As Bitcoin fell, mainstream crypto assets began to fall sharply. Through comparison, it can be found that although Celestia (token TIA), which has continued to rise before, has experienced a large increase, its decline is still very small. So what is the reason that supports TIA’s strength? How will modular blockchain Celestia change the crypto market?

See why TIA resists the decline from both sides of supply and demand

Essentially, the core reason for Celestia's resistance is that the buying orders are active and the selling orders are small. Next, we will analyze Celestia’s token release and usage scenarios.

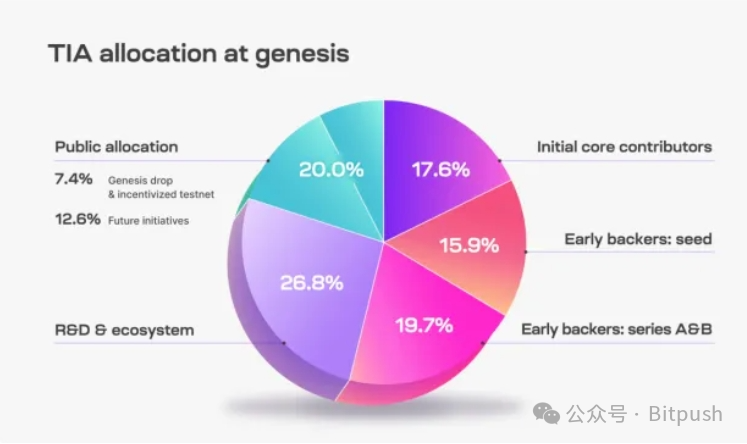

From the perspective of token release, TIA is a new currency just issued this year, with a total circulation of 1 billion. The inflation rate in the first year is 8%, and will decrease by 10% every year until the annual inflation rate drops to 1.5%. The following figure shows the allocation proportion of TIA’s main ecological tokens:

From the observation of token.unlocks data, it can be seen that there are actually very few TIAs circulating in the market at present. A large number of TIAs will be unlocked by the end of October this year. By then, the selling pressure on the market will increase significantly, and the TIA callback is expected to be strong.

From the demand side, TIA’s ecological use cases mainly include the following main scenarios: 1) Rollup developers’ fees for using Celestia DA need to be paid in TIA; 2) Similar to Ethereum, Rollup built on Celestia will use TIA as GAS fee; 3) Pledge; 4.) Governance. With the development of Rollup-As-A-Service ( RaaS ), developers have a large number of tools to build Rollup blockchain, which can quickly deploy Rollup while inheriting the security of the base layer. Many Rollups-as-a- Service protocols also provide Celestia as an underlying option. Here are some mainstream projects:

Manta: Manta Network is a modular blockchain for ZK applications, created by a team of founders from prestigious institutions such as Harvard University, MIT, and Algorand, and has received investments including Binance Labs and Polychain Capital.

Dymension: Cosmos ecological modular settlement layer Dymension launches Genesis Drop , issuing airdrops to Celestia, Ethereum Layer 2, Cosmos, Solana and NFT holders. Users can receive 70 million before 20:00 on January 21, 2024, Beijing time. DYM (accounting for 7% of the total supply), adding a golden shovel narrative to TIA.

Saga: Following Dymension, the Cosmos ecological scalability protocol Saga announced the genesis airdrop eligibility criteria and issued airdrops to the Celestia community. More than 27,000 wallets are eligible.

ZKFair: ZKFair is the first community-owned zkrollup, using Polygon ZK and Celestial DA architecture, powered by Lumoz.

Arbitrum Orbit : On October 25, 2023, the Arbitrum Foundation and the Celestia Foundation announced the integration of the Celestia modular data availability network into the Arbitrum Orbit and Nitro stacks, providing developers with the ability to publish data to Arbritrum One, Arbritrum Nova, and Celestia option, the Arbitrum Sepolia test network will be officially launched on December 20. Subsequently, multiple protocols on Arbitrum announced that they would integrate Celestia.

