Author: stella@footprint.network

Data source: NFT research page - Footprint Analytics

In February 2024, the cryptocurrency and NFT markets showed complexity. During the month, the transaction volume in the NFT field reached US$1.2 billion, a decrease of 3.7% month-on-month. It is worth noting that well-known NFT series, including Azuki, MAYC and BAYC, have experienced significant declines in transaction volume on public chains such as Ethereum, Polygon, BNB chain, Cronos, Optimism and Sui, with a drop of as much as 32.1 %. In addition, the poor performance of the Gas Hero game NFT has affected platforms such as Polygon and Mooar. At the same time, new narratives such as ERC404 and DN404 emerged during this period.

This report is based on data provided by Footprint Analytics' NFT research page . This page is a comprehensive and easy-to-use dashboard that provides the latest statistics and indicators necessary to understand the pulse of the NFT industry, including transactions, projects, financings, and more.

Crypto Market Overview

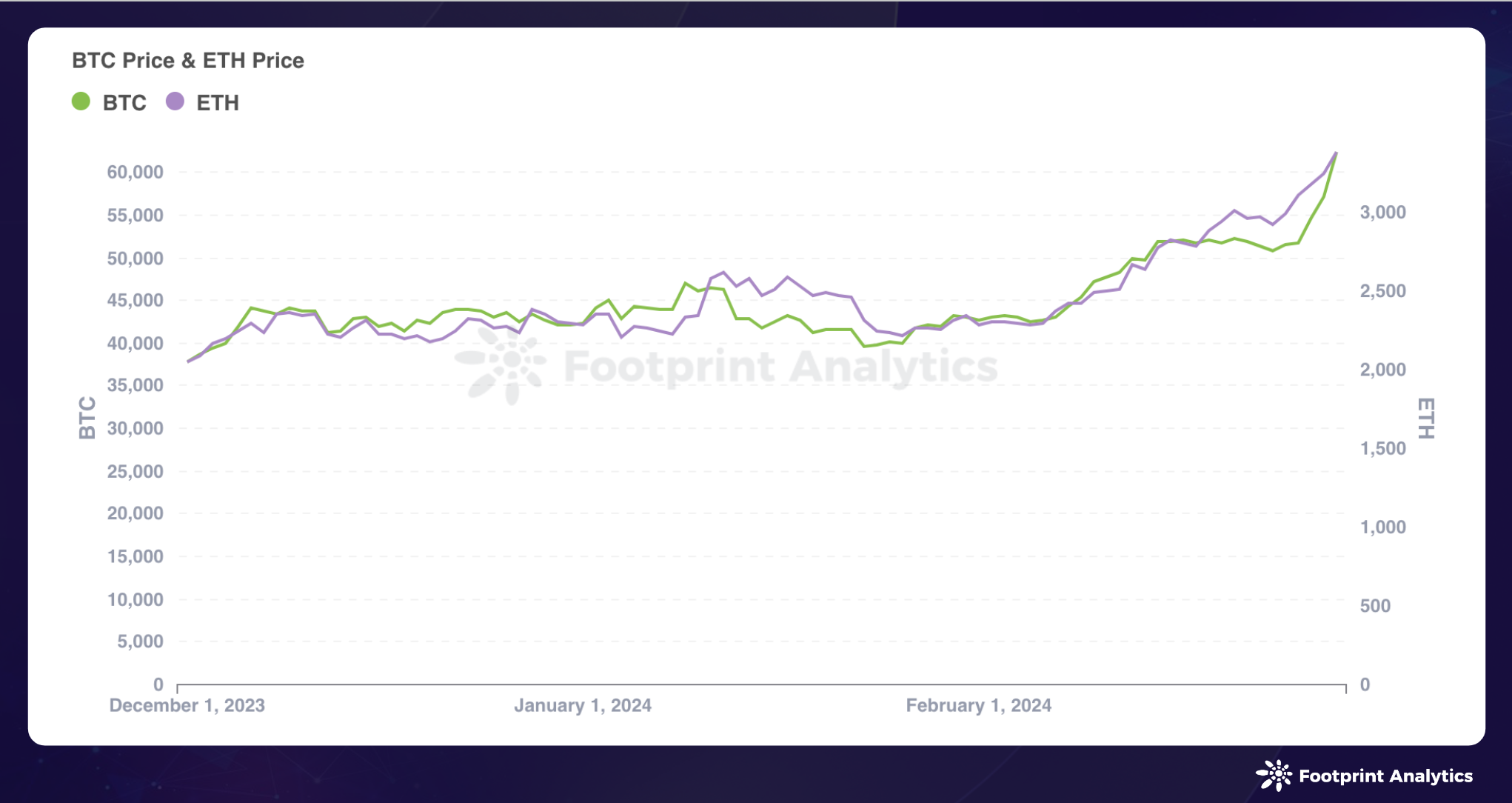

In February 2024, both Bitcoin and Ethereum showed significant growth. Among them, Bitcoin rose strongly, with an increase of as much as 46.5%. The closing price at the end of the month reached US$62,404, breaking through the US$60,000 mark for the first time since the fourth quarter of 2021, and is only 9% away from its historical high. Ethereum performed even more impressively, with an increase slightly exceeding that of Bitcoin, reaching 48.1%, and closing at the end of the month at $3,383.

Data Source: Bitcoin and Ethereum Prices - Footprint Analytics

