It’s already 2023, what else should we introduce about Dex?

Yes, although Dex is already a commonplace topic, it does not mean that the problem of Dex has been solved. It just has not yet ushered in a product that can solve the problem, meet the needs, and is easy to use.

This article mainly wants to introduce you to you in an excited mood. In recent years, I have seen a few innovative Dex. In addition to innovation, it is also a decentralized exchange that is friendly to retail investors and can also worry-free for large investors. Therefore, it avoids the inability of general users to contribute to liquidity due to technical barriers, and prevents defenseless general users from being easily attacked by arbitrageurs using MEV, resulting in loss-making exchanges. The author believes that this has been the case in recent years. One of the few Dex that has clear overall goals, innovative technology, and meets real usage scenarios is Dyson Finance.

The name Dyson is inspired by the Dyson sphere , which can capture most or all of the star's energy output, just like Dyson Finance's vision to minimize transaction wear caused by middlemen and capture the most liquidity.

1. The biggest problem of DEX at present: There are no liquidity providers who come out with a smile

Liquidity Provider (hereinafter referred to as LP) has always been the lifeblood of decentralized exchanges. Any dex must rely on LP to provide liquidity to ensure that the trading pair has enough depth to provide users who want to trade. However, for a long time, there has been no decentralized exchange in the form of AMM that can provide LP with predictable returns, and even a lot of funds will be lost due to Impermanent Loss losses .

In a situation where market makers have no way to predict the benefits of providing liquidity, it is difficult for retail investors to be willing to invest in LP for a long time and contribute to the liquidity of dex, because it is difficult for them to leave the game with a smile. The research organization topaze.blue and the well-known DeFi project Bancor even jointly published a research report two years ago, telling everyone that up to 49.5% of LPs ended in losses on uniswap v3 (it was even a bull market at that time).

2. How does the new generation of DEX solve this problem?

After the advent of the first generation of automated market maker exchanges led by Uniswap, which generally faced the problem of unpredictable market maker profits due to factors such as Impermanent Loss, other new decentralized exchanges have emerged one after another in an attempt to solve the problem of Impermanent Loss . Regarding the pain points that losses bring to market makers, the author below first lists several decentralized market makers that have tried to solve free losses in the past, and explains the difficulties and limitations they encountered:

DODO — PMM introduces market prices for active market making

Dodo exchange is a decentralized exchange that uses the self-invented PMM (Proactive Market Maker) as a market-making mechanism. The biggest feature of the PMM algorithm is that it introduces reference prices through oracles, and the market makers actively quote prices. In this case, Dodo will try to concentrate liquidity near the market price. In the case of actively updating prices and adjusting the parameters of the price algorithm, Dodo reduces the chance of LP Impermanent Loss caused by users trading here or conducting spread arbitrage.

However, Dodo also shows that it is impossible to completely eliminate Impermanent Loss. At the same time, Dodo also needs to rely on external oracles for price feeds. If the external price of the oracles deviates, it may also cause LP greater Impermanent Loss.

Bancor

Bancor, the ancestral decentralized exchange born out of the 2017 ICO boom, recently proposed a solution to Impermanent Loss. Simply put, it uses the Bancor protocol token $BNT to compensate for the Impermanent Loss of liquidity providers. Unexpectedly, this project was terminated on June 20 last year because it could not bear the loss . It can be seen that stimulating users to participate in liquidity provision by subsidizing free losses is not a method that can develop in the long term.

Other Dex that used to target free losses or predictable gains are now very few under the baptism of the bear market. Even if uniswap v3 is a bit like a put-selling dex, half of the transactions still come from sandwich attacks and Arbitrage attacks. In addition, many users are unable to profit from this due to the complexity of the interface and lack of sufficient prior knowledge of Uni V3. Some even claim that 80% of LPs in Uni cannot have long-term stability. income .

