Alameda Research and FTX's fraud and misconduct are mounting according to statements made by Caroline Ellison.

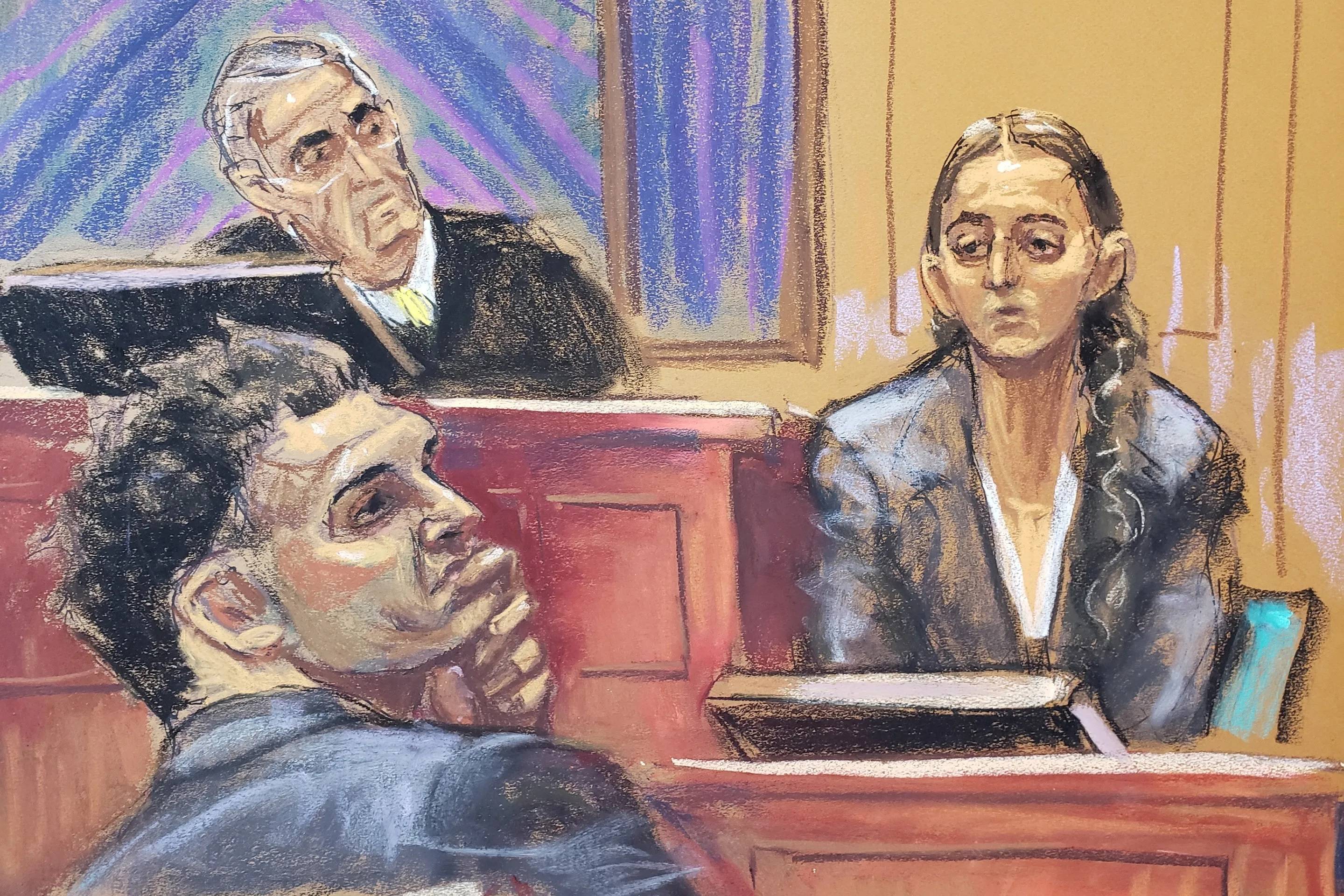

Caroline Ellison answers questions during day six of Sam Bankman-Fried's trial. Photo: Jane Rosenberg/Reuters

Caroline Ellison answers questions during day six of Sam Bankman-Fried's trial. Photo: Jane Rosenberg/Reuters

Following the 5th day of trial , witness Caroline Ellison - former CEO of Alameda Research investment fund - continued to be called by the court for cross-examination.

