Author: Pavel Paramonov , blockchain researcher

Compiled by: Felix, PANews(This article has been abridged)

In the crypto space, users can engage in many activities, such as staking assets, purchasing tokens and NFTs, conducting research, developing decentralized applications, and participating in airdrop mining, etc. However, what all these activities have in common is trading. Almost every user participates in trading, whether it is long or short positions on an exchange, trading assets in a liquidity pool, or trading on the NFT market. Interestingly, even illiquid assets are primarily traded via peer-to-peer (P2P).

Due to the lack of liquid markets for illiquid assets, trading of items such as crypto points, airdrop allocations, and whitelists often occurs in over-the-counter (OTC) markets. In this case, individuals need to engage in dialogue and negotiate the deal during the transaction. However, whether participants can trust each other becomes an important challenge. Trust is critical because a specific user must own the specified assets and be willing to deliver them following a proposed transaction. Malicious activities may occur and bring certain risks.

What if it was possible to create a trustless third party that provides secure transactions for both parties, providing security and preventing fraudulent activity? This is exactly what Whales Market aims to achieve.

Introduction

Whales Market aims to integrate OTC transactions onto a unified platform so that both buyers and sellers can conduct on-chain transactions. Funds are secured in smart contracts and will only be paid out to the relevant parties upon successful completion of the transaction. This feature not only simplifies the transaction process but also significantly reduces potential financial losses caused by fraudulent activities.

Whales Marke is developed by the LootBot development team. LootBot was created in the summer of 2023, when Telegram Bots were becoming popular. Based on past development experience, the LootBot development team decided to create a more ambitious and complex product - Whales Market.

product description

Whales Market supports 3 market types: pre-market trading, OTC market, and points market.

