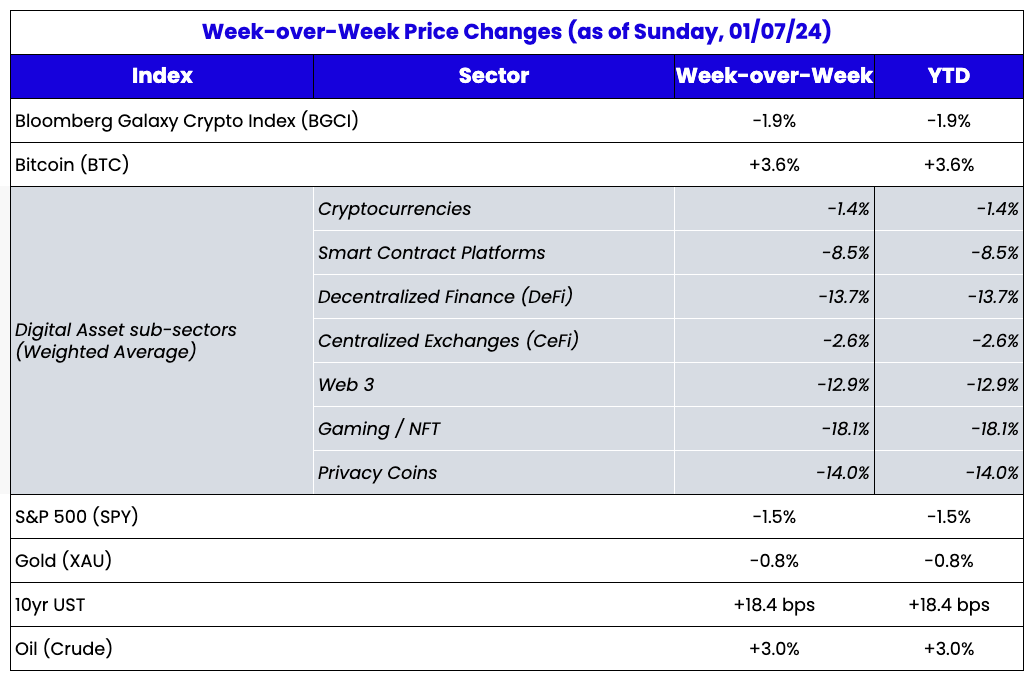

Source: TradingView, CNBC, Bloomberg, Messari

The predictions were wrong for two years in a row!

Over the past few years, we have released forecasts annually that focus on the sources of growth and potential risks for digital assets. Over the years, we’ve gotten a few big ideas right, and a few big ideas wrong:

- At the beginning of 2020, we wrote about the rise of DeFi and task rewards.

- Halfway through 2020, we discussed the rise of NFTs.

- In early 2021, we discussed the rise of social/sports tokens.

- In 2022, we did almost nothing right and everything fell short.

- In 2023, we correctly predicted that distressed investments in digital assets would deliver outsized returns and that digital assets as a whole would decouple from traditional markets and re-emerge as an uncorrelated asset class, but we largely missed what we believed Themes that will drive returns.

The most interesting thing about the past two years is that the consensus in 2022 was dead wrong, and the consensus in 2023 was even more wrong. A survey conducted by Deutsche Bank in early 2022 showed that only 19% expected negative returns for the S&P 500 in 2022, and only 3% thought returns would be below -15%. The S&P 500 ended up losing -19.6%. In 2023, the same Deutsche Bank survey showed that 39% expected negative returns on the S&P 500 to exceed 10%, and of course, the S&P 500 ended up +24.23%.

Consensus expectations for digital assets are harder to summarize, but it’s safe to say that few expect digital assets to plummet like they did in 2022, and almost none predict that digital assets will become the best-performing asset class in 2023, with returns close to Three digits. Going into 2024, there may be clearer reasons for optimism, but there are still plenty of reasons to be skeptical. Overall, we believe investors will continue to be rewarded for investing in this asset class in 2024.

But in order to navigate the many ups and downs throughout the year, we must get the themes and narratives right that drive performance. Granted, many themes and narratives change over time.