The significant rise in the cryptocurrency market in February was driven by a combination of factors. Among them, the U.S. spot Bitcoin ETF attracted up to $6 billion in capital inflows in February, a figure that highlights investors' firm confidence in cryptocurrencies as an effective store of value. In addition, market expectations for the Ethereum Cancun upgrade in March and the Bitcoin halving event in April have further pushed up prices. Together, these factors have provided strong support for the rise in the cryptocurrency market.

However, broader market dynamics, such as inflation concerns and Federal Reserve policy, may pose challenges to sustained growth. The increase in inflation in February means that the expected interest rate cut in the United States may be postponed until later this year or even later, which undoubtedly creates uncertainty for the continued growth of the cryptocurrency market.

NFT Market Overview

In February, while the overall cryptocurrency space showed significant growth, the NFT market faced a decline. During the month, the transaction volume of the NFT market reached US$1.2 billion, a decrease of 3.7% month-on-month.

Analyzing data from public chains such as Ethereum, Polygon, BNB Chain, Cronos, Optimism and Sui, we found that transaction volume dropped to $840 million, a 16.1% decrease from January. At the same time, transaction volume fell by 25.8%, and the number of unique users (wallets) also decreased by 14.6%. This downward trend is partly due to fewer days in February. In addition, significant fluctuations in key NFT series, changes in market dynamics and changes in investor sentiment are also responsible for the downward trend.