In addition, the main projects include general L2 Eclipse, decentralized API data service protocol Pocket Network, modular blockchain network Movement Labs, etc.

From the perspective of both supply and demand, TIA has been having very little circulation in the short term. As it is supported by more and more projects, it can enjoy airdrops, which makes it have a strong "golden shovel" effect. From the perspective of token release, the end of October 2024 is the biggest pain point, and TIA’s circulation has increased significantly; at the same time, well-known projects are rushing to the end of the bull market, and TIA’s golden shovel is no longer attractive, and its tokens will most likely An adjustment may occur at the end of October this year. However, it should be noted that as TIA’s usage scenarios expand, the pledge rate is expected to increase. At the same time, under the bull market, the depth of the callback may be relatively small.

Celestia uses Cosmos SDK as its technical base to conquer Ethereum

Celestia is a POS blockchain based on CometBFT and Cosmos SDK. The two key functions of its DA layer are data availability sampling (DAS) and namespace Merkle trees (NMT). DAS enables light nodes to verify data availability without downloading the entire block. Data Availability Sampling (DAS) works by having light nodes conduct multiple rounds of random sampling of small portions of block data. As light nodes complete more rounds of block data sampling, the confidence that the data is available increases. Data is considered available once a light node successfully reaches a predetermined confidence level (e.g. 99%). NMT enables the execution and settlement layers on Celestia to download only the transactions relevant to them. Celestia divides the data in the block into multiple namespaces. Each namespace corresponds to rollup and other applications built on Celestia. Each application only needs to download data related to itself to improve network efficiency.

Based on the above two key technologies, Celestia is extremely economical and efficient. The article "The impact of Celestia's modular DA layer on Ethereum L2s: a first look" published by Numia Data compared the costs of different L2s releasing callData to Ethereum in the past 6 months with the amount they might have spent using Celestia as the DA layer. (The calculation sets the TIA price at $12). From the difference in magnitude between the two, we can see the huge economic benefits that a dedicated DA layer like Celestia can bring to L2 Gas costs.

We have also introduced above that currently Manta, ZKFair, Arbitrum Orbit, general L2 Eclipse, decentralized API data service protocol Pocket Network, modular blockchain network Movement Labs and other Ethereum projects are using Celestia. It is expected that in the future There will also be more to use its features. The core reason why Celestia is so popular is that it gives developers new flexibility and customizability, allowing them to build unique products that cannot be achieved in a general approach. Instead of a monolithic top-down decision on the infrastructure stack, a modular bottom-up approach lets developers and builders build their own components and let the free market determine the best option.

In essence, the development of Celestia also poses a certain threat to Ethereum. Ethereum core developer Justin Drake said: There is a strong network effect around the shared security of DA. If Rollups stop consuming Ethereum DA, it will be a sign that Ethereum is losing out to some competitors in the settlement game. In this way, Ethereum will lose fee income, currency premium will be reduced, and economic security and economic bandwidth will shrink. I predict It will slowly but surely die.

How will TIA develop in the future?

Celestia has two exciting development directions: quantum gravity bridges and Cevmos. Quantum Gravity Bridge: QGB will enable Celestia to connect with any EVM-compatible chain beyond the universe, including ETH and AVAX, bringing even more liquidity. Cevmos: Cevmos is a Cosmos SDK chain specially made for Rollup settlement. The functionality of this EVM-integrated chain is to allow ETH rollups to upload their data to Cevmos and then pass it on to Celestia, thus improving the connection between the EVM and Celestia ecosystems.

Investing in TIA is mainly a bet that more Rollups and applications will use Celestia as their DA and consensus layer in the future. Judging from the current development of Celestia, Celestia still has great advantages in the short term. The biggest pain point is mainly at the end of October 2024, when a large number of tokens will be unlocked, and TIA prices are expected to see a major correction.