In summary, the current Dex mainly faces the following challenges for ordinary retail investors to serve as liquidity providers:

- The operating threshold is too high

- Income is unpredictable

- There is no effective curb on MEV arbitrage

The difficulties encountered by these decentralized exchanges have resulted in not so many people being willing to provide liquidity without rewards, which has also resulted in a shortage of liquidity in the decentralized world, or has been monopolized by a few professionals, which has also made decentralization The vision of centralized finance is even more difficult to realize.

Dyson Finance Solutions

Unlike other liquidity solutions, Dyson Finance's liquidity providers can directly see clear returns on Dyson's products. When LPs want to provide liquidity in Dyson Finance, they will see the following testnet interface, for example Say, if I want to provide 1000 USDC as liquidity of DYSN/USDC, then I will see the following situation.

Dyson will clearly tell the user that after three days, when the user exits liquidity, he will be able to obtain a clear income in USDC or DYSN. All the user has to do is to see if the income is in line with expectations. If you are satisfied, invest; if you are not satisfied, don't invest. Compared with Uniswap V3's new liquidity interface, UniV3's interface is more like a test paper, filled with many fill-in-the-blank questions that require prior technical knowledge.

What creates the special look of Dyson Fiance? There are two key factors here, one is dual-currency investment (Dual Investment), and the other is Dynamic AMM. Dual-currency investment here is a way for users to provide liquidity, and it is also a financial product; and dynamic AMM It is the mechanism responsible for determining transaction fees.

Dual Investment

Dual-currency investment is not an original concept of the Dyson Finance team, but this is the first time it has been transplanted to AMM to become a liquidity providing mechanism. Dual-currency investment is a centralized exchange (such as Binance and OKX , etc.) The mechanism of the last common structured product is that when users subscribe for dual-currency investment, it is actually equivalent to automatically selling options and receiving premiums.

Then you may ask, why would anyone be willing to spend this premium to buy options? The main reason is because he is optimistic about the future rise and fall direction, and believes that the current buying price or selling price you provide will be profitable one day in the future, so he is willing to pay the premium to buy it from you and then buy it after the expiration date. Or the right to sell, and this is where the profit comes from for the option seller.

Therefore, if you are an option buyer, you must be optimistic about the direction of the increase or decrease; conversely, if you are a seller, then you must believe that the market will stabilize before the expiration date, or it will not move in the direction of the transaction price. Go. But options are not the focus of this article. If you are interested, please read the series of articles introducing options by Anton, a professional option developer in Taiwan .

Dual-currency investment on the exchange actually means selling options on behalf of the user through the exchange (as a broker) and extracting certain profits from it. This is not the case on Dyson Finance. On Dyson, the liquidity provider is the option. The seller of the option, and the protocol party is the buyer of the option. The Dyson protocol will bet against the liquidity provider and pay them premium.

As shown in the example below, if I provide 10,000 $DYSN as liquidity, I actually sell options to Dyson protocol. If the price is lower than the current price 1.65507 usd per $Dysn one day later, I will get 10146.51 $DYSN, when the price is higher than the agreed price one day later, I will receive 16793.15 usdc, which will be higher than the current value of 10000 DYSN at the time of investment (16550.7 usd) anyway, while the Dyson protocol will receive the current price and the future price, and thereby obtain more liquidity.

Of course, the author here also wants to declare that we do not know whether DYSN will rise or fall in the next few days, so basically we can say that Dyson guarantees interest, but there is no guarantee of what the overall value of future principal and interest will be.

In this process, when LP puts Token A single currency as the liquidity of the tokenA/B trading pair, the protocol will use the internal customized Virtual Swap to calculate the value of the Token A single currency put here, and it can be equivalent. Based on how many token B, in this way, the liquidity pool updates the price and accumulates liquidity.

Under the mechanism of Dual Investment, for LP, withdrawing the single currency in the mortgage is equivalent to withdrawing liquidity. However, when withdrawing liquidity, Dyson has two points that are different from ordinary DEX:

- It has an expiration date and cannot withdraw from liquidity immediately. Unlike general dex, which can withdraw from liquidity at any time, Dyson will agree on an expiration date with LP, and LP can only withdraw after the expiration date.

- When you invest and there is no way to predict the expiration date, you can get token A or token B.