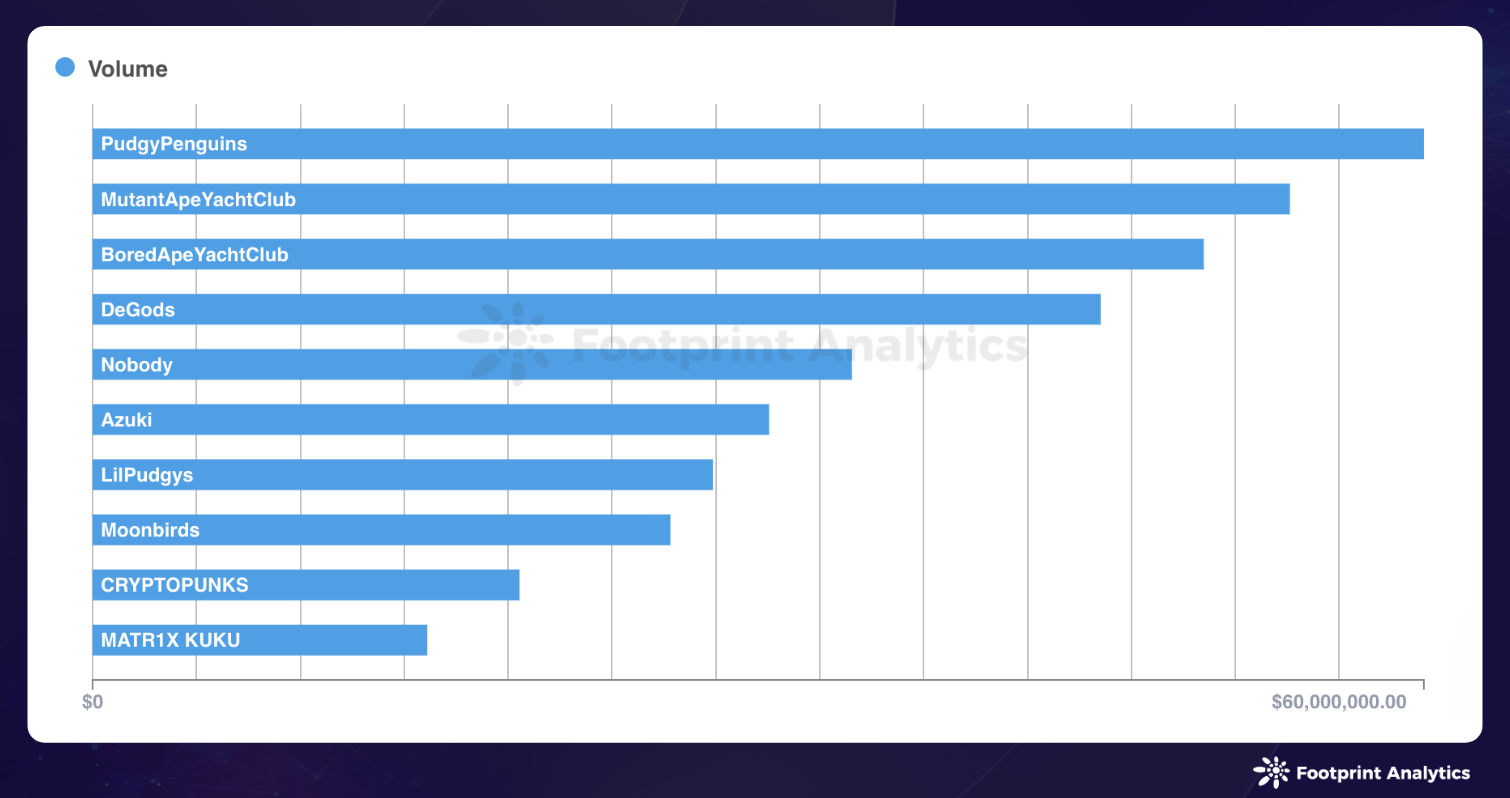

In February, the total transaction volume of the top ten NFT series on the above six public chains dropped sharply from US$570 million in January to US$390 million, a drop of as much as 32.1%. These series accounted for 46.2% of total market volume in February, down from 56.2% in January.

Data source: Top ten NFT series by trading volume in February 2024 - Footprint Analytics

The trading volume of Azuki , the leader on the list, fell sharply by 73.7% in January to $32.6 million. At the same time, the trading volume of Mutant Ape Yacht Club (MAYC) and Bored Ape Yacht Club (BAYC) also fell by 42.0% and 18.2% respectively.

Although Pudgy Penguins ' trading volume decreased by 32.8% to $64.08 million, it still stood out as the highest trading volume series in February. Its floor price increased by 15.0%, once close to BAYC's floor price. At the same time, Walmart expanded its partnership to introduce Pudgy physical toys to an additional 1,100 stores in the United States, bringing the total to 3,100 stores. This move not only enhances Pudgy Penguins' market influence, but is also an important step in the mainstreaming of Web3 intellectual property (IP), helping to increase its market share.

In eighth place is Moonbirds with a trading volume of $27.8 million. It is worth mentioning that Yuga Labs announced on February 16 that it had acquired PROOF, including Moonbirds and other assets. This move quickly pushed up Moonbirds’ floor price and trading volume.

The Nobody NFT collectible was jointly created by Nobody and the famous Hong Kong director Stephen Chow, and ranked fifth with a transaction volume of US$36.6 million. The series is launched on the Moonbox platform, which is dedicated to introducing AI-driven NFTs in the art and film fields. This release marks Stephen Chow’s official entry into the NFT field.