7 asset declarations to deal with creditors

In mid-2022, the cryptocurrency industry struggled with a liquidation crisis following the collapse of the LUNA-UST model. Faced with many parties being cash-starved, lender Genesis decided to ask Alameda Research to repay $400 million in the previous loan between the two parties.

Caroline Ellison claimed that she was instructed by Sam Bankman-Fried to pay Genesis, because otherwise, this lender could go bankrupt.

Evidence was filed in court, showing the value of Alameda Research's assets before and after the LUNA-UST collapse.

Evidence was filed in court, showing the value of Alameda Research's assets before and after the LUNA-UST collapse.

The problem here is that Alameda Research does not have such a large amount of cash available, because the fund also suffered losses because of LUNA-UST, forcing them to withdraw money from customer assets on FTX. According to Sam Bankman-Fried, this is the only way for Alameda to prove its financial capacity in the eyes of creditors without revealing holes in its funds to the outside.

Genesis then asked Alameda Research to provide financial reports to assess the health of the fund, to secure the remaining loans.

Caroline Ellison said the fund's situation at that time was not enough cash. Alameda had to borrow nearly 10 billion USD from FTX, and then lent back 5 billion USD to FTX's managers. Afraid that Genesis would know about it, withdraw the loan money, and publish the information outside, Sam Bankman-Fried decided to falsify financial declarations .

Sam Bankman-Fried asked Caroline Ellison to find a way to hide Alameda Research's internal transactions on its balance sheet. Alameda's CEO then presented Sam with 7 asset declarations on June 19, 2022, with different levels of information concealment.

In the end, Sam Bankman-Fried chose the 7th declaration, which completely concealed the story of Alameda borrowing money from FTX , and then sent it to Genesis. However, Genesis was also in difficulty at that time and continued to ask Alameda to refund another 500 million USD. Sam instructed Caroline to once again meet the lender's demands because he did not want them to go bankrupt.

When questioned by the prosecutor, Caroline Ellison admitted that she knew her actions were fraudulent and deceitful, and felt extremely pressured because she knew there would not be enough assets left for FTX users to withdraw money.

Alameda Research then sent the falsified balance sheet to other lenders such as BlockFi, etc.

Ellison said:

"When I first started working at Alameda, if someone had told me that in a few years I would have to falsify reports to send to creditors or siphon money from customers, I wouldn't have believed it."

Bribed Chinese officials to "freeze" $1 billion in assets

In November 2021, Alameda Research was involved in a money laundering investigation by Chinese authorities, causing $1 billion of the fund's crypto assets to be frozen on two exchanges, OKX and Huobi (now HTX).

To recover that money, the fund decided to bribe some Chinese officials with $150 million . Caroline Ellison said the people working on the case included David Ma, Director of the Institutional Client Group, and Constance Wang, who would later become COO of FTX - because they were both Chinese.

Before that, Alameda

As reported by Coin68, the US Department of Justice in March 2023 charged Sam Bankman-Fried with bribery related to the above incident, but the announced bribe amount was only 40 million USD. Lawyers for the former FTX CEO successfully appealed that Sam Bankman-Fried's original extradition agreement only included eight counts of fraud and racketeering, so the current trial will only hear seven counts after Remove the crime of cheating on financial donation regulations.

However, the presiding judge still allowed Caroline Ellison to present more because she thought it would help clarify the crime at FTX - Alameda.

