Shares of cryptocurrency exchange Coinbase (COIN) have hit an 18-month high after rival exchange Binance and its former CEO Changpeng Zhao pleaded guilty to money laundering and violating sanctions in USA.

According to TradingView data , on November 27, Coinbase closed at $119.77, its highest since May 5, 2022. It had little movement in after-hours trading.

This puts Coinbase stock up about 256.5% year to date, though still down 65% from its November 12, 2021, All-Time-High of nearly $343.

Coinbase shares soared just a week after Binance and founder Changpeng “CZ” Zhao pleaded guilty to money laundering, violating US sanctions and operating an unlicensed money transmitter business.

Zhao and Binance settled with the United States for $4.3 billion, which includes Zhao stepping down as CEO and Binance agreeing to monitor DOJ compliance for up to five years.

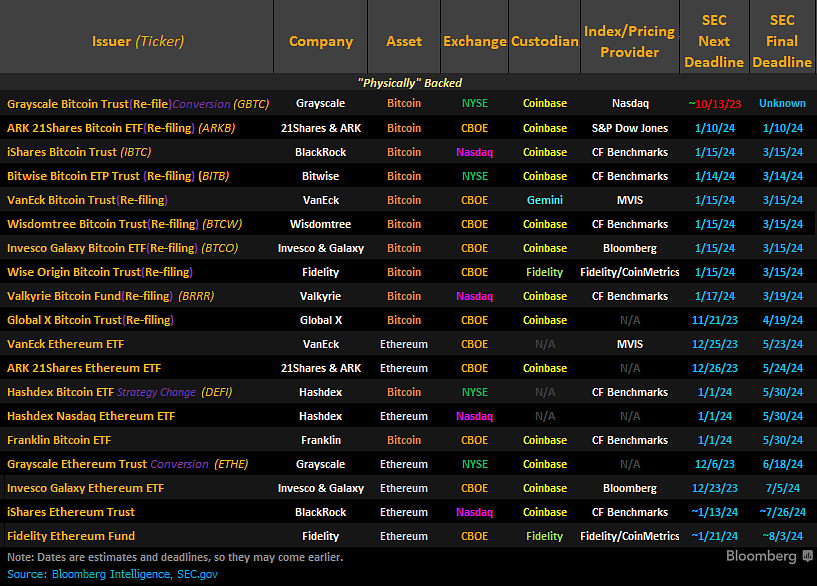

Analysis from Bloomberg ETF analyst James Seyffart shows that Coinbase is the custodian of 13 of the 19 spot crypto ETFs currently pending with the Securities and Exchange Commission.

However, Coinbase faces a lawsuit from the SEC, claiming that the exchange failed to register with the regulator and listed several Token in violation of US securities laws.

Coinbase attempted to dismiss the lawsuit and questioned the SEC's authority to oversee cryptocurrencies.