Prediction 1: Bitcoin is no longer boring and will once again outperform most stocks, while owning Bitcoin mining stocks will once again outperform Bitcoin

Like most people who entered the digital asset industry before 2018, the first blockchain network I used was Bitcoin when I first purchased BTC. This made sense from both a technical and macro perspective, especially since there were no other mature use cases for blockchain technology at the time. But over the past six years, our investment focus has shifted primarily to other applications and industries enabled by smart contract protocols. Frankly, Bitcoin has become a boring financial asset. Maybe you own it, but you certainly don't need to discuss or study it because it never changes. The development of NFTs, stablecoins, DeFi, etc. is built on other chains and requires continuous analysis and education.

That changes in 2023. Over the course of the year, we discussed and debated Bitcoin more than any other asset and chain, first about the reasons to own Bitcoin (March regional banking crisis, Blackrock Bitcoin ETF application) and secondly about new technological innovations ( Inscriptions, Ordinals). So, Bitcoin is no longer boring. Starting from the most obvious to the least obvious, here are a few reasons to own BTC and Bitcoin-related assets:

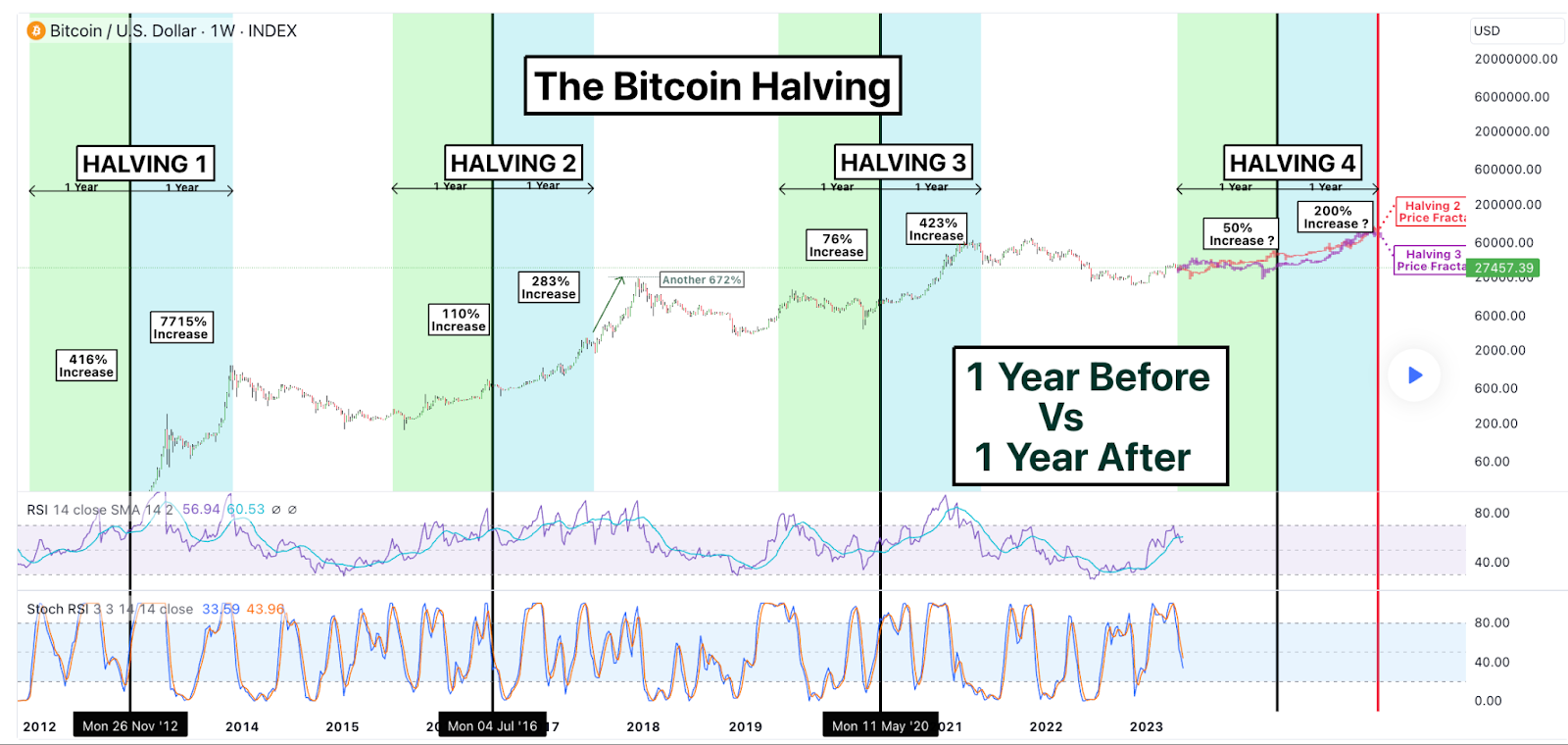

- Bitcoin has had three previous halvings, all of which were preceded by significant price increases. You don’t have to believe that the halving will change any fundamentals (I certainly don’t), but at this point, it has become a self-fulfilling prophecy. The April 2024 Bitcoin halving is widely seen as a catalyst.

