Author: TechFlow TechFlow

Solana's ecological performance has been extraordinary recently, and the entire ecosystem has experienced a general rise in prices. Especially the recent airdrop of Jito has made many users start to pay attention to Solana's interaction again. We have previously shared an article about possible airdrop opportunities in the Solana ecosystem. Interested readers can pay attention to the previous article: "Jito is fierce, don't miss the other 5 projects that will be airdropped in the Solana ecosystem"

This wave of "Solana" opportunities has not caught up, and people tend to look for the next "Solana".

Just like if the BRC inscription is not hit, people will hit the Eth\Solana inscription. It doesn’t matter whether it makes sense or not, just rush it first and then talk about it.

In the last bull market, Solana led the rise in Alt Layer 1, followed by public chain tokens such as Avalanche and Polygon that broke new highs.

After this wave of Solana market, more and more users began to pay attention to the ecological situation of Avalanche. AVAX also recently exceeded $30, ranking 11th. This article will take stock of Avalanche's latest ecological progress and project status, hoping to be helpful to friends who are concerned about Avalanche's ecology.

1. Avalanche Catalyst

From the perspective of the development of the public chain itself, Avalanche’s biggest progress is in the direction of RWA and cooperation with enterprises. The chart below lists financial institutions that are using or testing Avalanche, including:

1-Fidelity: Based in Boston, it is a leader in asset management and brokerage services, with approximately $4.2 trillion in assets under management. 2-JPMorgan Chase & Co.: Located in New York, it is a well-known global investment bank and financial services provider with approximately US$2.6 trillion in assets under management. 3-Wellington Management: Based in Boston, it is a major player in mutual funds and institutional management, with approximately $1.4 trillion in assets under management. 4-T. Rowe Price: Located in Baltimore, it is a globally recognized active investment management company with approximately US$1.31 trillion in assets under management. 5-KKR: Located in New York, it is a global investment company with an influence in the private equity field, with approximately US$429 billion in assets under management. 6-Apollo: Located in New York, it is a high-profile alternative investment management company with approximately US$461 billion in assets under management. 7-WisdomTree: Based in New York, known for ETFs and innovative investment solutions, with approximately $75.5 billion in assets under management. 8-ANZ: Based in Australia, it is one of the country's largest banks with a prominent position in financial services, not primarily based on assets under management (AUM). 9-Citi: Based in New York, it has a strong presence in consumer banking and global finance and is not primarily based on assets under management (AUM). 10-Republic: Based in New York, it is a leading Web3 platform focused on private investments and securities with an unspecified AUM.

In addition, Avalanche also cooperates with top global companies such as IEEE, TSM, and ST.

The above cooperation is also closely related to Avalanche's own emphasis on compliance. Not long ago, the SEC published a list of Tokens defined as securities, including many leading public chain projects such as SOL and MATIC, but AVAX was not among them.

The above cooperation is also closely related to Avalanche's own emphasis on compliance. Not long ago, the SEC published a list of Tokens defined as securities, including many leading public chain projects such as SOL and MATIC, but AVAX was not among them.

Combined with the characteristics of Avalanche's customizable subnet, we can still expect more enterprises to cooperate with it in the future.