pre-market

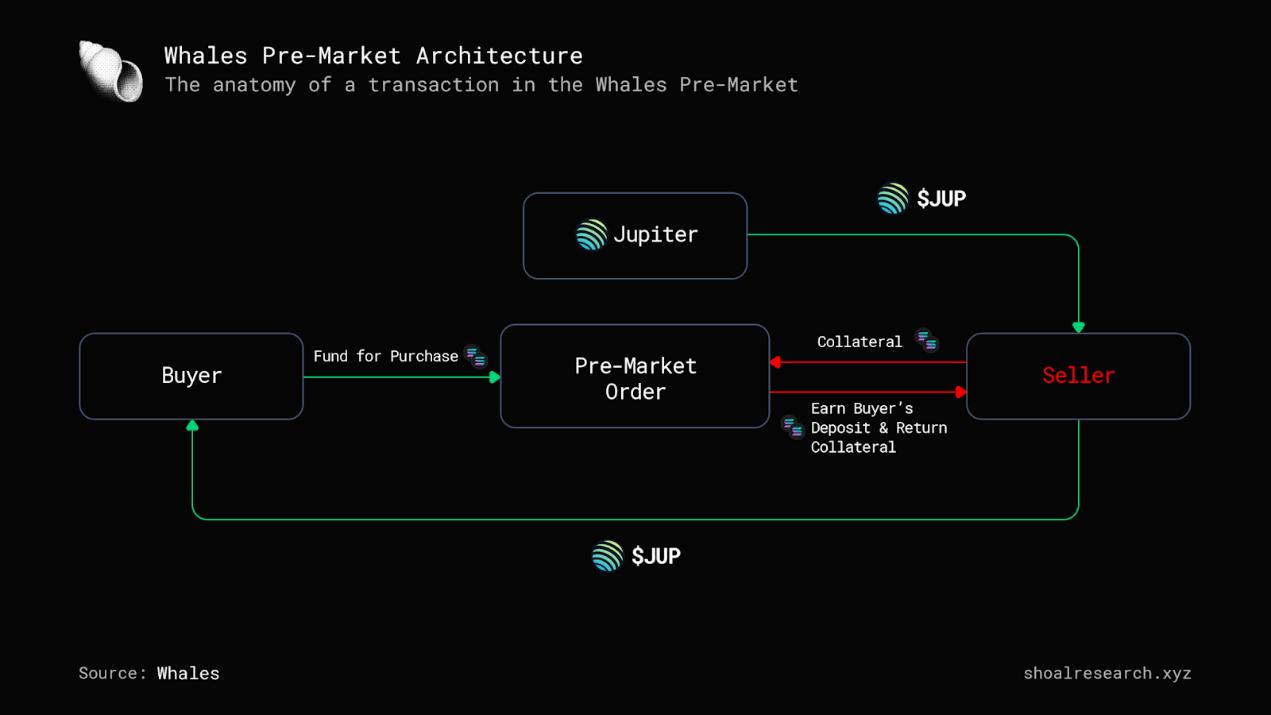

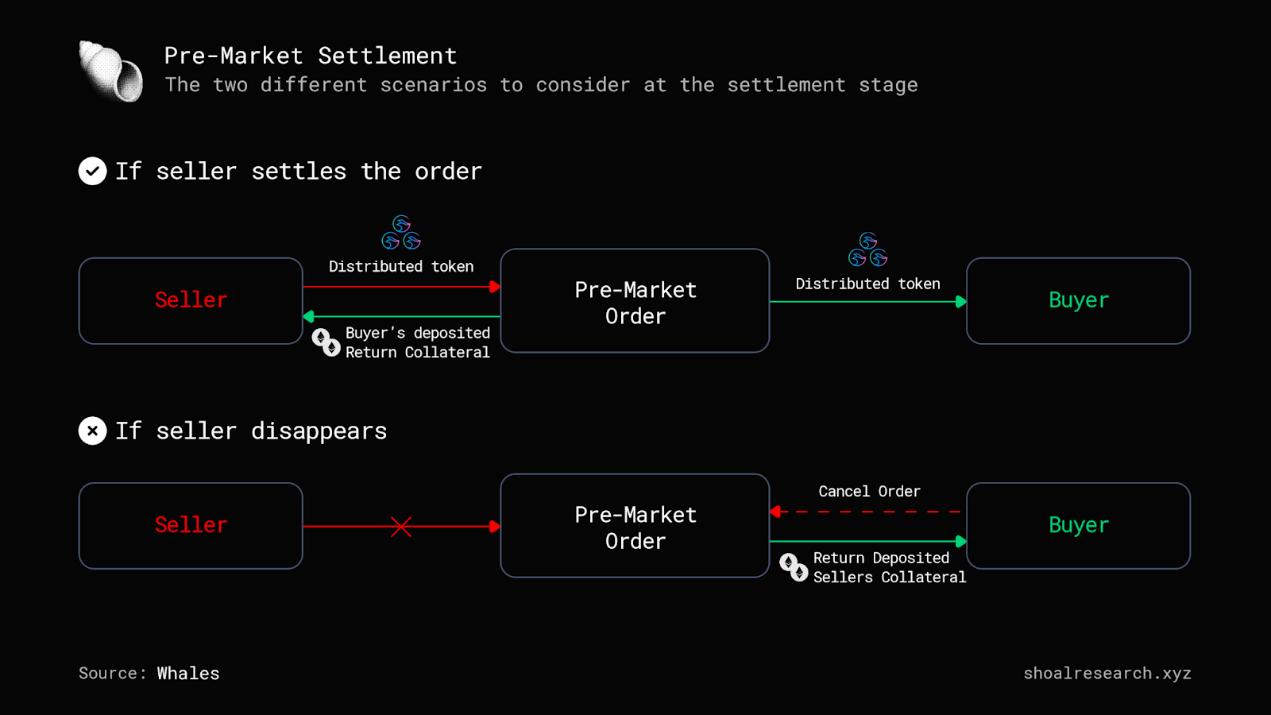

Whales Market’s pre-market market allows for the purchase of token allocations prior to the TGE (Token Generation Event). Although such transactions are relatively common in different private communities and some centralized platforms, security is insufficient and traders are prone to fraud and failure to deliver promised tokens. Whales Market changes this process by using smart contracts, enabling on-chain transactions between buyers and sellers, effectively preventing fraudulent activities.

There are two ways to buy and sell tokens:

- Create your own buy and sell quotes

- Complete other people's buying and selling quotes

Both sellers and buyers need to wait for TGE to settle or cancel orders. When TGE occurs and tokens are released by the foundation, settlement between buyers and sellers will count down for 24 hours. If the seller fails to settle in a timely manner, the mortgage funds will be lost. If the buyer decides to cancel the order, these funds will be transferred to the buyer.

OTC market

Traditionally, OTC markets have facilitated P2P trading of tokens and NFTs through various informal channels such as chat rooms and social media sites.

While these methods are convenient, lacking strict security measures, traders are vulnerable to fraud and scams. Similar to the pre-market market, Whales Market uses smart contracts to address loopholes to reduce the risk of potential losses.

To ensure user safety, Whales Market provides a token list. Various tokens on this list all have minimum liquidity of $300,000 on the DEX.

Users can also trade tokens outside the list, but the platform will display a warning sign prompting users to verify their minting address before proceeding with the transaction.