Source: TradingView

- The impending approval of a Bitcoin spot ETF will trigger demand from new investors, primarily financial advisors and RIAs. I expect the Bitcoin spot ETF to see a knee-jerk rally once it actually gets approved, which will be largely algorithmically led, lasting a few days, with prices eventually stagnating until the ETF really starts accumulating assets. Growth in the second half of 2024 is likely to be greater than in the first half. More than 30% of the total Bitcoin supply has not changed in five years, which could lead to a liquidity crunch as ETF issuers rush to buy Bitcoin every time a new ETF is created.

- The US presidential election in November coupled with expectations of 3-5 interest rate cuts will boost all risk assets as inflation takes a backseat to politics. Bitcoin is more susceptible to macro liquidity conditions than any other asset.

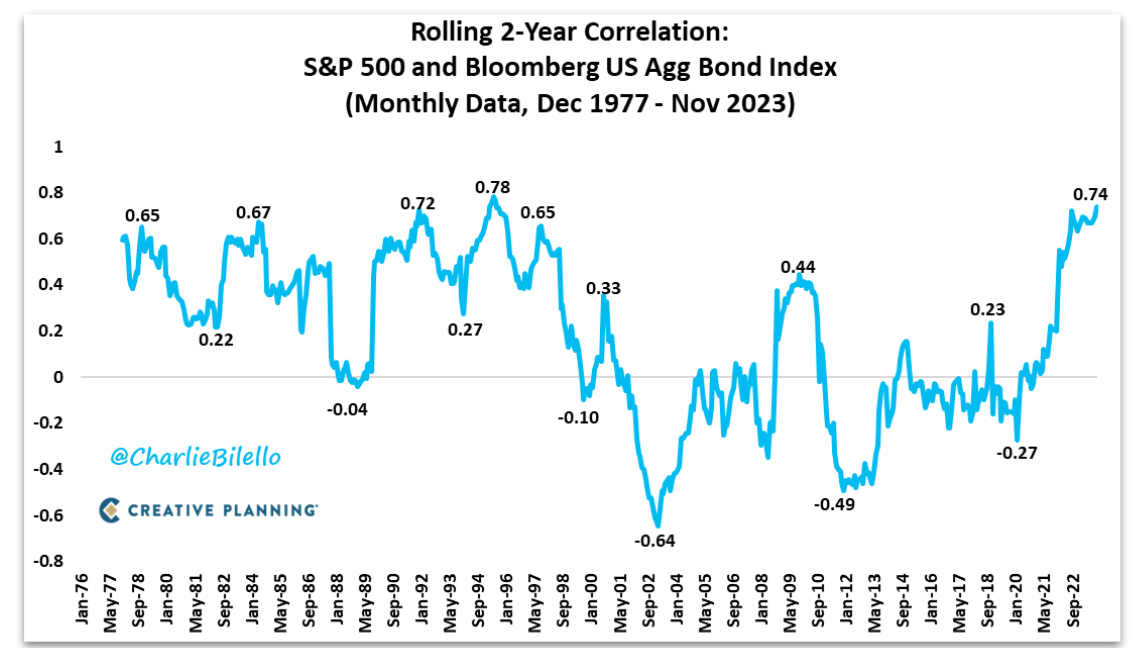

- The 60/40 portfolio is dead and has been dead for over two years. Over the past two years, the correlation between U.S. stocks and bonds has been the highest since 1993-95. If bonds and stocks no longer have a negative correlation, new financial assets will be recommended for inclusion in model portfolios. There is no asset with higher returns and lower correlation than Bitcoin. Bitcoin ETFs will naturally find their way into every modern portfolio allocation.