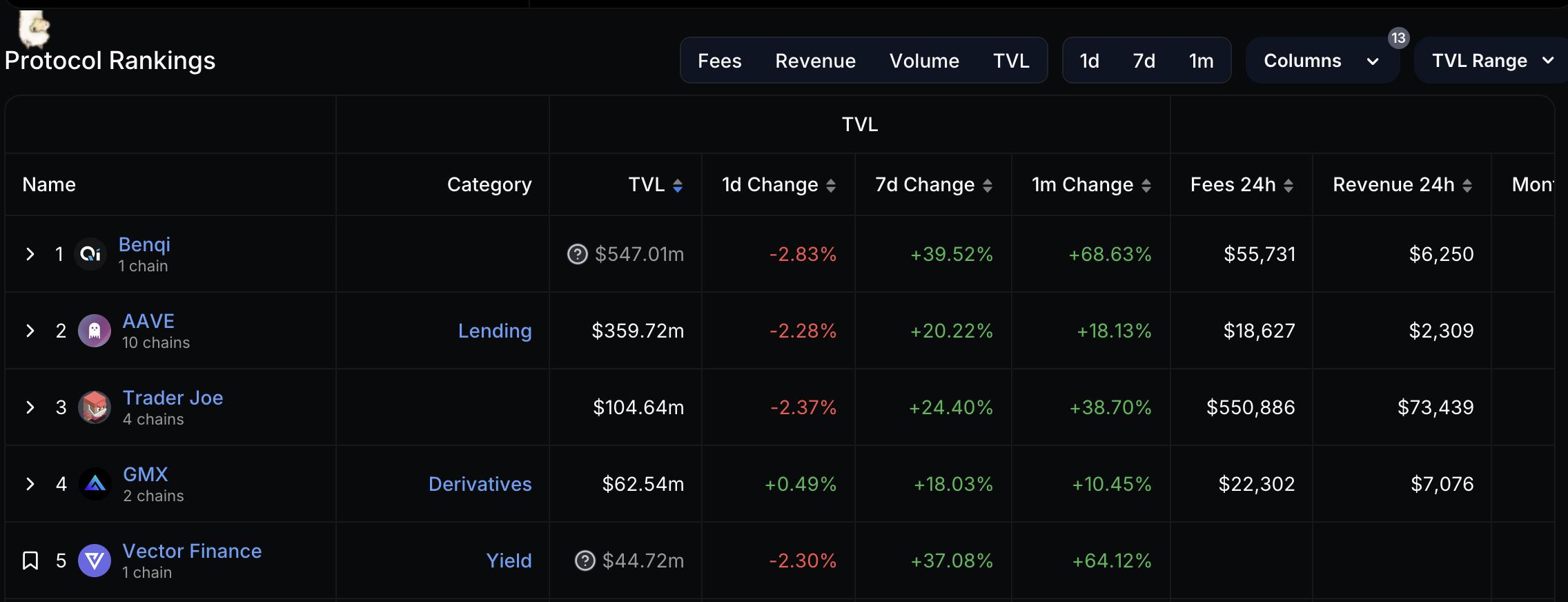

2. DeFi

Traderjoe: The largest DEX on Avalanche

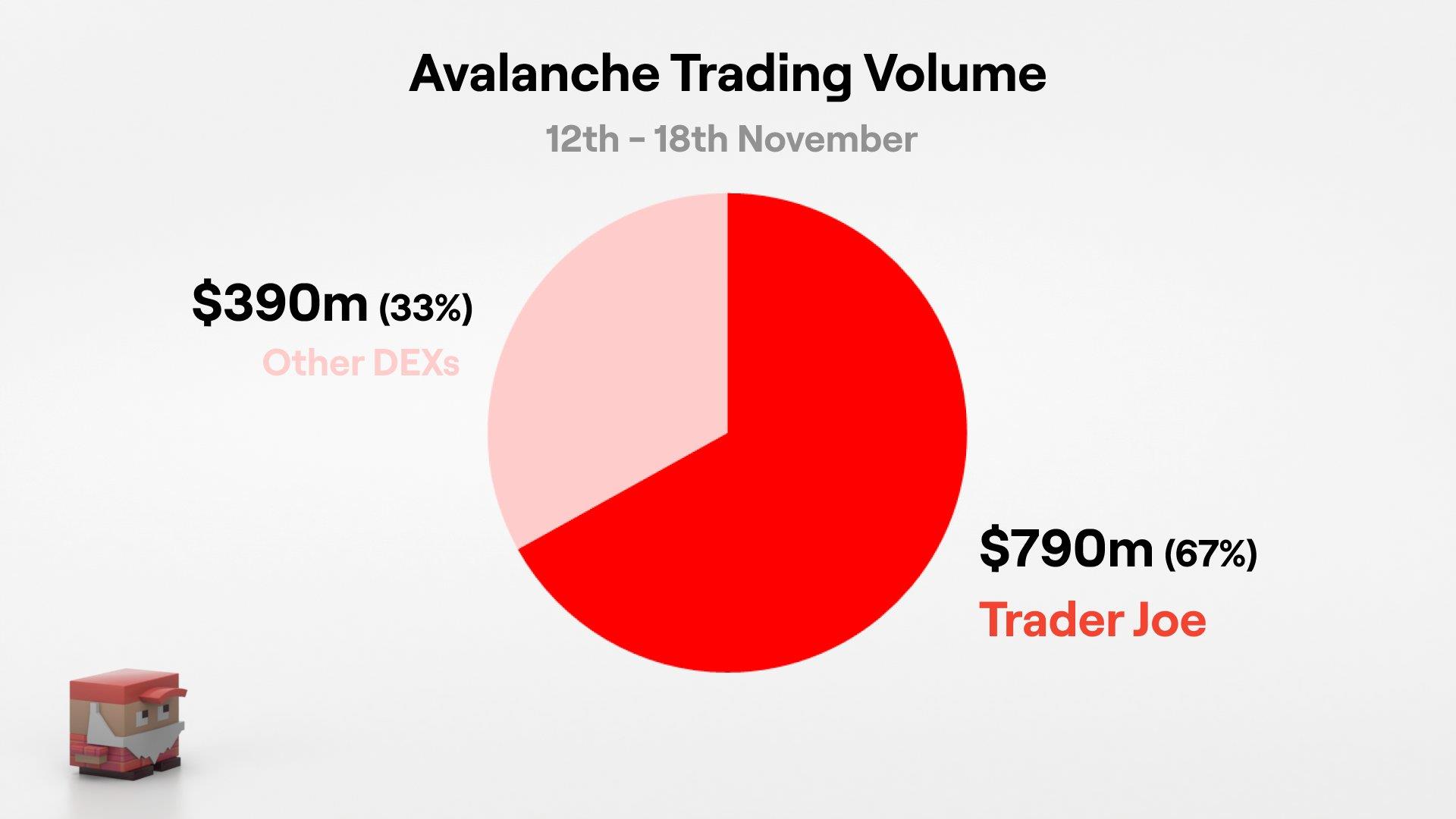

Speaking of DeFi, most of the trading volume on Avalanche occurs on traderjoe. Judging from the data from November 12th to November 18th, traderjoe’s volume accounted for 67% on Avalanche, making it a well-deserved Top DEX.

TraderJoe was born in 2021 and carried out a comprehensive brand update at the beginning of this year. At the same time, it launched the Liquidity book on the product and performed well during the arbitrum airdrop. For a detailed introduction to Liquidity Book, please refer to the article: "Compared with Uniswap V3, what problems does Trader Joe's Liquidity Book solve?" 》

