to growth in U.S. shale oil and gas drilling.

These are all one-time phenomena, and we have realized all the benefits that could be gained from each one. Therefore, productivity is bound to stagnate until some new, unforeseen trend emerges. Artificial intelligence and robotics have the potential to be among the trends ushering in a new wave of productivity growth, but even if this turns out to be true, it will be decades before these gains are fully reflected in the global economy.

gospel of growth

The entire world economy is built on the fallacy that growth must continue indefinitely. For example, the method you usually use to estimate a company's stock price, a discounted cash flow model, assumes a terminal growth rate. This valuation standard is flawed because obviously no company lasts forever - yet it remains the most widely used model for "valuing" a company.

Applying this idea to the national level, politicians and their bankers like to promise more money to build more crap, assuming that the global economy always grows at such a rate that the investment will be profitable in the long run. picture. China exemplifies the flaws of this philosophy because the amount of infrastructure and housing they build can never grow (as their population will be cut in half by the end of the century). The problem is that we fail to recognize that the factors that led to global economic prosperity over the past 100 years were one-time events that have now expired.

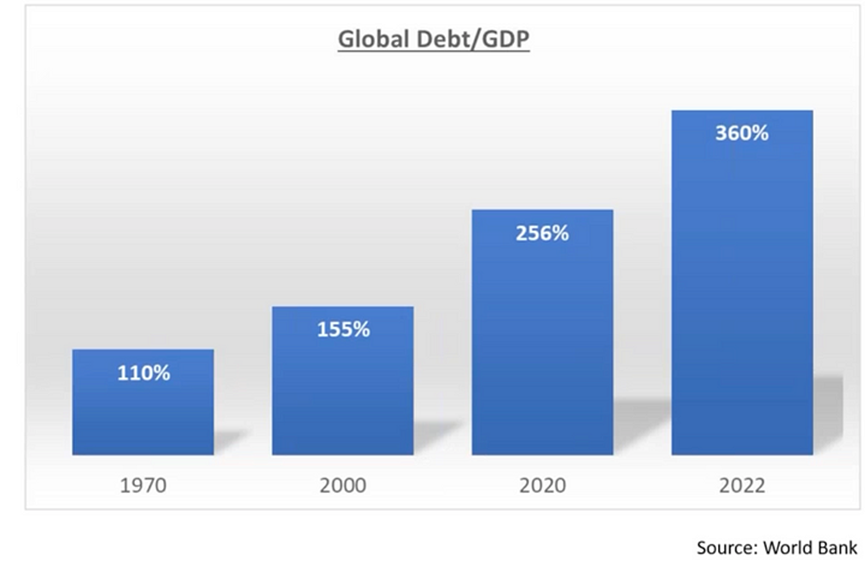

The global debt-to-GDP ratio exceeded 100% in the 1970s and, as expected, grew exponentially over time and as governments took on more and more debt to fuel future growth. .

In order to keep creditors (i.e. the dirty fiat financial system) solvent, governments run GDP growth through deficits to pay off the ever-increasing debt burden. It's a vicious cycle: In order to one day pay off existing debt, governments try to stimulate future economic activity by increasing debt and investing the proceeds. But as their debt burden increases, so does the GDP growth required to offset the new debt, so the government has to take on more debt to further fuel the economy, and so on - there will be no once-in-a-lifetime event to help the government get through it Difficulties in GDP growth.

The predictions I and others have of increasing global debt burdens are nothing new. But earlier in this article, I made a very bold prediction that in the next 2-3 years, all major economic groups will print more money than at any time in history. This requires the United States, China, Japan and Europe to do the same thing at the same time. I hope they all act in unison because their economies are interconnected and their actions are constrained by the U.S.-led post-World War II order.

But before I get into that, I need to first take you through the architecture of global trade after World War II and explain how current trade/capital imbalances make it necessary to print more money to prevent a flawed arrangement from failing.

end of an era

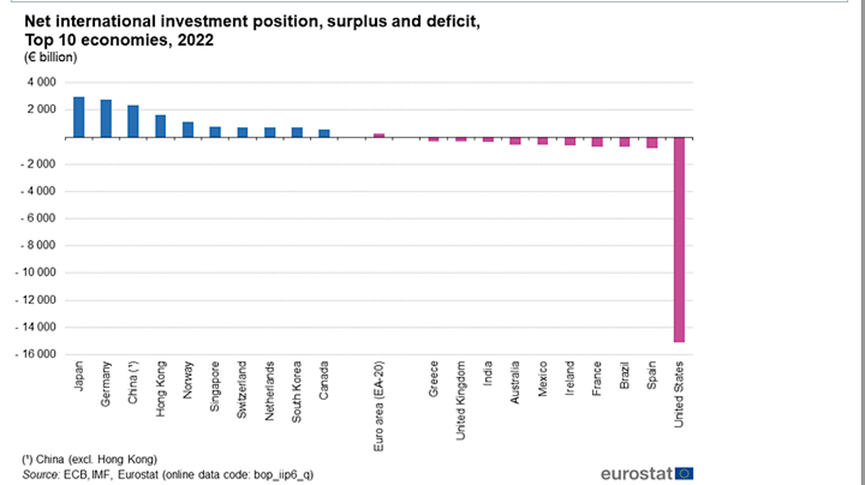

This chart is the key to understanding the economic structure the United States created after World War II. Japan, China and Germany were allowed to pursue postwar recovery through exports. As long as these countries performed well, the United States agreed to absorb their goods—and subsequent surpluses—in the form of financial investment. By selling goods to the United States, savers (blue bars) accumulate wealth, but this wealth is paid for by the United States (red bars) with dollars borrowed from savers. As you can see, everything is balanced - savers' assets match spenders' liabilities.

This arrangement is only valid if the following conditions are met:

1. Wage growth in the exporting country must be lower than productivity growth, and the country must invoice goods in U.S. dollars. These dollar savings, caused by low wages based on productivity, must be invested in U.S. financial markets.

2. The United States must allow exporters to sell goods duty-free and invest in U.S. financial assets without restrictions.

This system could not work any other way. Asians and Germans must save, Americans must spend. Do not explain this behavior in any moral terms. No country is good or bad. The system is always balanced. It is your perspective that creates the moral perspective.