Nobody NFT Series

Public chain and NFT trading market

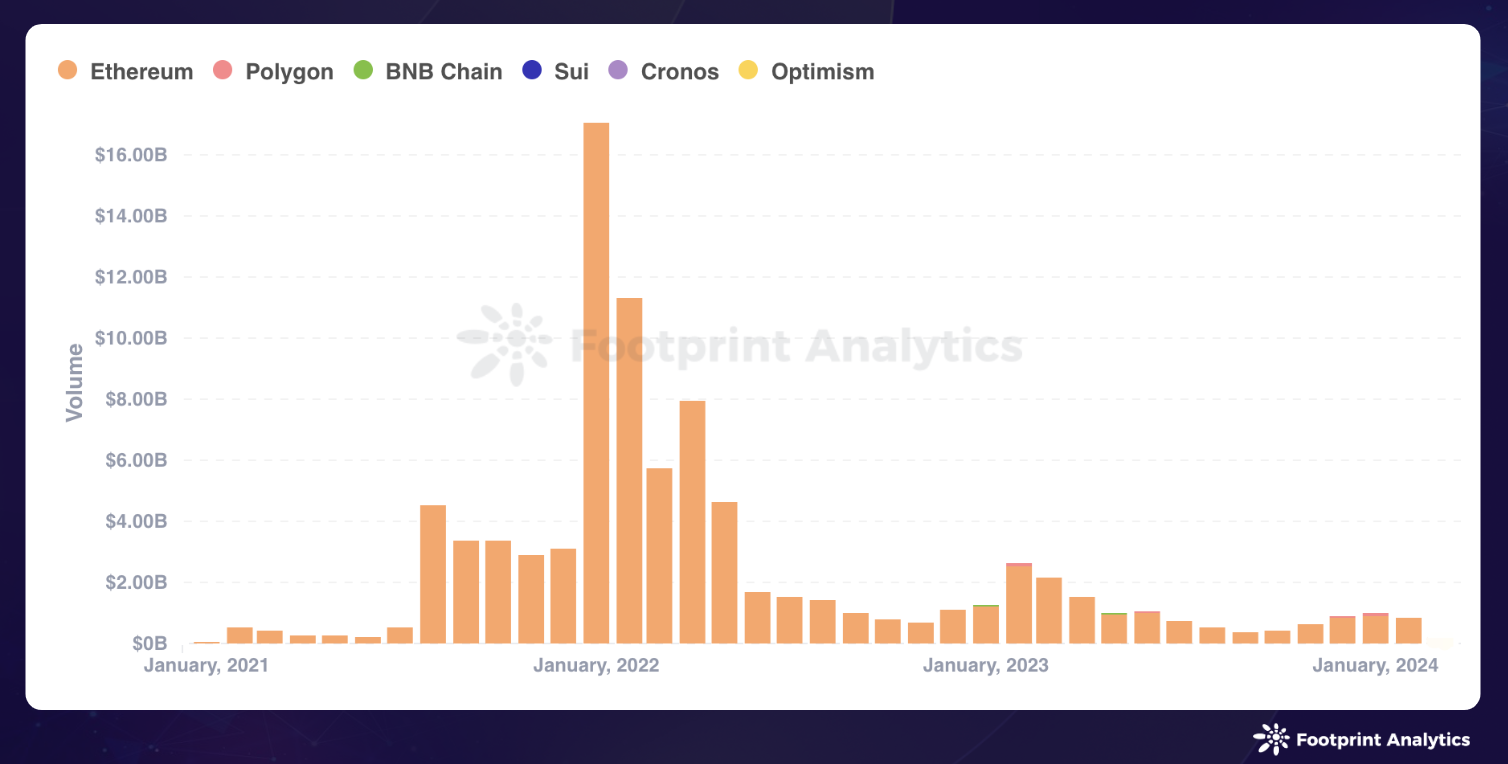

In February, Ethereum continued to hold the top spot in the NFT market, with its transaction volume reaching US$810 million, accounting for 97.1% of the entire market transaction volume. Although this number is down compared to January, Ethereum’s market share has increased slightly. Meanwhile, Polygon 's performance was less than satisfactory. Its trading volume fell sharply from US$110 million in January to US$20.4 million, and its market share shrank sharply from 10.4% to 2.4%.