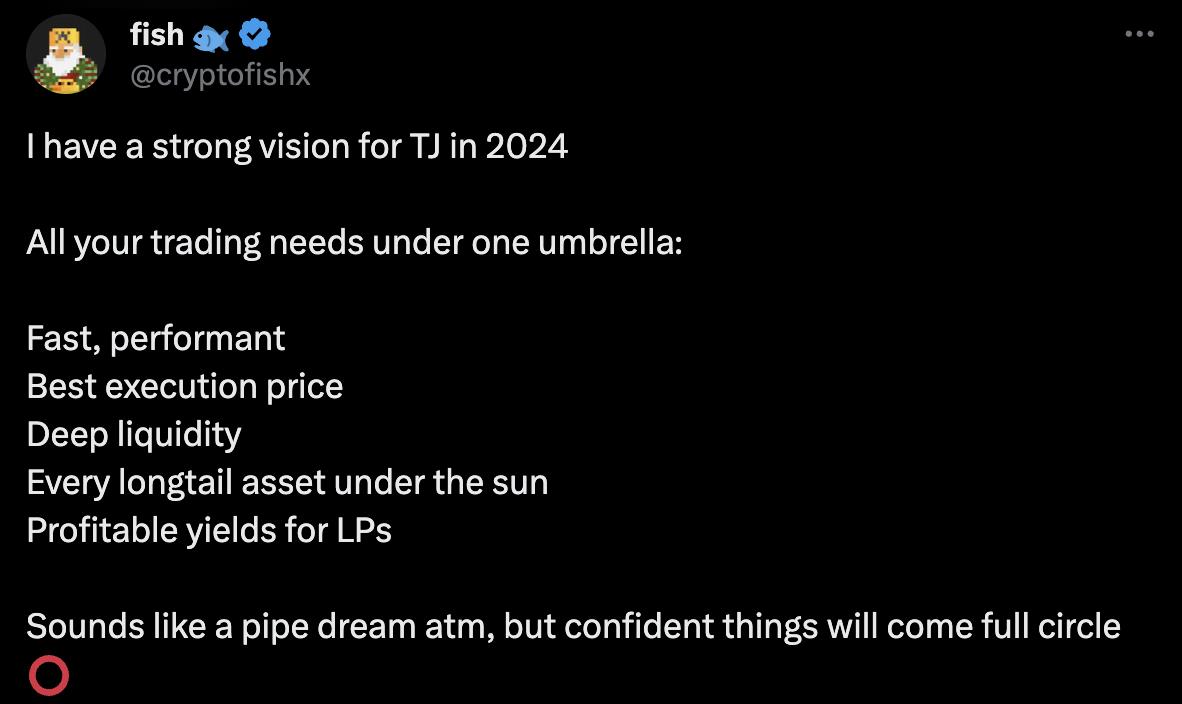

Regarding future development, the co-founders recently disclosed some of their plans on Twitter. However, for users, the most direct space to participate in the near future is Layerzero’s airdrop.

Currently $JOE has been deployed on Avalanche, arbitrum and BNB Chain. Users can cross their $JOE to different chains through the Bridge button on the official website homepage, and provide cross-chain for $JOE The solution is Layerzero.

Steakhut: Liquidity management solution based on Trader Joe’s

SteakHut provides automated liquidity management solutions for LPs. The project initially mainly served TraderJoe. Thanks to TraderJoe's recent increase, SteakHut's token $STEAK also reached 400% to 500% in one month. increase.