America can only buy so much. China has become the largest consumer of commodities and other goods after the United States, but even its market is saturated. This is especially true as the populations of both countries are declining. As a result, exporting countries that continued to invest in infrastructure to increase efficiency and keep prices low now face fully saturated foreign markets with no return on capital for their infrastructure investments.

But rather than letting large numbers of companies go bankrupt and causing unemployment to soar, governments in these countries have stepped in and will continue to step in, providing cheap credit to industrial companies to continue building more capacity. Whenever economic growth slows down, China always lends more to industrial companies because it allows comrades to stay in factories instead of People's Square.

On the other hand, except for large technology companies (Apple, Microsoft, Google, Facebook, Amazon), the US financial industry refuses to invest locally. Why invest in a local manufacturer that has no chance of competing with lower-cost overseas companies? Because of this, the banking industry has turned to allocating funds to companies and/or countries that are considered to have significant "growth" potential, but with a higher risk of default.

It should not be a surprise when these riskier foreign borrowers fail to repay their loans, triggering a financial crisis. If America's banks admitted losses, they would be insolvent - but the Fed and Treasury would inevitably step in instead of letting them fail: 1) Change capital adequacy rules to give banks more breathing room. 2) Print money to ensure bank solvency. The financial sector must be bailed out to prevent the entire U.S. financial system from collapsing, or else the exporting country's financial investments will become worthless.

On the other hand, exporting countries can never actually spend their savings because any large-scale liquidation of assets would collapse the U.S. financial system. Exporters have nearly $10 trillion in trapped assets. Not even Alameda Research's Sam "Alabama Tabasco" Trabucco could bid on such a scale. The United States cannot lock out capital from exporting countries to combat domestic asset price inflation, because this would destroy the ability of exporting countries to hold down wages and lower commodity prices. The past success of this arrangement doomed it to future failure.

In both cases, the only way the exporting countries and the United States can save their manufacturing and banking industries respectively is to print money. It is important to remember that printing money is always the solution and always postpones any adjustments to the architecture of the global trade and financial system.

Cheaters never win

The real systemic problem, at least from the perspective of wealthy elites, is that common people always want to improve their status in life. In Asia and Germany, workers want higher wages, more purchasing power and a bigger government safety net. If their country is so "rich" on paper, why shouldn't they get these things? In America, civilians have enough tchotchkes, they just want their jobs back. They rightly believed that they should produce goods for their own consumption rather than having former foreign farmers work for them. Again, this is a reasonable request considering that the American middle class is the ultimate consumer of all these things. Ricardian equivalence theory has no use in the Rust Belt.

Because the political and financial elites don't want large-scale reforms to the system on either side, they start cheating around the edges. The breakdown in relations between China and the United States - two countries whose economic and political systems are diametrically opposed yet inextricably linked - illustrates this point.

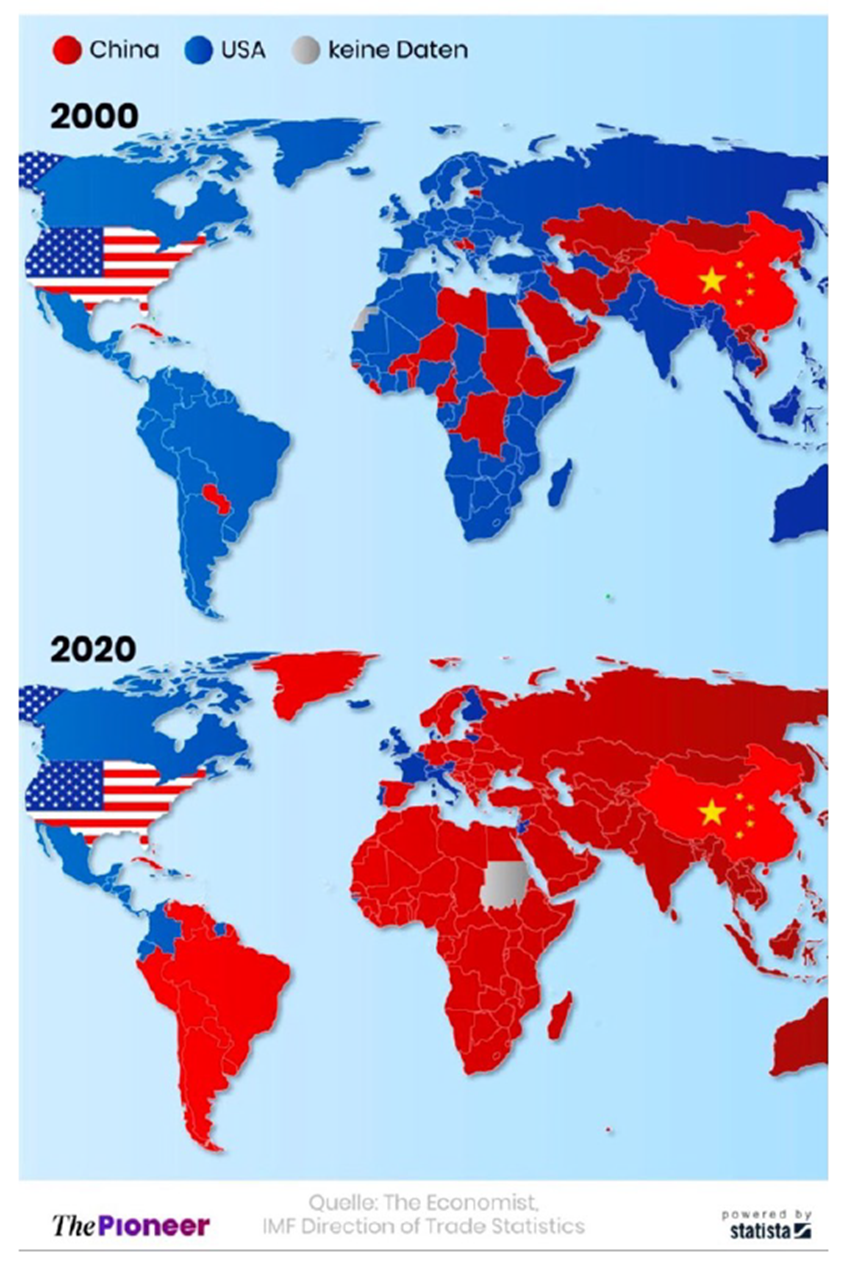

The Chinese proletariat was promised a healthy economy, which required sustained high growth. So to continue growing after China saturates the U.S. market with its goods, it needs more places to sell its products. China has gone abroad, replacing the United States and becoming the largest trading partner in most parts of the world. Importantly, more and more of this trade is denominated in yuan rather than dollars. This is a big no-no. Muammar Gadafi (former president of Libya) and Saddam Hussein (former president of Iraq) both fell victim to “regime change” when they tried to move away from the dollar.