To ensure privacy, Whales Market has launched a new feature where buyers and sellers share quotation access links with restricted access, so private quotations are not visible on the public market.

points market

Similar to the OTC market, the points market allows secure P2P points trading. The number of projects using the "points system" is gradually growing. Whales Market utilizes smart contracts to allow mutually agreed-upon on-chain transactions between buyers and sellers.

After the token is released, Whales Market will automatically convert the points into the corresponding token according to the foundation’s announcement.

Risks involved

Points orders must be set in advance, but the final ratio of conversion into tokens will not be announced until TGE. This could result in the seller's points ending up being significantly greater than the value of the tokens they received, potentially resulting in adverse consequences for the seller.

Currently, Whales Market allows trading of Friend.tech points. There are future plans to add these capabilities to protocols such as MarginFi, Kamino, EigenLayer and Rainbow.

Tokenomics

Whales Market’s entire ecosystem revolves around its native token, WHALES. The main practical functions of WHALES token include:

- Revenue sharing: 60% of fees collected will be redistributed to WHALES token stakers

- Development fee: 20% is used to cover ongoing development costs

- Repurchase and destruction: 10% is used to repurchase and destroy tokens to achieve a deflation mechanism

- LOOT revenue sharing: 10% divided between LOOT pledgers and xLOOT holders

To ensure that the release volume contributes to the growth of the protocol, the token release volume is tied to specific key indicators (KPIs) related to transaction volume.

The Whales Market team allocated 9.5% of the total supply, with a 9-month cliff period and a 36-month vesting period.

pledge

Whales Market generates revenue by charging fees to the OTC market, with 60% of the fees allocated to WHALES stakers. When users stake WHALES, they are rewarded with xWHALES, which serves two purposes: to gain a share of the revenue and to act as collateral in all OTC markets.

The staking mechanism works as follows:

- The staking contract includes a pool of two types of tokens: WHALES and xWHALES.

- Participants stake their WHALES tokens and receive xWHALES tokens in return.

- Holding xWHALES tokens entitles stakers to receive increasing amounts of WHALES rewards.

- To achieve this, the revenue generated by the contract continuously purchases WHALES tokens, which are then added to the staking pool.

- The exchange rate of xWHALES to WHALES increases, benefiting stakers.

This mechanism also prevents the immediate dumping of WHALES tokens after receiving the reward, since the reward is gradually distributed over time.

Reward distribution

Depending on the blockchain (EVM, SOL, etc.) and the market, fees are charged in different assets. To simplify the process of claiming rewards, the protocol regularly converts these collected tokens into WHALES tokens.

These transactions can be found on the protocol’s dashboard. The allocated WHALES tokens will then be distributed equally among stakers as rewards.

Stakers can withdraw xWHALES tokens and convert them back to WHALES tokens at any time.

income

As mentioned in the Token Economics section, Whales Market earns revenue through fees collected from pre-market trading, OTC markets, and points markets. The following describes the fee standards and which operations require payment.

In pre-market trading, there are fees for closing quotes, settling orders, purchasing tokens, and canceling orders. If you choose to close the offer, you will need to pay a 0.5% platform fee. For settlement orders (buy), a 2.5% platform fee is charged. When you make an offer to buy or fulfill another user's offer to sell, there is also a platform fee of 2.5% on the total tokens purchased. If the order to purchase tokens is canceled due to the seller losing contact, a 2.5% platform fee will be incurred.

In the OTC market, Whales Market only charges listing and selling fees. Whenever an offer is created, whether for buy or sell, a 0.1% fee is charged and is included in the total margin. When you fulfill a purchase offer by selling tokens, a fee of 0.1% will be charged and deducted from the amount received.

In the points market, users are required to pay fees for closing quotes (buy or sell), settling and canceling orders, and purchasing points. If you choose to close the quote, the platform fee is 0.5%. For all other cases, the fee is 2.5%.

Valuation

To determine the valuation of Whales Market, a comparative analysis will be conducted using three key indicators:

- Revenue to TVL Ratio

- Market cap to TVL ratio

- Pledged assets to market capitalization ratio

These metrics will be compared to two main competitors: Uniswap and Blur. By comparing these metrics, the goal is to gain insight into the relative valuation of Whales Market versus established players in the blockchain space.