- The long-awaited Gox bankruptcy distribution will not affect the price of Bitcoin. While 142,000 BTC (more than $6 billion) is expected to be distributed to creditors this year, most of it will not be sold. First, over the past five years, most of Mt. Gox's claims have been purchased by bad investors, and much of the risk to the Bitcoin price has been hedged. Secondly, anyone who owned Bitcoin back in 2013 and held their bankruptcy claims for 10 years is probably a blockchain and Bitcoin enthusiast, so there is no reason to believe that most creditors will sell their cherished assets, No matter how much the price goes up. Third, third, after Mt. Gox filed for bankruptcy, Bitcoin Cash (BCH) forked from Bitcoin, which meant that 143,000 BCH would also be distributed. Few, if any, original BTC holders care about BCH, so it is more likely that BCH will be sold immediately than BTC.

- Bitcoin mining stocks (i.e. MARA, RIOT, CLSK, CIFR, BITF, IREN, etc.) will outperform BTC again in 2024. Mining stocks are collectively up 399% in 2023 (compared to BTC +155%). Historically, the BTC halving was bad for miners because the block subsidy (which historically accounts for 98% of miner revenue) will be halved, but now this problem will be alleviated due to the rise of Ordinals and BRC-20s, Because they have become a major part of mining revenue. In the past, the analysis of mining stocks was very simple - fixed costs versus variable revenue that fluctuates with the price of BTC - but now, equity analysts need to consider these other revenue streams, and that has not happened yet. Bitcoin transaction fees surged to all-time highs in Q4 2023, driven by BRC-20 transactions and fungible memecoins issued using the Ordinals protocol.

Prediction 2: Tokenization of Real World Assets (RWA) will happen, but only if you can trade tokens, stocks, and bonds in one place

The tokenization of RWA is one of the most talked about new topics in 2023. But the data is misleading.

Tokenization of real-world assets refers to the tokenization of personal items ranging from financial assets and real estate to art and jewelry. In theory, blockchain can increase liquidity, transparency and efficiency by converting physical assets into digital tokens. This innovation will allow for fractional ownership, broader allocations, and easier access to investments that have traditionally been illiquid or excludable. The secure, immutable nature of blockchain transactions, coupled with the potential of smart contracts to automate and streamline processes, has further attracted institutional adoption and marked a new era in asset management and investing.