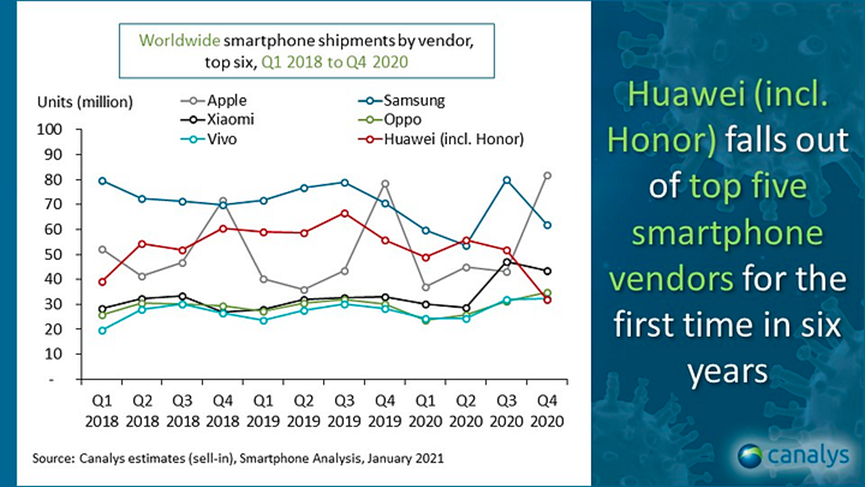

The United States has responded more subtly to China's trade expansion, enacting semiconductor trade restrictions and sanctions aimed at hindering China's technological progress. Huawei is China’s first major technology company victim. When they lost access to state-of-the-art chips and U.S. mobile operating systems, their domestic and international smartphone sales plummeted.

Being good is ok, being too good is treasonous.

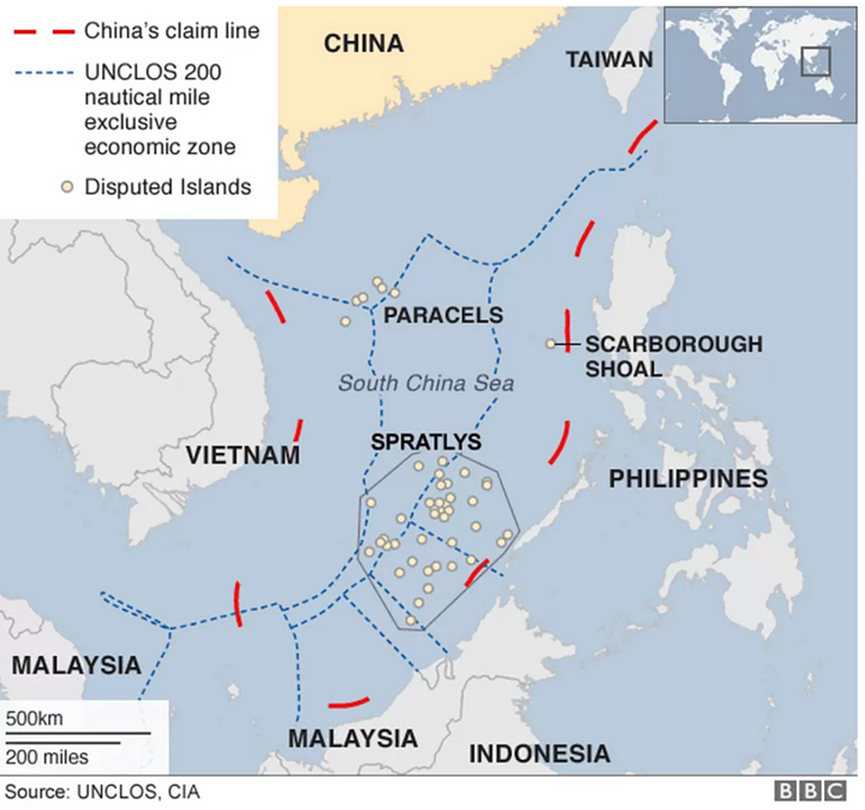

Like the United States, China wants to ensure military security along its trade routes. The Chinese strengthened their military power to ensure trade via the Silk Road (land routes) and the String of Pearls (sea routes). Historically, military safeguards for trade have been the job of the United States, and she is angry about China's renewed "aggression." (In any case, China would not describe protecting its trade lanes as “aggressive.” Perspectives are everything.) The United States responded by increasing arms sales to Taiwan and encouraging a military buildup in Japan.

The world now trades more with China than with the United States.

China ensures that it can protect its coastal areas.

In order to appease the proletariat who just want high-paying manufacturing jobs back, former US President Trump launched a trade war with China. The current US President Biden continued his onslaught and signed the CHIPS Act and the Inflation Lowering Act . These bills provide generous government subsidies and direct payments to companies building domestic semiconductor facilities and clean energy infrastructure. The spending will be paid for by issuing more debt in the form of bonds, which in turn will be purchased by America's trading partners.

The United States is cheating by using the savings of China, Japan, and Germany to rebuild domestic industry so that American companies can make goods for America. Obviously, this reduces the market for Chinese, Japanese and German goods. Unsurprisingly, many export-focused countries are clamoring for "protectionism" (as if US politicians only care when faced with electoral defeat).