Recently, SteakHut has also completed a seed round of financing and will expand its vision to provide better liquidity management solutions for the entire Avalanche ecosystem. For a more detailed introduction to SteakHut, please refer to the article: "Detailed Explanation of SteakHut: Liquidity Management Solution Based on Trader Joe"

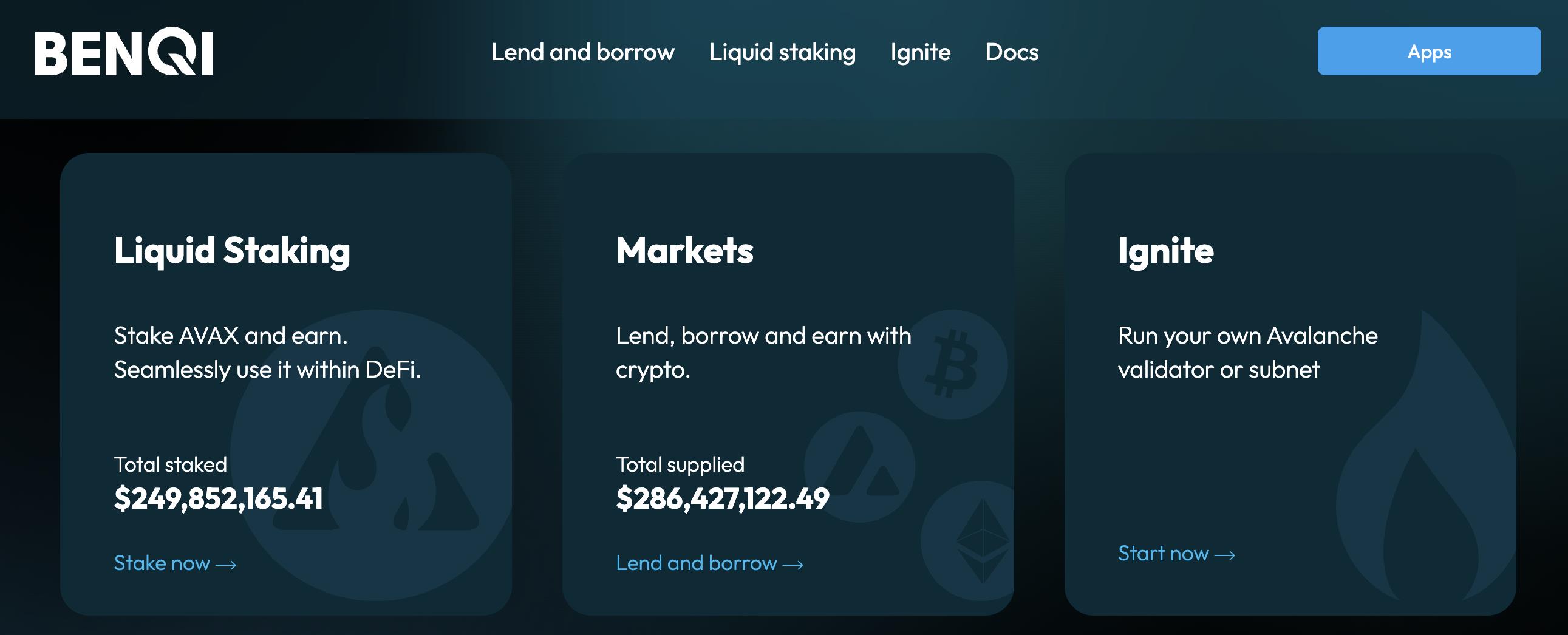

Benqi: The largest lending and liquidity staking protocol on Avalanche

Benqi is one of the most important protocols in the Avalanche ecosystem, providing lending and liquidity staking services for Avalanche. It is also the protocol with the highest TVL in the Avalanche ecosystem.

Benqi has a very long history in the Avalanche ecosystem. Whenever $AVAX has a good performance, its token $QI tends to receive more attention. At the same time, $QI is also the only token in the Avalanche ecological project that is listed on coinbase.

3.GameFi

Shrapnel: Avalanche’s most popular AAA chain game

Shrapnel is a project launched in early 2022. At that time, we made a nearly 30-minute video detailing its white paper and prospects. Interested friends can learn more through the video: SHRAP | Shrapnel is a 3A shooting chain game on Avalanche, encouraging independent creation.

This game has become popular recently, mainly because its token $SHRAP has been on an upward trend, and currently FDV has exceeded 1 billion.

Shrapnel has released some promotional videos before and conducted offline tests at many Avalanche events, and the feedback was generally good. At the same time, two months ago, the project once again received US$20 million in financing led by Polychain.

Driven by Shrapnel, more and more users are paying attention to the gaming ecosystem on Avalanche. However, in summary, except for Shrapnel, there are currently no games that have performed particularly well. Defikingdoms and Ascenders, which were relatively popular in the past, have experienced launch bugs and soft rugs respectively.