Introducing the concept of dual-currency investment into automated market makers is not only refreshing, but the most important point is that it solves two problems

- Benefits to investors: Make the income of liquidity providers predictable. After the advent of the Dyson mechanism, any investor can turn the provision of liquidity into a financial product with a fixed return. This is a very important point because it represents the user. You can spend the least effort and the least prior knowledge to decide whether this is a worthwhile investment, while also bringing a highly sustainable financial product with fixed income to DeFi.

- External benefits to the overall environment: Another interesting point about converting investors into liquidity contributors is that in this process, investors who were originally purely self-interested have also quietly become liquidity providers, invisibly benefiting the overall environment. The centralized liquidity market contributes to transaction depth.

Finally, one thing worth mentioning here is that unlike the general dual-currency investment in centralized exchanges, which help users sell options from platforms such as Derbit and then take a commission from the users, Dyson will keep the profits as much as possible. It will even provide additional $DYSN token rewards to users. The author once conducted an actual test before the article was published. After selling ETH 1800 options on Derbit seven days later, the annualized return was 117.5%.

If you choose a commodity with the same expiration date and the same price in Binance’s dual-currency investment product, you will find that the APR is only about 84.59%. On Dyson Finance, you can get 115% APR under the same conditions, and this is not Contains additional Dysn token rewards.

Dynamic AMM

Another thing worth introducing in the Dyson system is Dynamic AMM. There are various pools in Dyson Finance. The pricing of each pool is based on the constant multiplier of xyk to price the assets in the trading pair, but the difference lies in Dynamic Amm, Dynamic AMM has two main features. First, it can dynamically adjust transaction rates and is asymmetric. Through these two features, we can see that on Dyson Finance we can target the same transaction separately. The right buyers and sellers can dynamically set transaction fees and adjust fees to respond to different market conditions to reduce friction and value extraction caused by arbitrageurs or MEVs.

Here, the author will explain these two characteristics separately.

- Dynamically set transaction fees <br>First of all, in Dyson Finance, the transaction fee will change according to the reserve ratio of the two currencies in the trading pair in the pool to adapt to the intensity of the transaction and the market's response to the two currencies. The level of demand for the currency, for example, in a Dyson ETH / USDC pool, the initial purchase and sale transaction fee is 0%. When reserves for a specific token are reduced by x%, a corresponding x% fee will be added to sell transactions involving that token. For example, let's say the liquidity pool originally held 1,000 ETH, and after someone purchased it, the pool was reduced by 10%, leaving 900 ETH. Therefore, a 10% fee will be charged for "Sell ETH" transactions.

- Asymmetry <br>The so-called asymmetry means that the transaction fees of the two assets in the trading pair are independent. When the buying fee of token A in the trading pair is very high, buying token B will not change because of this. Taking ETH-USDC as an example, Dyson Finance can use Dynamic AMM to set different handling fees for two different transaction directions (USDC->ETH; ETH->USDC). These Rates adjust based on the intensity of trading activity.

Here, Dyson's design will allow "reverse" transactions to have larger handling rates because Dyson believes that "reverse" transactions are more likely to involve arbitrage activities. Therefore, Dyson's clever design would charge higher fees to arbitrageurs who "share the profits." For example, if you buy ETH at a new, higher price after someone buys it, it doesn't look like arbitrage, and Dyson won't charge you.

But if you sell the ETH in your hand back to the liquidity pool immediately after someone purchases ETH, then this behavior is likely to be arbitrage (capturing the price difference). Here, Dyson also uses reverse transactions to Charge a higher fee to increase the friction cost of arbitrage, and finally return it to LP and the currency-holding community through premium and token profit sharing.

Although as fees increase, the price difference quoted by the pool will expand, but it will grow organically until there are no more traders willing to trade in the market. Therefore, transaction fees do not increase indefinitely. In addition, the transaction fee itself will gradually decrease over time, because the Dyson protocol has a rule that the transaction fee is halved every t seconds (half-life) until it drops to zero.