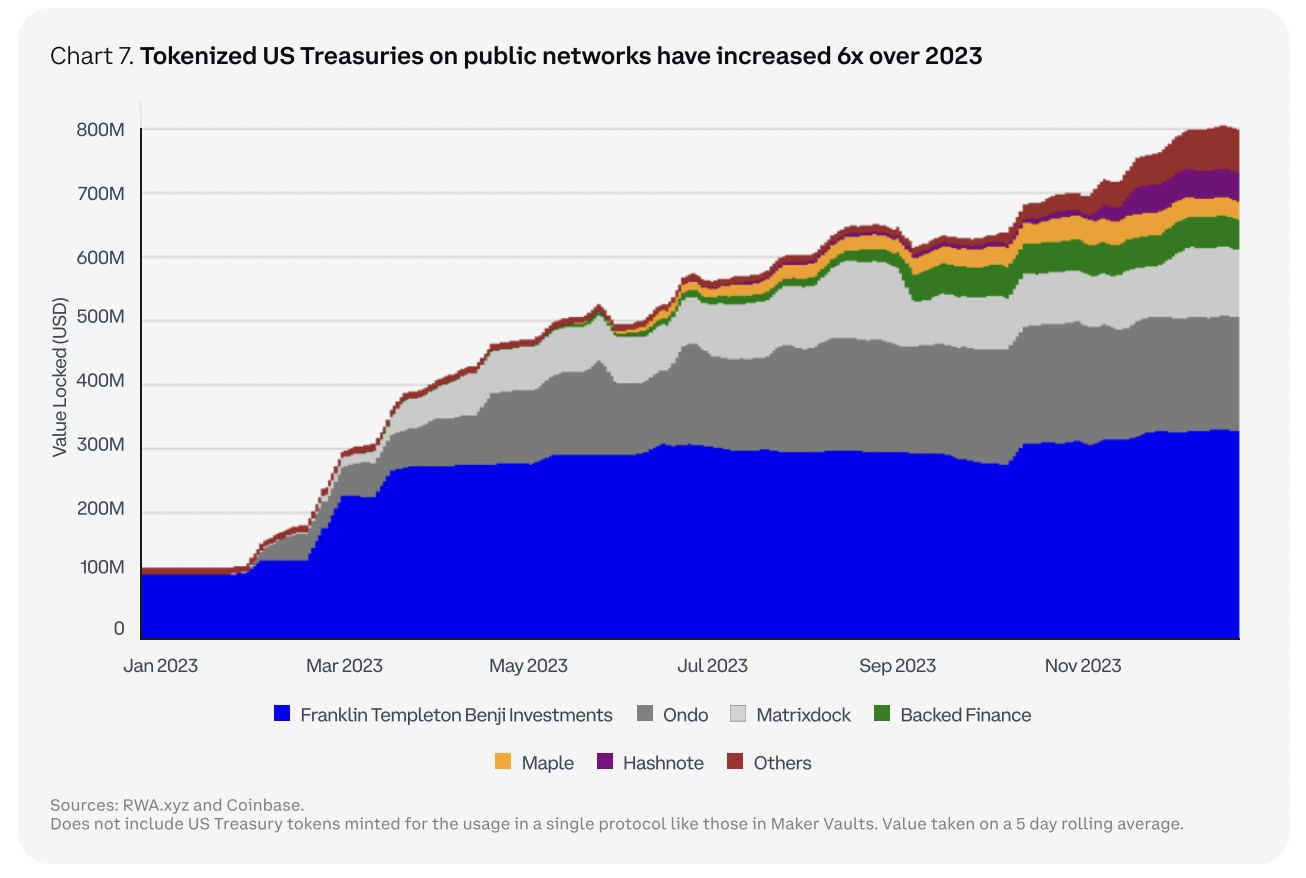

While RWAs hold great promise, what has emerged so far is the rise of tokenized U.S. Treasuries. The reason for this is not any of the above, but that DeFi applications and on-chain stablecoin issuers are too cash-rich to invest outside the blockchain ecosystem. As U.S. Treasury yields rise, tokenized Treasuries provide them with an on-chain solution. The on-chain token market based on U.S. Treasury yields grew sevenfold in 2023, reaching $832 million. That's great, but it's just a very concrete example of tokenizing real-world assets and simply doesn't solve any of the inefficiencies of the traditional financial system.

Source: Coinbase

Currently, only people who are already into the cryptocurrency ecosystem will care about the tokenization of RWA (especially US Treasuries) because it solves a special use case for them. To get more people to pay attention, tokenized RWA must provide a compelling value proposition. One or both of the above two conditions must be met:

- Someone tokenizes an asset that has real demand. Tokenizing disposable hotel assets isn’t going to excite anyone. Tokenizing NBA contracts wouldn’t be exciting either. But if you tokenize something that has real value to people, like Apple stock, or the Mona Lisa, or a municipality's project financing debt, and if you own the token and residents receive benefits, then you can Generate new needs. Tokenization for the sake of tokenization will not drive demand.

- It’s a chicken-and-egg question, but as long as the brokerage industry and the cryptocurrency world are completely separate, there’s no need to tokenize anything. Ultimately, all assets need to be owned and traded on-chain, otherwise they shouldn’t be. People with brokerage accounts don’t need to trade stocks and bonds on-chain, and those who trade entirely on-chain don’t have a large enough financial audience to attract the tokenization of brokerage assets. The real driver of value is that when you can bring all valuable assets together on the same layer, you transcend traditional liquidity and rollout barriers. For example, selling a collectible car to the mass market on the chain, using DeFi interest rates of 2% to 3% per year (compared to global market interest rates of 5% to 30%) to lend against the user's property, or “Money” is consumed as a proportional reduction of all assets. Money is online, communication is online, news is online...the world is online now. But money and assets are still separate and this simply doesn't work.

Prediction 3: This is the last "supercycle" for digital assets before TradFi normalizes the industry.

There are increasing parallels between 2019 and 2023, with sentiment hitting rock bottom, followed by the resurgence of Bitcoin and eventually the rise of other layer-1 protocols and applications. After Bitcoin outperformed all in 2019, we saw the rise of DeFi, stablecoins, and ultimately NFTs in 2020-2021. Ultimately, 2024 may follow in the footsteps of 2020, with a resurgence of decentralized applications and the emergence of some new areas.