However, judging from the current popularity of the community, games such as Off The Grid (launched by Gunzilla Games), BloodLoop, and Defikingdom are more discussed in the community.

4. NFT

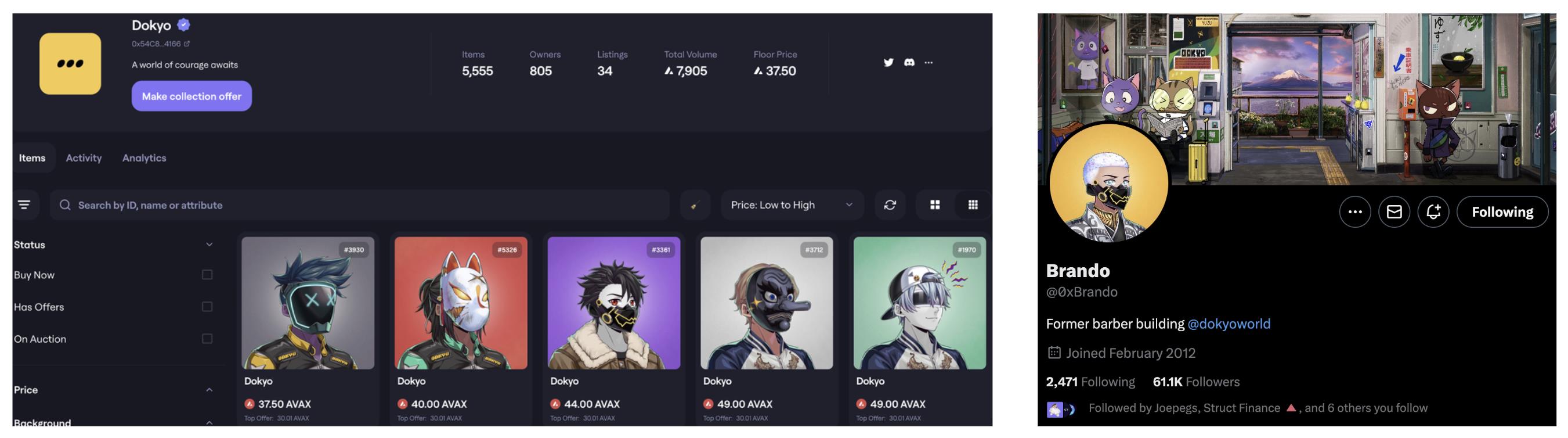

Dokyo: The most popular NFT in the Avalanche ecosystem currently

If you pay attention to the Avalanche ecosystem, you will see that many people have changed their avatars to Dokyo. There are 5,555 NFTs in total, and the current floor price is 37.5 $AVAX. The currently known founding team member is 0xBrando.