According to Dyson’s white paper, we can summarize that this design has the following benefits:

- The handling fee will automatically adapt to market changes: through DAMM, there is no fixed trading fee for any trading pair on Dyson. Instead, the fee increases with higher trading volume and decreases with lower trading volume, automatically balancing to Achieve optimal profitability.

- To redistribute the value extracted by MEV:

Unlike many dexes in the past that were eager to use external compensation to deal with free losses, Dyson Finance chose to charge arbitrageurs (reverse transactions) larger transaction fees, and finally distributed these profits to the real liquidity of this protocol. Contributive people.

3. Does not rely on external information: The Dyson Finance model does not rely on external information sources, such as price or trading volume oracles. Instead, in addition to volatility, it is able to obtain the information it needs based solely on internal dynamic operations, which will help Dyson become a more resilient DeFi protocol.

Transaction Fees

Today under Dyson's design, we can see that the transaction fee is as follows

Fee = 1-(1-x%)(1-y%) //x% is the transaction fee charged by dex for transactions in this direction last time; y% is the expected increase in a certain token in the pool caused by this transaction Or reduce by y%

In the initial setting, the transaction fee is zero, and different transaction fees will begin to occur as the transaction starts. At the same time, if no transaction is generated, the transaction fee will also decrease over time.

The lifeblood of Dyson Finance: PCV (Protocol Controlled Value)

For the DeFi protocol, the most important lifeline is to have a treasury that it can control. Dyson's income comes from the income from dual-currency investments with users and the transaction fees that Dyson extracts from traders, as shown below, The sum of these becomes the financial source for Dyson protocol to issue rewards. In Dyson, each pool will have its own PCV. The more PCV, it also means that the protocol has more funds that can be used as rewards. Dyson’s calculation of PCV as follows:

PCV = TVL (Total Locked Value) — User’s redeemable funds (expired redeemable funds + discounted value of unexpired redeemable funds)

Simply put, the more PCVs we have, the healthier the pool is.

Dyson Finance’s Economic Model

At present, Dyson Finance's white paper has not disclosed the full version of the economic model, but some interesting elements can already be seen from the newly launched products and white papers, such as the design of SP points, membership system, and token functions, as well as future possibilities. Have product planning combined with market strategies.

Governance Token $DYSN

The governance token of Dyson Finance is $DYSN. Mortgage governance tokens can participate in the governance decisions of the protocol, share the revenue of the protocol and increase the return on their investment in Dyson.

SP points and Dyson Membership program

When introducing Dyson's economic model, what needs to be mentioned is their membership system and the member-exclusive additional reward tokens $SP. This is a set of tokens that allow Dyson users to closely follow the development of Dyson. Mosaic mechanism.

The membership system is a very interesting self-marketing mechanism. The most successful one used this year should be the SocialFi protocol Friend.tech , but as early as 2021 when DeFi and SocialFi were not popular in referral codes, Chen Pin, a core contributor of the Dyson protocol, They have already used the referral code to become a member in one of their insurance agreements , 3F Mutual , but I think this time Dyson Finance’s narrative and products are more mature, and it retains the fun of the online and offline marketing system. .

In Dyson Finance, the membership program is a program that allows Dyson users to automatically market for Dyson and earn diverse and passive income. In fact, it is somewhat of a direct sales nature, but it is also through This method allows the community itself to participate in the development of the protocol and share the results of the protocol.

First of all, if you want to become a member of Dyson, you can only be invited by an existing member. After becoming a member, everyone can get three invitation codes to invite others to join, and anyone can play these two roles at the same time. .

In addition to earning premiums through dual-currency investment, Dyson can also earn $DYSN through the membership system, but the difference is that it will be sent in the form of $SP (points). SP is A kind of points that can be redeemed into $DYSN. There will be a cooling-off period after each redemption, so users cannot redeem an unlimited number at any time; in addition, SP can also use this to measure a user's activity in the Dyson protocol. There are currently two ways to obtain SP:

- Dyson members can immediately receive SP as prime reward when participating in dual-currency investment.