Data source: Public chain monthly NFT transaction volume - Footprint Analytics

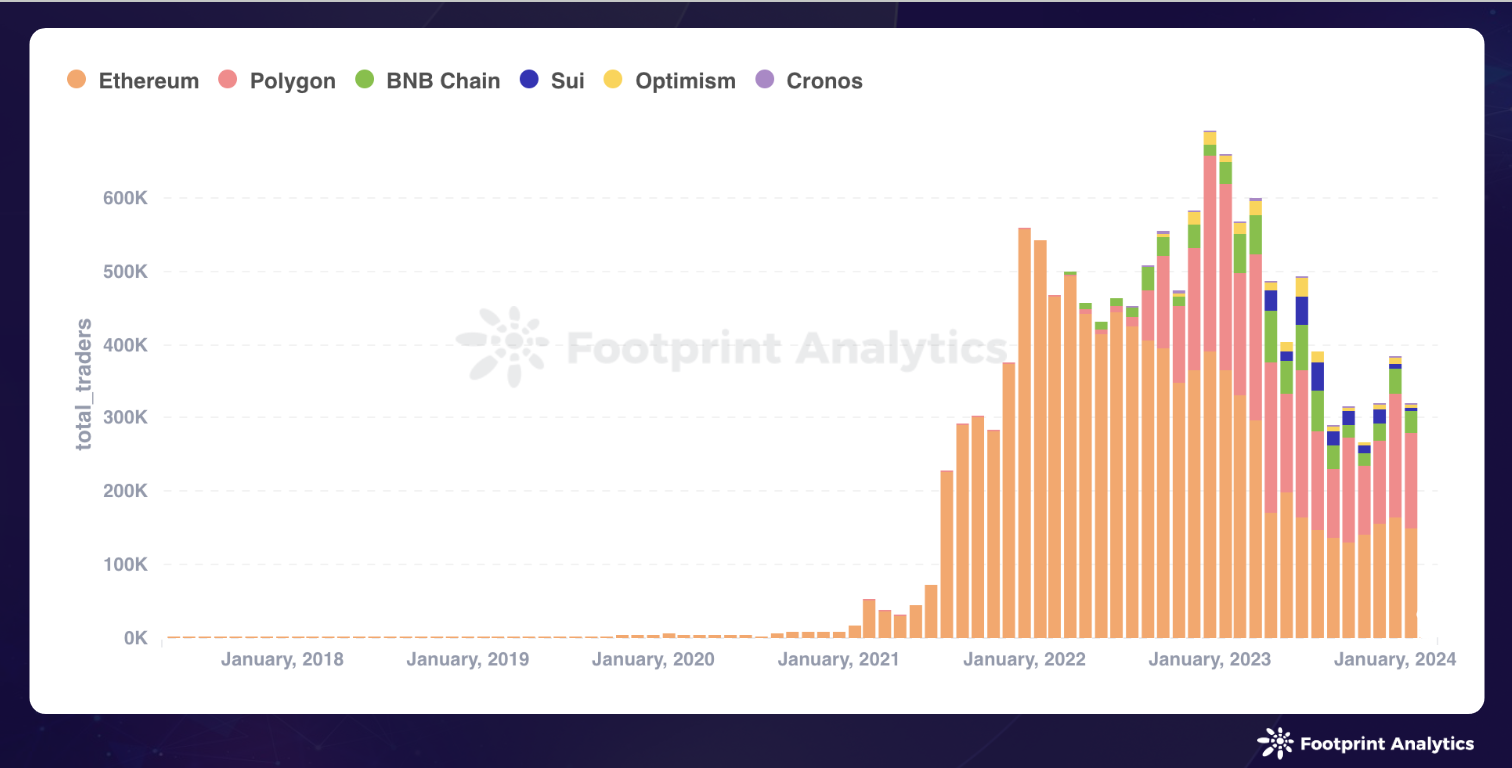

The number of unique users of Ethereum (ie, the number of wallets) dropped from 163,000 in January to 150,000 in February. However, its market share increased from 42.7% to 46.9%. Polygon's number of users also declined, falling to 129,000, causing its market share to drop to 40.4%. At the same time, the BNB chain ’s market share grew modestly by 9.7%, with its number of users reaching 31,000.

Data source: Number of monthly NFT users on the public chain - Footprint Analytics

