Written by: Jack Inabinet , Bankless

Compiled by: Felix, PANews

After a decade of delays and rejections, the U.S. SEC last week finally approved the listing of a Bitcoin spot ETF on U.S. stock exchanges, much to the delight of the entire crypto industry.

The spot Bitcoin ETF product began trading on January 11, and although Bitcoin did not achieve the surge that some crypto people had hoped for, inflows into the ETF met analysts' expectations, with inflows approaching $2.9 billion.

While the $1.2 billion in GBTC redemptions caused by the BTC ETF’s approval and crypto traders unwinding their positions from bullish BTC ETF bets are suppressing Bitcoin prices, the long-term impact of the ETF approval cannot be underestimated.

Cryptoassets can now be invested in every (or at least most) American’s traditional brokerage account, unlocking the ability of a whole new group of capital to purchase cryptoassets. Even better, the traditional financial giants that issue Bitcoin ETFs now have a profit motive to promote crypto assets (at least Bitcoin), as issuers try to expand the assets under management held by their products and generate more Fee income.

With the arrival of a spot BTC ETF, traders are now looking at ETH and trying to get ahead of the launch of the spot ETF, which has a final approval deadline of May 23.

There is always a bull market in the crypto space, and as market attention turns to Ethereum, ETH/BTC is up 25% this week, breaking away from the downward trend that has been in place since the Ethereum merger for nearly a year and a half.

While traders have begun preparing in earnest for the arrival of an Ethereum spot ETF, not everyone is convinced.

Why are spot Ethereum ETFs rejected?

Eric Balchunas, senior ETF analyst at Bloomberg, believes that there is only a 70% chance of an Ethereum spot ETF being approved in May. The SEC needs to make approval decisions on multiple Ethereum spot ETF applications before the end of May, including VanEck, Ark 21Shares and Hashdex.

What is even more pessimistic is that JPMorgan Chase strategist Nikolaos Panigirtzoglou believes that the SEC is necessary to identify ETH as a non-security before the Ethereum spot ETF is approved, and the possibility of the SEC doing so before May is no more than 50%.

SEC Chairman Gary Gensler, the decisive vote in approving the spot BTC ETF, has always insisted that Bitcoin is not a security under federal securities laws, but he has refused to provide any clarification on the delineation of ETH.

Some are concerned that Ethereum’s proof-of-stake design and ability to generate yield means that ETH will automatically be considered a security.

Could an Ethereum spot ETF be approved?

There are many people in the market who are skeptical about the approval of the Ethereum ETF. But thankfully, they could also be wrong.

Many crypto people are concerned that the SEC will classify ETH as a security and thus reject a spot ETH ETF, as the agency has stated that the vast majority of crypto assets are investment contracts subject to federal securities laws. Nonetheless, ETH’s status as a non-security appears to have been solidified.

The U.S. SEC has sued several crypto exchage because these exchanges listed crypto assets that the SEC considered securities, including other L1 tokens such as SOL, NEAR, and ATOM. None of these enforcement actions identified ETH as a potential security.

Panigirtzoglou, a strategist at JPMorgan Chase, believes that it is necessary for the SEC to make a decision on whether ETH is a security, but the agency voted to approve the Ethereum futures ETF in October last year, thus clarifying Ethereum's status as a non-security.

While the SEC insists that their action to approve a spot Bitcoin ETF does not indicate the commission is willing to approve ETFs for other crypto assets, it is this approval that clears the way for an Ethereum spot ETF.

The core of Chairman Gensler’s approval of a spot Bitcoin ETF is based on a U.S. Court of Appeals ruling that Grayscale’s proposed spot BTC ETF is sufficiently similar to two approved BTC futures ETFs to deserve similar regulatory treatment.

With an Ethereum futures ETF approved, just like Bitcoin, a U.S. appeals court ruling sets a precedent that could prevent the U.S. SEC from rejecting an ETH spot ETF over concerns about fraud or manipulative trading, which is exactly what the SEC rejected Reasons for previous BTC ETF application.

