Written by: Interview with Zero and One

2023 is a year of great significance for the Bitcoin ecosystem. It has risen from US$16,500 at the beginning of the year to US$40,000. The Bitcoin ecosystem has also reached a new peak. The Bitcoin protocol has developed rapidly in the first quarter of 2023. After one year By the fourth quarter, the market was booming. At the end of the year, against the backdrop of huge challenges faced by both digital assets and traditional markets, the dormant state of the ecosystem ushered in a renaissance.

The explosive growth of Inscription has promoted the wave of Bitcoin innovation. In addition to Bitcoin itself, market funds have also spilled into its ecosystem. The most striking thing is that the enthusiasm for inscriptions has also been transferred to other public chains.

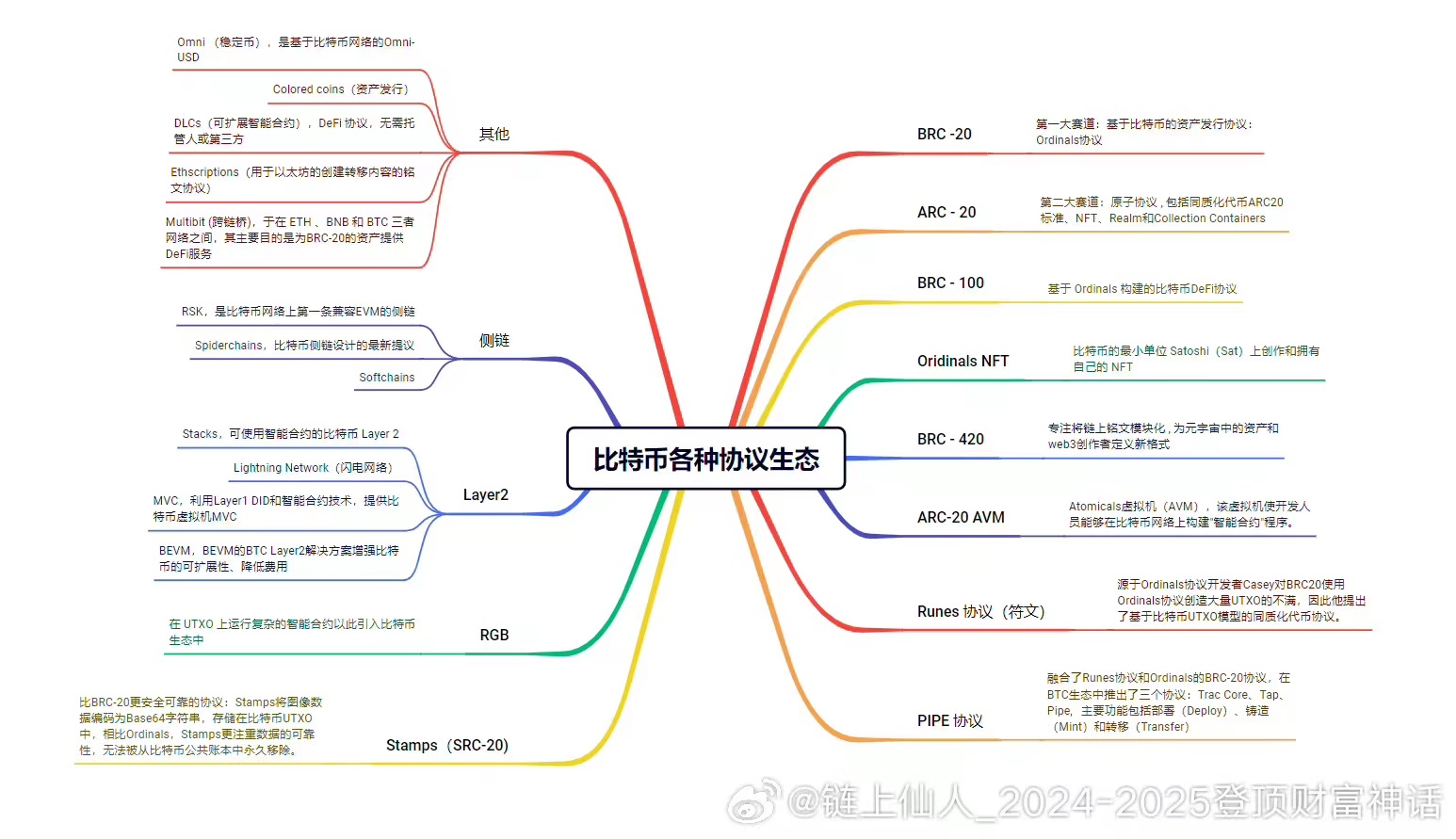

Popular protocols in the Bitcoin market

The explosion of the Bitcoin ecosystem started with the launch of ORDI on first-line platforms. Since October last year, with the promotion of Bitcoin ETF news, the value of Bitcoin has gradually returned, and the ecosystem of various Bitcoin protocols has fully blossomed.