Revenue to TVL Ratio

The current revenue to TVL ratio is as follows:

- Whales Market: 0.02

- Blur: 0.36

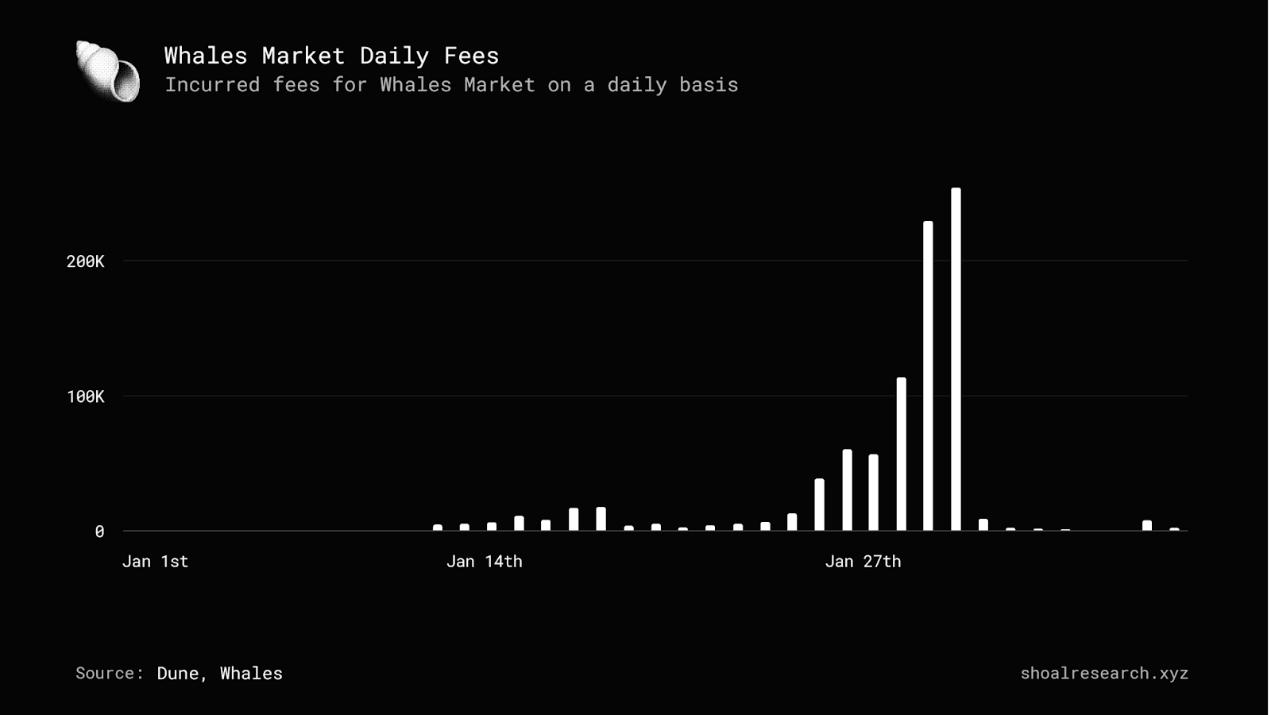

These charges have been incurred since the inception of the Agreement. While Blur's ratio is much higher, it's worth noting that Blur came about much earlier than Whales Market, which only launched in early January 2023.

However, when examining the statistics for the past two months and comparing them to TVL's earnings during that period, a significantly different result emerged:

- Whales Market: 0.02

- Blur: 0.02

It's clear that both currently have equal ratios, which suggests that they generate almost the same percentage of expenses. Blur's current FDV is $2.26 billion, while whale Market's current valuation is $264.33 million, which means the gap between the two is almost 10x.

Market cap to TVL ratio

- Whales Market: 1.35

- Uniswap: 1.13

- Blur: 5.94

Blur has the highest ratio, indicating that it may be overvalued compared to Uniswap and Whales Market.

It is worth mentioning that the TVL under market capitalization is slightly different. It is called Total Value Escrowd (TVE) in Whales Market and acts as an escrow between two parties. The mechanism of Uniswap is slightly different from other DEXs.

Pledged assets to market capitalization ratio

This indicator is only available for Blur and Whales Market.

- Whales Market:35%

- Blur: 30%

Whales Market still has a lot of room to grow in terms of staked assets in the protocols, the ratios of the protocols are very close, but it should also be remembered that Whales Market is only 3 months old.

in conclusion

In summary, Whales Market provides a comprehensive solution to the illiquid and decentralized crypto market, providing support for a variety of markets including OTC, pre-market trading, and points trading. Additionally, token economics, staking options, and yield mechanisms ensure a sustainable and profitable ecosystem. Overall, Whales Market offers a promising platform that solves the challenges faced by P2P traders in the crypto market.

Related reading: Wintermute OTC Annual Report: Trading volume increased 4 times in the second half of the year, TradFi is resurgent