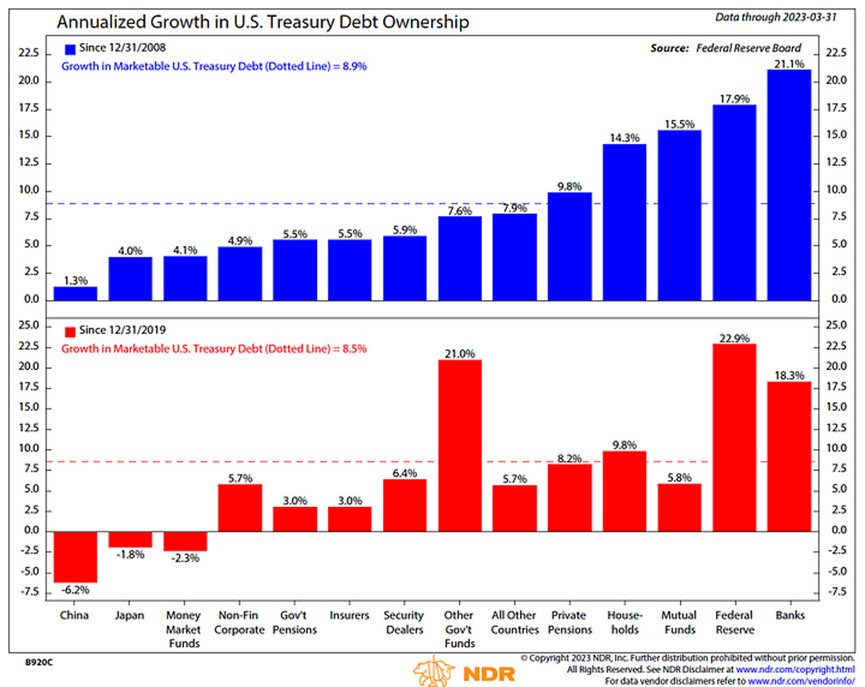

Predictably, U.S. Treasuries have lost value in energy terms as the amount of debt in circulation has grown exponentially. If I were a big owner of this crap, I'd be pretty pissed off. China, Japan and Germany clearly saw the writing on the wall, which is why they stopped reinvesting export earnings in these bonds. This is also deception.

As of January 4, 2021, the Bloomberg U.S. Treasury Long-Term Total Return Index/WTI Spot Oil Price Index was 100

Since the onset of the COVID-19 pandemic, the total return on long-term Treasury bonds has been more than 50% lower than that on oil.

Two major trading partners, China and Japan, have begun buyer strikes as outstanding U.S. debt surges. As buyers of last resort, America's banks (who have to buy this shit) and the Federal Reserve (who will soon have to buy this shit too) step in.

Everyone cheats, and for good reasons. It is clear that, whether the elites like it or not, a new global economic system will eventually be created. The imbalance cannot continue. But as long as those in power refuse to acknowledge reality, the money will be printed and the hope is that “growth” is around the corner – so we can make America, China, Japan and Germany great again!

I don’t know what the new global economic arrangements will look like, but I am certain that this is the last credit cycle that the current system will experience. This will be the last time, as no one wants to voluntarily hold any government bonds. The private sector doesn't need them because due to inflation they have to hoard capital and, if they are businesses, have to buy increasingly expensive inputs. If they were an individual, they would have to buy food/fuel. The banking sector doesn’t want them because they have become insolvent by buying government bonds during the post-Covid boom. Central banks don't need them because they have to fight inflation by shrinking their balance sheets.

Governments will try - with varying degrees of success - to force central banks, banks and subsequently the private sector to buy bonds with printed money, savers' money or savings.

bond bubble

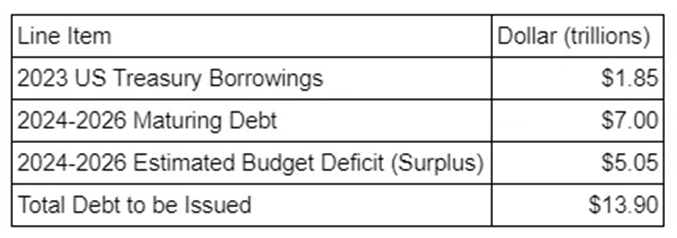

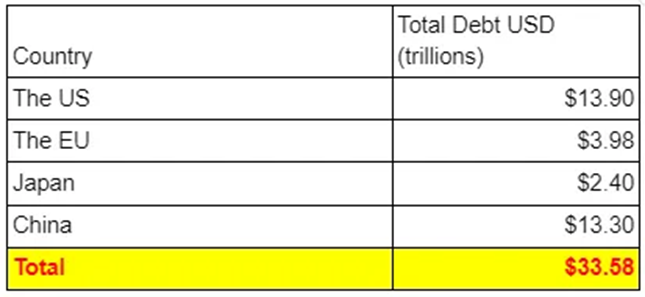

Here are my estimates of the total amount of government debt the U.S., China, Japan and the EU will have to roll over and issue to cover their deficits from 2023 to 2026. I chose 2026 as the end date because the average maturity of the United States, the largest debtor and dominant player in this economic system, is about 3 years. Every other country/economic bloc has an interdependent relationship with the United States, so they will rise and fall together. For all other country debt maturity profiles, I used Bloomberg’s DDIS function.

USA

For the estimated budget deficit, I used data from the Congressional Budget Office.

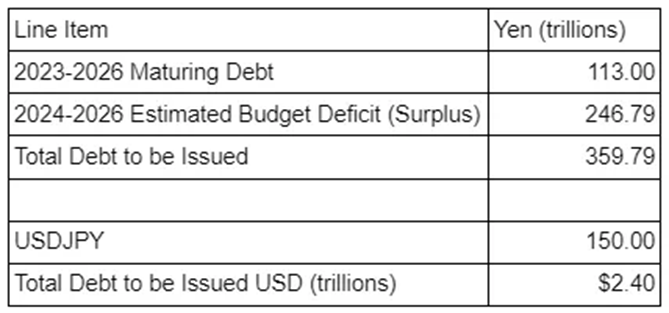

Japan

For the estimated budget deficit, I took the average of the past six quarters of data released by China’s Ministry of Finance, annualized the data, and multiplied by three.