1. The popular Ordinals and BRC20

Before Ordinals became popular, the Bitcoin inscription market had not been well-known by the public, but the emergence of the BRC20 standard reversed the situation. When ORDI surged, Bitcoin NFT was also activated.

BRC20 is a homogeneous token that runs on the Bitcoin blockchain based on the Ordinals protocol. Inscription is a technology that uses Ordinals to write specific information (such as pictures, text) into Sats, the smallest unit of Bitcoin. Currently, BRC20 tokens such as ORDI, rats, etc. have no practical applications other than trading. After Ordinals became a reality, there was a new wave of interest in the Bitcoin blockchain and its capabilities. Developers across the crypto world began experimenting with the network's potential, culminating in the BRC-20 standard.

Similar to Ethereum's ERC-20, the BRC-20 standard is an experimental token protocol that allows the minting and transfer of fungible tokens on the Bitcoin network through Ordinal inscriptions. This enables users to store a script file on Bitcoin and use it to attribute coins to a single Satoshi. Unlike ERC-20 tokens, BRC-20 tokens exist directly on the Bitcoin network. They also do not use smart contracts like ERC-20 tokens, which means that BRC-20 tokens have more limited functionality than their Ethereum counterparts. Compared with traditional token standards, BRC-20 has better compatibility and interoperability, so it has been recognized and used by more and more people.

2. Atomcial protocol (ARC-20)

The ARC-20 token standard is provided by the Atomics protocol and is minted and transferred based on BTC's UTXO. Marking a major innovation in the Bitcoin ecosystem. The protocol is cleverly designed to facilitate the minting, transfer, and updating of digital objects. These objects are similar to a new type of non-fungible token (NFT) that can now be managed directly on the Bitcoin blockchain.

ARC-20 faithfully follows the "Not your keys, not your coins" principle advocated by Bitcoin OGs, and is closer to BTC fundamentalism in both principle and actual participation. It can be said that ARC-20 tokens It's BTC itself. Therefore, ARC-20 is significantly different from other protocol tokens.