Currently, we are seeing a similar environment taking shape, and the adoption of digital assets and the accompanying appreciation may be about to hit another huge climax. One of the major headwinds, concerns over U.S. regulation, may also become a tailwind, meaning that as the regulatory environment becomes clearer and TradFi players become more comfortable, this could bring a significant amount of investment into the ecosystem. new capital. After the last "supercycle," returns may become more normal.

While the libertarian dream of cryptocurrencies with no rules and no government sounds good in theory, in order for digital assets to actually exist, Wall Street will inevitably get involved, and we're already starting to see that happen.

- Blackrock, the world’s largest asset management company, may manage the largest BTC fund (ETF) by the end of this year.

- Citadel, Jane Street, Goldman Sachs and others will become the largest market makers.

- BNY Mellon will become Bitcoin’s largest custodian.

- CME’s Bitcoin futures trading volume has surpassed that of Binance.

- The next wave of digital asset issuance is likely to come from corporations, municipalities and universities, and be underwritten by investment banks. To date, most tokens have been issued by decentralized and/or jurisdictionally ambiguous entities, however, issuance of tokens by companies, municipalities, and universities can help align stakeholder incentives.

But in 2024, most investors and institutional funds will invest in BTC through new ETFs. The rest of the digital asset industry will remain a blip in most investors’ horizons and may still be too small for most investors. Therefore, in the next 12-24 months, digital assets can still bring excess returns to a small group of non-Bitcoin digital asset investors. After this expected surge, I believe other parts of the industry will become institutionalized as well. However, in 2024, investors can still receive airdrops, rewards, and parse on-chain data in advance. Another cycle and old ways of investing will still work, but soon too much popularity and homogeneous valuation techniques will shrink returns.

Prediction 4: Interoperability solutions will improve

At the end of the day, no one really cares what chain they are on, nor should they. Interoperability between chains was a topic we focused on last year, but the focus has shifted from layer one and layer zero chains (like Cosmos and Polkadot) to middleware providers (Chainlink CCIP, layer zero OFT, Circle’s CCTP, etc. ). Over the past two years, we have seen an increasing number of new Tier 1 and Tier 2 launches, which has overall led to fragmentation of the market. While users have more choices when it comes to new, faster and cheaper chains, the problem they are now experiencing is a general lack of compatibility. Not all chains can communicate with each other, and many are incompatible when it comes to simply passing assets back and forth. The rise in bridging vulnerabilities illustrates weaknesses in this area and the need for technology that does not rely on pegged assets.

Imagine if you could only send emails between two Yahoo Mail users or between two Gmail users. Or imagine if you could only play video games between people using the same console or phone. This doesn’t work, and it doesn’t work in the blockchain world. End users should not have to choose which chain they are on in order to use a blockchain application.

For organizations entering this space, what they need is technology that is more seamless and free of security risks. To date, a big focus for institutions has been on issuing their own assets that are compatible across many different environments, including existing public blockchains as well as private enterprise versions such as JPMorgan Chase’s Blockchain, Figure’s Provenance Zone blockchain).

While the final solution may not necessarily be obvious, one or more solutions must become the norm in order for more people to use them.

Prediction 5: User experience will eventually improve, leading to the launch of some killer applications in the fields of gaming, artificial intelligence, and DePIN

In the early days of the Internet, users relied on IP addresses to connect to different websites. To the average user, these strings of numbers are meaningless. At the end of 1987, the Advanced Research Projects Agency network put forward two proposals, RFC 1034 and RFC 1035. This was the beginning of domain name services. The Domain Name Service (DNS) converts these strings of numbers into names, such as amazon.com. This shift made the Internet much more usable and searchable, and billions of people use the Internet today.

In 2023, with the launch of ERC-4337, there are similar proposals for digital assets to create "smart accounts". These accounts are designed to radically simplify the Web3 user experience. With smart accounts, users don’t need seed phrases, download browser extensions, and in many cases, pay gas fees, allowing for faster transactions.