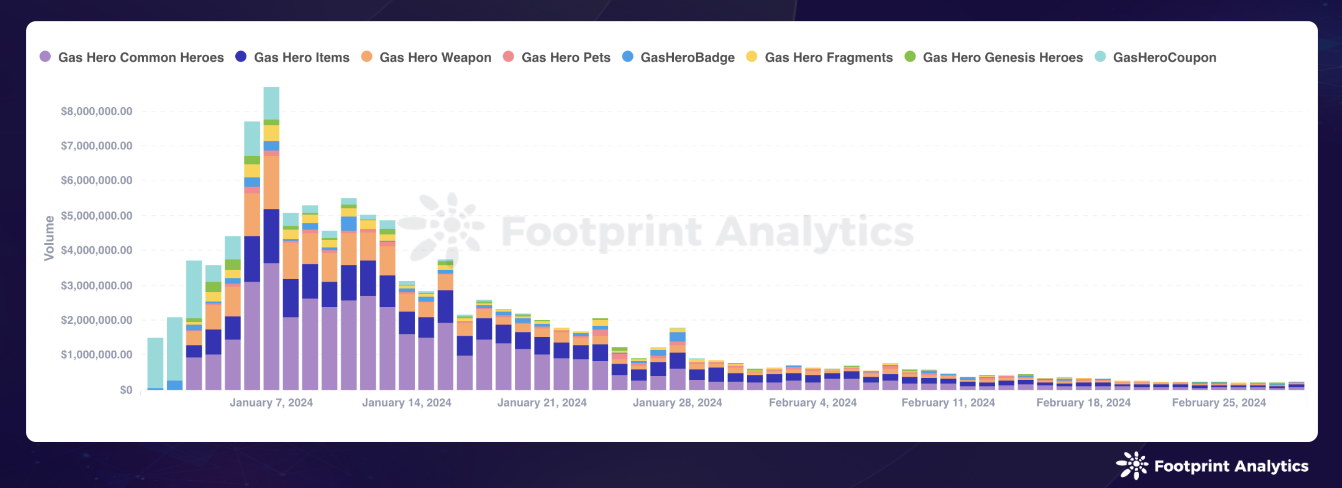

According to data from Footprint Analytics , in February, the NFT trading volume of Gas Hero , a Web3 game developed by Find Satoshi Lab, dropped sharply by 87.2% to US$12.3 million, which was in sharp contrast to the US$96.1 million trading volume in the month of its launch in January. This decline had a significant impact on trading activity on the Polygon and Mooar platforms, with significantly reduced trading volumes. The Gas Hero team announced strategic adjustments on February 28 and returned to the closed testing phase to optimize the economic model and improve user experience.

