Original | Odaily Odaily

Author | Nan Zhi

At 12:00 noon today, the governance token BSSB issued by BitStable started the pledge round (over-raising) and fixed-price sales round (rush purchase) on Bounce. Many users encountered the situation that the official interface was unable to enter.

Some users who can enter will encounter situations where the signature cannot be completed during the rush purchase. In fact, after the public sale started, all the places (100) were taken by "scientists".

Subsequently, BitStable issued a document on the Uneven distribution (of tokens). In order to realign the distribution of BSSB and adhere to DAII’s strategic roadmap, we have made a difficult but crucial decision: we will destroy 75% of the BSSB tokens participating in the fixed-price auction.

Taking into account high gas fees and the additional costs incurred, this effectively increases the cost of participation sixfold for interested parties. We are committed to transparency and fairness, and we believe these steps are critical to aligning with those values. "

To put it simply, the project party BitStable felt that the public sale was being rounded up by "scientists" and the tokens were unevenly distributed, so they directly destroyed the tokens obtained by the "scientists" to reduce their profits. Odaily will explain the incident in detail in this article.

rush sale public sale

The public sale of BSSB is divided into two parts: super-raising and snap-up. The snap-up part is 4,200,000 tokens, with a total of 100 ETH raised. Each wallet can invest a maximum of 1 ETH. Due to the high expected profits, participants will invest the upper limit amount, thus determining the amount that a maximum of 100 wallets can obtain for the public sale.

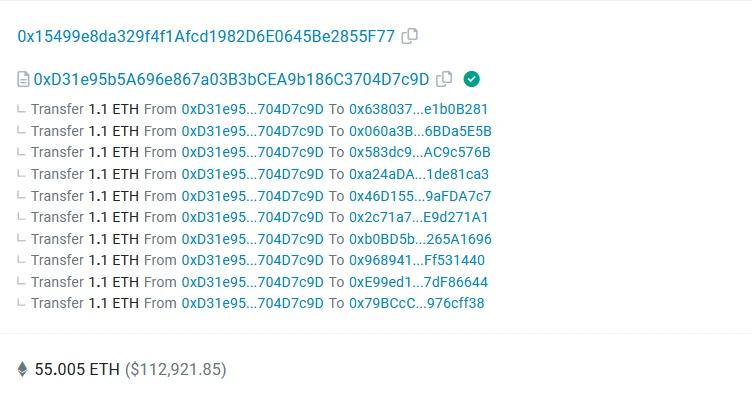

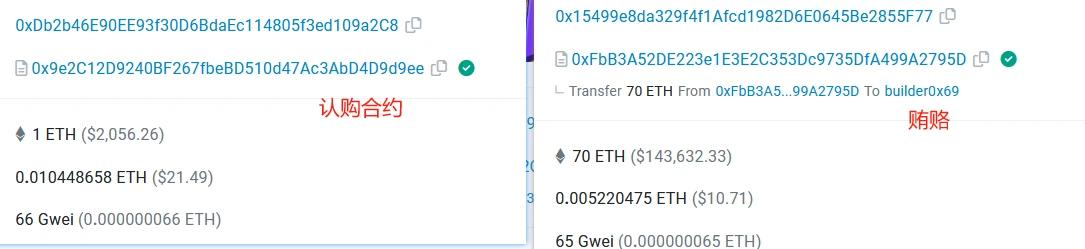

Scientist No. 1 0x15499e8da329f4f1Afcd1982D6E0645Be2855F77 distributed 55 ETH to 50 wallets at 11:30 today, with each wallet receiving 1.1 ETH.

12: 00 The public sale started, 0x1549 initiated a snap purchase through the above 50 wallets (each wallet Gas 66 Gwei), and bribed the miner builder0x69 with 70 ETH to ensure the success of the snap sale. The transaction was packaged 11 seconds after the public sale, 0x 1549 succeeded Grab 50 spots.

(Note: Miner builder0x69 also produced a bribery API tutorial )

Scientist No. 2 0x5F6f , Scientist No. 3 0xd8A7 , and Scientist No. 4 0xE7f9d grabbed 22, 11, and 7 quotas respectively by increasing the Gas. The Gas was 3000 gwei, 1584 gwei, and 888 gwei respectively.

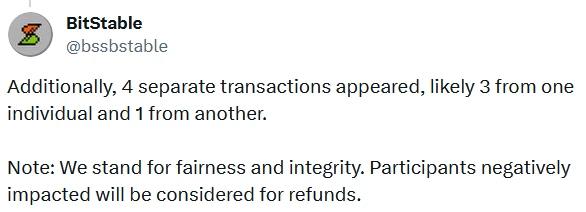

BitStable then announced its decision to destroy 25% of the tokens to maintain "fairness." Later, BitStable conducted address analysis and stated that there were four separate transactions, possibly from two individuals, stating that "participants who were negatively affected will be considered for refunds," or that only the tokens of the aforementioned scientists will be destroyed.

AUCTION rise

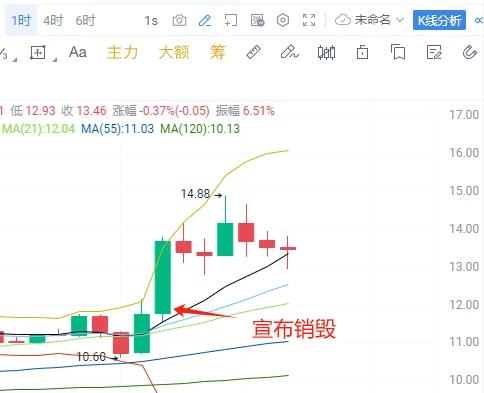

After BitStable announced the destruction of snap-up round tokens, the popularity of the super-raising round began to rise, because AUCTION tokens need to be pledged to participate. AUCTION began a round of rise after the news came out, with an increase of 16% in one hour.

As of 20:40, the super-raising round interface shows that 824,400 AUCTIONs have been pledged. Based on the current price of 13.5 USDT, 11.12 million US dollars of funds have participated in the super-raising.

It’s difficult for scientists to get their money back

According to the cost calculation of Scientist No. 1, one account will receive 4,200,000 × 1% × 25% = 10,500 BSSB, and its single number cost is approximately 70 ÷ 50 = 1.4 ETH, so the corresponding single cost of BSSB is 1.4 × 2050 ÷ 10500 = 0.273 USDT.

The total number of coins after destruction is 21, 000, 000-4, 200, 000 × 75% = 17850000 coins. The corresponding market value of the scientists’ return needs to reach 17850000 × 0.273 = 4.897 million US dollars. There are currently only a few mainstream BRC-20 If the token exceeds this market value, scientists who participated in the rush purchase expect it will be difficult to recoup their capital.

(Note: OKX’s largest 24-hour trading volume, piin, has a market capitalization of US$4.2 million; the second sats, US$273 million; the third rat, US$56 million; and the fourth MMSS, US$6.51 million)

And if the project party does not perform any operations on it, the scientists participating in the rush purchase still hope to make a profit. Usually, participation in public sales is based on "everyone's ability." It is relatively rare for the project side to directly intervene in the scientists of the public sale. It is difficult to come up with a single answer on what is truly fair.