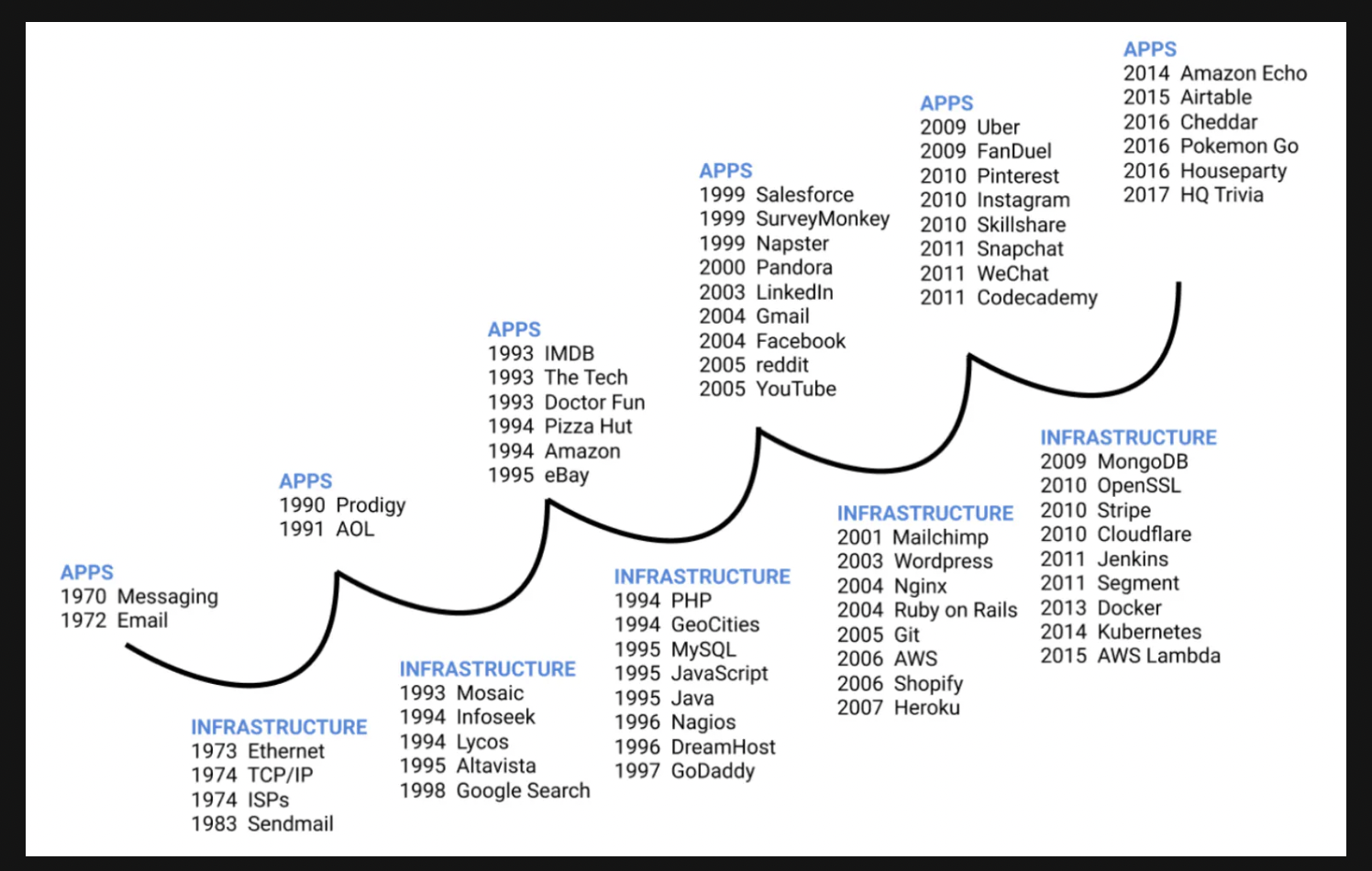

We need a solution like this before most new users can easily get on-chain. But the question remains, will a "killer" app emerge before user experience and infrastructure improve, or will better user experience and infrastructure lead to a "killer" app? The following is excerpted from "Myth of the Infrastructure Phase":

"A common view in the web3 community is that we are in the infrastructure stage, and what should be done now is to build the infrastructure: better base chain, better interoperability between chains, better clients, wallets and browsing The reason for this is: First, we need tools that make it easy for people to build and use applications that run on the blockchain. Once we have these tools, we can start building these applications. But when When we talk to founders who are building infrastructure, we keep hearing that the biggest challenge they face is getting developers to build applications on it."

It is generally accepted that new computing platforms begin as a standalone infrastructure phase, followed by an application ecosystem. However, the reality is that new computing platforms start with killer applications that inform the type of infrastructure that needs to be built. This starts the "application <> infrastructure cycle".