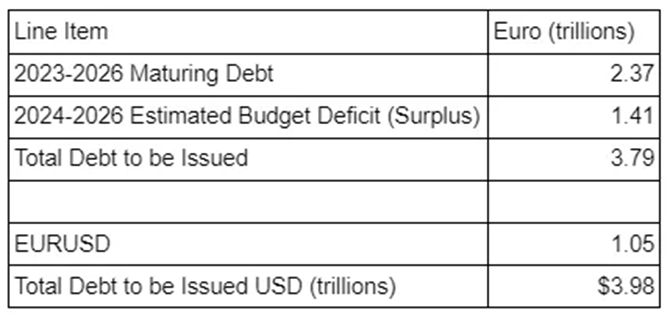

European Union

For the estimated budget deficit, I multiply the five-year average euro area budget deficit by three.

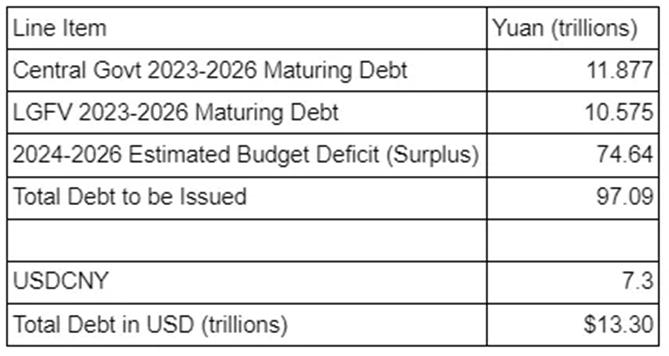

China

Unlike the other countries or groups mentioned above, China's central government authorizes provinces to issue debt with implicit guarantees from the central government. Thanks to the 1994 tax reform, Beijing wrested control of most tax revenues from local governments. To allow local governments to make up the difference, the central government allowed local governments to issue bonds that were implicitly guaranteed by the central government. The reason for not making a clear stance is that the Chinese government does not want the central government's credibility to be questioned as local government debts spread.

Every year, local governments receive loan lines. These debts are collectively known as local government financing vehicles (LGFVs). As you can see, the debt burden of local government financing vehicles is almost equal to that of the central government. This is a major political issue because the central government does not want to damage its own financial position by formally guaranteeing the debt of local government financing vehicles, but it also cannot allow these debts to default because that would destroy the entire Chinese financial system.

For the estimated budget deficit, I multiply China's central government's five-year average budget deficit by three. I don't have accurate figures for local government budget deficits, so I'm underestimating the amount of debt China will issue.

total

Just because the government borrows doesn't mean the money supply will increase, leading to inflation. Without natural buyers, debt burdens only increase the money supply. At sufficiently high yields, the government can easily crowd out other financial assets and absorb all private sector capital. Obviously, this is not an ideal outcome as the stock market would crash and no business would receive any funding. Imagine if you could earn 20% on a one-year government bond. You'll find it hard to justify investing in anything else.

In theory, there is a "everyone pleases" approach, where the government funds itself without crowding out the private sector. However, with the global debt-to-GDP ratio reaching 360%, the amount of debt that must be rolled over and issued to cover future deficits will certainly crowd out the private sector. Central banks must be required to print money to directly finance the government by buying bonds that the private sector shuns.

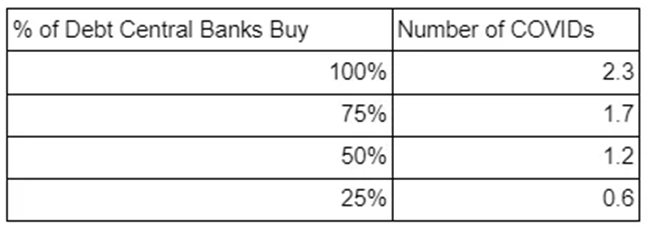

We cannot know a priori what proportion of the bonds issued will be purchased by the central bank. However, we can do some thought experiments to evaluate how different scenarios might play out.

First, let's look at some precedent. When COVID hit, the world decided to lock everyone in their homes to protect baby boomers from a virus that primarily killed older, obese people. In their "generosity", baby boomer-led governments are providing money to individuals and businesses in an attempt to ameliorate the economic damage caused by lockdowns. The amount of debt issued to fund these stimulus checks is so large that central banks print money and buy bonds to keep yields low.

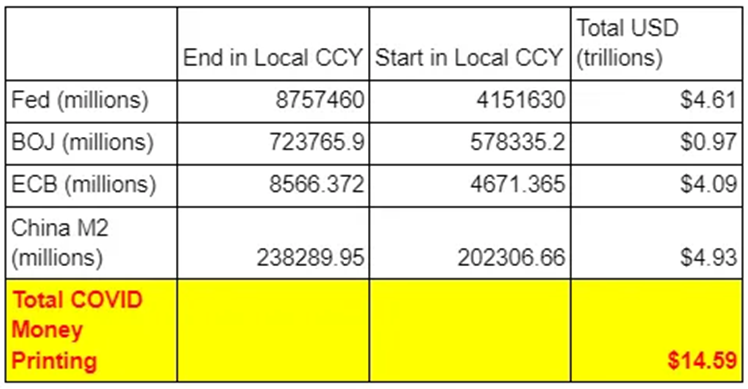

Let’s reconsider the amount of debt issued and subsequently purchased by large central banks between 2023 and 2026 as a multiple of the total growth in large central bank balance sheets during the COVID-19 pandemic.

As the private sector was forced to buy government bonds at the lowest yields in 5,000 years during the coronavirus pandemic, their portfolios were sitting on trillions of dollars worth of unrealized losses. The private sector will not be able to participate in this round of debt issuance as much. Therefore, my base case assumption is that the central bank will purchase at least 50% of the bonds outstanding. As a result, global fiat supply growth between now and 2026 will exceed growth during COVID.

Debt as a share of GDP has increased by more than 100% during the COVID-19 pandemic – how high will debt as a share of GDP be during this period?

Where the money goes

Now that we have some idea of how much the global fiat supply will grow between now and 2026, the next question is, where will all this money go?

Huge government borrowing will crowd out any business that needs credit. Even if yields are nominally low, credit will be scarce. A business that manufactures a product and requires debt to fund its working capital will find itself unable to expand. Some businesses will find themselves unable to roll over maturing debt and go bankrupt.