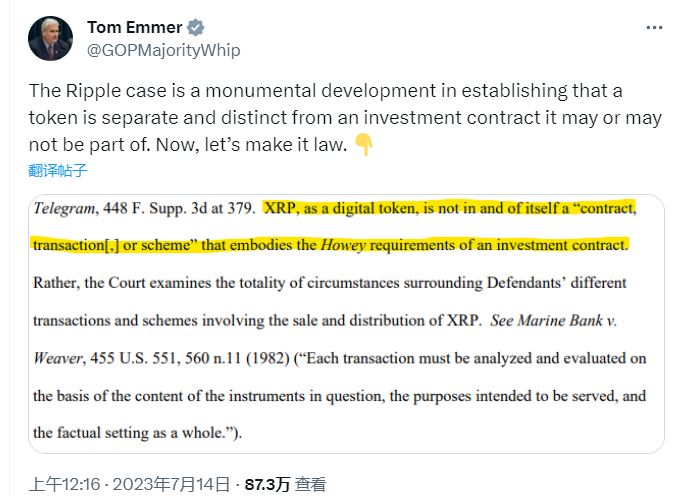

In addition, the legal precedent established by the SEC v. Ripple case found that digital tokens themselves do not meet the Howey test and are securities only when sold as investment contracts, eliminating market concerns about whether ETH's return through staking constitutes an investment contract, thus Let this profitability be irrelevant to ETH spot ETF approval, as this type of transaction has nothing to do with ETH staking that would violate securities laws.

Are Ethereum Spot ETFs Bullish?

The approval of an Ethereum spot ETF could have bullish long-term implications, but it would also most likely become a selling news event. Even for Bitcoin, the debut of its ETF was basically in line with analysts' expectations. Bitcoin's price has fallen 12% from its listing peak.

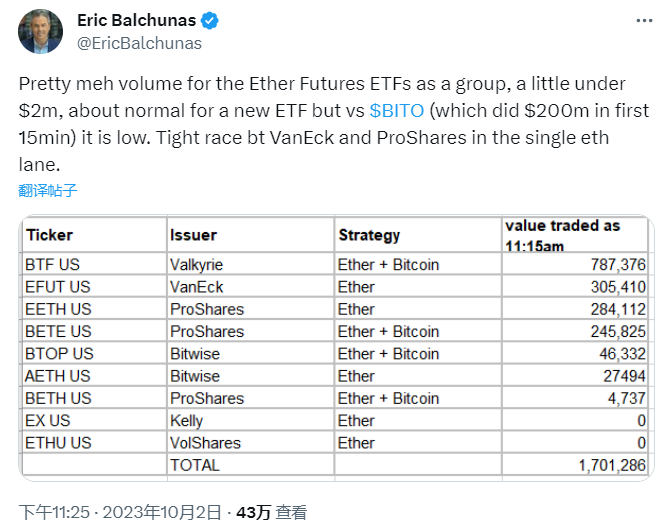

When the Ethereum Futures ETF was launched last year, demand for ETH futures was disappointing, achieving only $1.7 million in trading volume in the first hours of the market, while Bitcoin futures and spot products generated hundreds of millions of dollars at the opening trading volume.

While futures products are inferior to spot products because they expose investors to contango and backwardation effects (i.e., the price of the next month’s contract may be higher or lower, respectively, than the price of the expiring contract), TradFi market participants have exposure to ETH The almost complete lack of demand suggests that demand for off-the-shelf products may be similarly insufficient in the future.

Issuers need to attract sufficient market demand for Ethereum spot ETF products to be successful, and it is unclear how to tap that demand. Perhaps TradFi intends to create demand by marketing ETH to regular users on CNBC.

While it’s unclear how much demand there will be for Ethereum spot products, market participants are clearly less optimistic about the likelihood of an Ethereum spot ETF being approved than a Bitcoin spot ETF.

The approval of the Ethereum spot ETF may be unexpected. Unlike the Bitcoin spot ETF, investors began planning as early as half a year before the Bitcoin spot ETF was approved, and there was a large-scale capital inflow. This means that if an Ethereum spot ETF were to be listed, it would likely be a bullish start.