Digital asset markets have been building infrastructure for years, mostly battle-tested infrastructure on which real consumer applications can be built. To date, the most successful application of blockchain technology is the U.S. dollar stablecoin. We saw early traction for NFTs and DeFi in 2020 and 2021, but more user growth is still needed before it becomes "mainstream." In 2024, similar early growth trajectories are expected for artificial intelligence, gaming, and DePIN (decentralized physical infrastructure network). While this may drive up individual project token prices, the entire digital asset market will not grow until a few of these projects become "hot."

- Games - Perhaps Web3 games are most likely to bring the next 1 million+ users. Axie Infinity paved the way for blockchain-based games a few years ago, hitting a record of 1 million active users at its peak, but ultimately fell flat due to design flaws and excessive hype. Many companies have been working hard to address flaws in the first iterations of web3 games. Therefore, we expect to launch several commercial games in 2024, some of which have already gone through alpha and beta testing stages in 2022 and 2023. We predict that mobile gaming will become a major focus, with Asia leading the way in bringing in the new wave of users. The games will likely be available on the Apple App Store and Google Play Store, and the stablecoin will be used for in-game purchases. Major players in the online gaming industry such as Ubisoft, EA, and Zynga have begun to embrace online gaming and are partnering with traditional companies to bring these games to the masses. In addition, blockchain technology allows the gaming community to have a greater say in the direction and development of the game, which will help create more loyal users and make them evangelists of the game.

- DePIN – This is an area that could clearly benefit from blockchain and tokenization, although the project is still in its early stages. The idea is to decentralize access to resources that would otherwise be unavailable - compute, wireless, storage. Blockchain provides a way for users to access these resources, pay for them, and receive rewards for providing these resources. The current version of the DePIN project shows promise in design, but has yet to gain real traction. However, the new generation of projects is more focused on creating a healthy demand side rather than just incentivizing the supply side. The growth of AI-related technologies is driving the DePIN project’s use cases (such as the need for computing).

- Artificial Intelligence – The intersection between blockchain and artificial intelligence is a match made in heaven. As any data trader knows, "garbage in = garbage out". While the few companies that train today’s AI models (Microsoft, Google, Open AI) aren’t fed junk data, their inputs are naturally biased. An artificial intelligence experiment conducted by Microsoft on Twitter in 2016 showed the disadvantages of incorrectly training artificial intelligence models. The incentive model naturally created by blockchain can help solve this problem. By decentralizing and rewarding trainers and validators in the network, these models will organically reduce bias and ultimately produce better models.

Prediction 6: Ethereum re-emerges as the universal asset of the “long blockchain”

Bitcoin surged in 2023, newer, faster layer 1 protocols (SOL, AVAX) gained even more, but Ethereum (ETH) lagged behind. However, the storm is coming. Ethereum is likely to outperform Bitcoin in 2024, driven by the expected EIP-4844 upgrade, which will increase Ethereum's network efficiency and favor layer 2 solutions, resulting in a potential 90% reduction in fees .

What's more, after the listing of the Bitcoin ETF, ETH is likely to become the next asset on Wall Street's radar. While Bitcoin is a great asset, it doesn't give you access to much of the growth in blockchain. If you long DeFi, NFTs, Stablecoins, DePIN, AI and RWA, you need to own a lot of different types of assets, which basically means you need to become an accredited investor and invest in funds, or you need to quit your day-to-day Work and be immersed in the world of digital assets around the clock.

Or - you can own ETH. In 2024, ETH will no longer be interpreted as "hard currency" or as a decentralized technology with hundreds of developers upgrading it. Instead, it will be described as the number one app store for all blockchain applications. Who doesn’t want to invest in the “Apple App Store of blockchain”?

If you just want to be "blockchain long"... you can embrace ETH and benefit from every application built on or adjacent to ETH.

Conclusion

The biggest benefit of operating multiple fund strategies at Arca is our ability to invest in almost any type of blockchain innovation in at least one fund strategy. But more importantly, the liquidity of the token gives us the ability to change our minds and invest instead if we are wrong or see something more correct.

Inevitably, many of these predictions will prove wrong. But by challenging these assertions and looking for where we go wrong, we will inevitably uncover new themes and narratives that are more interesting as investors and blockchain enthusiasts.