3. Bitcoin Layer2

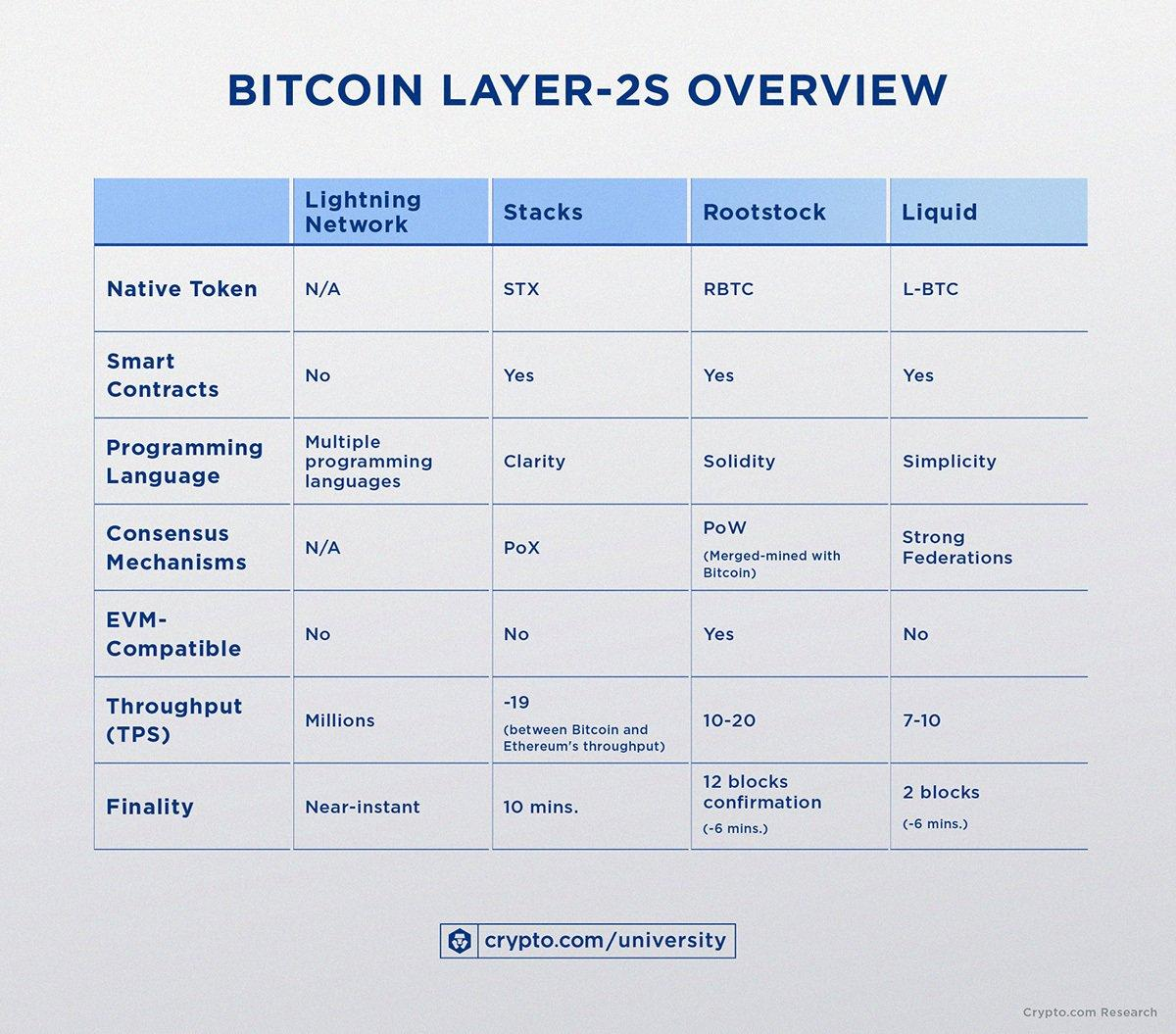

Since Bitcoin itself does not support smart contracts, which limits the development of Bitcoin's more complex ecological business, many Bitcoin side chains and Layer 2 began to emerge. Bitcoin Layer2 refers to the protocol built on the basic layer of Bitcoin. These protocols were developed to provide scalability to the Bitcoin network by processing transactions outside of the main blockchain (main chain). They can also solve other technical challenges and provide additional functionality to Bitcoin. These Layer-2 can help improve Bitcoin's overall performance while benefiting from its security and network effects.

Bitcoin-based protocols such as Lightning Network, Rootstock, Stacks, Liquid Network, and the Bitcoin Aggregation Project bring scalability and programmability to the Bitcoin network. Taken together, they show what the next phase of the network's growth might look like. Among them, the Lightning Network was first launched in 2016 and is a layer 2 payment protocol built on the Bitcoin blockchain. It enables near-instant payments by using Bitcoin’s native smart contract capabilities. The Lightning Network consists of multiple two-way payment channels that process transactions in parallel to the main blockchain. It is designed to solve Bitcoin’s scaling issues, such as long block creation times, limited throughput, and high transaction fees.

4. Runes protocol

Runes aims to solve the inefficiencies of many previous protocols, especially BRC-20. Unlike the multi-layered nature of some protocols, Runes is designed to be elegantly simple. By using OP_RETURN in a transaction, it causes the tokens to be assigned to a specific UTXO, with the output index, token amount, and token ID. This simplified mechanism is not only easy to understand, but also efficient in operation. The protocol clearly defines the flow and distribution of tokens, reserving a special message for the initial coin offering. This ensures clarity and transparency in the operation of the token. Although Runes look promising, their usefulness and longevity remain to be tested.

In addition to the Bitcoin protocol mentioned above, there are also PIPE protocol, ARC-20 AVM, BRC-420, RGB, Stamps (SRC-20), etc., which are all popular protocols in the Bitcoin protocol ecosystem.

Bitcoin Protocol Tokens and Inscription Tools

Some Bitcoin protocol tokens:

BRC-20: Ordi, sats, rats

ARC-20: ATOM, Realm

SRC-20: stamp, kevin, utxo

Rune:Pipe

Rune Alpha: COOK, PSBTS

Some inscription tools:

Wallets: Ordinals Wallet, Xverse, OKX Web3 Wallet, Unisat Wallet

Trading markets: OKX Ordinals Market, Unisat Marketplace, Ordinals Market, EVM.ink

Data analysis market: Dune, whatscription, GeniiData

The most commonly used tool is probably the wallet, and some wallets currently also integrate trading market functions. For most newcomers, a wallet is all they need.

Forecast of future market trends

2023 can be considered the year when the Bitcoin ecosystem fully blossoms. The emergence of Inscription has revitalized the Bitcoin ecosystem and attracted a large number of developers and investors to join the ecosystem. Perhaps it is still too early and we are still on the eve of an ecological explosion. The protocols that can stand out under the current situation are worth looking forward to and exploring, but the circulation and evolution of digital gold have not yet been completed.