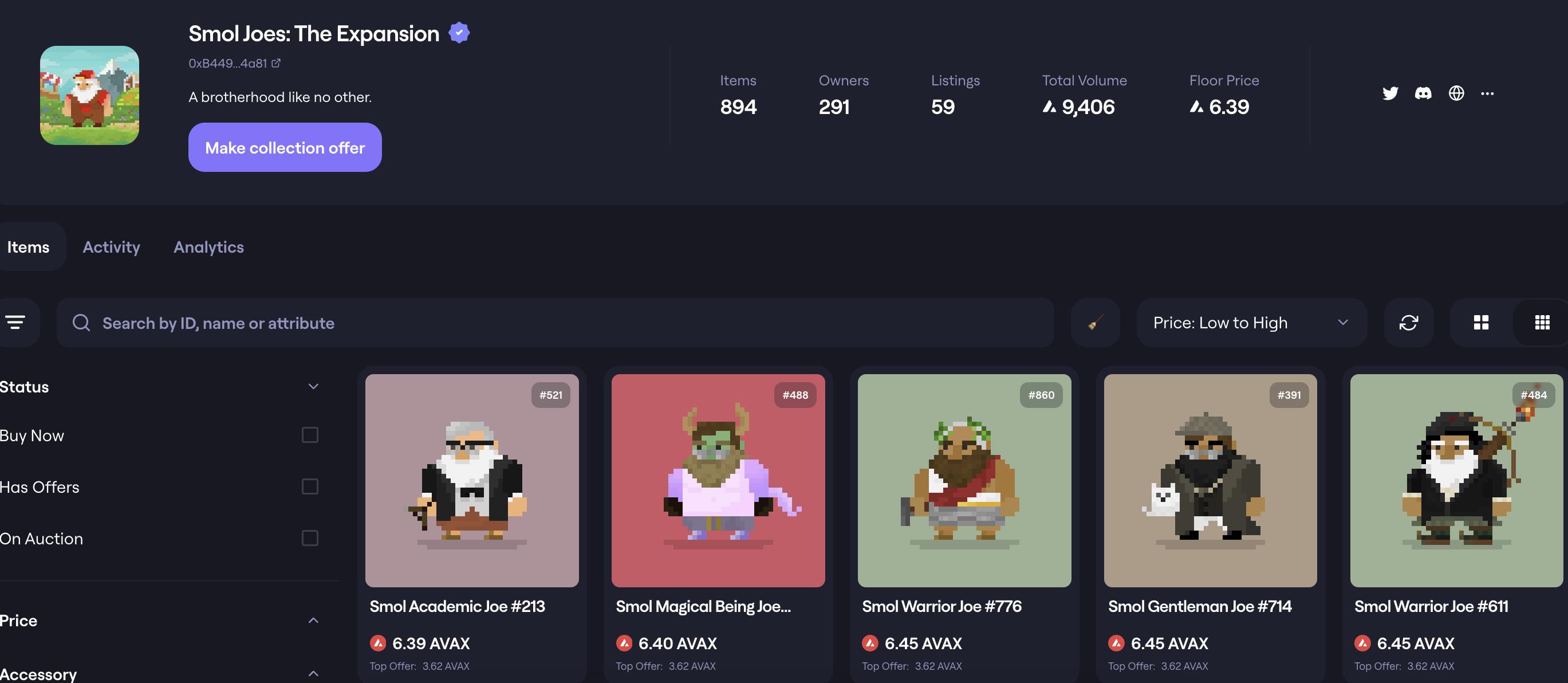

Smol joes/Joe Hat: NFT project launched by TraderJoe team

Smol joes/Joe Hat: NFT project launched by TraderJoe team

The TraderJoe team also launched its own NFT platform, Joepegs, and received millions of dollars in financing from FTX and Avalanche. Afterwards, they launched multiple NFT projects, but currently there are only two core projects, Smol Joes and Peon.

In addition, as early as 2021, the TraderJoe team launched the Joe Hat project, which benchmarked uniswap's unisocks, with a total of 150 pieces. If you have $HAT, you can exchange it for a hat in the real world.

Recently, Joe Hat has been hyped by "mysterious power", the price has also reached ATH, and the discussion on Avalanche is also high. However, the market fluctuates greatly, so it is recommended to pay careful attention.

5. meme

5. meme

Husky: Bonk on Avalanche

Husky is the first "dog" on Avalanche and is a meme item that almost everyone knows.

The project has been launched for more than two years, and it was only recently that the project experienced an exaggerated increase when everyone was discussing the Avalanche meme.

Coq: The latest meme that has only been online for 3 days

$COQ is a meme project launched by @WojakSatoshi on December 8. After the project was launched, the community enthusiasm was high and the market has been rising. The current FDV is 18 million, which has exceeded Husky.

However, it should be noted that Coq stated on its official website that it has no relationship with the previous "Avalanche Chicken" chikn, which was a well-known ponzi game on Avalanche.

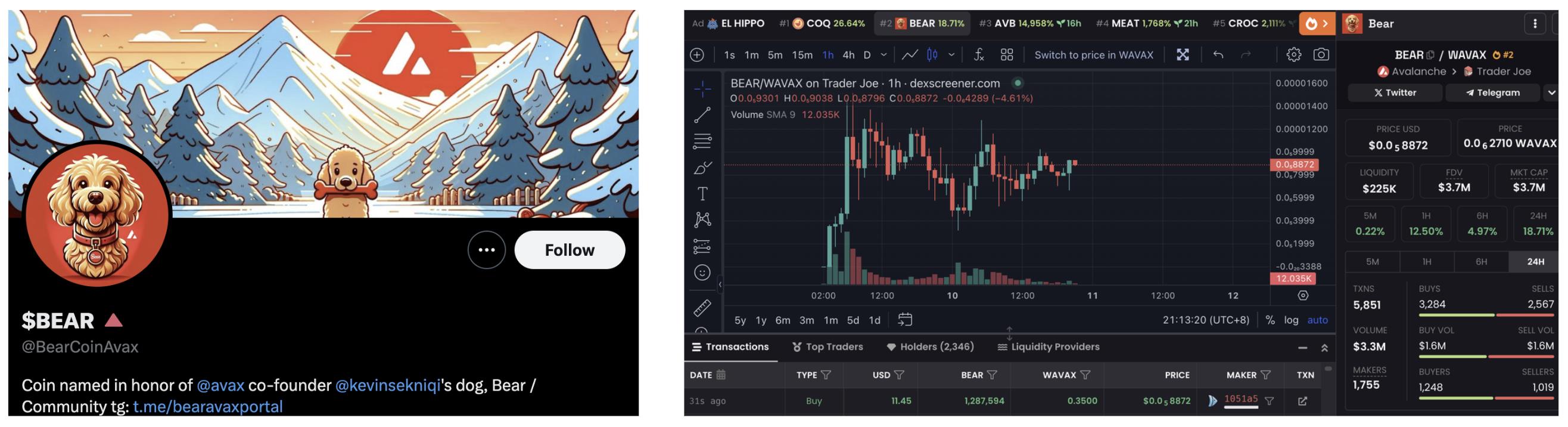

Bear: Avalanche co-founder’s “dog”

$BEAR was released on December 9. After Avalanche co-founder Kevin posted his dog on social media, it was named "BEAR", and all users posted a meme named "BEAR".