“Things that worry Sam”

Caroline Ellison regularly kept a diary, including one entry about the things that worried Sam Bankman-Fried during the summer and fall of 2022, when Alameda Research began to be "hit" by the liquidation crisis. is spreading in the cryptocurrency market.

Sam Bankman-Fried began blaming Caroline Ellison for not setting up hedge investments for Alameda, pushing the fund into its current debt position, and having to withdraw $10 billion in assets from FTX users to compensate for losses. However, Ellison believes that Sam's investment decisions are the main cause.

By September 2022, because of continuously withdrawing money from FTX users to repay debt, the amount of money Alameda owed to the exchange increased from 10 billion USD to 13 billion USD.

In the list of "Things that worry Sam", Caroline Ellison said the former FTX CEO was trying to raise Capital from Middle Eastern investors , including Saudi Arabia's Crown Prince Mohammad bin Salman.

In addition, Ellison also revealed that Sam Bankman-Fried proactively contacted authorities to take legal action against Binance , in order to "play dirty to the opponent".

To maintain the appearance that the situation is still okay, the FTX boss planned to buy back the messaging application Snapchat , as well as invest in Japanese government bonds.

The days leading up to the collapse of FTX - Alameda

By early November 2022, Alameda Research's balance sheet was leaked , showing that the majority of the fund's assets were in the form of FTT and "Sam coins" were extremely liquidation. Crypto investors then reacted extremely negatively to the above news, causing the price of FTT to drop sharply.

Next, after Binance CEO Changpeng Zhao announced that he would liquidate all of the FTT holdings of the platform, FTT went into free fall and a wave of withdrawals from FTX began, leading to the collapse of both FTX and Alameda Research just 6 days later.

When inside information about Alameda was leaked, Caroline Ellison was on vacation in Japan, but quickly returned to the office in Hong Kong.

The management team close to Sam Bankman-Fried began to assess the situation, mentioning that the amount of money flowing out of the exchange was up to 120 million per hour. Some began to wonder whether FTX had enough funds left to satisfy users' withdrawal requests.

Sam Bankman-Fried asked Caroline Ellison on behalf of Alameda Research to post to reassure the investment community on Twitter, saying that the fund still has more than $10 billion in unaccounted assets and there are still defensive investment channels. However, Ellison now told the court those claims were untrue.

- the balance sheet breaks out a few of our biggest Longing positions; we obviously have hedges that aren't listed

— Caroline (@carolinecapital) November 6, 2022

- given the tightening in the crypto credit space this year we've returned most of our loans by now

She added that Sam Bankman-Fried was the one who originally drafted the post, but she edited it and posted it on her personal account.

After Binance CEO tweeted to sell FTT, Caroline Ellison continued to write that Alameda Research was willing to buy back all of that FTT at 22 USD, claiming that Binance was just "threatening".

@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

Caroline Ellison then Chia in a text message with Sam Bankman-Fried that despite what was happening, this was the time when her mood was the best in the past year. When asked by Sam why, Caroline replied:

In SBF trial today, it was while reading these messages for the jury that Caroline Ellison's voice broke https://t.co/FR7zCylNyL pic.twitter.com/lfNonduCv5

— Inner City Press (@innercitypress) October 12, 2023

“I think I've been hoping for this day to come for a while, and now that it's actually happened, it feels so relieved to no longer have to worry about it, one way or another. ”

When Chia the above conversation, Caroline Ellison began to cry in court, saying: "I feel relieved because I no longer need to lie." She called this "the worst week of her life".

Sam Bankman-Fried is urgently looking for new investors to get more money to help FTX. The former CEO of the exchange is said to have sought out all the organizations that had cash available at that time, such as Sequoia, Genesis, Apollo, etc. At the same time, Alameda Research's creditors were still aggressively asking the fund to repay debt.

Coin68 compiled

Join the discussion about the hottest issues of the DeFi market in the Fomo Sapiens chat group with Coin68 admins!!!