Data source: Gas Hero NFT Series Daily Trading Volume - Footprint Analytics

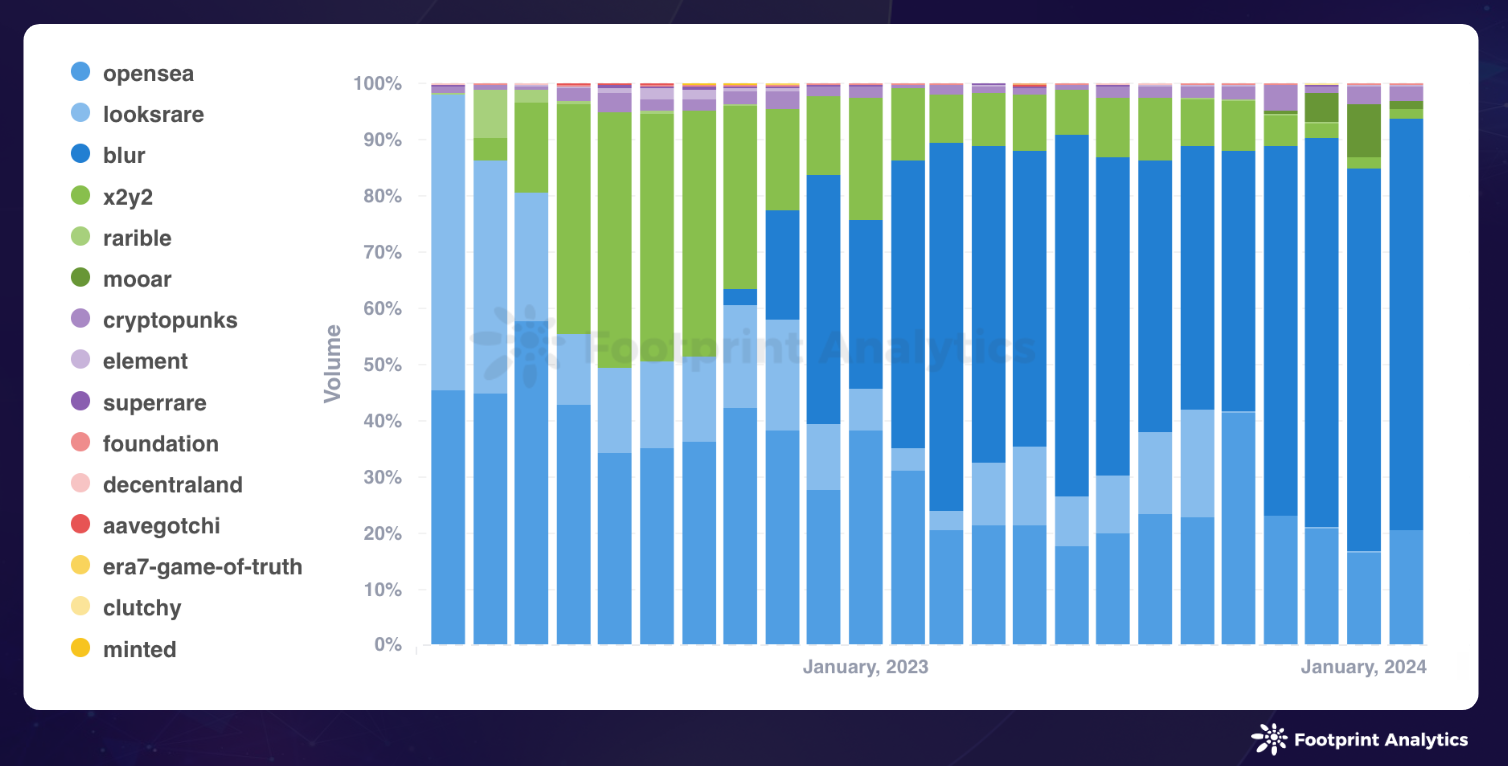

In February, Blur continued to maintain its leading position in the NFT market, and although its trading volume fell to $610 million, its market share increased to 73.1% from 68.3% in January. OpenSea 's trading volume edged up to $170 million and it managed to increase its market share to 20.5%, reversing its previous downward trend. However, due to the Gas Hero mentioned above, Mooar's trading volume shrank significantly to $12.3 million, causing its market share to drop sharply to 1.5%.

Data source: NFT trading market monthly transaction volume proportion - Footprint Analytics

Although the number of unique users (wallets) dropped to 224,000 from 279,000 in January, OpenSea still occupies a leading position in the NFT market with its large user base. Meanwhile, Blur's user base has grown, reaching 61,000, while Element 's has declined slightly, to 36,000.

Data source: Number of monthly users of NFT trading market - Footprint Analytics

NFT investment and financing situation

Public records show that the NFT market conducted three rounds of financing in February, which was a period of relatively quiet investment activity. While progress overall has been slow, Animoca Brands has been particularly active.

- Binance Labs announced its investment in NFPrompt, one of its Season 6 (S6) incubation projects.

- The WELL3 project developed by YogaPez has successfully raised more than $5 million through seed funding and NFT sales, with Animoca Brands, Newman Group and Soul Capital Partners leading the investment.

- Imaginary Ones, a unique series of animated 3D character NFTs, recently completed a new round of financing with participation from investors including Cypher Capital Group, Animoca Brands and MH Ventures.

Highlights this month

- Pudgy Penguins physical toys will be sold in 1,100 new Walmart stores.

- Yuga Labs acquires PROOF and Moonbirds.

- Pandora proposed the ERC-404 concept, and its token soared by 12,000% in a week.

- Magic Eden’s Ethereum trading market in partnership with Yuga Labs was launched on February 27.

- Solana NFT’s cumulative trading volume exceeds $5 billion.

- NodeMonkes leads Bitcoin Ordinals to new highs as Bitcoin price approaches all-time highs.

______________

The above research report data includes:

- Public chains: Ethereum, Polygon, BNB Chain, Cronos, Optimism, Sui

- Trading markets: OpenSea, LooksRare, Blur, X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era7, the Sandbox, Minted, Clutchy, BlueMove, Hyperspace, Tocen, Keepsake, Mooar

The content of this article is for industry research and communication only and does not constitute any investment advice. Market risk, the investment need to be cautious.

Footprint Analytics is a blockchain data solutions provider. With the help of cutting-edge artificial intelligence technology, we provide the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data of more than 30 public chain ecosystems.

Product Highlights:

- Data API for developers

- Footprint Growth Analytics (FGA) for GameFi project

- Big data batch download function Batch download

- All datasets provided by Footprint

- Check out our Twitter ( Footprint_Data ) for more product updates