The project has only been online for one day, and the market fluctuates greatly. This is only for information sharing and does not serve as any investment advice.

6. other

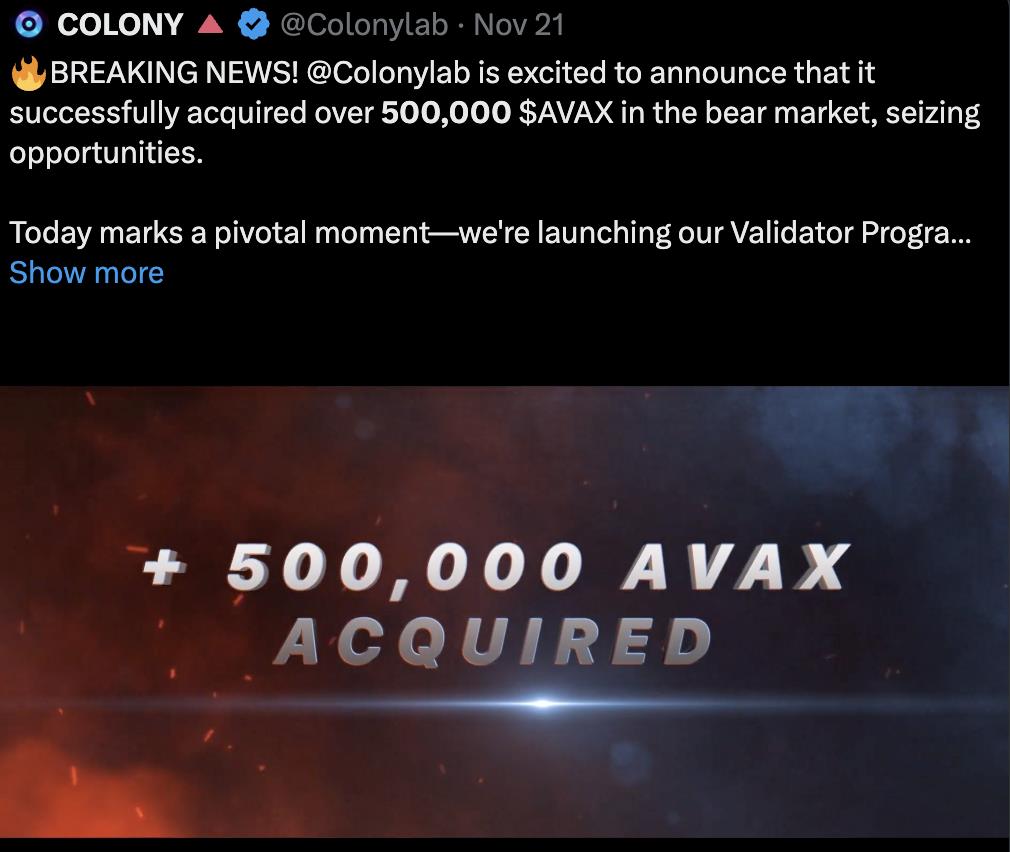

Colony: An aggregation platform supporting early-stage projects on Avalanche

Colony is also a project launched in 2021. The primary reason why it has received widespread attention recently is that Colony has launched the Avalanche Ecological Fund Plan with more than 10 million US dollars to support the development of Avalanche ecological projects. This is due to the fact that Colony has been accumulating $AVAX tokens during the bear market. Currently, there are more than 500,000 $AVAX in the treasury, with a current value of approximately US$15 million.

Colony token $CLY has also experienced a recent increase of 385.5%, with a current market value of 24 million and FDV of 38 million. Holding $CLY tokens and staking them will have the opportunity to receive the following benefits:

1-Participate in early investment in projects supported by Colony

2-Airdrop of activity Colony investment project

3- Get Avalanche’s validator incentives

4-Get$CAI Airdrop ($CAI is the Avalanche Index Fund launched by Colony)

5-Get$CLY Airdrop (from Colony’s protocol income, such as unstake fee)

Aval: The most famous inscription on the Avalanche

Following the inscription craze of several other public chains, Avalanche also launched asc-20 tokens, among which aval was the most discussed in the community. It is understood that the current OTC price is 0.2u, and the popularity is average.

Hyperspace: New NFT platform, you can do tasks to earn points

Hyperspace is a well-known cross-chain NFT platform. Currently, it has launched a points activity for completing tasks on Avalanche, and you can get $AVAX rewards. In the just-concluded Season 1, a total of more than one million US dollars in incentives were given out.