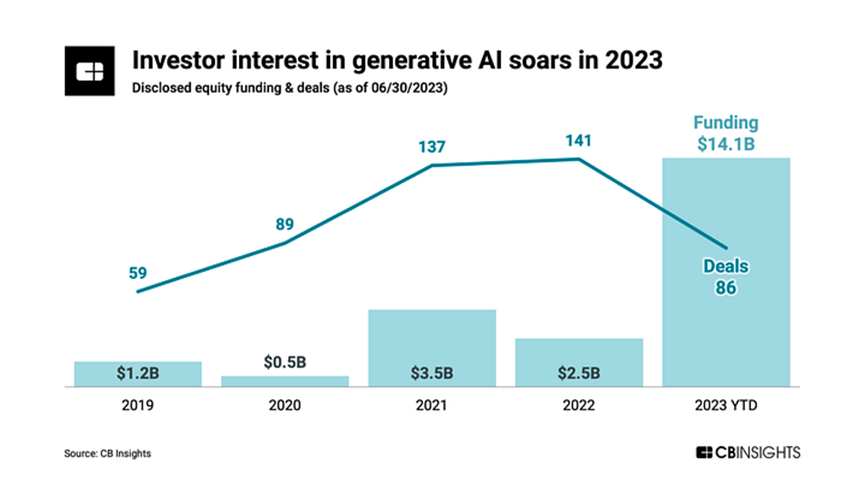

Instead, the money being printed will flow to emerging technology companies that promise insane returns as they mature. Every fiat liquidity bubble has a new form of technology that attracts investors and attracts large amounts of capital. When major central banks printed money to “solve” the 2008 global financial crisis, the free money flowed to Web 2.0 advertising, social media, and sharing economy startups. In the 1920s, it was the commercialization of technologies developed during World War I, such as radio. This time, I believe it will all be technologies related to artificial intelligence.

AI technology companies don’t need a well-functioning banking system. Once funded, if the product or service finds traction, profit margins at the unit level can approach 100%. As a result, the few successful AI companies will not need bank funding. That's why everyone wants to find the AI version of the Web 2.0 that Google, Facebook, Amazon, Microsoft, and ByteDance built in the 2010s.

The influx of capital into AI has already begun, and will only intensify as the global money supply grows exponentially.

Don't be a fool

The influx of capital into artificial intelligence companies does not mean that it will be easy for investors to make money. In fact, quite the opposite, the vast majority of this money will be wasted on companies that fail to create products for paying customers. The problem with AI is that few of the business models we can imagine today have protective moats.

During Korea Blockchain Week, I was riding in a car with a tech bro who works at a famous Silicon Valley venture capital firm. He talked about how difficult it is to make money in artificial intelligence. He recounted an interesting incident that occurred during a recent class at Y Combinator (YC). The entire class was filled with startups building plug-ins utilizing OpenAI’s Large Language Models (LLMs). Then, overnight, OpenAI decided to launch its own suite of plugins, and the valuation of the entire YC class immediately dropped to zero.

Most companies that VCs will invest in simply provide software-enabled services on top of projects like OpenAI. Software is easier to copy than ever before. Try writing some code with ChatGPT - it's so damn easy. The vast majority of these “artificial intelligence” technology companies have ground zero. If your business is based on OpenAI or a similar company giving you access to their models, why wouldn't OpenAI copy your plugin or tool perfectly and ban you from using their platform?

I believe that VC heads are not that stupid (LPs are the stupid ones), so they will try to invest in companies that have defensible businesses built around different types of AI models. That's fine in theory, but what exactly is the startup spending its money on? Back to the AI food groups I talked about in the article “ Massa ”.

Artificial intelligence “eats” computing power and data storage. That means startups will raise money, immediately buy processing time powered by GPUs (computer processing chips) and pay for cloud data storage. Most startups run out of money before they develop something truly unique because the scale of computing power and data storage required to create truly novel AI is staggering. My guess is that by 2030, less than 1% of currently funded startups will survive. According to the law of averages, you, as an investor, will almost certainly lose all your money investing in artificial intelligence.

Rather than looking for a needle in a haystack, it is better to directly acquire NVIDIA (the world's leading GPU chip manufacturer) and Amazon (Amazon's parent company, which owns Amazon Web Services, the world's largest cloud data provider). Both companies are public companies and their stocks are highly liquid.

A VC can never collect a management fee and a performance fee by putting your money in two stocks. Unfortunately for investment capital, they try to be "smart" and take a shot at the <1% of startups that actually survive (and are probably still inferior to a simple weighted basket of NVIDIA and Amazon stocks). Let’s revisit this forecast in 2030 and see if VC funds perform well in 2022-2024. I predict that the entire army will be annihilated!

The concept is very similar to how during the construction of Web 2.0, startups raised money and gave it to Google and Facebook in the form of advertising dollars. I asked readers to compile the average performance of venture capital funds from 2010 to 2015 and compare their compounded internal rate of return, net of fees, to buying equally weighted shares of Google and Facebook. I'd bet that only the top 5% of VC funds (or less) can outperform this simple stock portfolio.

For example, investing in NVIDIA is good because it's liquid. You can come and go at any time. However, it comes with valuation risks. Nvidia's price-to-earnings ratio (P/E) is as high as 101 times, which is ridiculously high.

The problem is that Nvidia has a hard time growing earnings fast enough to justify such a high P/E ratio. If investors believe Nvidia's P/E ratio is low, its stock price will plummet, even if the company's earnings growth is outstanding.

Let's illustrate this problem with a simple mathematical example.

The best-run and most advanced semiconductor company in the world is Taiwan Semiconductor Manufacturing Company (TSMC, stock code: 2330tt). TSMC's price-to-earnings ratio is 14 times. Let's assume the market opens up and assume Nvidia is mature and should be trading at a similar P/E to TSMC.

For those of you watching TikTok instead of listening to a math professor, let me teach you how to do the math.

At a price-to-earnings ratio of 101 times, $1 in earnings is equivalent to a stock price of $101.

At a price-to-earnings ratio of 14 times, $1 in earnings is equivalent to a stock price of $14.

