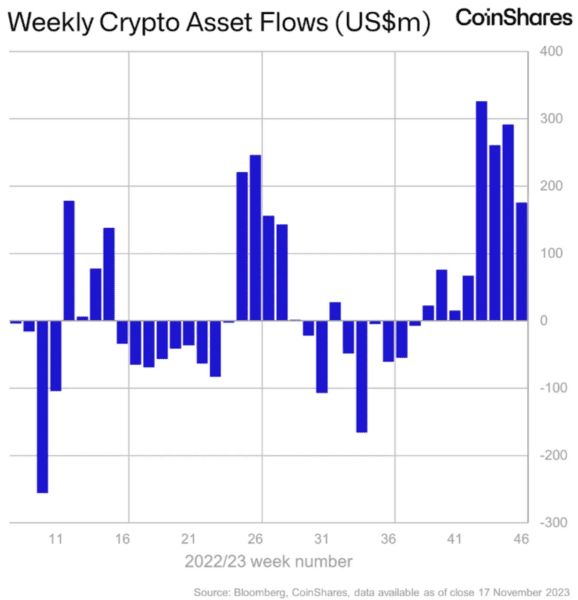

Crypto asset management company CoinShares said in a report released on Monday (20th) that digital asset investment products have experienced net inflows for eight consecutive weeks. The net inflow last week was approximately US$176 million, which brought the year-to-date inflow to 13.2 One hundred million U.S. dollars. However, current annual inflows are still well below the levels in 2021 and 2020, when net inflows were US$10.7 billion and US$6.6 billion respectively.

The average weekly trading volume of digital asset ETPs reached $3 billion, twice the average this year. CoinShares also noted that digital asset ETP trading volume is rising as a share of total cryptocurrency trading volume, averaging 11%, compared with the long-term historical average of 3.4%, well above the average during the 2020/21 bull market .

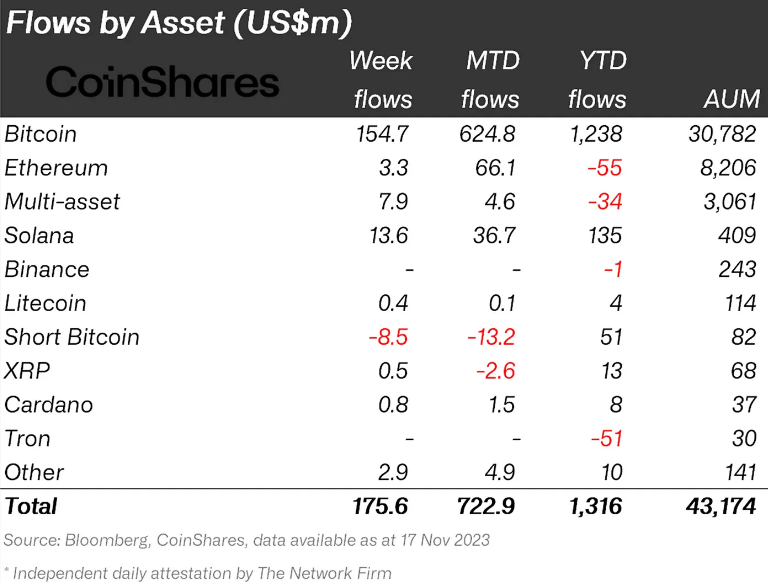

In terms of investment in ETPs in various regions, Canada, Germany and Switzerland continued to show net inflows of US$97.7 million, US$63.3 million and US$35.4 million respectively, while futures products in the United States saw a net outflow of US$19.2 million.

In terms of various currency investment products, Bitcoin continues to dominate, with a net inflow of approximately US$155 million last week, and inflows in the past eight weeks accounted for 3.4% of assets under management. Net outflows from short Bitcoin investment products were $8.5 million. CoinShares reiterated in a report that this continued positive sentiment is related to the impending approval of a Bitcoin spot ETF in the United States.

Multiple Altcoin investment products saw net inflows last week, the most notable of which were Solana, Ethereum and Avalanche, with net inflows of US$13.6 million, US$3.3 million and US$1.8 million respectively. Uniswap and Polygon saw outflows of US$550,000 and US$860,000 respectively.