Host: Stephanie (@stephaniiee_eth)

Guest: Anna (@AnnaMSGeorge)

If you are interested in DeFi and MEV, you may have heard of intent-based trading, frequent batch auctions, solver models, order flow auctions, OFAs), etc., CoW Swap can be said to be a model of the above innovations, integrating them organically into DEX products to provide users with the best prices, find the best routes, and protect against MEV attacks.

In this episode, Stephanie and CoW Swap co-founder Anna discuss the design of CoW Swap in detail, including how the transaction cycle in CoW Swap, which starts from collecting user transaction intentions, is different from the traditional transaction life cycle; outsourcing transaction execution to mature How to ensure the security of users' funds when solving solvers; how to guide effective competition among solvers, which is a key component in taking intent transactions to the next level; how to continue to incentivize solvers while avoiding their malicious behavior?

They also discussed broader topics such as how new entrants view Uniswap's first-mover advantage, why CoW Swap adopts MEV minimization rather than MEV maximization, and why dapp-level MEV mitigation is necessary significance.

"The transaction cycle and design of CoW Swap"

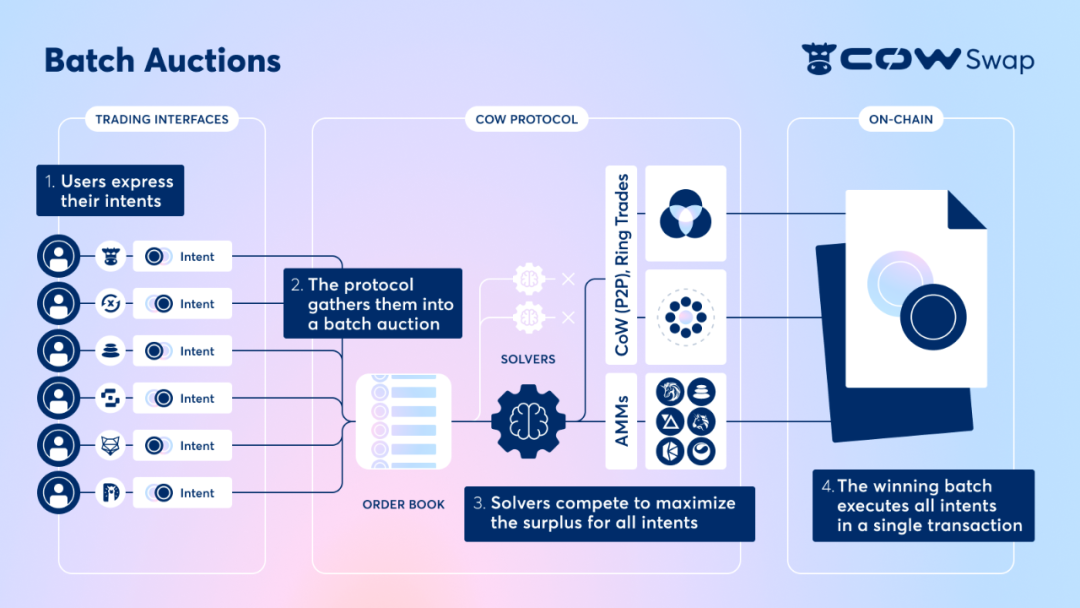

The trading cycle of CoW Swap is mainly divided into four steps

1. Users express their intentions through signed messages. The signed messages include the tokens to be bought or sold, the amount of the purchase and sale, and the validity period of the transaction execution.

2. The CoW protocol collects order books that users intend to place off-chain for batch bidding.

3. The third-party transaction execution solver accesses the order book. They are good at mathematics and can quickly find out the optimal execution path (including all on-chain liquidity, demand coincidence, and ring transactions) and the best price. They compete with each other. , protocols rank the value they can provide to users, and the solver that wins the auction can execute the batch of transactions.

4. The winning batch executes all intentions on the chain at a unified price in one transaction.

How CoW Swap starts competition among solvers

The key reason why CoW Swap can elevate intent transactions to a new level is that it introduces competition at the execution layer, rather than just a simple on-chain execution model. In order for this competition to be carried out effectively and ensure that users' transactions are better executed, the cultivation work of CoW Swap has mainly gone through three stages:

1. Gnosis runs some solvers internally. It is relatively simple at the beginning. It collects the API endpoints of some aggregators, such as paraswap, 1inch and 0x, keeps comparing their return values, and then decides to submit the transaction to the API that can provide the best transaction return.

2. When I participated in Devconnect in Amsterdam last year, I met a very smart and mathematical team. They were small and very interested in running solvers, so they started to develop their own algorithms and successfully won the API competition.

3. Market makers became interested in solvers, and they began to integrate with existing solvers by providing their own liquidity. Private liquidity gave them an advantage.

There are currently 16 solvers in CoW Swap's solver set, each with their own areas of expertise.

Design that coexists incentives and constraints

CoW Swap distributes incentives to solvers every week. The incentives are divided into two parts: one part is about continuity, because you want solvers to continue to participate in the competition, instead of only quoting when they think they can win in a certain competition, and at the same time, when there is Some solvers are still quoting when they are offline or have malicious behavior; the other part is based on how much better the solution found by the winner is than the second best solution. This is to ensure that they will not only focus on providing more solutions than the second best solution. For the 1-cent path, the more value they find than the second most valuable one, the more incentives they get.

The incentive source is currently 2% of the CoW tokens issued annually, and in January we will introduce a small fee that is actually divided from the value we provide to users. These fees are earned by the solver, but they must use them to buy back CoW tokens and send them back to the CoW treasury.

Currently the solver set is theoretically permissionless, but in practice there are some elements that require permissions. Since it is theoretically possible for solvers to take advantage of users' slippage tolerance, CoW Swap requires margins from competing sovlers. This mechanism does not need to be centralized. The current centralization factor exists because CoW DAO also operates a margin pool to lower the entry barrier. But in 2024, solvers will be able to build their own margin pools, and the smart contract will automatically check whether the solver is There are private keys, whether access is provided, and whether a margin pool has been established. In this way, the solver can automatically join the competition.

"MEV Maximization vs. MEV Minimization"

CoW Swap focuses on the direction of MEV minimization, because the MEV maximization method has some risks.

First, from the moment you start maximizing MEV, you need to extract value from your users. In order to extract value, you need multiple parties to participate, and then you need to reward their efforts, which means users cannot get 100% of their MEV back. In the best case, users can get a small rebate, but in CoW Swap's view, the MEV value is created by users from the beginning, and they should not suffer losses.

Second, due to the need to redistribute value, it will also become inefficient, because the cashback transactions need to be packaged into blocks, which means more block space is needed.

Finally, MEV maximization introduces more complexity and now requires the introduction of PBS (Proposer/Builder Separation). Flashbots really brought MEV to the center of the discussion in the first place and advocated for the democratization of MEV, which means that everyone can extract MEV instead of only one player can benefit, which is all good. But the bad thing is that it allows more players to enter the game and makes MEV extraction truly professional, making today's MEV problem more serious. Of course, we don’t know what would have happened now without these discussions, but it does become a big problem now.

CoW Swap believes that most MEV opportunities occur at the application layer, where users initiate transactions, so the opportunities for MEV should be minimized. CoW Swap collects user transaction intentions and sets the batch of transactions in each block to a unified clearing price, thereby ensuring that there is no possibility of capturing value or reordering these transactions.