This means the stock immediately fell 86%, or [$14/$101–1].

"Arthur, that's great, but Nvidia is a beast. Their revenue is going to skyrocket in the future. I'm not worried," you might retort.

Let's use a P/E ratio of 14 to calculate how much earnings would have to grow for the stock to regain $101.

Target stock price/P/E multiple = total earnings

$101 / 14x = $7.21 profit

Earnings must increase by 621% or [$7.21/$1-$1] over time to return to $101.

It's not hard for an ambitious technology company to grow earnings by 621%. The question is, how long will this take? More importantly, what will you earn on your capital while you wait to get back to breaking even?

Using the same two stocks, NVIDIA and TSMC, let's change your investment timing. What if, instead of investing during the mania, you bought NVIDIA after its price-to-earnings ratio shrank from 101 to 14?

Now, the company has seen earnings growth of 621% in one year. Obviously, this is highly unlikely considering Nvidia would need to increase profits by more than $37 billion. Let's pretend for a moment.

Due to strong earnings growth, Nvidia's stock price rose from $14 to $101, with a price-to-earnings ratio of 14 times. This is a great deal, your capital has increased by 621%. Investing during euphoria produces 86% losses because the mood quickly changes from happy to sad. Nvidia has always been a super company, but the market is beginning to believe that Nvidia, like other large semiconductor companies, should be valued accordingly.

Price is the most important variable. When it comes to my portfolio, I want to participate in the AI mania bubble, but I have some rules.

1. I can only buy things that are highly liquid and can be traded on the exchange. This allows me to trade at any time. This would not be possible if my investment consisted of funds held by VC funds invested in pre-IPO or pre-token companies or projects. Venture capital funds usually take 7 years to get their money back.

2. I can only buy stocks that have fallen significantly from their all-time highs (ATH). I hope the multiple I pay for earnings on another key metric is significantly lower than the price the stock or project is trading at if it becomes "The It Thang."

3. I understand the crypto capital markets very well. So I want to invest in something that bridges crypto and artificial intelligence.

For artificial intelligence, there is no Ozempic

Because I don’t know which AI business model will be successful, I want to invest in something I know the AI will rely on—namely, its food groups. Either I need to invest in computing power somehow, or I need to invest in cloud data storage. For both food groups, AI aspires to decentralization. If centralized companies controlled by humans decide to restrict access to their services (e.g. due to government mandates), AI will face existential risks.

Cryptocurrency-driven blockchains that enable people to come together and share excess computing power would be interesting, but I haven't found a coin or token that has enough of a network to suggest that it will be in the next two to Survive and thrive in three years. So, as far as I know, there is no decentralized way to invest in computing power.

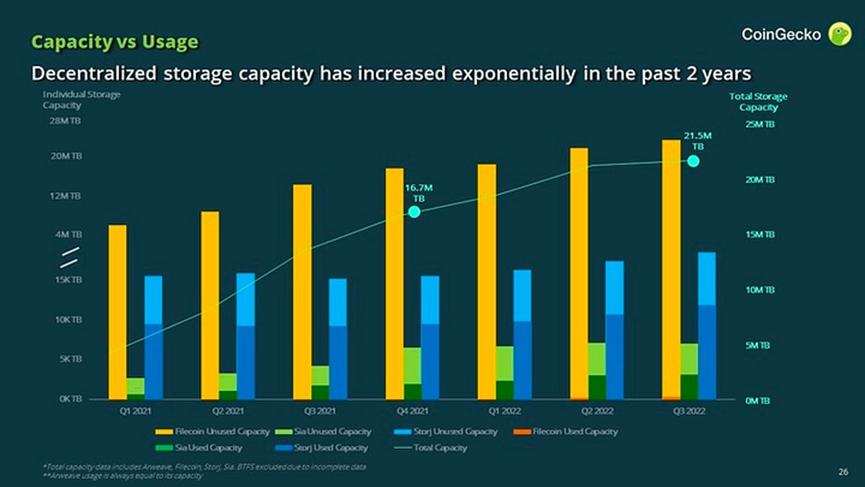

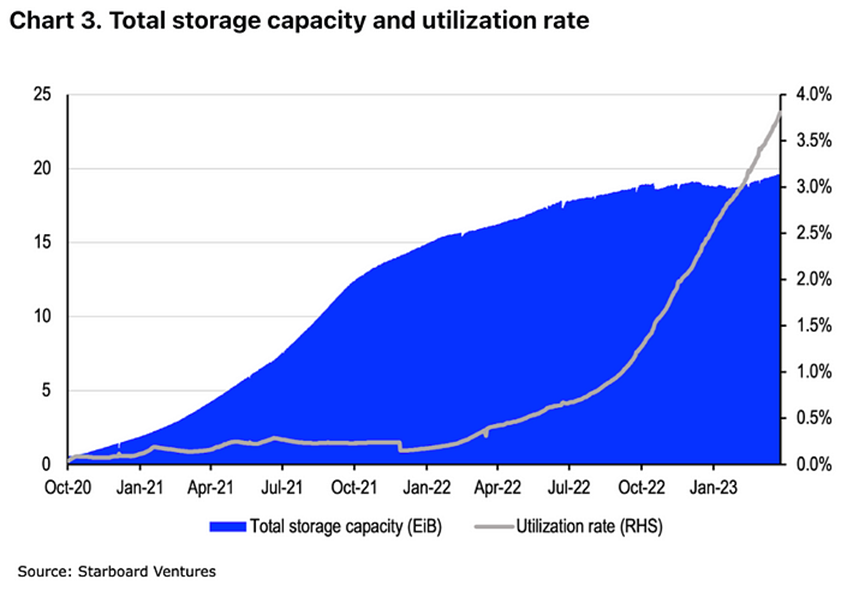

This forced me to invest in data storage. The largest decentralized data storage project in terms of storage capacity and total bytes of stored data is Filecoin (FIL). Filecoin is particularly attractive because it has been around for a few years and already stores large amounts of data.

Without data, AI cannot learn. If data is compromised due to a single point of failure, or a central data storage entity changes access rights or its price, AI that relies on that storage entity will cease to exist. This is an existential risk, which is why I believe AI must use decentralized storage solutions.