However, it has been previously announced that more than one million $AVAX rewards will be given out, which is very different from the current incentive amount, so the community also has a certain amount of fud, and Season 2 has also begun.

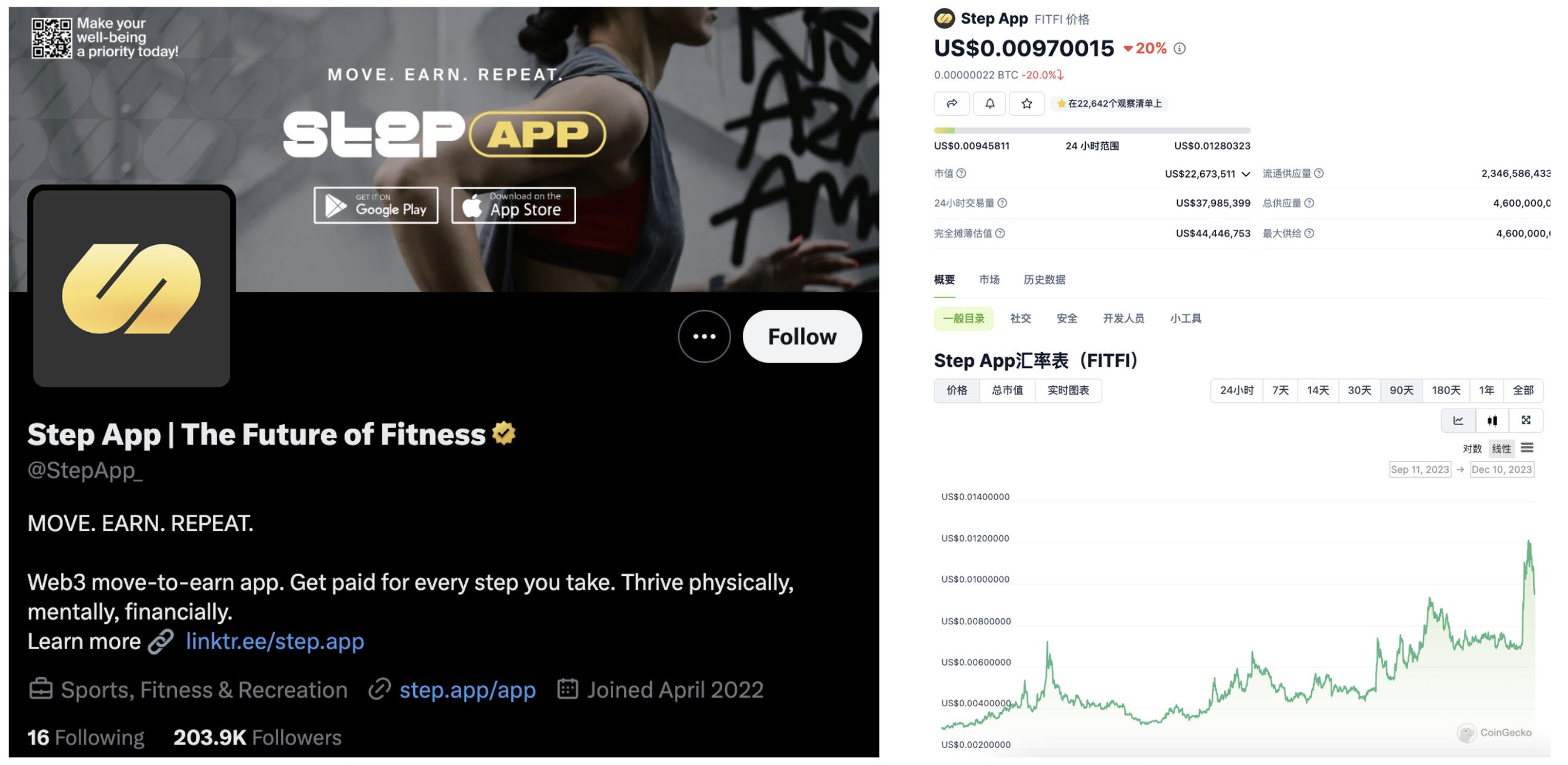

Fitfi: StepN on Avalanche

StepApp is a running shoe replica on Avalanche. Recently, some Avalanche users began to discuss it due to the rebrand plan, and its token $FITFI also increased by 95% in 30 days.

After several years of development, the Avalanche ecosystem currently has more than 350 protocols and applications. At the same time, many projects have gradually ceased operations or become soft rug. The following is a relatively complete project situation of the Avalanche ecosystem.

Note that this article is only a compilation of key information and does not constitute any investment advice. Interested friends are also welcome to join the Avalanche communication group ( link ) to share and discuss.