- Member recommendation reward: Each member can invite up to three referrals. Whenever your referee redeems his points to $DYSN, the referrer will receive additional SP as a referral reward. That is to say, the more your downline recommenders invest, the more points you will receive as a reward, forming a relationship of "alliance, team formation, mutual benefit"

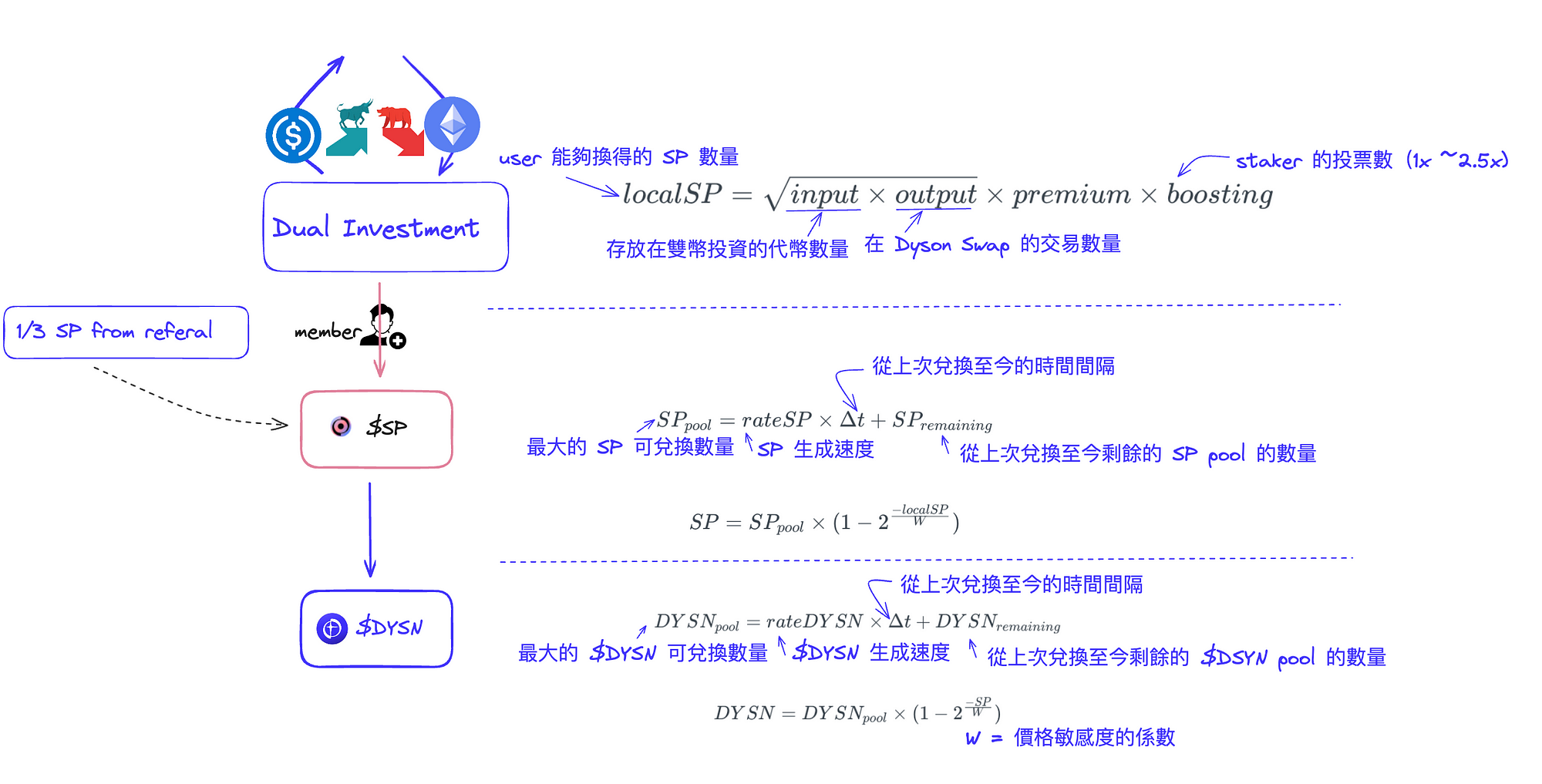

In addition, it is not possible to redeem $SP from localSP, and then redeem it from SP to $DYSN at any time. Here we can see various factors that are conducive to ecological development on Dyson. , for example, the amount of dual-currency investment, the number of transactions in Dyson dex, and the number of sDYSN on hand as a staker will also affect the amount of $SP; in addition, SP will also be affected when it is exchanged. The generation speed of SP, the time interval between the last redemption, and the number of redeemable DYSN remaining in the pool will also affect the redemption of SP into DYSN.