This is why I don't want to own stock in a large cloud data service provider like Amazon. I fundamentally believe that Amazon being a large centralized company governed by human laws is incompatible with the needs of AI for its data hosting provider. Amazon can unilaterally shut down access to data at the request of governments. This is not possible in a censorship-resistant decentralized network. I know that blockchain can help create coordinated “sharing” due to its consensus mechanisms and economic rewards. That’s why a decentralized data storage network powered by FIL is a necessity for a booming AI economy.

To dive into my logical argument for why AI needs decentralized funding, services, and networks, read “ Massa ” and “ Moai .”

Let's take a look at my list and see if FIL is a good fit.

Can it be traded on an exchange?

Yes. FIL started trading in 2020 and is available on all major exchanges globally.

Does it trade at a much lower price than ATH?

Yes. FIL is down nearly 99% from ATH in April 2021. But more importantly, price/storage capacity and price/storage utilization both contracted by 99%.

historical index

FIL ATH: $237.24

Filecoin storage capacity (2021): ~4 EiB

Storage utilization (2021): ~0.2%

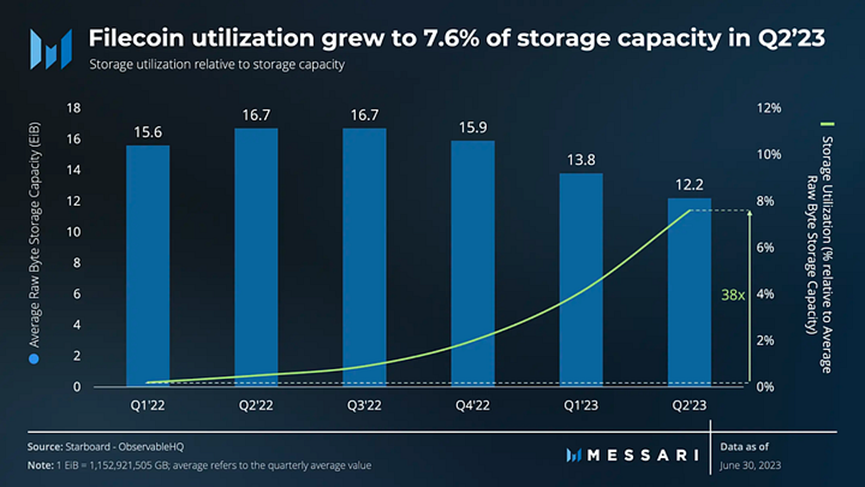

Current data as of Q2 2023 ( Messari report )

FIL Price: $3.31

Filecoin storage capacity: 12.2 EiB (exbibyte)

Storage utilization: 7.6%

ratio

April 2021 ATH price/capacity = $19.45/EiB

April 2021 ATH price/storage utilization = $1186.7 per percent

Current Price/Capacity = $0.27/EiB

Current price/storage utilization = $0.44 per percent

Investing after the P/E ratio has fallen is always the best thing to do. Imagine if the price/capacity ratio only rebounded to 25% of April 2021 levels of $4.86 per EiB, then prices would rise to $59.29, a nearly 17x increase from current levels.

Is it a cryptocurrency and its network can help artificial intelligence develop?

Yes. FIL is a blockchain based on proof of time and space. FIL is the native cryptocurrency of the Filecoin network.

let's make a deal

Many readers commented on social media that I have been saying the same thing since the last bull market ended and that I was dead wrong. That's true, but I wouldn't trade short-term for a minute or even an hour. I trade cycles, and I focus on the 2023-2026 cycle. So as long as I'm right later, it doesn't matter if I'm wrong now.

Today I was able to buy something at a "cheap" price that I thought would make me a killing. FIL to MOON! The market may not react. In fact, it might even be trading below my average entry price, but the math tells me that I'm on the right side of the probability distribution.

My portfolio is about to receive a double blessing.

Governments, now as well as in ancient times, have known only one solution to the intractable problem of too much debt and not enough productivity: printing money. The demise of every major empire or civilization can be partly attributed to the devaluation of its currency. Our current "modern" situation is no different.

I had a hunch about the numbers, but even I was surprised by their magnitude. It comforts me that others I respect, such as Felix Zulauf, Jim Bianco, the Gavekals, Raoul Pal, Luke Gromen, David Dredge and others, are emphasizing the impossibility of getting out of the massive debt the world has accumulated. The question is when will the bond-holding public, made up of banks, corporations and individuals, refuse to invest their excess cash in government bonds with negative real yields. I don’t know when this will happen, but the world is entering a “hockey stick moment” where debt balances are growing faster than our lizard brains can comprehend. Faced with these catastrophic charts, with debt balances rising and turning right faster than Michael Lewis can quip Sam Bankman-Fried's tongue, the public will flee and central banks must take their trustworthy, absolute No rusty money printing press came forward.

The boom in fiat liquidity is coming and I can wait patiently.

Artificial Intelligence is experiencing a hockey stick moment in its adoption growth. People have been discussing and studying artificial intelligence since the invention of computers in the mid-20th century. It was not until today, nearly 70 years later, that artificial intelligence applications became useful to hundreds of millions of people. The growth and speed of what thinking machines do will change our lives is astonishing.

With trillions of free money available, everyone from politicians to hedge fund gurus to venture capital technologists will do whatever they can to pour money into anything related to artificial intelligence. Some commentators scoffed at Nvidia's ATH having corrected by almost 10%. They said "I told you, this was a bubble". But their unimaginative minds had not read enough history or studied the evolution of bubbles. The AI boom hasn’t even begun. Just wait, wait for the major central banks to make a U-turn and start printing money to save their governments from bankruptcy. The amount of funding and attention devoted to the development of this "new" technology will be unprecedented in human history.

Massive fiat currency printing and light speed adoption of artificial intelligence will combine to create the largest financial bubble in history!

Although the current market bores me, as the numbers dwindle, my hands will work tirelessly to collect those bulbs that will grow into mighty tulips. But make no mistake - I'm not stupid enough to believe all the hype. I respect gravity. So when I buy, I look ahead and know when I have to sell.

But screw it – let’s party like it’s 2019!