Recent Dyson Finance trends

Recently, Dyson Finance's products have been launched, and many market activities are also in full swing. Here’s a quick introduction for you:

1. Pioneer mainnet officially launched Linea

Dyson Finance officially launched the assault version of the mainnet on Linea on October 25. Linea was developed by the Consensys team that built Metamask and is a second-layer network based on zkEVM. Currently, Dyson has received a certain degree of attention in the Linea ecosystem, as well as Linea The endorsement of the official team in the community, I personally think this is a very interesting start, because there is currently no particularly strong Dex on Linea, and the Linea ecosystem has not yet ushered in an explosive period, and unlike other DeFi products, it may require Infrastructure support such as Chainlink can only be launched. Dyson basically does not need to rely too much on external data support to operate, and it has a good chance of seizing the opportunity of the ecosystem.

Of course, this is just the first step for Dyson. According to the official article, they will launch Polygon zkEVM next month , and they even plan to implement Dyson-specific Hooks on uniswap v4 in the future.

2. Recent market activities

Dyson Finance is currently running an event on Galxe where you can get NFT by solving tasks . If you are a hard-working friend, you can check it out. What you need to do is very simple, which is to deposit 0.01 eth or 15 usdc on Dyson for dual-currency investment, and use Exchange 0.01 Ether for the corresponding usdc on Dyson, and follow their social media to get their NFTs. There may be unexpected surprises such as airdrops. In addition, Dyson Finance will also hold trading competitions and essay competitions from time to time. It has even been heard recently that events similar to the IQ 180 that have given out large amounts of airdrops in the past may also happen on Dyson Finance, giving friends who are familiar with the white paper but not good at participating in events a chance to get rewards.

Risk and Contract Audit

Finally, the Dyson team itself has stated that the Dyson protocol also has risks. For example, the protocol itself may go bankrupt due to the following reasons:

- There is no market fluctuation, causing the funds in PCV to be insufficient to pay the rewards of dual-currency investment.

- Incorrect parameter adjustments may also cause system crashes

Of course, the author believes that Dyson's feature of not relying on external data should have been able to avoid many natural and man-made disasters for Dyson, because many unexpected attacks are found between protocols and protocol combinations, or because of external Caused by dependence on data input.

As for the security of smart contracts, Dyson Finance’s contracts have now been audited by two auditing companies, Dedaub and Decurity . These two auditing companies have good reputations and auditing quality in the blockchain. Dedaub’s customers include Coinbase, Blur, Lido, GMX, etc.; Decurity is Yearn's auditing company and has also won the runner-up honor in the CTF competition organized by Paradigm. In addition, according to the Dyson team, they will participate in Code4Arena audit activities again in the future.

Finally, the author also wants to say that any investment and DeFi products must contain a certain degree of risk, and detailed research must be conducted before making any investment.

If you want to know more about Dyson Finance, here are the relevant links:

– Website: https://dyson.finance

– Twitter: https://twitter.com/DysonFinance

– Discord: https://discord.gg/pBsH2sJHkt

– Medium: https://blog.dyson.finance

– Whitepaper: https://docs.dyson.finance

Finally, I would like to thank many people for completing this article. First of all, I would like to thank Ian for introducing me to the Dyson project. I would also like to thank Robin for helping me read the content very carefully and finding out many typos and idiosyncrasies in the writing. This made me It can make the entire article smoother and more readable. Finally, I would also like to thank Chen Pin, the core contributor to the project, for taking the trouble to answer my questions and provide feedback on my article.